Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

+Access Orennia’s full 2025 Year in Review here or use the form below.

If the stock market is the measure by which we gauge the last year, 2025 was as unremarkable as the Stranger Things finale. From beginning to end, the S&P 500 grew 16%, a surprisingly common annual return for the index. That lags some recent post-pandemic year returns, but nothing to shake a stick at.

Yet, 2025 will go down in the history books as anything but unremarkable. It was the year that Donald Trump, becoming just the second president to be inaugurated twice into the Oval Office, began reshaping the world order at a scale and pace not seen since FDR.

On the energy front, the president signed the Unleashing American Energy executive order on his first day in office outlining the new administrations priorities for energy: weaking climate policies, deregulation and attempting to reshore the production of anything the country may need to fire its economic engines.

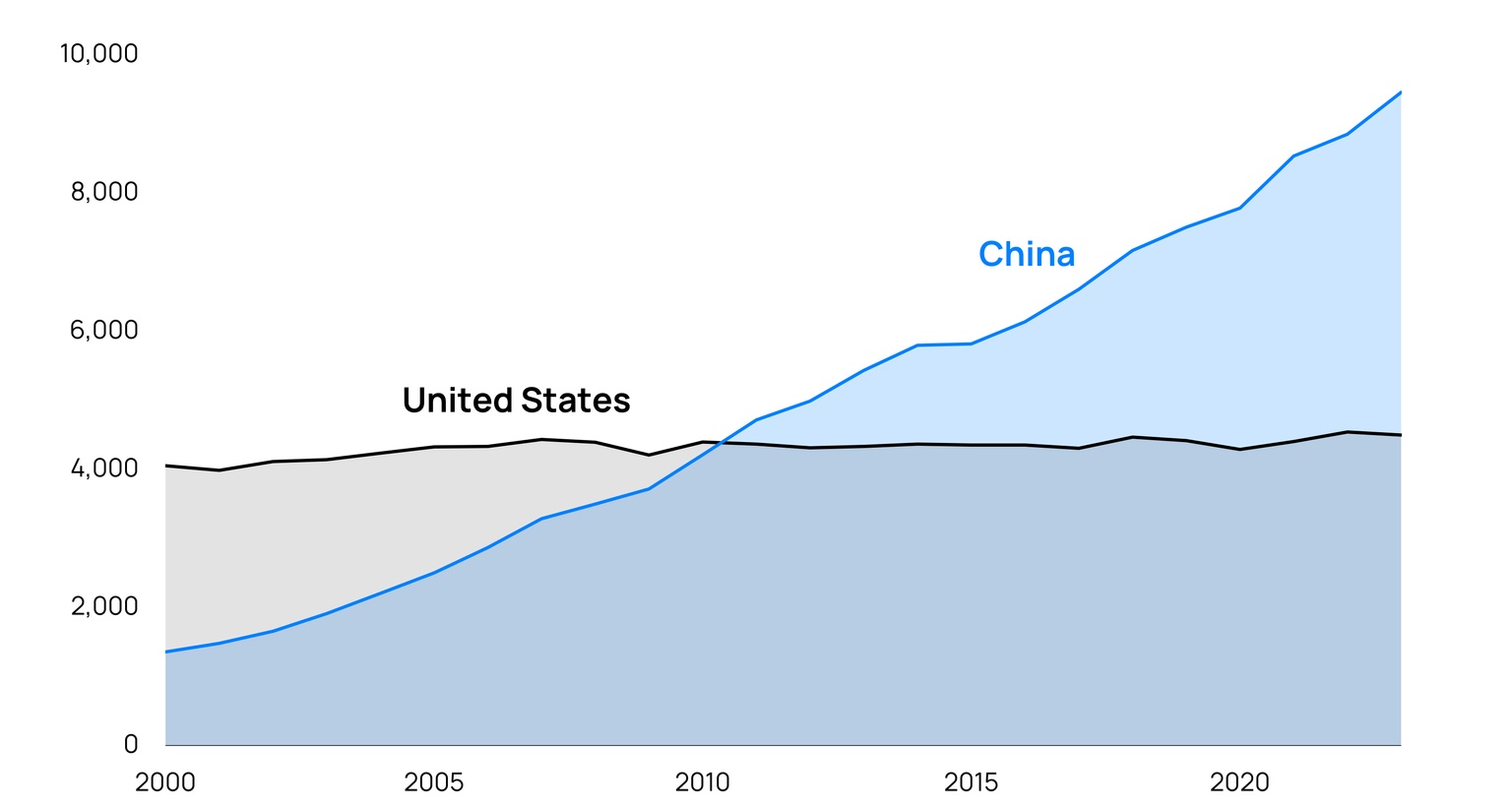

Source: Energy Institute, Statistical Review of World Energy 2024

A race with China to develop AI intensified after a cheap, yet powerful Chinese model called DeepSeek was unveiled at the start of the year. Electricity is the lifeblood of AI, and China is in a league of its own when it comes to power generation, something the new administration must grapple with.

