By Aaron Foyer

VP, Orennia

The Houston Livestock Show and Rodeo is the largest livestock exhibition and rodeo in the world. The event, which takes place over a 20-day period every year in March, regularly welcomes more than 2 million attendees. This year, musical acts who graced the rodeo’s main stage included Eric Church, Zac Brown Band and Blake Shelton. On the rodeo grounds, the big draws were new offerings from food vendors, most notably the Texas torpedo – a spicy jalapeno stuffed with brisket and cream cheese, then wrapped in bacon.

The whole event is like Texas trying to outdo itself.

And then it hit: This year, on the final Saturday of the rodeo, an intense storm hit the Houston area, causing many of the attendees to flee. Hail the size of golf balls pounded the area, damaging everything from car windshields to home roofs.

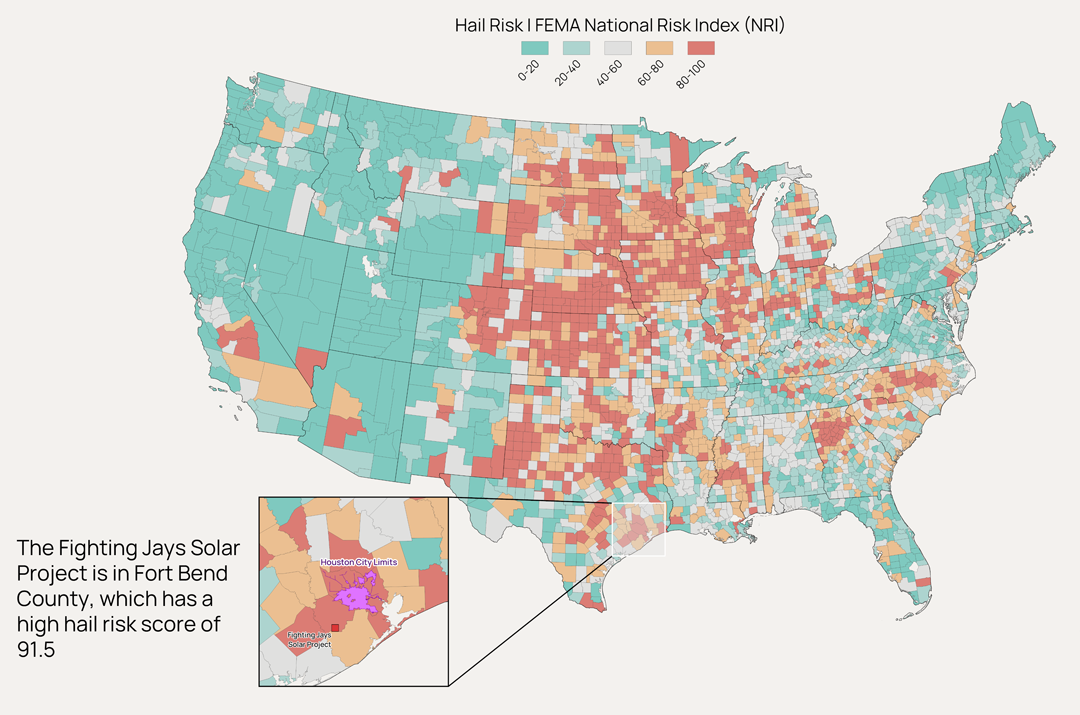

The rural county of Fort Bend just outside of Houston got particularly hard hit. On top of substantial damage to residential properties, a 350 MW solar project got absolutely pulverized. An aerial video posted on X (formerly Twitter) captured the extensive damage inflicted on the Fighting Jays Solar Project. The clip went viral, raising awareness of – and concern over – the susceptibility of renewable projects to extreme weather.

As we now head into hail, tornado and forest fire season, developers and financiers must increasingly consider how to assess and mitigate these risks.

______________________________________

SO, WHAT TO DO ABOUT EXTREME WEATHER RISKS?

To start, there is no shortage of awareness about the impacts of extreme weather and climate change on business. Just two weeks ahead of this year’s fateful Houston rodeo, the US Securities and Exchange Commission (SEC) released its final rules regarding how public companies disclose their climate risks. As part of the sweeping new rules, companies will be required to publish material impacts of climate change on their strategies, business models and outlooks. The Fighting Jays project is case in point for the type of risks projects and companies face going forward.

