Aaron Foyer

Vice President, Research and Analytics

Early solar PV markets may provide some clues

Vice President, Research and Analytics

It’s been a long road for solar. Considering roughly 380 gigawatts of solar PV capacity was added globally last year, it almost strains the mind to remember back to when the technology was niche. Yet, some of the industry’s early steps towards significant cost reductions came from those first customers willing to pay a premium for early solar cells. New industries like green hydrogen looking for early offtakers may follow in solar’s footsteps.

The early users: While cheap utility-scale solar panels were still a pipe dream in the 1960s, 70s and 80s, there were some demand cases that were not as sensitive to price. The emerging space sector discovered that solar panels worked well for satellites, allowing them to operate for much longer than alternatives, including batteries. The same was true back on Earth with solar-powered calculators, something companies like Sharp and Casio capitalized on for decades. An entire generation of school kids unwittingly learnt about the photovoltaic effect when they “put the calculator to sleep” by simply covering its solar cell during math class. Even remote military bases leaned on early solar panels for power when other sources proved more logistically challenging.

Solar-powered calculators: an early niche market for solar cells; image courtesy of charlesdeluvio, Unsplash

These niche markets planted the seeds for the solar PV industry, allowing for the first commercial factories and knowledge centers to develop. This eventually led to the industry’s flourishing, which now adds hundreds of gigawatts of capacity per year.

Now, it’s hydrogen made from electrolysis – often referred to as green hydrogen – that is hoping for expansion. Much like the early days of solar PV, green hydrogen developers are keenly seeking the right offtakers to help catalyze the industry and drive down costs.

Hydrogen is a product already heavily used in several markets across the world. 90% of it is consumed in refining or in the production of methanol and ammonia. It’s typically made using either coal or natural gas and without capturing the associated carbon emissions. This carbon intensive product is referred to as grey hydrogen.