Silicon Valley often gets carried away investing in technologies with little real-world demand — shoutout to anyone hanging out in the Metaverse today. AI is not that.

ChatGPT is officially the fastest growing consumer app of all-time. The job market has already been warped by employees who are much more efficient at their jobs because of the technology. Chatbots represent the first major threat to Google’s incredible search business. And university students are so adept at AI that ChatGPT use plummets when summer break hits. In an economy that rewards attention, it’s no surprise that the four hyperscalers — Meta, Microsoft, Alphabet and Amazon — are investing nearly $100 billion per quarter, largely in data centers.

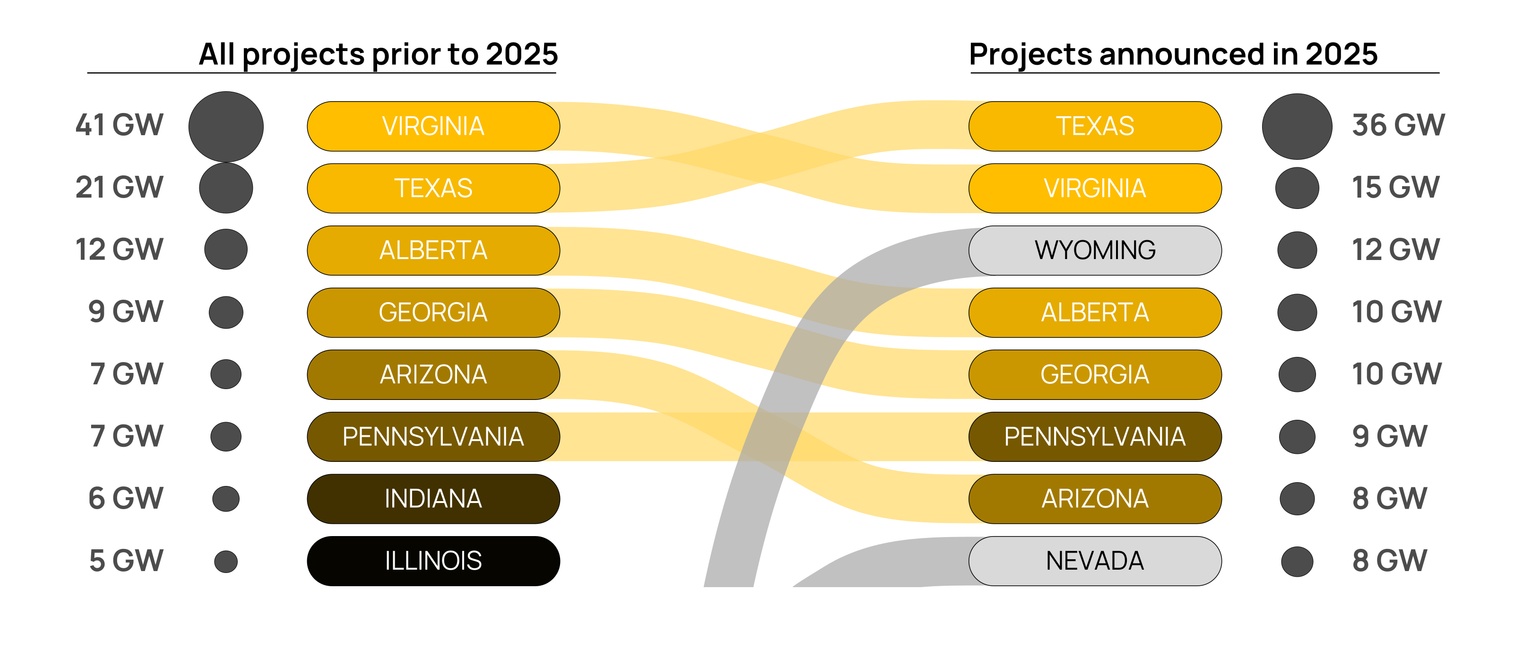

Evolving footprints: The only trend more popular than Get Ready With Me videos last year was launching new data center projects. Of all the data center capacity across the US and Canada, operating or in development, half were announced in 2025.

