Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

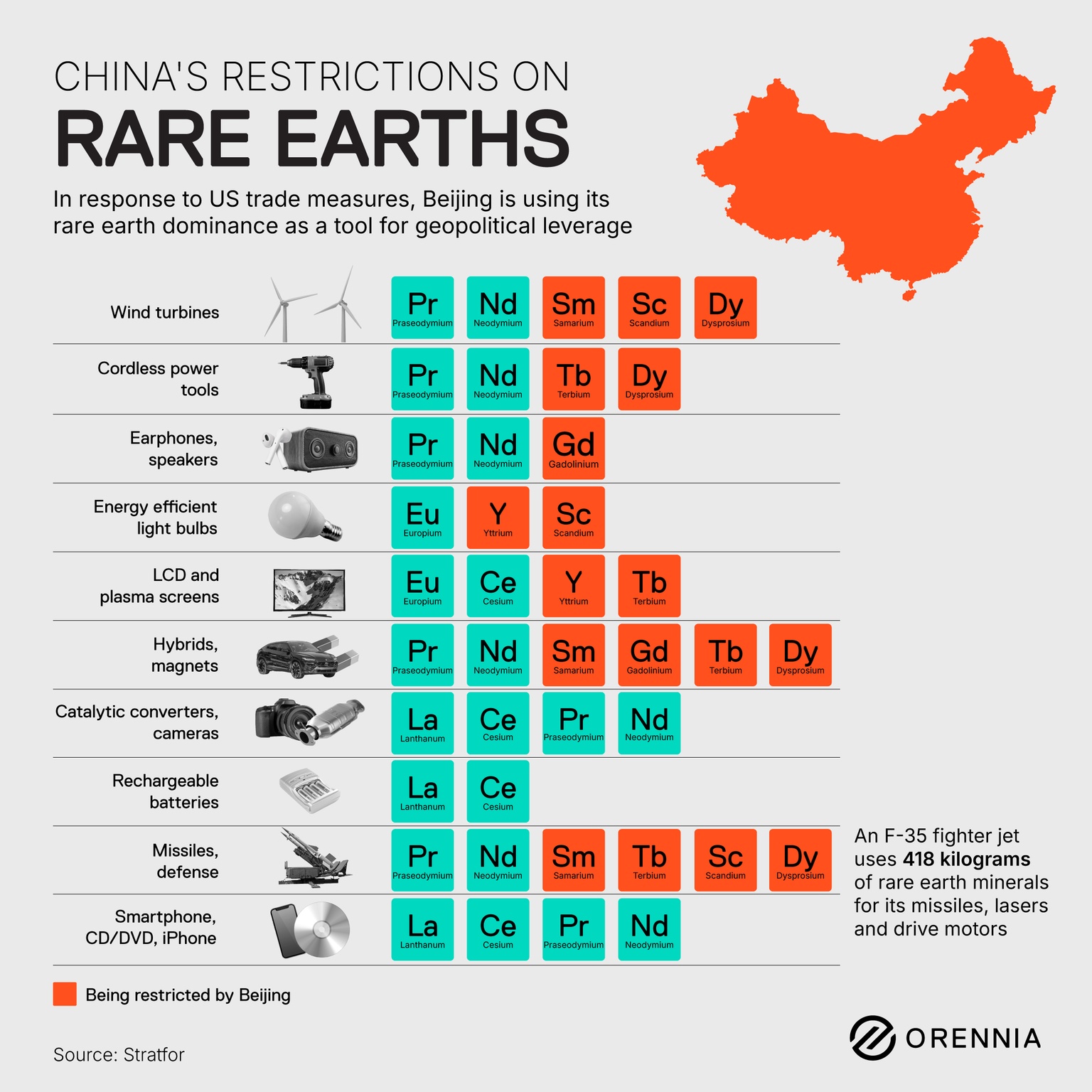

Beijing has tightened export controls on a range of rare earth elements, using its near-monopoly on these critical minerals as leverage in response to US trade and technology restrictions. The move underscores how minerals have become a new front in global industrial competition.

About REEs: Rare earths like neodymium, praseodymium, and dysprosium are essential for magnets in EV motors, wind turbines and defense systems, as well as in consumer electronics and clean-energy technologies.

China’s share of the rare earths and permanent magnet production, according to the International Energy Agency:

China’s new measures target key elements such as dysprosium, terbium, scandium, and gadolinium, materials key for high-performance magnets and advanced electronics. Beijing will now require exporters to seek government approval and report foreign buyers.

To counter this, the US has been funding new processing facilities and supply agreements with allies including Australia and Japan, while the Pentagon has backed domestic projects by companies like MP Materials and Lynas to reduce dependence on Chinese supply chains.

+Bonus reading: China’s rare earth restrictions 2025

Data-driven insights delivered to your inbox.