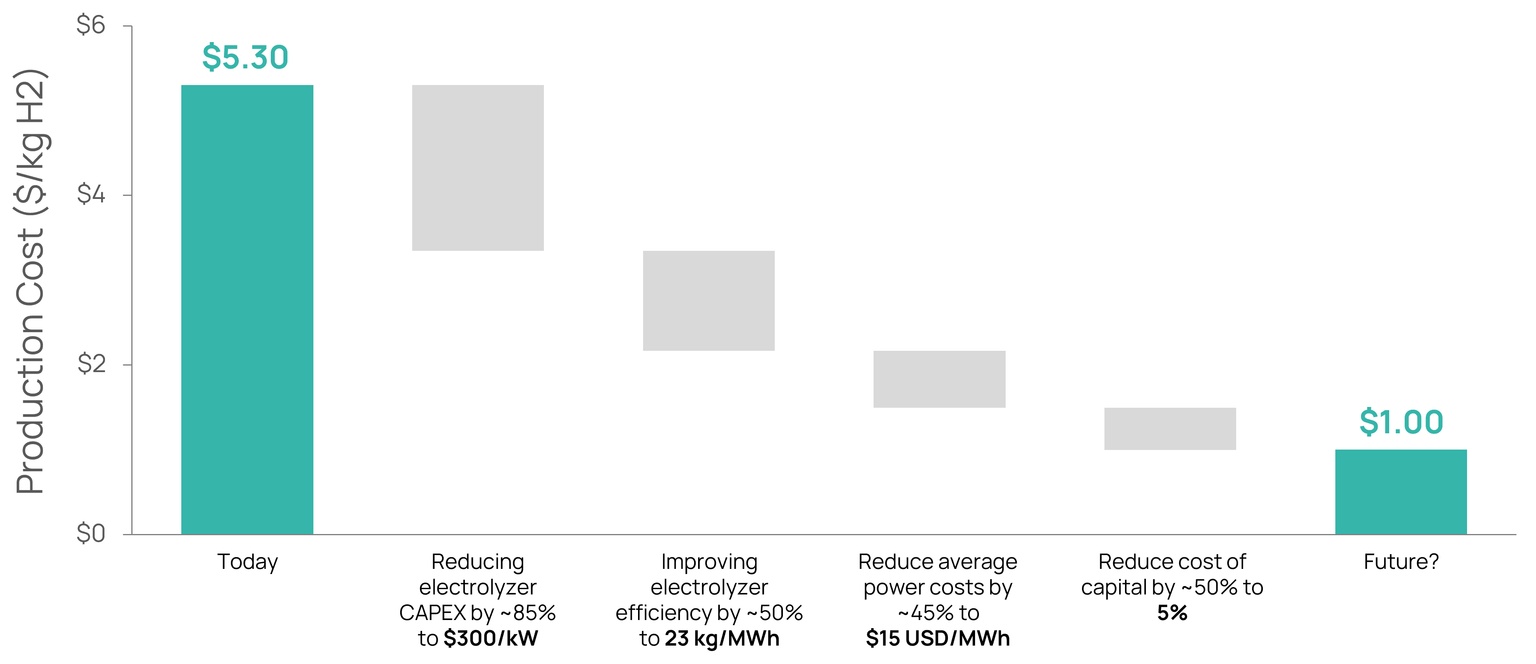

There are many industries considering low-carbon hydrogen as a means to decarbonize, including heavy-duty trucking, shipping, steelmaking and power generation. A key barrier for many industries is cost. While grey hydrogen often sells for between $1 and $2 per kilogram, its green counterpart made from splitting water in an electrolyzer is produced for many multiples of that. Our models have a well-designed and well-located green hydrogen project in the US producing for more than $5 per kilogram before policy support.

In order to be cost competitive, the US Department of Energy launched its Hydrogen Shot, a technology accelerator with the goal of making electrolysis-based hydrogen “$1 per 1 kilogram in 1 decade”.

The good news is that much of the reduction in cost needed to reach the $1-per-kilogram milestone can come from improvements to the electrolyzer. In many ways, electrolyzers are ideal for economies of scale as they are dependent on chemical and machine manufacturing, so can be mass produced. Much of the remaining reduction will come from cheaper power with many expecting the price of renewables to come down still further.

Context: Solar PV’s improvements are the pinnacle standard for improvements in cleantech. Between the mid-1970s and today, the price of crystalline solar cells fell more than 99% while their efficiency rose from around 13% to today more than 27%.

For the new green hydrogen industry, in order to take the first steps towards mass production, enough large offtake contracts are needed. And it’s not obvious who is going to sign up first.

Let’s start by digging into what could influence early adopters. While there are likely many drivers, some of the most influential include how sensitive specific industries are to hydrogen prices, sectors where electrification looks challenging, individual corporate initiatives and national-level policy pushes.

