Aaron Foyer

Vice President, Research and Analytics

The winners and losers of the data center boom

Aaron Foyer

Vice President, Research and Analytics

Breaking the fourth wall here.

My fellow colleagues Jeff Taylor, Keaton Horner and I sat down and picked who we believe will be the greatest beneficiaries of the data center boom (and some who might wish we could go back to the era before ChatGPT). This once-in-a-decade event is driving powerful and unexpected change across the entire energy industry, an impact usually saved only for global geopolitical events.

We set out to answer the big questions on everyone’s minds.

Before jumping straight in, let’s clarify the terms of the draft.

First, this is limited to energy-related entities and technologies. As the old saying goes, during a gold rush, sell shovels. Nvidia and any startup that can share in the growing GPU chip market is going to do very well, as will anyone who can affordably improve the energy efficiency of data centers, but this is outside of the discussion.

As for winners and losers, think of it in terms of how a player’s trajectory has changed with the infusion of data center growth into the mix. Winners are technologies or entities whose outlooks have improved for the better, either directly or indirectly. Conversely, losers face a harder road ahead, getting outcompeted for finite resources or experiencing negative impacts from data center growth.

So, without further ado and with apologies to those who don’t love sports analogies, welcome to the 2024 Data Center Fantasy Draft.

Like any proper draft, the number one overall selection is coveted. In the case of data centers, it’s an easy choice: utilities.

