Aaron Foyer

Director, Research

How will bill 388 impact the ability to meet data center demand?

Aaron Foyer

Director, Research

When lawmakers play grid engineer, they rarely know what wires they’re crossing. Such has been the case in Germany over the past several decades as moves by politicians looking to score political points by phasing out nuclear power have spectacularly backfired.

Atom-aversive: Germans have long been skeptical of atomic energy, going all the way back to 1970s. In 1975, to protest the construction of the Wyhl nuclear power plant along the Rhine River, 30,000 protestors occupied the plant’s construction site, leading a court to prematurely end the project. Concerns about nukes only grew following the accidents at Three Mile Island and later at Chernobyl.

The 1998 German election brought to power the left-leaning Social Democrats and Green Party who, with wide public support, limited the lifespan of the existing nuclear fleet and banned any new projects from going forward, sounding the death knell for Germany’s nuclear industry.

Angela Merkel’s Christian Democratic Union (CDU) and the Free Democrats (FDP) formed a new coalition a decade later and somewhat extended the life of the plants, known as the “phase-out of the (nuclear) phase-out.” (It’s punchier in German: “Ausstieg aus dem Ausstieg”.) But their fate was sealed.

This was all part of Energiewende (German for “energy turnaround”), an effort to boost Germany’s reliance on renewable power. And while the country now gets 40% of its power from wind and solar, the phaseout of nuclear power has been nothing short of a disaster.

The numbers: Germany, an advanced and highly industrialized nation, produces less power today than it did at the start of the millennium, despite growing its population by 2 million people. The shutdown of nuclear plants increased reliance on coal power, and €16 billion worth of new gas projects were announced last year to ensure steady power supplies to the volk.

A streetlight in Berlin highlighting anti-nuclear sentiment in Germany // Flickr

The country now boasts the highest power prices in Europe, which in turn hamper its once-proud industries. In 2023, German automotive manufacturers were paying twice as much for power as their competitors in the US and three times as much Chinese firms.

A survey conducted by the German Chamber of Commerce and Industry last year found more than half (!) of large companies in Germany are considering relocating abroad and cutting domestic production, citing high energy costs.

Energy turnaround, indeed. Direction wasn’t specified.

To Texas: Across the pond, a bill is making its way through the Texas legislature that looks to have similar industry-hampering impacts. Bill 388, which has already passed the Texas Senate, could do to the US’ emerging AI industry what the nuclear phaseout is doing to German automaking.

As Substacker Doug Lewin wrote, “the Texas Senate is the biggest threat to US energy security.”

Bill 388 is ostensibly about ensuring the grid is reliable. And hey, after Winter Storm Uri left millions in Texas without power in below-freezing temperatures a few years ago, there’s no shortage of support for grid reliability.