Source: Orennia

What surprised many was where projects were being unveiled. While Texas and Virigina maintained their status as go-to states to place server farms, other jurisdictions, notably Wyoming and Nevada, emerged for developers.

For the better part of the year, all eyes were on Congress as industry waited to see what metaphorical tool the Republicans would use on the Inflation Reduction Act’s clean energy tax credits: scalpel or sledgehammer?

The House and Senate ultimately chose to go with a scalpel, editing most of the tax credits and completely removing support for wind and solar. To be fair to the new administration, it doesn’t get enough credit for preserving key tax credits for many of the clean power technologies, including batteries, nuclear and geothermal. Though, as analysts who talk about energy policies for a living, a title that rolls off the tongue easier than the “One Big Beautiful Bill Act” would have been nice.

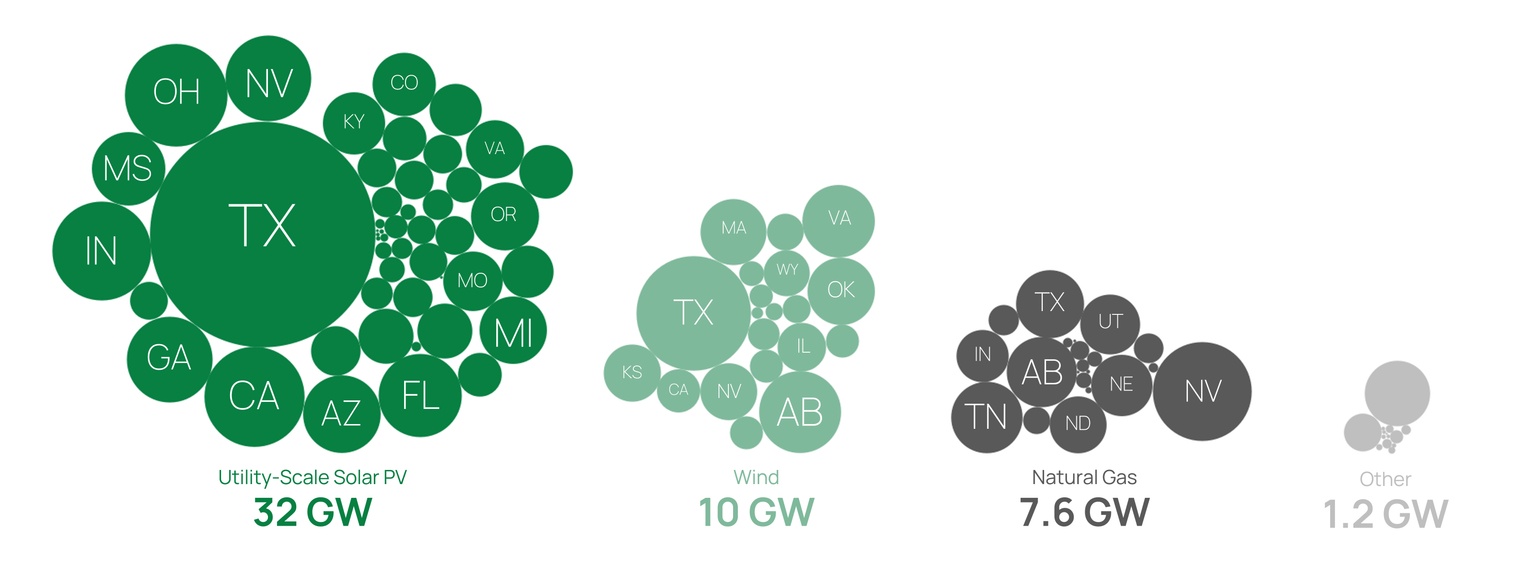

Regardless of tax credit support, wind and solar remain the only power technologies that can be meaningfully added to the grid in the coming years, with new nuclear still a decade away and the gas turbine shortage showing no signs of letting up.

Utility-scale solar and wind accounted for 83% of all new power generation brought online in 2025.

Source: Orennia

With the AI race going full tilt, but limited options for new power, developers got creative last year, turning to some novel electricity generating technologies, including modified airplane engines, fuel cells and microgrids.