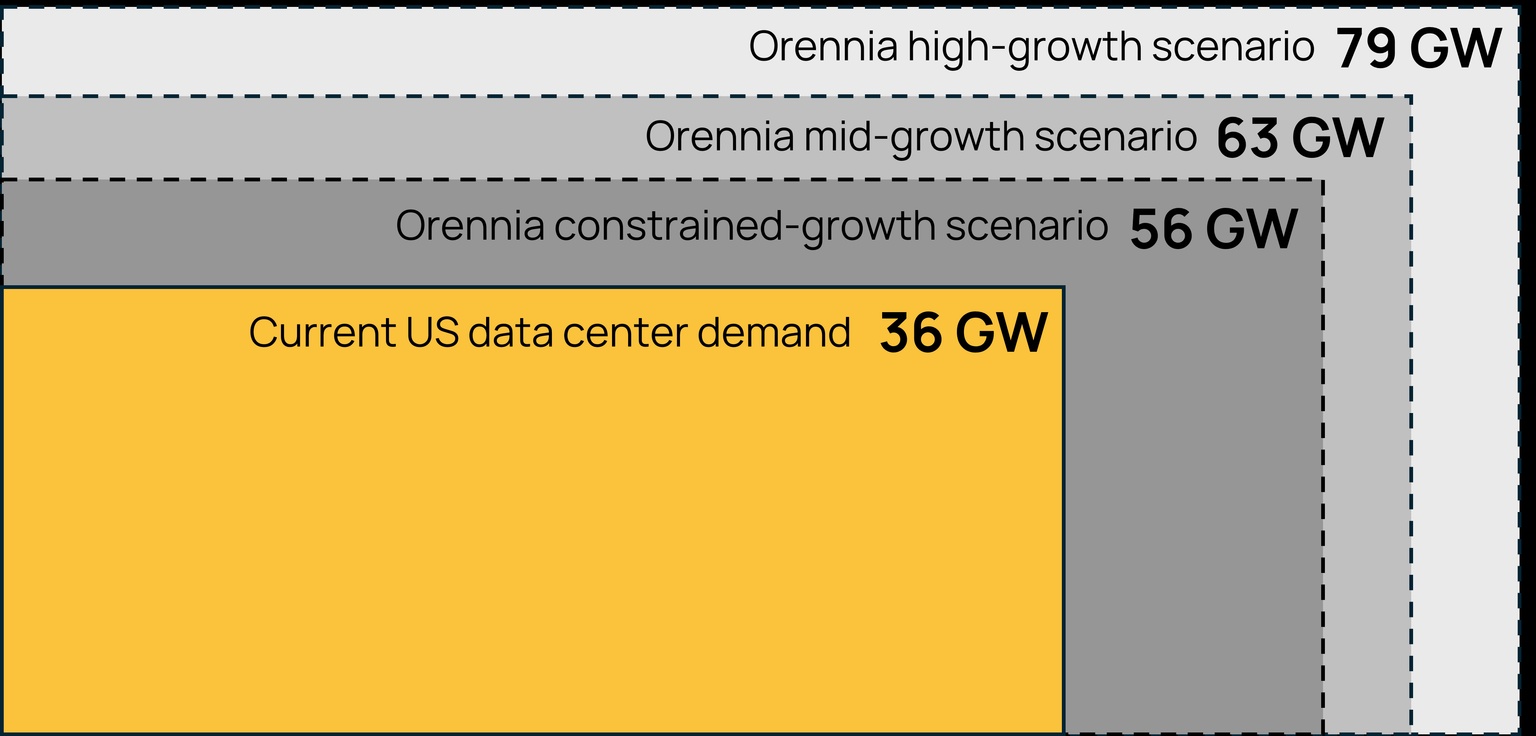

To meet the power requirements of new data centers, tens of gigawatts of new power generation is needed by 2030 in the US alone. For the expected total new load growth required, there’s a range of views: McKinsey pegs it at 50 gigawatts to power new American data centers by the end of the decade, Goldman Sachs has it closer to 47 gigawatts while BCG estimates it to be 28 gigawatts. At Orennia, we built a bottom-up forecast and our central case, with demand growth limited by the number of identified facilities in each state or power supply available there, we see 27 gigawatts of incremental power demand from new data centers being built by 2030. Though, we have scenarios where it could top 40.

Either way, Christmas came early this year for utilities: $30 to $50 billion of new power projects are needed by the end of the decade to meet additional power demand should this all come to pass.

The list includes most types of power generators, gas producers and midstreamers.

