By Aaron Foyer

VP, Orennia

_____________

DATA SPOTLIGHT

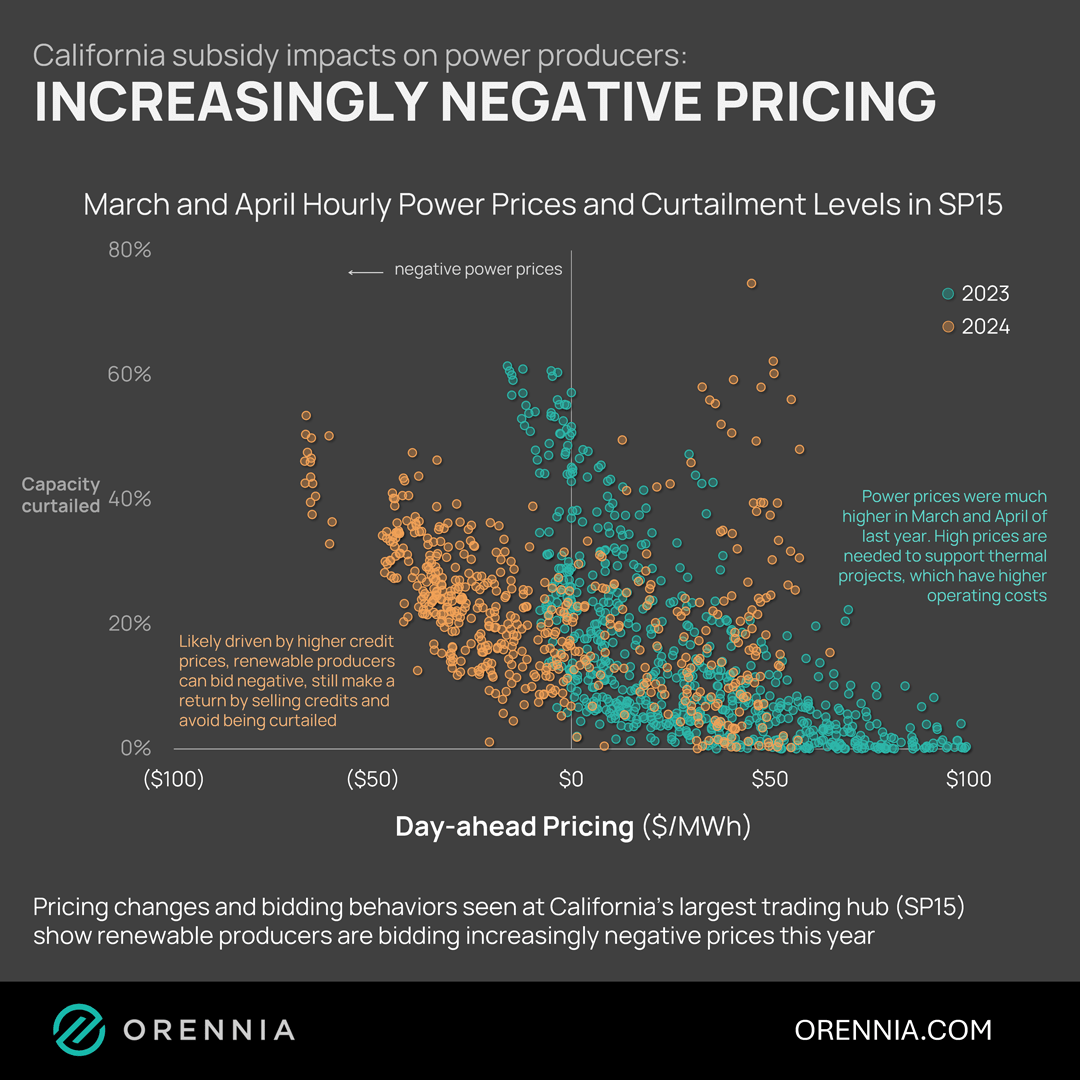

Negative power pricing in the California Independent System Operator (CAISO) market occurs when the supply of electricity exceeds demand to such an extent that producers are essentially willing to pay consumers to take their electricity. This phenomenon can be attributed to several factors:

- Renewable overproduction: California has a substantial amount of renewable energy generation, particularly from solar. Especially during periods of high solar output, the power supply can greatly exceed demand. This is most pronounced in March and April when solar supply is significant, but demand has yet to reach summer highs.

- Inflexible generation sources: Some power plants cannot easily or economically reduce output. In California, this is often nuclear but can include coal and natural gas. This inflexibility can contribute to excess supply.

- Grid constraints: Transmission constraints can prevent the export of excess electricity to other regions where it might be needed, further exacerbating the local oversupply issue.

- Rules and incentives: CAISO market rules and incentives might encourage generators to continue producing electricity even when demand is low. For example, renewable sources may earn renewable energy credits (RECs) and production tax credits (PTCs), or contracts that pay them for the electricity they generate, regardless of market prices.

The growth of negative pricing between March and April of last year compared to this year is remarkable, and likely indicates elevated REC prices.

The impact: Producers that cannot easily reduce output but still have high operating costs (like thermal plants) are forced to accept periods of negative prices. As it relates to setting up a functioning power market for when incentives eventually roll off, persistent negative pricing may send the wrong signals to investors.

Despite the ramp up of cheap renewables and negative pricing events, California residential power prices have gone up much faster than the national average.

Aaron Foyer is Vice President, Research and Analytics at Orennia. Prior to Orennia, he leveraged his technical background in management consulting and finance roles. He has experience across the energy landscape including clean hydrogen, renewables, biofuels, oil and gas, petrochemicals and carbon capture.