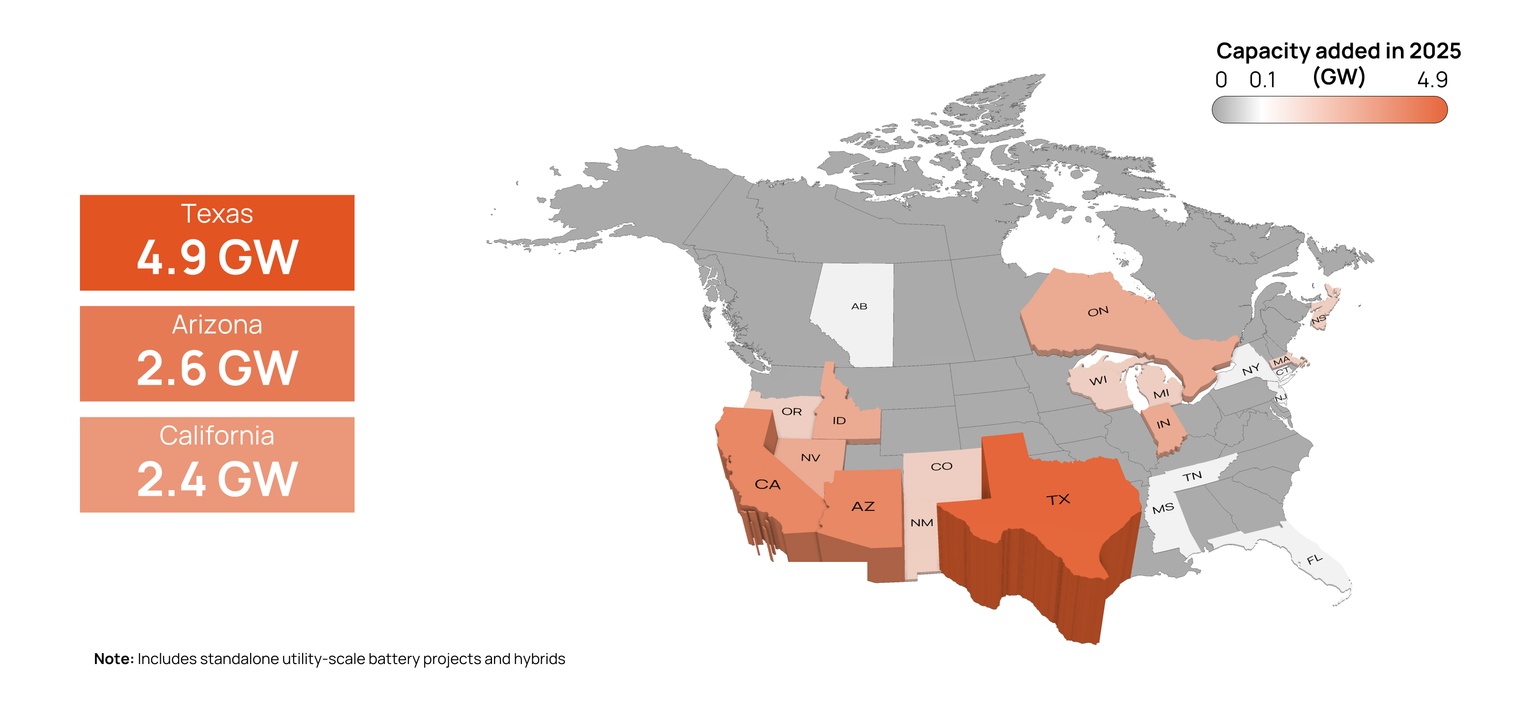

In the US and Canada, batteries play a similar role to solar power that thunder plays to lightning. After tens of gigawatts of solar power are added onto a state’s power grid, daytime electricity prices usually collapse. That allows batteries to roll in like thunder afterwards to take advantage of predictable daily price swings and shift power generated in the day to be used at night.

The challenge batteries face is they quickly eat their own lunch. Three years ago, both California and Texas were ripe for batteries following significant solar power build-out and attractive daily price swings. But following just a few years of battery development, that daily price move has largely been muted, challenging economics of future batteries.