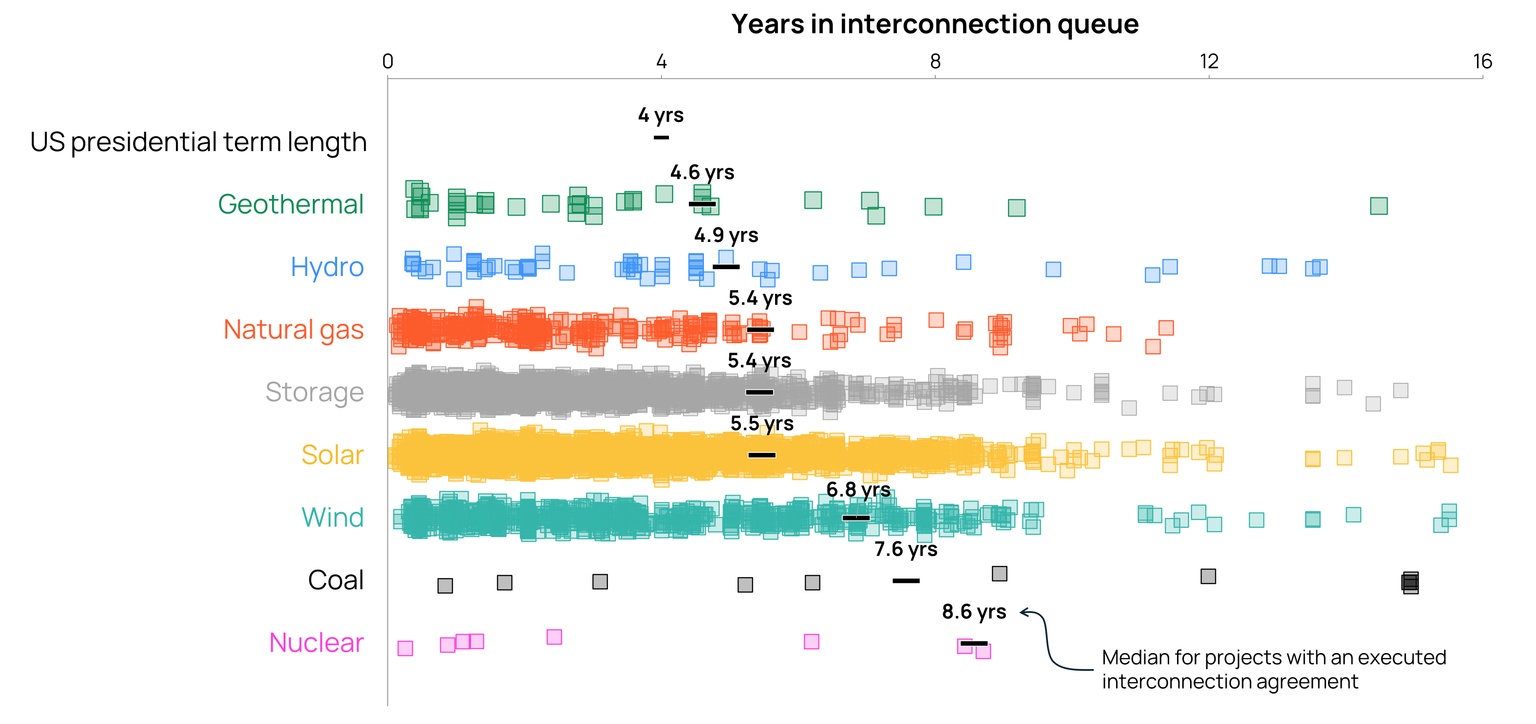

Generators: In the American Civil War, Gen. Nathan Bedford said the key to victory was to “get there firstest, with the mostest.” This pretty much sums up the current state of the American power industry. Almost every type of power generation will benefit from data centers, and the those that are commercial, scalable and can connect to the grid quickly will benefit the most. With that in mind, the big winners are likely to be wind, solar and gas.

For wind and solar, each has its merits. The higher capacity factor for wind power makes it more suitable for the low downtime needs of many data centers, though solar projects typically spend less time in development so can connect to the grid quicker.

Gas producers: In a note published by Raymond James in April, the bank views the demand of natural gas for data centers growing by 10 billion cubic feet per day in its base case. That’s just shy of the totality of US liquefied natural gas export volumes. There are lower estimates, including Goldman Sachs with growth of ~3.3 billion cubic feet daily. Regardless, the additional demand will help stymie low gas prices across the continent and warm the hearts of domestic gas producers.

Natural gas also stands to benefit from challenges in building electrical transmission. Bringing wind and solar into load centers often requires new or upgraded transmission lines. Yet, just 55 miles of high-voltage transmission lines were added in 2023, roughly the distance between San Francisco and San Jose. For data centers, it may be easier to connect to existing gas infrastructure, if even just for backup power.

Source: Orennia

And speaking of…

Midstreamers: The pipeline-building firms will be needed to divert the large volumes of gas into these facilities, especially for the largest data centers, which are often hundreds of megawatts in size.

Alan Armstrong, CEO of pipeline giant Williams, let it be known on an analysts call in August the firm was staying busy with data centers. “We, frankly, are kind of overwhelmed with the number of [data center] requests that we’re dealing with, and we are trying to make sense of those projects,” Armstrong said.

The Big Tech firms all have ambitious climate targets but are unlikely to be deterred from rapid AI development in the name of emissions. To square the circle, they are starting to invest in several emerging technologies that either provide low-carbon baseload power or remove carbon emissions from the atmosphere. Data center developers have not appeared to be particularly sensitive to electricity prices and seem willing to invest in earlier-stage technologies.

The following solutions, which have to date been slow to attract investors due to their high costs, will benefit from recent investments that may ultimately bring prices down.