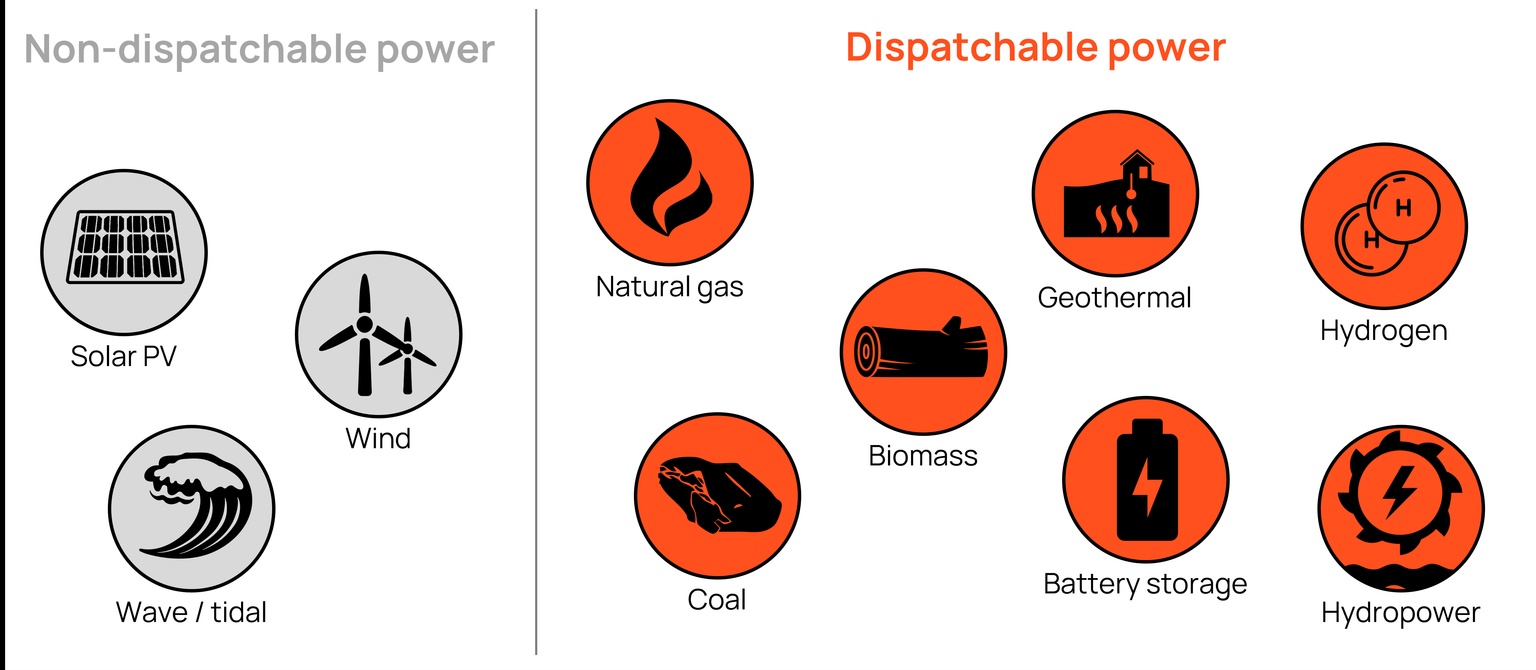

The issue: At the heart of the bill is a requirement that half of all capacity coming online in the state starting next year must be dispatchable — power that can be turned on and off when needed to meet demand. And since no new nuclear or coal plants are likely to be brought online in Texas anytime soon, that means gas.

And while batteries are the definition of dispatchable, to the Texas Senate, that matters about as much as a comment box in Tiananmen Square and so are unexplainably excluded.

In other words, for every unit of wind, solar and batteries brought online in Texas, a unit of dispatchable power must also connect to the grid.

Let’s reframe that for the context of this story: for every gigawatt of natural gas that comes online, just one gigawatt of wind or solar can be added in Texas.

For the coming technological arms race for AI, that move could nearly seal the victory for China.

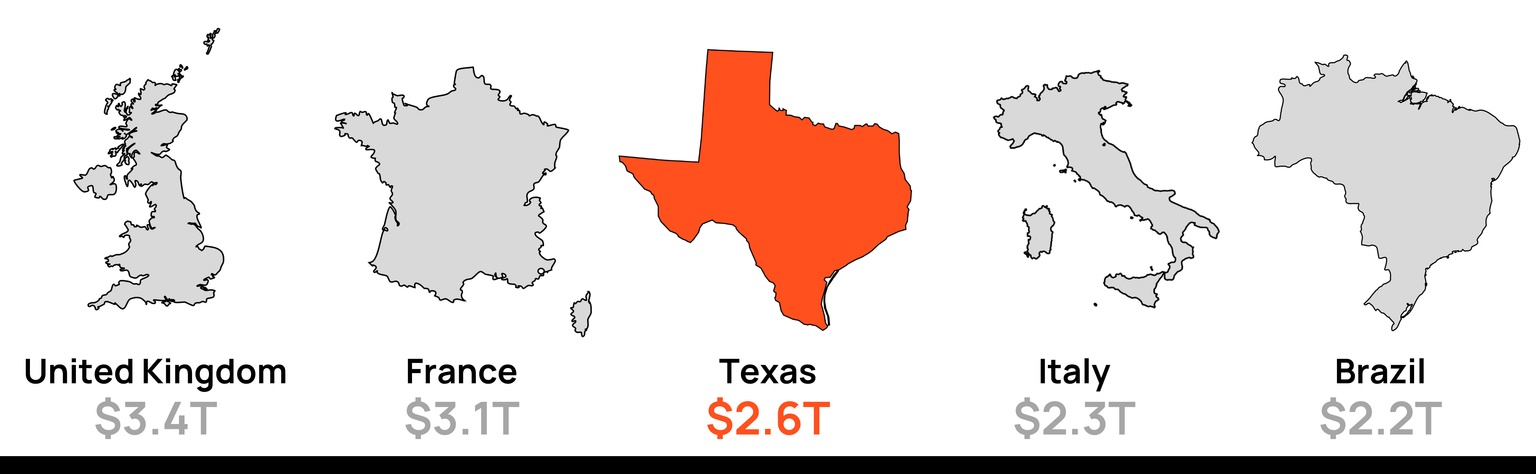

It’s easy to lump every state together and treat the US like a single unit, but the country is heterogenous. And if there were any state being close to being its own country, it’s Texas.