Source: Orennia

That by no means spells the end for batteries. Developers now need to sharpen their pencils to navigate complex tax credit rules around foreign equipment suppliers outlined in the One Big Beautiful Bill Act (ugh) and return to market fundamentals to spot opportunities. Batteries can also play a critical role for utilities looking to enhance local grids, for states looking to meet clean-energy mandates and for data centers to manage gigawatt-scale ramping.

Thomas Edison once famously said that the problem of transmission is the problem of distance.

It used to be that large power plants were built near where the power was going to be used, so the distance that transmission lines needed to carry electricity was short. But sources being built today, notably wind, solar and even geothermal, are produced at the resource and need to be brought into consumption centers, requiring longer transmission lines.

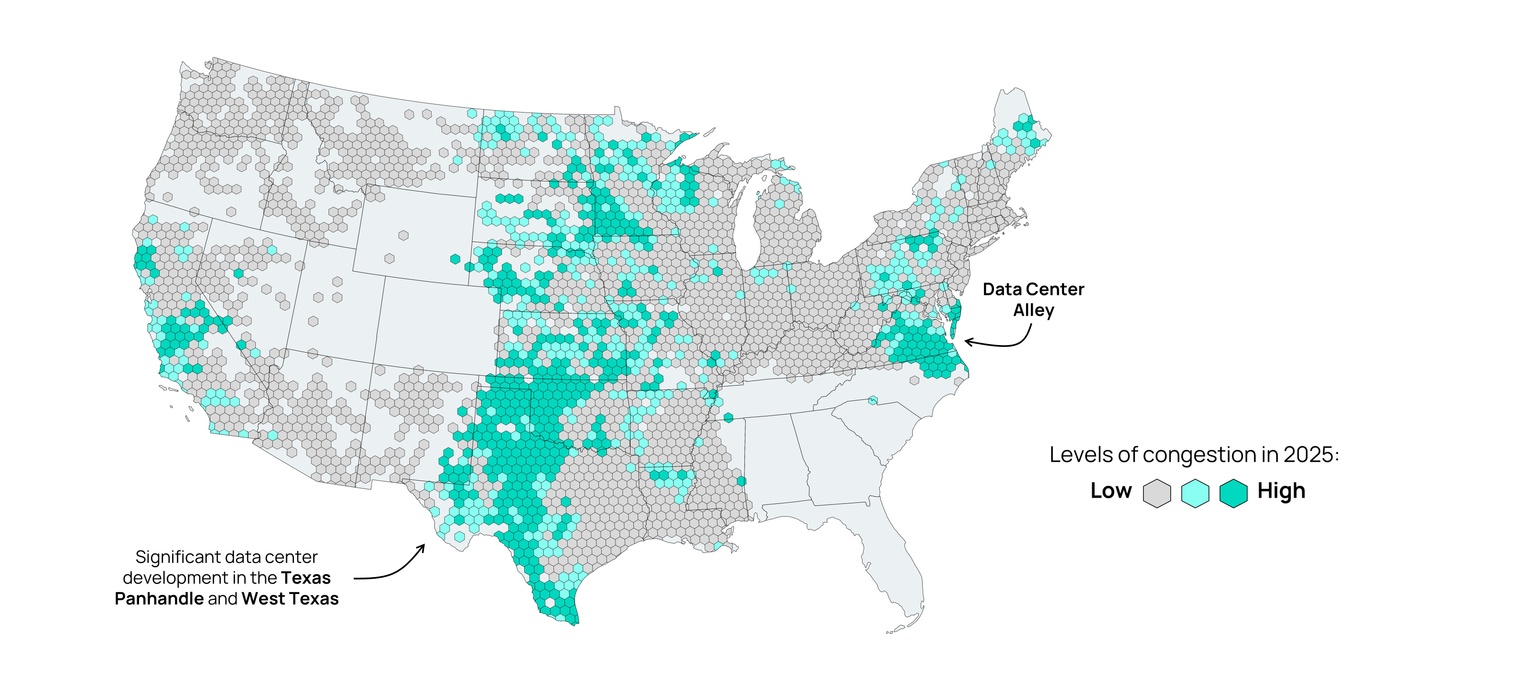

Unfortunately, new transmission projects continue to face fierce local opposition, limiting the number of new lines being built. As a result, areas with significant wind and solar development like California and the Midwest are seeing increasing congestion. The power lines are full.