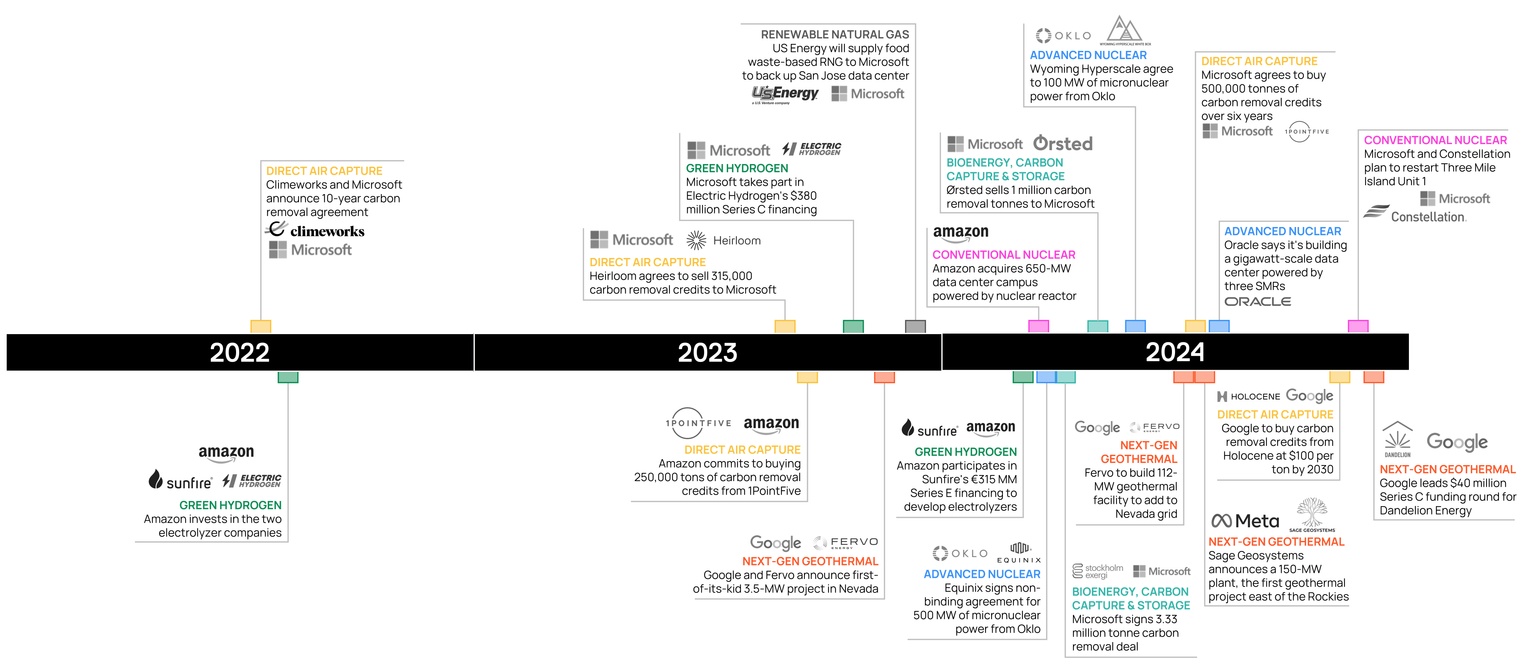

Next-generation geothermal: Clean renewable baseload power sourced from anywhere on Earth has always been a holy grail of sorts, but new designs have not yet had the opportunity to come down the cost curve. This may soon change as Google and its parent company, Alphabet, have been active in the space, investing in next-gen geothermal company Fervo as well as the home geothermal company, Dandelion, itself a spinout from Alphabet X. Meta also recently announced funding for Sage Geosystems’ first-of-its-kind plant, the first US geothermal project east of the Rocky Mountains.

Source: Public disclosures

Nuclear: Like Brendan Fraser, atomic energy has made a comeback in the hearts of Californians. There are only a few technologies that can truly match the power needs of gigawatt-scale data centers, and nuclear is one of them. On the conventional nuclear front, Amazon acquiring the data center campus powered by the Susquehanna nuclear plant and Microsoft driving the resurrection of the Three Mile Island Unit 1 reactor both made headlines. Big Tech has also been active in the advanced nuclear space, with Oracle announcing a data center powered by three small modular reactors and even Oklo’s micronuclear reactor is getting attention from companies like Equinix and Wyoming Hyperscale.

Bioenergy with carbon capture and storage: More commonly abbreviated to just BECCS, this system produces electricity that is both baseload and carbon negative, so it checks multiple boxes for hyperscalers. The power generation technology has long been viewed as one of the most expensive, but Microsoft signing deals with Ørsted and Stockholm Exergi paired with the current credit price of $160 per tonne could spur more investment in the space. In September, the British power generating firm Drax announced $12.5 billion of investment into US-based BECCS projects, a decision the company’s president partially chalked up to data center growth.