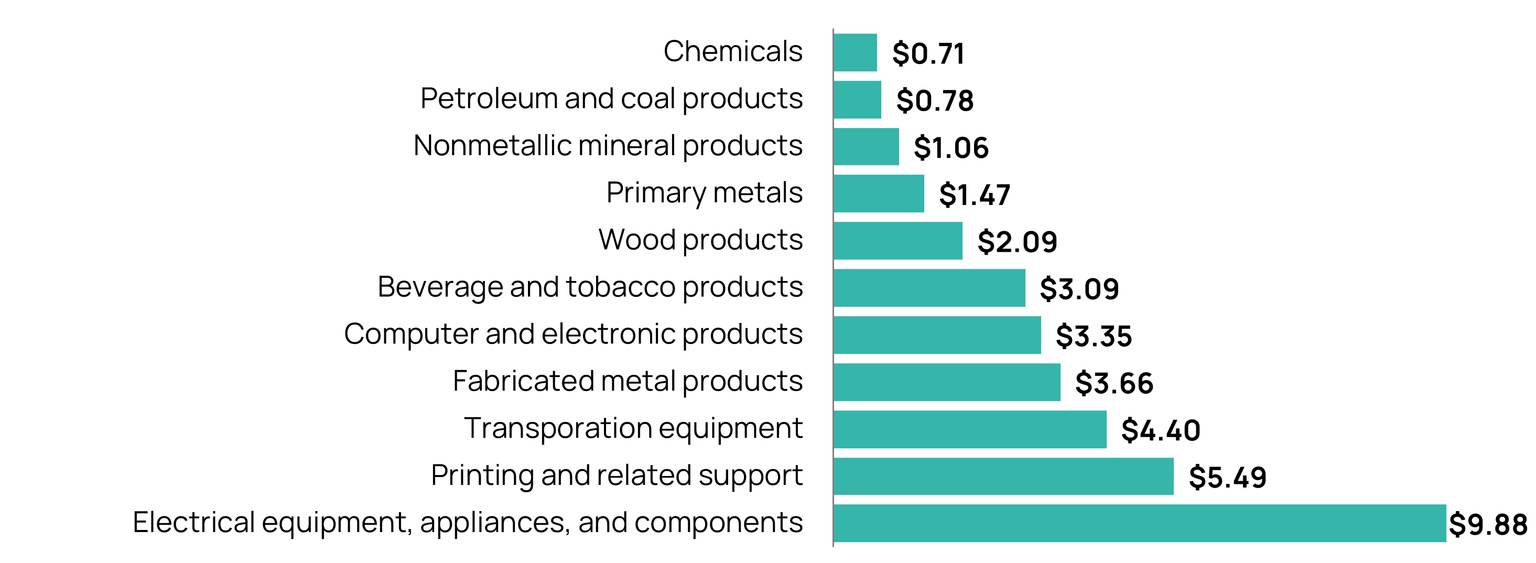

Managing costs: The US Energy Information Administration collected data from several manufacturers over the cost of their purchased hydrogen and found there are existing industries already paying premium pricing. For many of these industries, including electronics, metal and wood products, hydrogen represents a small share of total costs. Switching over to green hydrogen could be a low-cost or even a cost saving avenue to decarbonize their supply chains and so could justify early offtake agreements.

Note: Assumes a lower heating value of 0.1146 MMBtu per kilogram of hydrogen

Source: MIT, US Energy Information Administration

While many of these niche markets amount to just a small share of today’s demand, there are other industries which may adopt hydrogen at scale over costly alternatives to drive decarbonization.

Transportation: In 2022, the sector accounted for 10 gigatonnes of carbon dioxide or 22% of energy-related emissions globally. And while electric cars sold at their highest levels ever last year, many segments within transportation are not suitable for batteries. Because of the relatively low energy density of lithium-ion batteries (LiB), heavy-duty trucking, aviation, and shipping are all difficult to electrify, especially over long distances. An electric container ship with no room left for containers is not really a solution. Enter hydrogen.

Liquid hydrogen is roughly 80 times more energy dense than a LiB. This makes it better suited for industries where weight and volume are key considerations.