Source: Orennia

Data centers are also starting to drive grid congestion. Areas like Virginia, the Texas Panhandle and West Texas with large operating data centers now regularly see high levels of grid congestion. This is the result of a mismatch in construction times, with hundred-megawatt-scale data centers taking just a couple of years to build, but the requisite power lines taking a decade or more.

It was a rough start to the year for carbon capture. Safety and longevity concerns about the emerging technology seemed briefly justified after ADM announced a leak at the food processor’s CCS demonstration facility in Decatur, Illinois, though data later showed little reason for concern. On top of that, South Dakota declined permits to Summit’s carbon pipeline, dealing a potentially fatal blow to the industry’s largest potential pipeline in the Midwest.

But fortunes for the industry turned as the hyperscalers, seeking low-carbon baseload power, embraced adding carbon capture to gas-fired power plants as a solution. On top of that, ethanol producers discovered they could boost their margins by adding carbon capture through updated tax credit rules. This was enabled by the Trailblazer Pipeline that connects several ethanol facilities to a sequestration hub in Wyoming coming online in the fall.

In Canada, newly elected Prime Minister Mark Carney tried to kickstart the country’s stagnant economy by overhauling obstructive climate policies and limiting regulations on select “nation-building” projects. As part of the moves, Carney and the Premier of Alberta appear to be teeing up support for the giant Pathways Alliance carbon capture project in the Canadian oil sands.

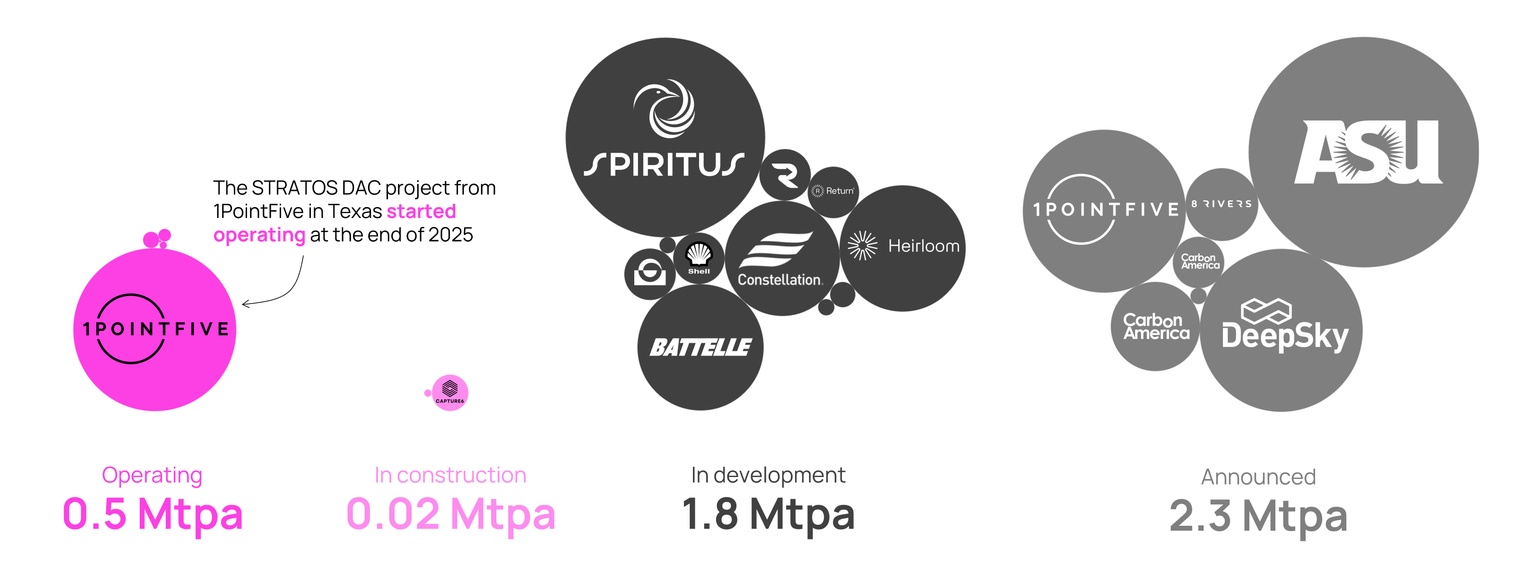

Source: Orennia

And direct air capture is getting its largest test yet, with 1PointFive announcing it was set to start pulling carbon dioxide from the air at the end of last year at STRATOS, the largest DAC facility in the world.