Direct air capture: If US-based data centers end up consuming 3 to 10 billion cubic feet per day of additional gas and increase their emission profiles, expect some atonement by tech companies in the form of new DAC projects. These carbon removal facilities may have to be strategically located in regions not competing with data centers for power, as the cancellation of CarbonCapture Inc.’s Project Bison underscored. But multiple DAC startups have been getting attention from hyperscalers, including 1PointFive, Holocene and Climeworks.

Data source: Orennia

Green hydrogen: Any technology competing for green electrons is tempting to throw into the potential bust category, and electrolysis-based hydrogen is quite sensitive to high electricity prices and transmission and distribution costs. However, a behind-the-meter solution where both electricity and hydrogen are produced and used on-site may be the exception.

Two electrolyzer startups, Sunfire and Electric Hydrogen, received investments from tech companies, and the data center startup ECL plans to build a 1-gigawatt off-grid data center powered by on-site green hydrogen. This would be another solution that could bypass the lengthy interconnection queues.

Other rookies that show promise: Renewable fuels could increasingly be used as backup for data centers. Many currently use diesel for backup generators, so renewable diesel could be swapped in to reduce emissions. Similarly, with the jump in natural gas use, low-carbon-intensity renewable natural gas (RNG) may be used to bring down carbon intensities, as highlighted by Microsoft’s deal with US Energy last year to supply RNG to back up a data center in San Jose.

Blue hydrogen probably also benefits in a round-about way. While green hydrogen may be used as an off-grid solution, data centers look like they’ll outcompete other loads looking for clean power on the grid. As a result, some regions will be less attractive for green hydrogen, which has the knock-on effect of making blue hydrogen look better by comparison.

Like Tom Brady, even long and prosperous careers eventually end. For technologies that still look well on their way to retirement, there is only one to talk about.

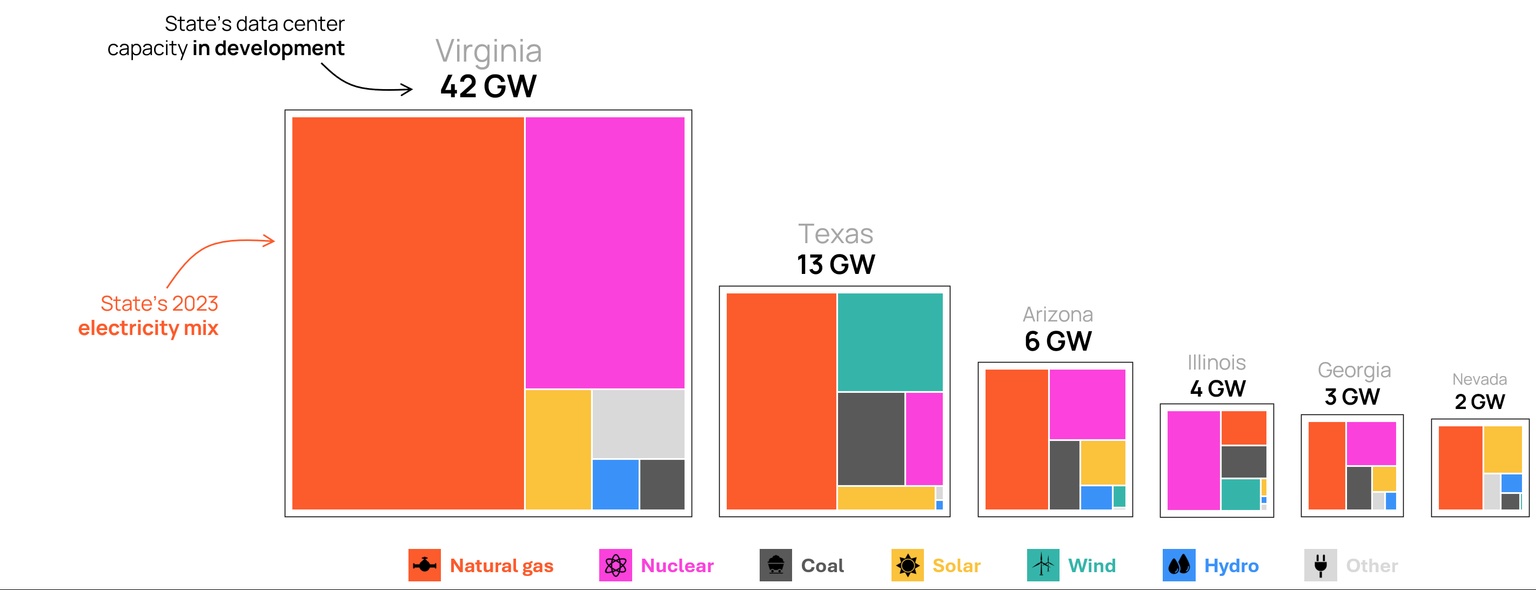

Coal: Data centers may alter the journey of US coal retirements, but the ending looks the same. Of the ~180 gigawatts of operating coal facilities in the US, Orennia still expects more than 90% to be retired by 2050. That said, the surge in new power demand from data centers may delay some of the expected retirements in the interim.

Source: US Department of Energy

And why wouldn’t they? Prices from PJM’s 2025/26 capacity auction hit $269 per megawatt-day earlier this year, nine times higher than last year’s auction. This was the result of both substantial plant retirements and increased power demand, including from data centers. These higher prices more than incentivize the continued use of existing coal plants that have modest operating costs.

How the US Environmental Protection Agency finalizes the treatment of coal plant emissions will likely have a greater impact on the future of coal than data centers. The government agency proposed new rules earlier this year that would force existing coal-fired power plants operating beyond 2039 to either install carbon capture or shut down by 2032.

The final category belongs to those whose futures are less rosy because of data center growth. Let’s start with some technologies.

E-fuels: All the Power-to-X (PtX) pathways use low-cost clean electricity to create some type of clean fuel. These include green hydrogen, e-ammonia, e-methanol and e-fuels, all of which have green hydrogen as a foundation. Given how sensitive the production costs of these fuels are to power prices and how insensitive data centers are, it’s expected the clean fuel facilities will either be outcompeted for finite green electrons or face incompatible power prices wherever data centers are vying to grow.

It’s not just clean fuels that will suffer from high prices.

Consumers: The Maryland Office of People’s Counsel estimated the impact to consumers of the aforementioned bombshell PJM capacity market auction. The state ratepayer advocate believes monthly bill prices will jump between 2% and 24% for homeowners and commercial businesses as a result. In Oregon, Portland General Electric is seeking to increase rates this year by 10.9% for consumers, higher than its rate hike of 7.4% estimated earlier this year. The region is a hotbed for data centers and recently nearly doubled its 2030 power demand estimates for the power-hungry facilities.

No matter how you cut it, data centers look inflationary for consumer prices.

And of course, emissions: In the short and medium term, with the expected delays in coal plant retirements and a surge of new gas demand that could rival the entire US LNG export market, it’s no surprise that emissions related to data centers are expected to go up. For those keeping count, that’s a double whammy for consumers who will need to run their air conditioners a bit harder due to a warming climate and run them using higher-priced electricity. Electric vehicles may also get hurt by high power prices, which erode their lower operating cost advantage, often a key selling point.

Yet, there is hope. In the long arc of history, perhaps the greatest long-term benefit we’ll see as a society is from the set of technologies labeled in this fantasy draft as “promising rookies.”

The amount of capital being put toward data centers and the energy to power them is staggering, with $30 to $50 billion being spent by the end of the decade solely on related US energy projects. There is more than $400 billion of cash, cash equivalents and marketable securities currently sitting on the collective balance sheets of Alphabet, Amazon, Apple, Meta, Microsoft and Oracle. Even a sliver of that could serve as a miniature Inflation Reduction Act focused on financing a wide range of emerging technologies and ultimately bring costs down for wider adoption.

So, will our short- and medium-term emissions go down because of data centers? Almost certainly not. But could global decarbonization be accelerated inadvertently as a byproduct of feeding power-hungry hyperscalers? It just might.

Looking back on our board, here’s how the draft played out:

Originally published in Latitude Media

Data-driven insights delivered to your inbox.