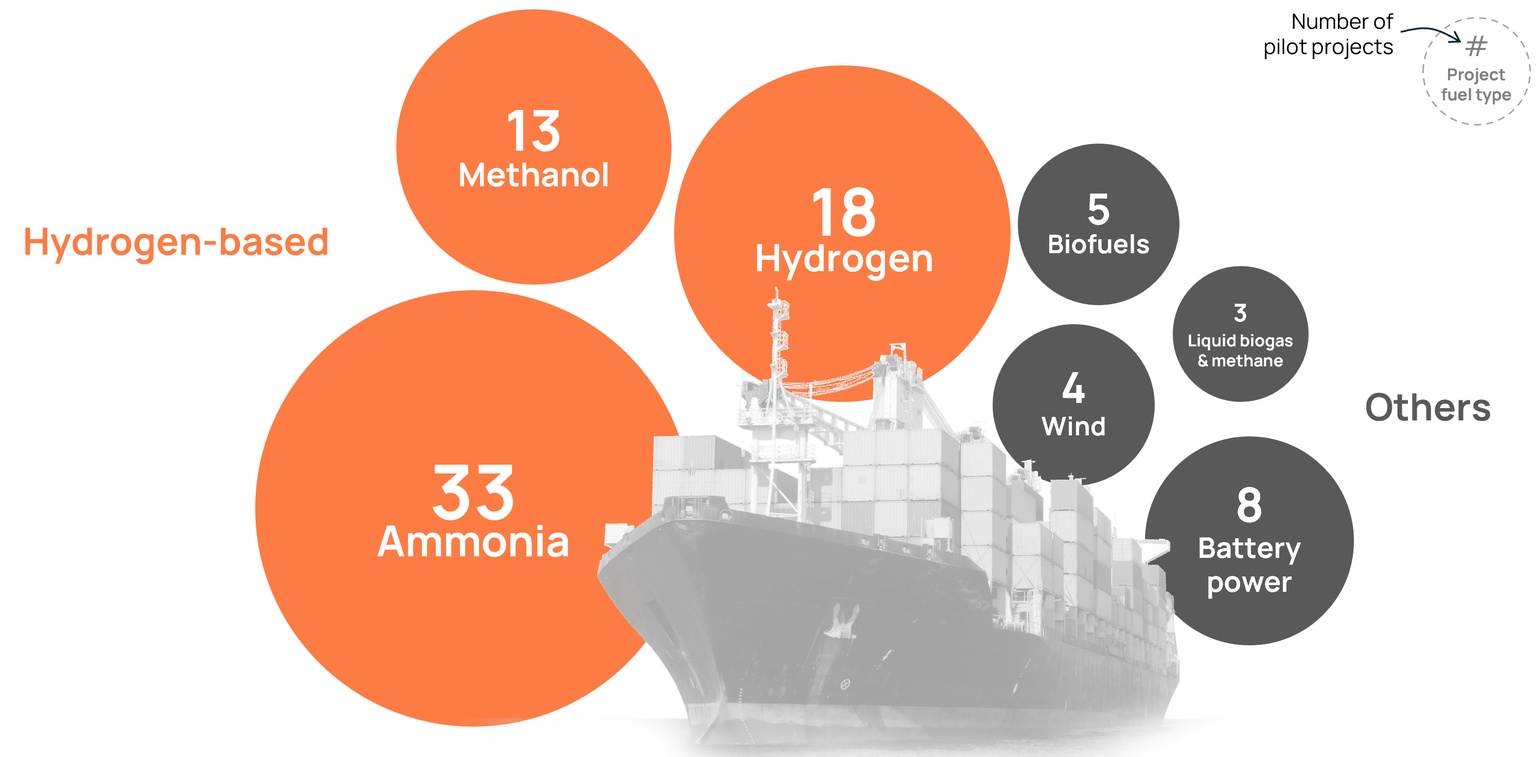

In the latest Global Maritime Forum report on pilot and demonstration projects for the global shipping industry, hydrogen-based fuels accounted for three quarters of the fuel types being tested on large vessels. When looking at shipping fuel production project pilots, those made from electrolysis, notably hydrogen and ammonia, accounted for 83% of all projects.

Green fuels are starting to be more widely adopted for marine transportation. Dutch shipping giant Maersk is looking to be net zero by 2040 and is prioritizing green methanol made using electrolysis to meet its goal. Across the North Sea, German chemical maker Linde recently started commercial operations supplying ferries in Norway with liquid green hydrogen.

Source: Orennia, Global Maritime Forum

Steelmaking: The dominant process used today to make steel is a carbon intensive one. Most steelmakers use coke synthesized from coal to react with the oxygen in iron ore. This reaction removes oxygen from the ore, reducing it and releases carbon dioxide as a by-product.

An alternative process known as direct reduced iron (DRI) can use hydrogen instead, still removing the oxygen from the ore but emitting only water vapor. While this is estimated to increase the unit cost of steel by 30%, increasing carbon prices will narrow the cost gap and make low-carbon hydrogen more competitive. As will lower hydrogen prices.

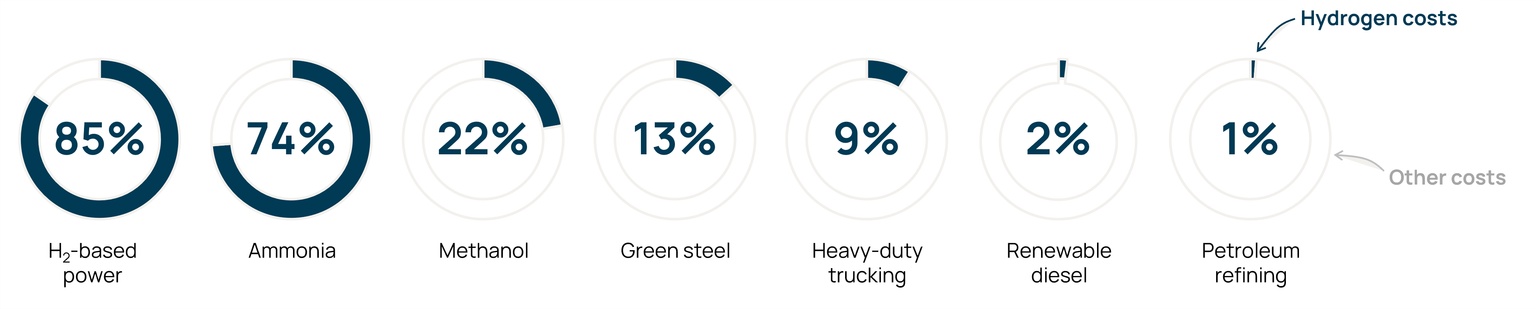

And refining: Hydrogen is used extensively in the refining of petroleum, renewable diesel and sustainable aviation fuels, accounting for 25% of current global demand. With the capital intensity of the large facilities and the costs required for raw materials, hydrogen represents very little of the total production cost.