If the meme of Pablo Escobar standing around waiting were an industry last year, it would be clean fuels.

The demand for renewable natural gas, biodiesel and renewable diesel all hinge on government policies, particularly on the volumes that industry will be required to blend into fuel stocks. But instead of receiving certainty on those future volumes, companies faced stasis from Washington, leaving the year no more confident on future demand than when they entered it.

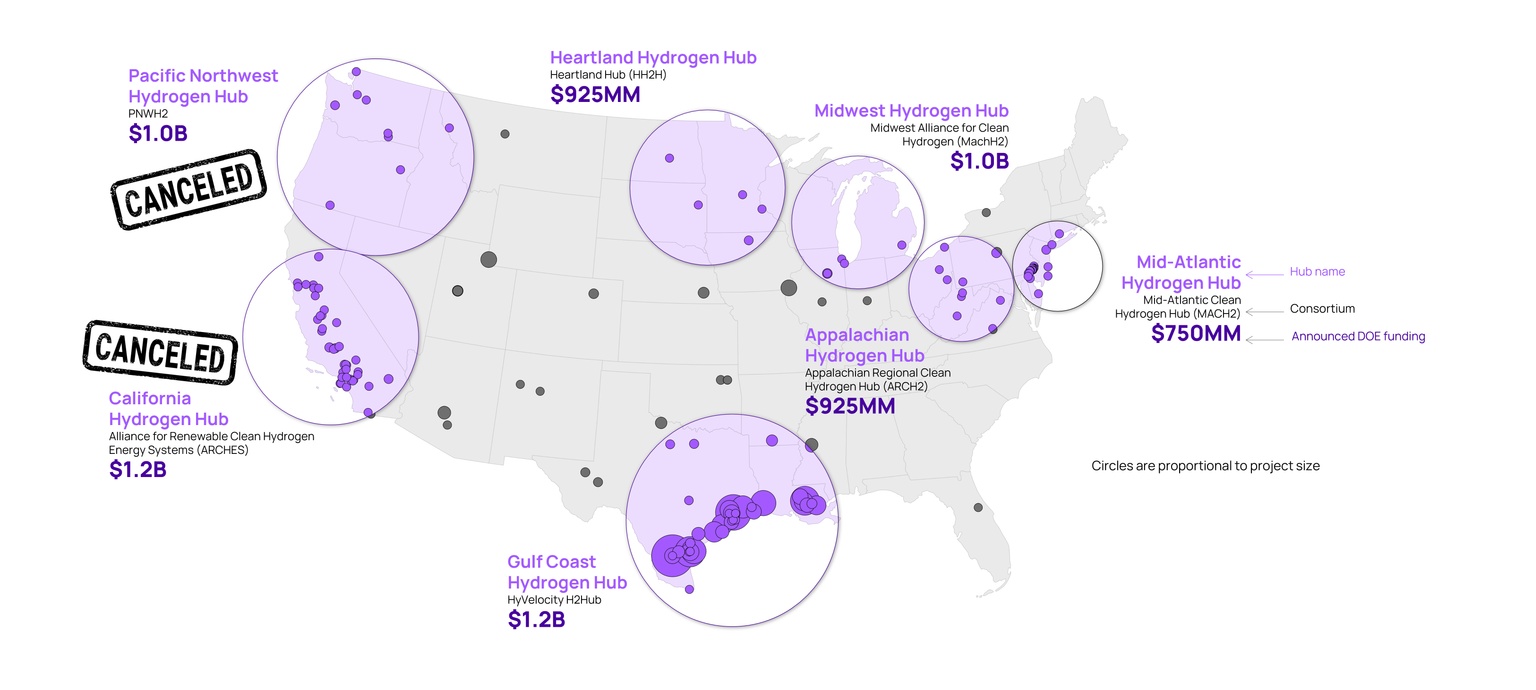

One fuel that did get certainty was clean hydrogen. In keeping with the Escobar theme, the new administration went full sicario on the industry, eliminating tax credits and terminating loans to two hydrogen hubs, with more rumored to come.

Source: Orennia

Lacking domestic support, clean fuels might still find buyers internationally, where demand is robust. Biogas demand is strong and growing in Europe and China. And several of the fuels would benefit from the International Maritime Organization formally adopting its net-zero fuel framework, which it’s scheduled to vote on later this year.

