Aaron Foyer

Vice President, Research and Analytics

Aaron Foyer

Vice President, Research and Analytics

Data source: Orennia Power Projects Dashboard, 2022-2023

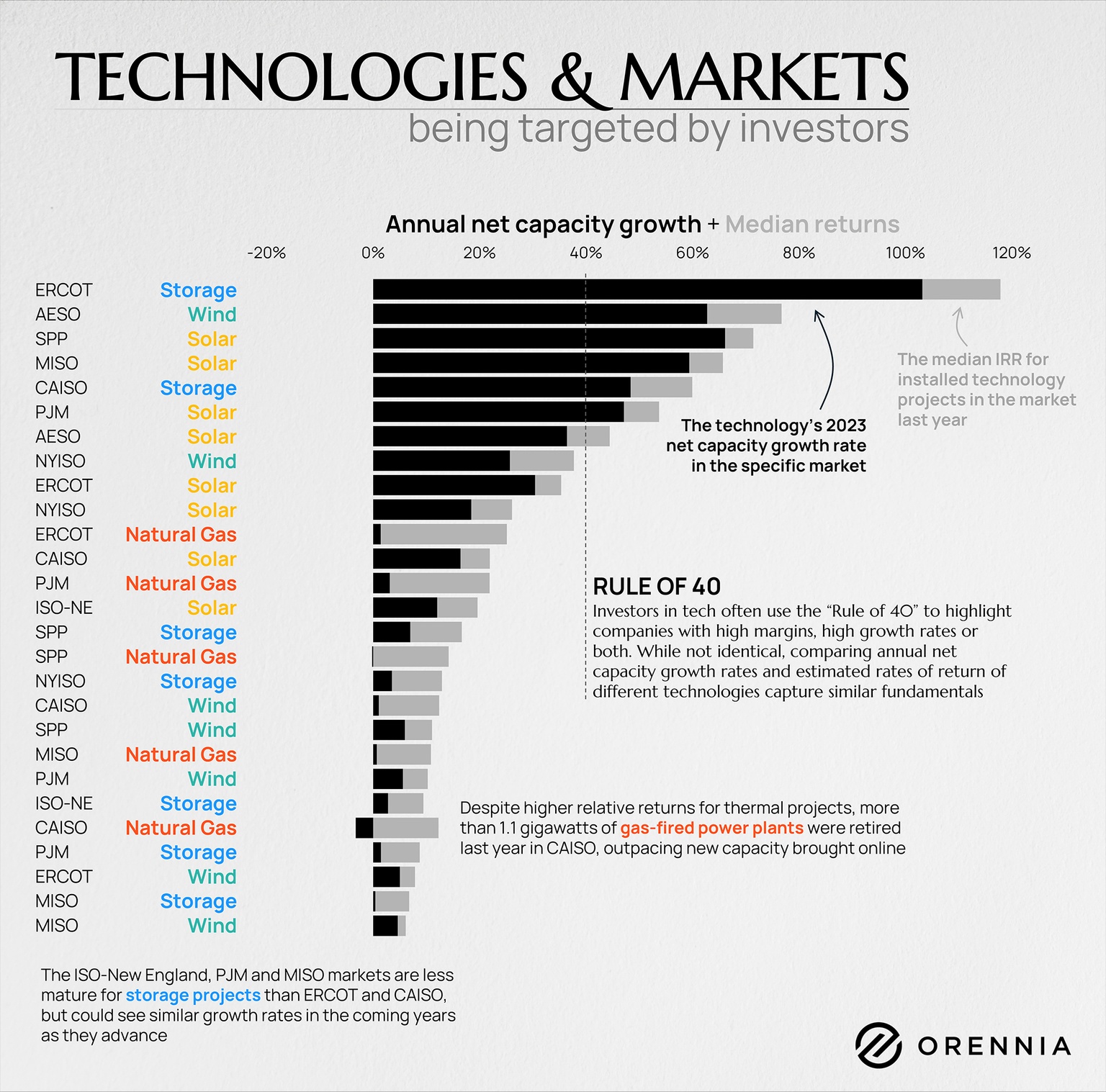

Clean power projects, particularly solar and storage, are growing quickly across North America. What are unique ways to capture investor sentiment?

Rule of 40: Typically used to benchmark SaaS companies, investors will add annual revenue growth and operating margins together. The goal is to find companies with either high margins, high growths rates or both and it’s a positive indicator if the combined value is over 40%.

Metrics are different in the power sector but looking at which technologies in which markets are growing the fastest and have the best returns can bring forward similar trends.

Some key trends

Solar: It turns out that incentives paired with ultra-cheap solar panels leads to surging solar growth. Almost every market saw double-digit growth last year. Returns are not necessarily remarkable, but when ~32 gigawatts of solar is installed, projects become routine and capital costs come down.

Storage: Some markets are more mature than others. Particularly ERCOT and CAISO, both with large solar and wind penetration, have seen significant growth in battery storage recently. This could be a sign of things to come in emerging storage markets like NYISO and SPP.

Wind: While higher returns than solar, there has been a recent slowdown in the sector. The combined effects of supply chain issues, length permitting processes and a growing backlash against wind farms has stunted their growth.

Natural gas: With cheap gas and high electricity prices, gas-fired power plants have relatively high returns compared to other power projects in the US. But, due to both a high existing installed base and some hesitancy to invest in carbon-emitting power projects, the net capacity growth rate of gas is lower.

Data-driven insights delivered to your inbox.