Just in terms of energy, it’s the only US state with its own power grid — ERCOT is separate from both the Eastern and Western interconnections. And because the grid doesn’t cross state lines, Texas regulates its grid itself through the Public Utility Commission of Texas. Together, this means its grid and power market are not subject to federal programs related to transmission from the Federal Energy Regulatory Commission (FERC). Texas has more autonomy than any other state in deciding how its electricity market works, from pricing rules to generator participation.

There’s a reason state tourism has been running the slogan “Texas, it’s a whole other country.”

World Bank, Texas Office of the Governor Greg Abbott

The Texas economy is a force to be reckoned with. Generating $2.6 trillion in annual GDP, it’s more comparable to large industrialized European nations than most other American states.

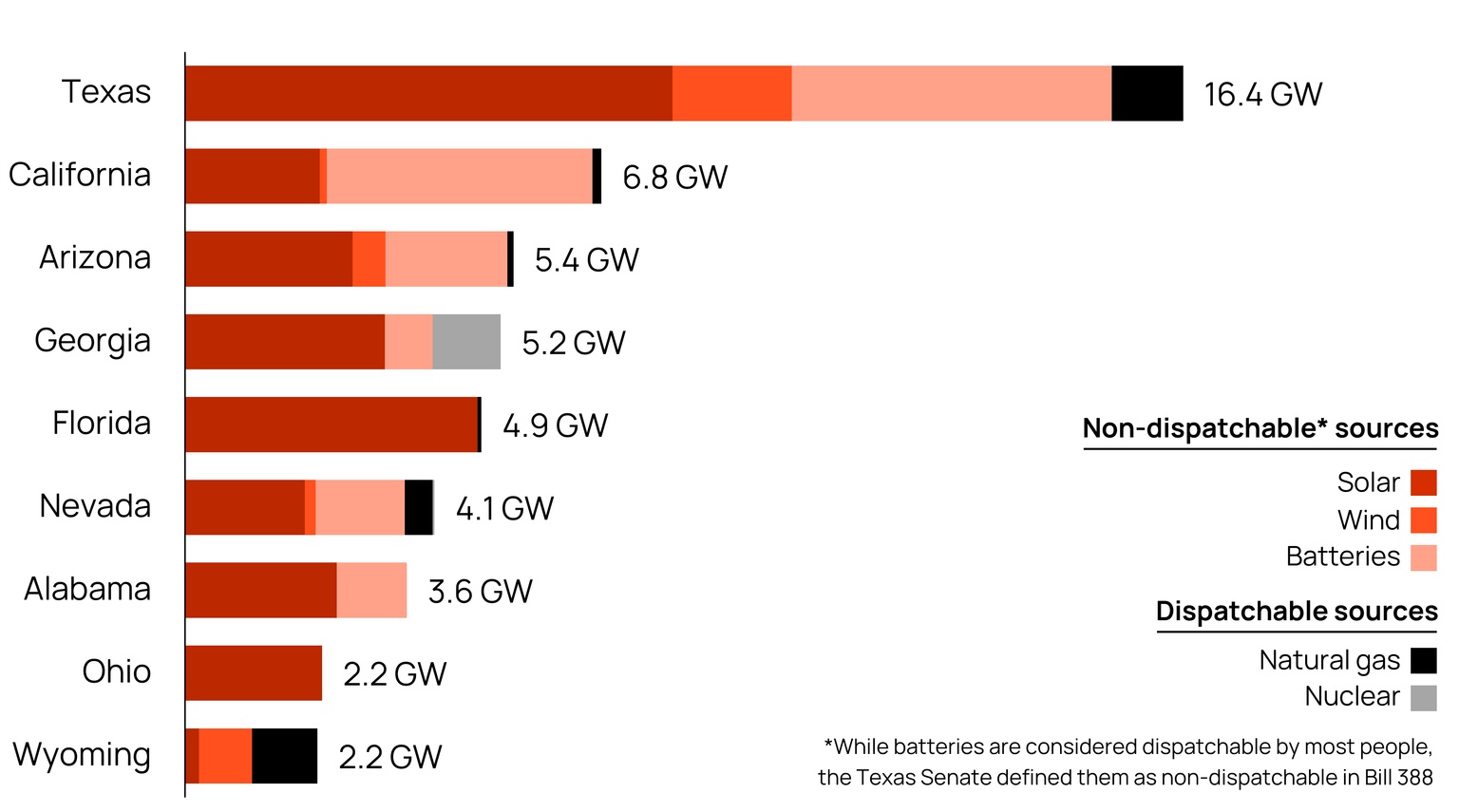

Business friendly: ERCOT is, in economist parlance, the freest energy market in the country. With little for regulation but plenty of wide open spaces, Texas has become the go-to market for renewable developers. Last year, more than 15 gigawatts of renewable and battery projects came online in the state, more than double the next closest, California.

And it’s not just energy developers. Texas is second only to Virigina for states where data centers are being advanced. The ease of building power projects and data center growth makes the Lone Star state one of the single greatest assets the US has for competing against China in AI.

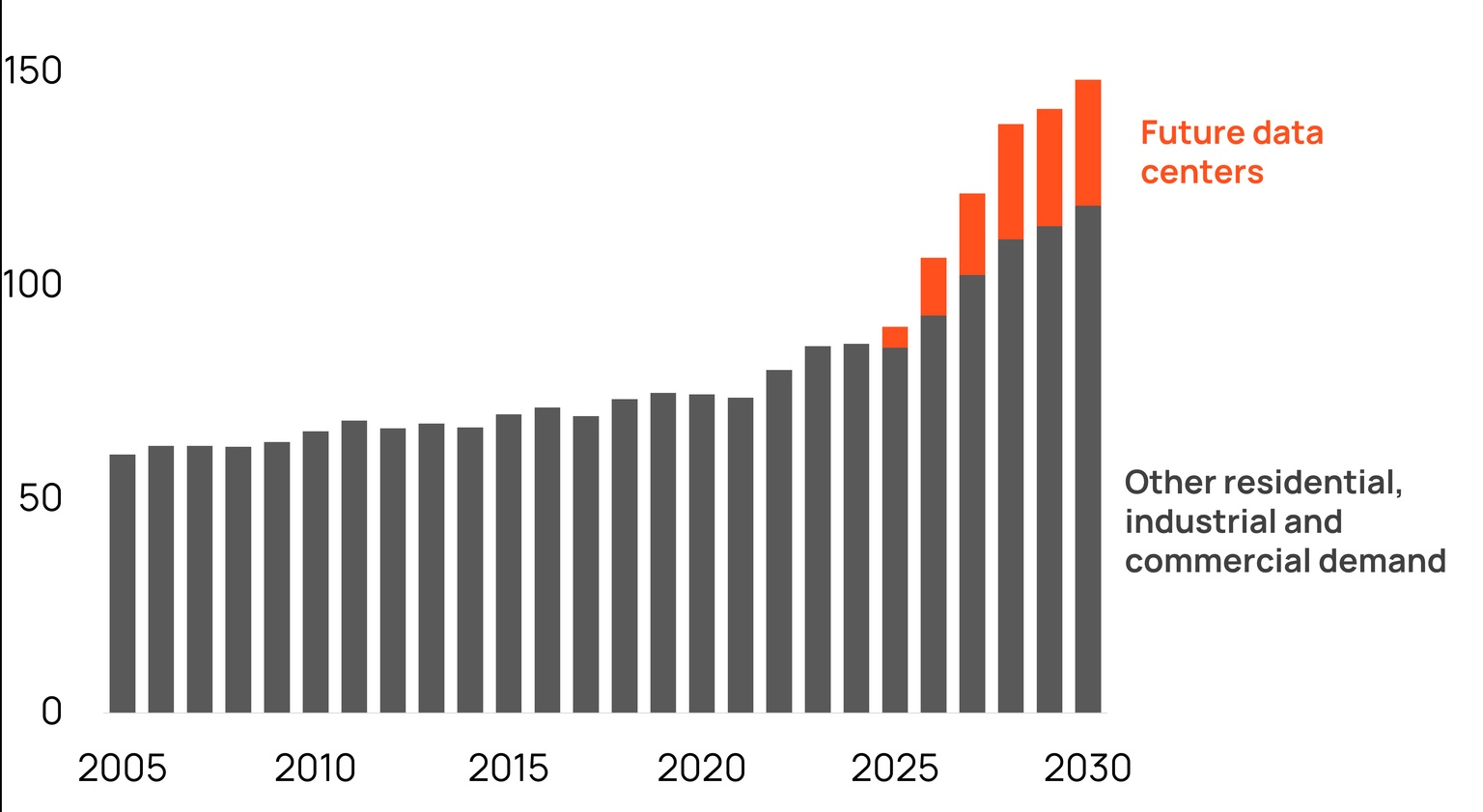

Rapid growth: In its latest forecasts for load growth, ERCOT sees its peak power demand growing by more than 70% by 2030, nearly half coming from data centers. And to meet that new demand, more power needs to be brought online, and fast.