Note: Undiscounted full project costs including both capital and operating costs using hydrogen at $1.00/kg

Source: Orennia

Given petroleum refining is closely tied to the natural gas industry, gas-based hydrogen is likely to be preferred in the future. But that may not hold true for refiners of renewable diesel and other sustainable fuels, who are more oriented towards the availability of quality, low-carbon-intensity feedstock sources and other energy inputs. A clear example is the Come by Chance refinery in Newfoundland, which was recently converted to produce renewable diesel by Braya Renewable Fuels. The facility is taking advantage of the nearby offshore wind resource by partnering with ABO Wind for a local source of green hydrogen.

Still not for everyone: There remain several major industries that are very price sensitive, especially when it comes to major energy inputs. Adopting hydrogen as an alternative will be more difficult until costs come down for these. As an example, our models have low-carbon hydrogen blending increasing the price of power generation by an average $93 per megawatt hour. This compares to just $8 to $10 per megawatt hour by incorporating CCUS instead (report here). These industries might be the long-term beneficiaries of hydrogen costs coming down, but unlikely to be early buyers at scale.

Buyers may also come at the country level, with several governments having already laid out national-level hydrogen strategies. Germany and Japan, two of the largest global industrial economies, are each facing energy security issues. They each find themselves short on energy and long on hydrogen.

Germany: Low-carbon hydrogen offers the opportunity to decarbonize several key industries for the country, which is itself the industrial heart of Europe. The sector as a whole, including strategic industries like chemicals, steel and cement, emits one quarter of the country’s greenhouse gas emissions. The loss of cheap Russian gas, which accounted for 55% of the country’s supply in 2021 and dropped to zero by the following summer, is also forcing Germany to shift its energy supply chains. The government is actively preparing for a shift to hydrogen.