In detail: The insurance industry, with its hordes of Spock-like actuaries crunching through risk models, is a helpful lens through which to look at climate risk. Even more so is the reinsurance industry – insurance for insurance companies.

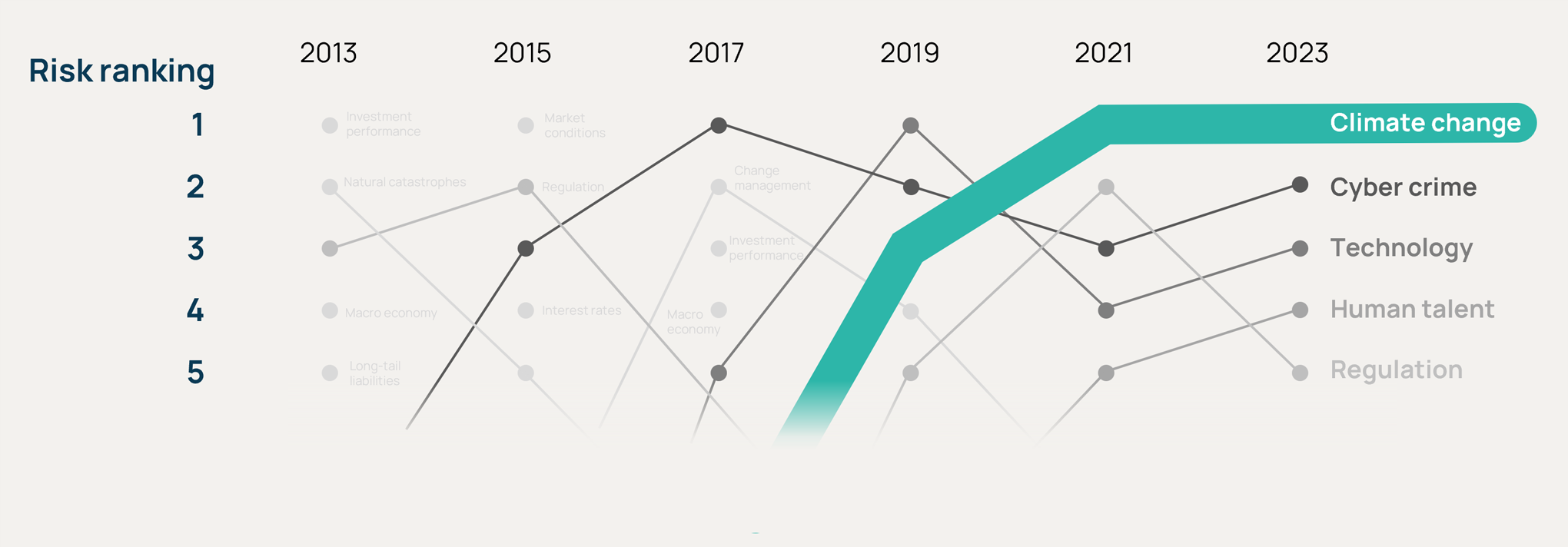

PricewaterhouseCoopers (PwC) releases a bi-annual Banana Skins report on the top risks facing businesses, including insurance companies. For reinsurers, climate change topped the list in both 2021 and 2023.

Top Risks Facing Reinsurance Companies

With an ever-increasing number of billion-dollar weather events and a rapid build-out of renewables, insurers and developers must measure and find ways to mitigate some of these impacts from climate change.

The data: In a study released last year, GCube insurance found hail was the costliest renewable insurance claim, averaging around $58 million per incident and accounting for more than half of the insurers’ loss claims. In a similar study published in 2020, the National Renewable Energy Laboratory (NREL), which looked at insurance claims from solarvoltaic projects, found that fire, hail and wind dominated.

Solar projects are especially vulnerable to weather, particularly hail.

Fighting Jays Solar Project in High-risk Hail Area

At the center of each panel is the solar cell made up of silicon wafers just 160 micrometers thick, roughly the thickness of a human hair. To endure hail the size of baseballs, which often travel at the speed Shohei Ohtani throws baseballs, solar panels are covered by tempered glass.

Destruction Prevention: A study from Vrije University Amsterdam quantifying the impacts of hail on PV panels found visible and invisible damage to panels was caused by storms with 3-centimeter-sized hailstones or larger. In particular, hailstones 4 centimeters and above caused the most damage.