Source: ERCOT

In normal circumstances, there’s probably no better state than Texas to build new power projects quickly to meet the new data center demand, but Bill 388 would completely upend normal.

The crux of the issue with the Texas Senate’s strategy is that gas power simply can’t be ramped up quickly due to the well-documented delay on orders for new gas turbines (including by us). A newly proposed gas plant today can expect its turbine delivered by the end of the decade, if it’s lucky.

The scale: By our estimates at Orennia, just 9.5 gigawatts of new gas power are likely to be built in Texas from 2026 to 2030, between when the Texas bill would kick in and when new orders of gas turbines could start showing up. Over that period, we also forecast nearly 50 gigawatts of wind and solar set to be built (notwithstanding Bill 388 being passed).

The Texas bill can’t boost gas generation until at least 2030 but will very likely eliminate 38 gigawatts of data-center-powering electricity that would otherwise have come online.

The sacrifice: As a rule of thumb, it costs roughly $1.1 billion to build a gigawatt of solar in the US today and about $1.3 billion for onshore wind. That means, at today’s prices, more than $40 billion in new investment would be foregone in the state as a direct result of the bill.

(As an FYI, NextEra pegs a gigawatt of new gas power at $2.4 billion, more than double the cost.)

But the investment losses go beyond just the foregone power projects. All that power was meant to support the modern industrialization of Texas, between data centers, crypto, oil and gas, and other industries. Notable data center projects being developed in Texas include IREN’s 2-gigawatt Sweetwater data center in West Texas, CloudBurst’s 1.2-gigawatt Next-Gen Data Center Campus near San Marcos, and the infamous $500 billion Open AI Stargate development in Abilene.

Source: Orennia

And then there’s the jobs. The International Renewable Energy Agency (IRENA) estimates that 3,500 full-time jobs are created for every gigawatt of installed utility-scale solar PV. For wind farms, needing more operations and maintenance work than a solar installation, it’s closer to 12,000 full-time jobs across their 25 operating years. Depending on the exact mix of projects that Bill 388 would effectively kibosh, that’s 130,000+ middle class jobs that will never hand over a paycheck.

Make America Great Again.

The bill does include a get-out-of-jail card, though it won’t be free: power generators, utilities and electric cooperatives that fail to meet the 1-to-1 dispatchable power requirement will need to buy credits from a new dispatchable power trading scheme.

Details about the credit market and prices have yet been published, but between whatever the costs of these new credits are and the electron shortage this bill is setting up, Bill 388 will almost certainly drive up energy prices for consumers, if it ever goes to law.

Invisible hand, meet government-issued gloves: For a state that prides itself on a free market and lack of regulation, Bill 388 is remarkably political.

In the opening paragraph of the first draft of the bill, the intent of Bill 388 was for 50% of megawatts installed in ERCOT starting in 2026 to “use natural gas.” Likely to obfuscate the Texas state government clearly picking winners and losers, wording in the bill was updated from using “natural gas” to using “dispatchable power.”

And then, as though someone informed the lawmakers that batteries were dispatchable, a subsequent version of the bill was appended with “… other than battery energy storage.”

The Texas Senate pointed to grid reliability issues during Winter Storm Uri as part of its justification for beefing up dispatchable power in the state. Ironically, the North American Electric Reliability Corporation’s final report on the storm found it was natural gas-fired units that accounted for the majority of plants that experienced outages.

Bottom line: There’s no need for governments to meddle in power markets. Institutions like independent system operators and regional transmission organizations exist and are explicitly tasked to ensure customers receive reliable electricity at the lowest cost. It’s literally their job.

One only needs to look to Germany, with customers paying the highest electricity prices in Europe and companies packing their bags, to see what happens when political whims shape power market decisions.

And amid a power-hungry technological arms race with China, it’s no time for Texas to find this out.

Data-driven insights delivered to your inbox.