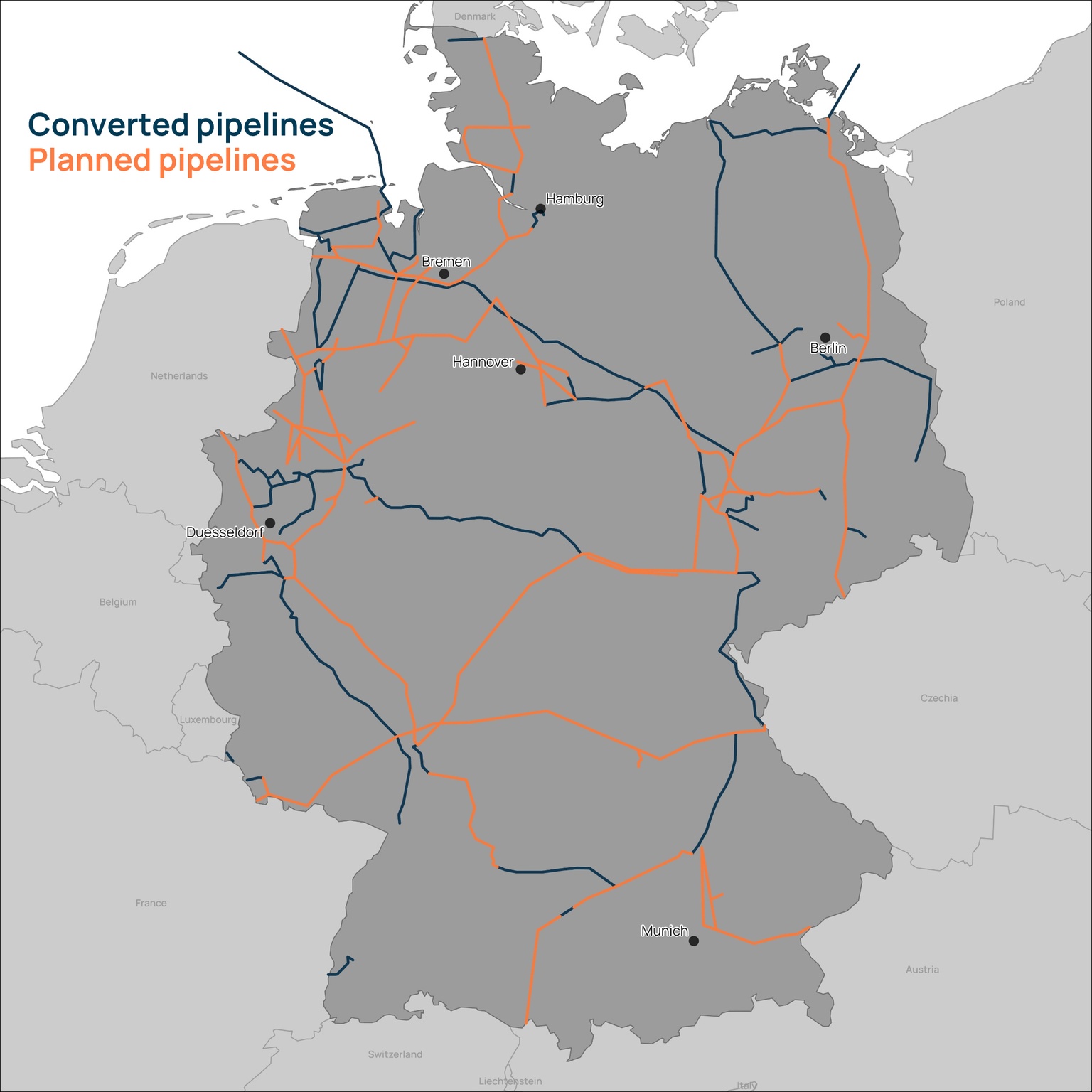

Germany’s National Hydrogen Strategy, released initially in 2020 and updated last year, expects total hydrogen demand to hit between 95 and 130 TWh by 2030. This equates to between 33% and 44% of the country’s natural gas consumption in 2021. Preparations for the shift include spending an estimated €20 billion on a vast 9,700-kilometer hydrogen pipeline network across the country and targeting 10 gigawatts of new electrolyzers. Some uncertainties in the project remain, with estimates of the new infrastructure nearly doubling energy prices, even before the price of hydrogen is included.

Source: Orennia, FNB Gas

The German government estimates this would meet between 26% and 35% of the country’s expected 2030 hydrogen demand, relying on imports for the rest. This lead Germany to signing international trade agreements with countries, including the United Kingdom, Canada, and Namibia.

Japan: The East Asian island nation is no stranger to energy security issues, either. The country is sustained almost entirely by imported energy with an energy self-sufficiency ratio of just 11%, one of the lowest in the world.

In 2017, Japan became the first country in the world to publish a national hydrogen strategy. Updated again in 2023, the country is looking to increase its supply of ammonia and hydrogen six fold, cut supply costs by a third and expand the entire industry’s production. The aim is to ramp up the use of hydrogen across the country, with a goal of spending $107 billion on hydrogen supply chains over the next 15 years.

There are many different initiatives across the country, including a goal for e-methane – synthetically produced with clean hydrogen and carbon dioxide – to supply 90% its gas supply for cities by 2050. On the electricity side, Japan’s largest power producer JERA is set to trial the co-firing of ammonia with coal at its 4.1-gigawatt Hekinan thermal power station. Late last month, the country also announced a $26-billion hydrogen passenger jet program.

Much like Germany, to meet its ambitious hydrogen targets, Japan will rely on imports for much of the needed supply. In this pursuit, it has signed several import agreements, including with India, Oman and Brunei. In 2022, Japan also received the world’s first shipment of liquefied hydrogen, shipped from Australia.

Leveraging wealth: Developed countries may also accept higher early costs for a technology recognizing the greater long-term benefits. Markus Steigenberger, the managing director of the German think tank Agora Energiewende, noted how Germany paid higher prices early on for solar PV modules, which helped pave the way for the industry to lower costs.

“Indeed, the German people are paying significant money, but in Germany, we can afford this – we are a rich country. It’s a gift to the world.” – Markus Steigenberger, Managing Director of Agora Energiewende

A familiar dynamic in energy transition exists in the green hydrogen space: the opportunity is recognized, scale is needed to drive wider adoption, but who signs first?

In the early years of solar cells, the first adopters weren’t the giga-scale utility power companies but instead niche use cases. Industries like satellites, solar-powered calculators and remote outposts were the first to sign early agreements at higher prices because the alternatives were worse. Before electrolyzer and power prices come down, it could be these niche markets or international buyers that plant the first seeds of the early green hydrogen industry.

Data-driven insights delivered to your inbox.