Luckily, not all projects will be subject to major hail risk. There are clear corridors and fairways where the risk of specific storms is higher. Understanding where these are allows developers to better prep projects for weather. The Fighting Jays Solar Project was in an area already highly susceptible to severe hail. But with the climate changing, is that enough?

It’s still unclear whether preventive measures were used for Fighting Jays, but there are several tools available.

_____________________

THE DIFFERENT APPROACHES

Increasing the thickness of glass can make a big difference. The Vrije University study found glass with a thickness of 3.2 millimeters (standard thickness for commercial PV projects) can be destroyed by 5-centimeter ice balls. That damage is reduced to just micro-cracks by increasing glass thickness to 4 millimeters, though this comes with higher costs and may lower output.

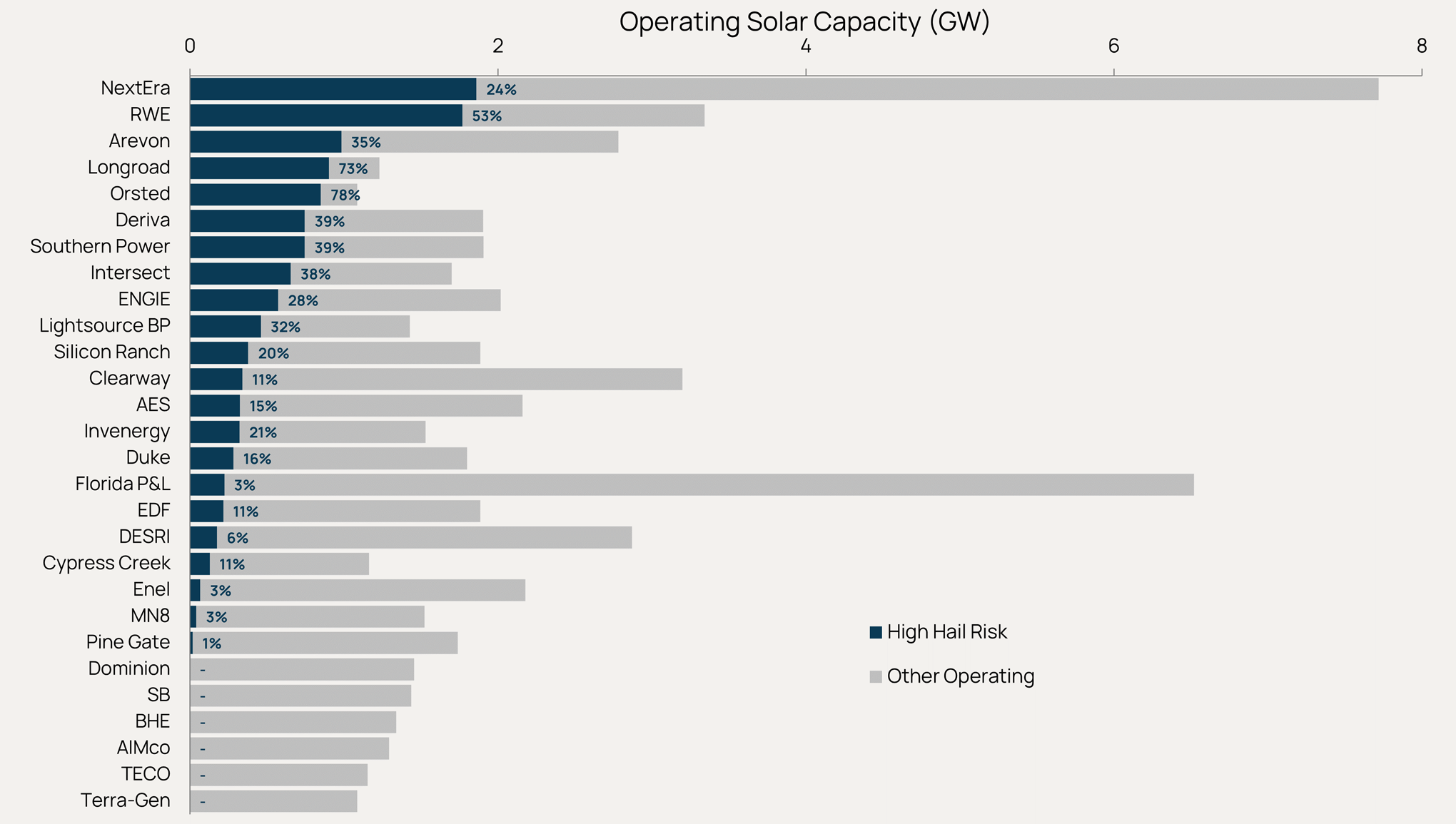

Hail Risk of Large US Solar Operators

Source: Orennia

Adjusting the position of solar panels to brace for a storm can also reduce its impact. Modules mounted on single-axis trackers can be adjusted for angle. By stowing panels as close to vertical as possible for a storm, the strike of hailstones can go from direct hits to passing glances, reducing overall hail damage.

Some insurers are taking matters into their own hands.

Preventive storm chasing: A consortium of insurance companies in Alberta established a non-profit program in 1996 to proactively reduce the size of hailstones before they fall and cause damage. The Alberta Hail Suppression Program dutifully tracks summer storms using advanced weather readings. Should any storm risk unleashing severe hail, a fleet of planes is launched with the purpose of using silver iodide to cloud seed. This produces crystals early in a storm’s formation, preemptively forming small hailstones that drop out and ultimately reducing major damage (and insurance claims!). To date, this has largely been used to protect agriculture but could be used for other infrastructure like solar projects in the future.

_______________________________

FOREST FIRES ALSO IMPACTING PROJECTS

In June 2023, New York was briefly transformed into a scene from Blade Runner 2049 when forest fire smoke from wildfires in Quebec blanketed the city. This was not unique. According to the US Environmental Protection Agency, wildfire seasons have grown longer, with more frequent and intense fires. Being born and raised in Calgary, forest fire smoke was never something we grew up with yet now seems to happen every summer.

Developers, investors and grid operators increasingly need to understand how forest fires and the associated smoke impacts projects.

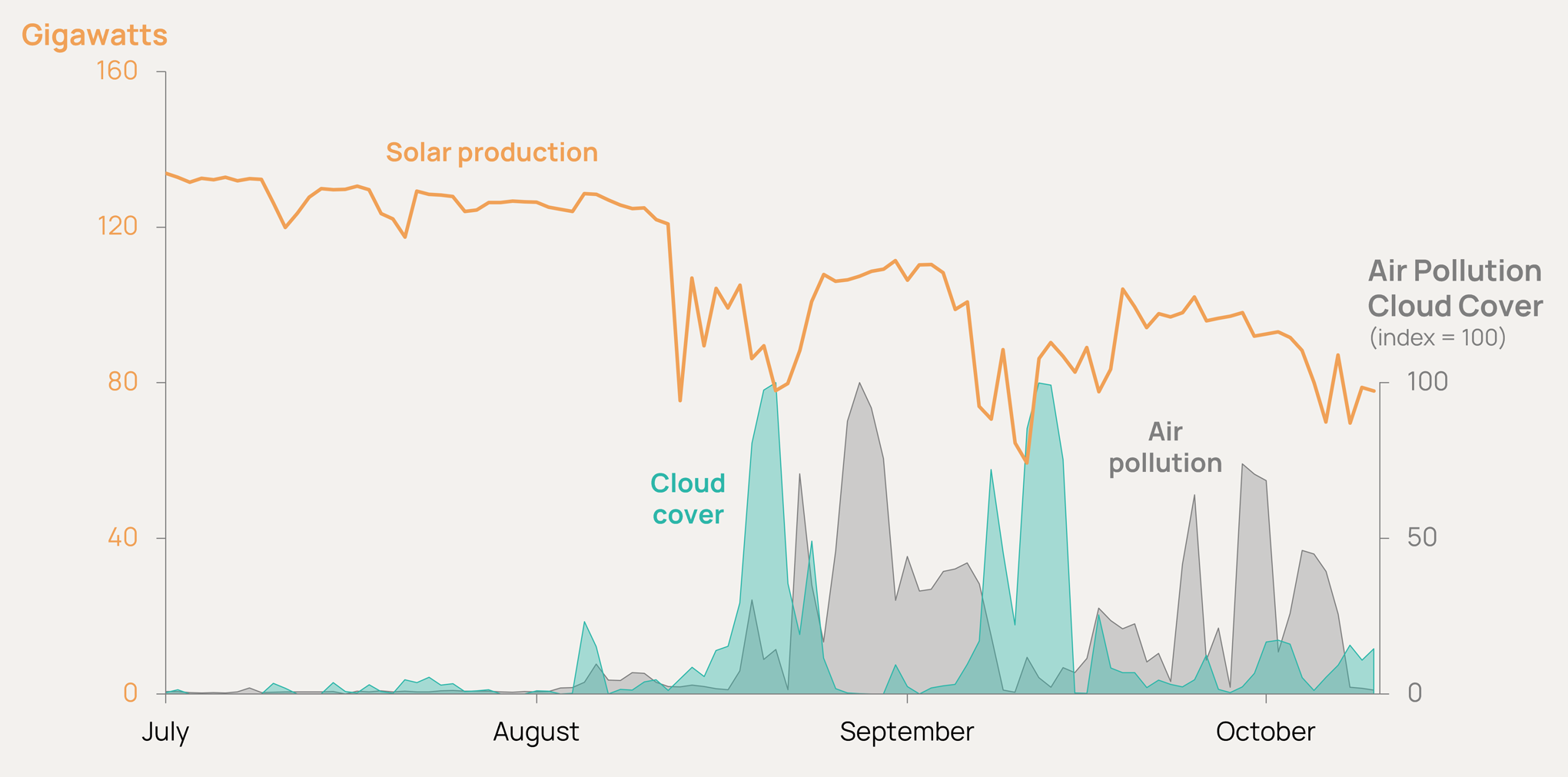

Forest Fire Smoke, Cloud Cover and CAISO Solar Production, Summer 2020

Sources: Orennia, California Air Resources Board, CAISO

Hazy findings: Smoke may not affect the output from solar projects as much as you might suspect, although it still has meaningful impacts.

A study published late last year in Applied Energy looking at 53 utility-scale solar PV projects found smoke reduced output by an average of 8.3%. A similar study from NREL found there was a 10% to 30% reduction in generation during peak hours. While not a dramatic drop-off, NREL found it would still have a big impact on power markets. As solar becomes a larger portion of our electricity mix, an unpredictable multi-day output drop of 10% across generating assets would force grid operators to maintain more backup across the entire system. In places like California, where ~40% of power in the summer already comes from solar, an extended period of smoke could mean gigawatts worth of power outages. Even losing just a couple percentage points of production could be the difference between a project being profitable and not.

____________

WHAT’S AHEAD?

Businesses are increasingly turning to financial instruments like weather derivatives to help protect against unexpected shifts in weather. The most common are offered by the Chicago Mercantile Exchange (CME).

How they work: They’re essentially hedges against the weather. Companies looking to protect themselves against abnormal temperatures (hot or cold) could buy a weather future linked to the ratio of heating degree days (HDD) to cooling degree days (CDD) over a period. A utility that risks losing sales from a warmer-than-usual winter could enter a futures contract and be paid if the winter ends up being warm, making up for lost revenues.

Weather future volumes on CME hit record highs in 2023, in part due to El Niño, a serial weather troublemaker. The average open interest for weather futures and options was four times higher from January to September in 2023 than it was a year earlier over the same period, according to Reuters. That jumps to 12 times higher when compared to 2019 volumes.

________________

SPARKED THOUGHTS

- SEC rules create new industries? The SEC’s climate disclosures – likely bound for the Supreme Court – will create new measuring and reporting requirements for companies. Databases that can easily assess and quantify climate risks to projects are the real winners here.

- Risk management rising? Using historical data to predict future insurance won’t capture the future volatility created by climate change. There will be more projects like Fighting Jays that get smashed by hail or impacted by forest fire smoke. Understanding which projects require additional protection measures can save money and headaches in the long run.

- Hedge against the weather? Renewable projects, whose outputs are largely governed by the availability of wind and sun, can further reduce project risk by mitigating against unfortunate weather. Expect this industry to continue to grow. While this comes at a cost, it will reduce the volatility of revenues and allow investors to deploy cheaper capital.

Aaron Foyer is Vice President, Research and Analytics at Orennia. Prior to Orennia, he leveraged his technical background in management consulting and finance roles. He has experience across the energy landscape including clean hydrogen, renewables, biofuels, oil and gas, petrochemicals and carbon capture.