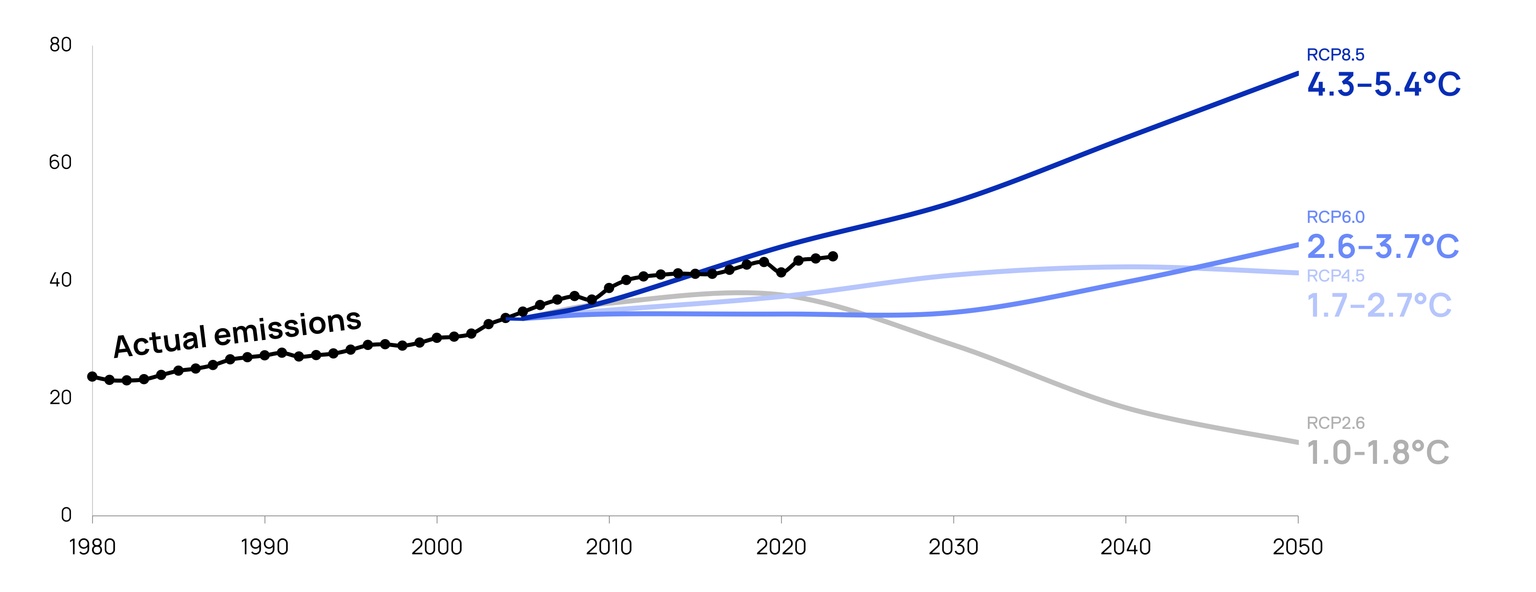

Those Aperol Spritzes hit the spot last summer as global temperatures reached their second-highest level on record, 1.48°C above pre-industrial levels. At 42.2 gigatonnes of carbon dioxide emitted last year, we narrowly avoided another record-breaking year, saved by an El Niño event. Corals took a beating, with 84% bleached in the worst such event on record. And policies looking to address environmental issues took a worse shellacking than Drake at the Super Bowl after President Trump turned his ire on both domestic and international climate efforts.

But one president does not run the world and the progress being made to address climate change should not be forgotten.

Glimmers of hope: We are the first generation since the Industrial Revolution breathing in cleaner air than our parents and grandparents, with emissions of nearly every air pollutant falling. The number of countries developing coal power has dropped by more than half over the last decade. The number of people without electricity continues to fall. As does Brazilian deforestation. Renewable’s share of total power generation is growing in every G20 country. More than 70 countries have reduced their national-level emissions since the Paris Agreement was signed. And the pace of emissions growth globally has slowed since the signing of the landmark climate agreement in late 2015.

Source: International Energy Agency

All in all, while there is still much work to be done, we are starting to turn the corner on climate change and have likely avoided the worst-case climate scenarios.

All the best in 2026. We look forward to spending it with you.

+Access Orennia’s full 2025 Year in Review here or use the form below.

Get a full recap of the past 12 months and gain valuable insights for the coming year with our 150+ page report on what's shaping the energy transition: