Aaron Foyer

Vice President, Research and Analytics

Data centers looking for greener backup are looking at RNG

Aaron Foyer

Vice President, Research and Analytics

The Victorian era was a period of remarkable English innovation. Breakthroughs in physics and engineering led to inventions like the electric telegraph, X-ray machines and the hipster-friendly Penny Farthing bicycle. One English scientist, William Henry Fox Talbot, mastered light and electronics to develop early photographic processes while another, Joseph Swan, developed a British-made incandescent lightbulb independent of Thomas Edison’s. It was nonetheless a society with problems to solve.

London suffered from periodic breakouts of cholera, the result of unsafe drinking water and inadequate sanitation. In the 1850s, to try to mitigate the cholera, an engineer named Joseph Bazalgette designed the world’s first modern sewage system, London’s vast underground sewer network that both literally and figuratively relieved the city.

One drawback of the concentrated flow of raw sewage was a buildup of sewer gases, the result of the anaerobic digestion of the waste that flowed through the system. As a sign of the issue, locals dubbed the period from 1859 to 1865 as the “Great Stink”.

Again, innovation came to the rescue.

The original gaslighting: Birmingham inventor Joseph Webb developed a lamp that could safely remove the sewer biogases, bringing them to the surface to be burned and generate light. Eventually patented as the Webb Patent Sewer Gas Lamp, these gas lamps both lit up the streets of London at night and rid the city of much of the sewer gases and germs that literally plagued it.

The Carting Lane gas lamp in London // Flikr

Eventually, flaring systems and waste-to-energy initiatives more efficiently solved the sewer gas problem and lamps switched to lightbulbs provided the city with lighting. As a result, nearly all of London’s lamps are now electric, save one remaining gas lamp that continues to burn. In an indiscrete alley behind the Savoy hotel, gas still lights up the small street of Carting Lane just steps from the Thames.

Fast forward: Today, engineers are looking to solve a modern infrastructure and public health problem: how to backup power-hungry data centers in a way that avoids emitting greenhouse gases. The vast majority of data centers currently use diesel generators for backup, but diesel is not a clean option, driving companies to look for alternatives. Unfortunately for batteries, often the technology of choice for backup power, the economics don’t pencil for data center use.

At the same time, existing biogas producers are currently facing an uncertain future as rule changes by a governing body in California could alter the commercial landscape for the industry leading developers to look for a new home for their product.

Could biogas, specifically renewable natural gas, fill the void and be the ideal backup for data centers?

Society has become accustomed to a well-functioning behind-the-scenes data center industry. In October 2021, it took just a few of Facebook’s data centers going down to create global turmoil as the company’s entire ecosystem was disconnected from the internet for six hours.

Time is money: Any system downtime creates losses for businesses and pain for customers. Atlassian estimates the average cost of data center downtime to be $9,000 per minutes and can be much higher. Fortune 1000 companies lose $1 million per hour from outages while high-risk industries like finance and health are closer to $5 million per hour.

It’s believed the 2021 outage for Facebook cost the company $100 million, and a 5-hour outage at Delta Airlines’ operation center in Atlanta resulted in the cancellation of more than 1000 flights and cost the company $150 million.

In short, data center downtime is bad for business, which is why achieving near-perfect uptime is critical. Data centers can charge, and businesses are willing to pay for reliable backup to avoid any downtime.

While diesel is currently the backup of choice, natural gas is increasingly considered as the fuel for the job, driving a pique in interest for the low-carbon alternative, renewable natural gas (RNG).

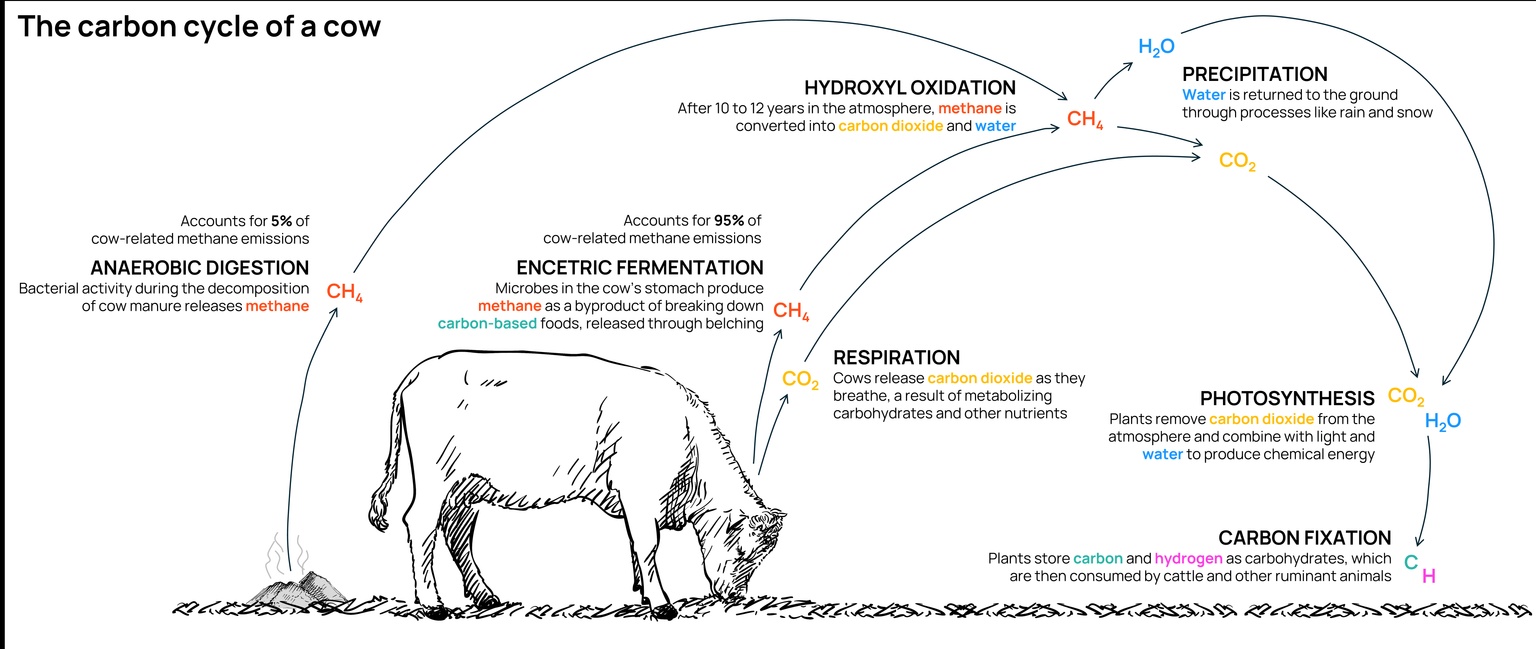

RNG primer: Energy innovators figured out that letting the decomposition of wastewater, organic waste, landfills and cattle manure take place in oxygen-free or “anaerobic” conditions result in the generation of biogas – a mixture of carbon dioxide, methane and other trace gases.

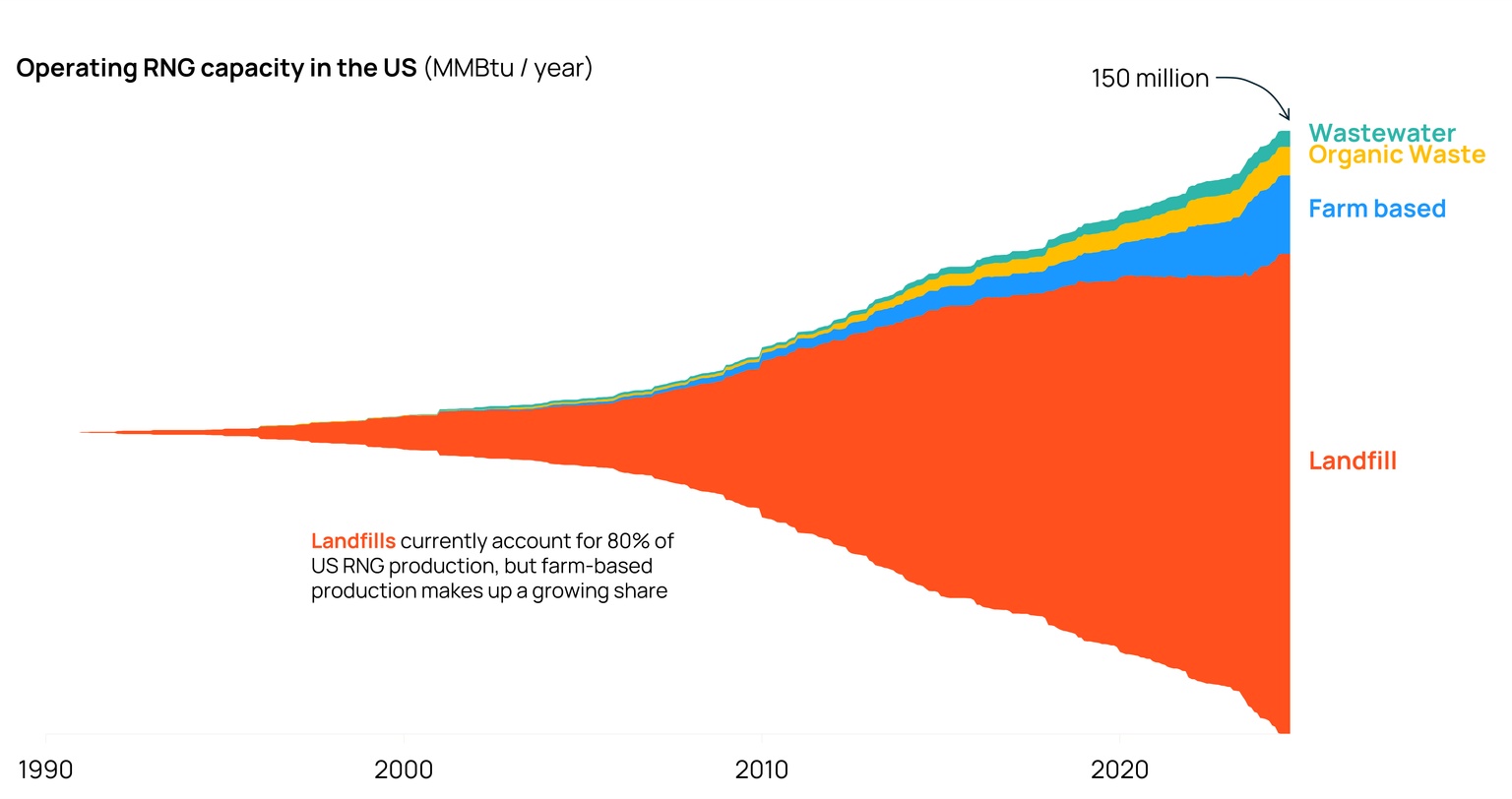

By capturing the biogas and purifying the mixture to methane, a renewable fuel is created. This is often referred to as biomethane or, more commonly, renewable natural gas. With US production dating back to the 1990s, RNG continues to grow as a source of renewable clean fuel.

Source: Orennia (RNG dashboard)

By the numbers: Methane has a warming potential ~28 times more potent than carbon dioxide, with landfills, farm-based manure management and wastewater treatment collectively account for ~30% of human-related methane emissions in the US. By capturing and using the methane instead, it both sources useful energy and avoids releasing the more harmful greenhouse gas. For this reason, many RNG projects are considered “carbon negative” and generate valuable credits.

Credits are key.

Selling waste: The cost to produce RNG is its primary challenge. Some of the emerging forms of the renewable gas, like organic waste and farm-based projects are particularly costly, often 10 to 15 times more expensive to produce than conventional natural gas.

To incentivize producers to generate energy from what are typically waste products, lucrative credits are needed. The most impactful program to do this in the US is the California Low-carbon Clean Fuel Standard (LCFS).

How it works: California’s LCFS is managed by the California Air Resource Board, also known as “CARB”. (Ironic, for the state famous for avoiding carbs.) The state agency sets annual carbon intensity targets for its transportation fuels and any fuel used with a lower intensity can generate credits.

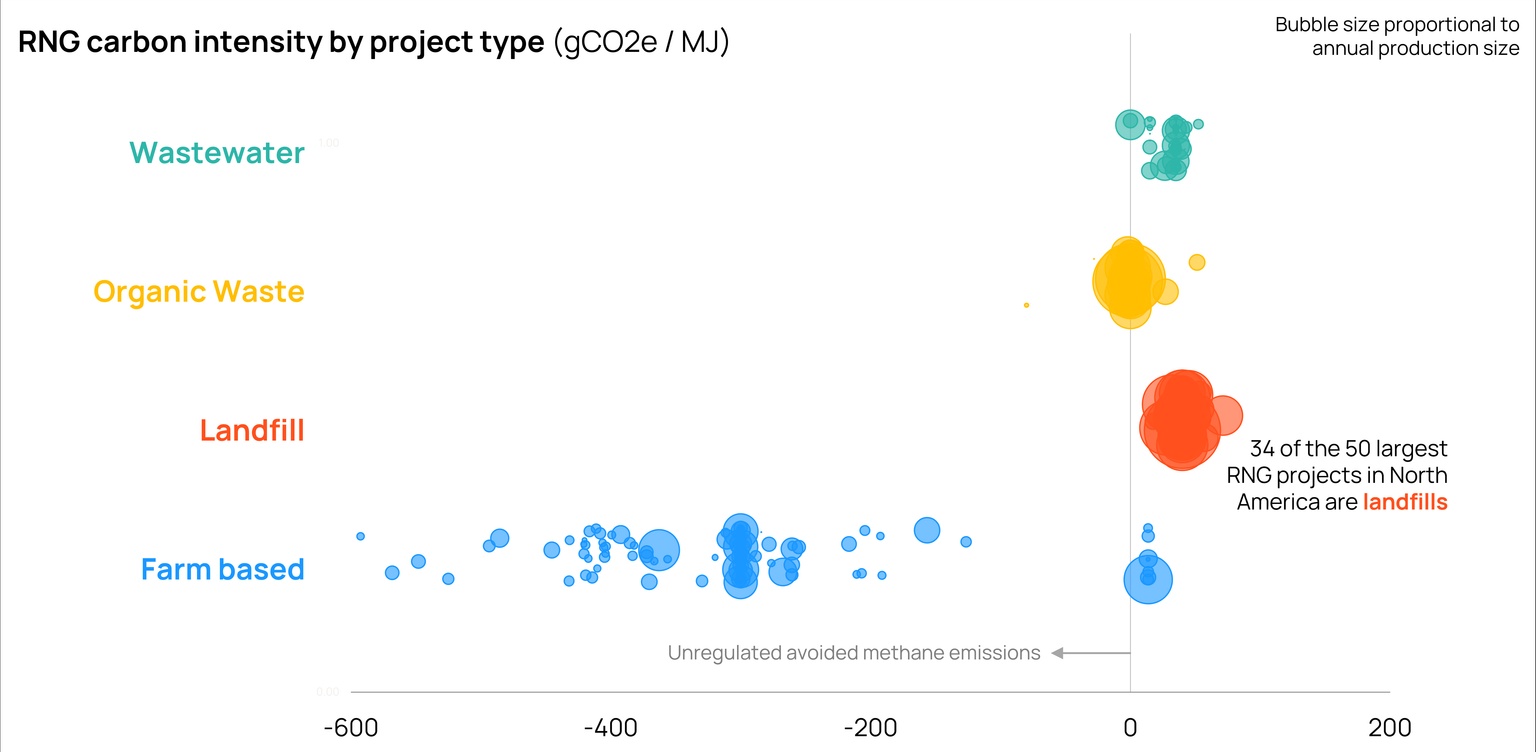

As it happens, farm-based projects that manage manure have by far the lowest carbon intensities of all RNG production. This has little to do with the projects themselves and more to do with politics.

Source: Orennia

Your average dairy cow produces 3.5 gallons of milk every day along with 18 gallons of manure. That manure is then gathered into huge lagoons of waste where nature runs its course and methane is released in the decomposition process.

Don’t go after farmers: Unlike wastewater treatment centers, organic waste sources and landfills, whose methane releases are heavily regulated, CARB has been hesitant to regulate farms, despite accounting for half of the state’s methane emissions. Farmers already run on thin profit margins, and there is evidence some dairy farms make half as much from RNG as they do from selling milk. By leaving the methane unregulated, farmers continue to benefit from the lucrative LCFS credits.

But that looks like it could change. CARB is set to vote on the future of RNG credits to dairy farmers this month as environmental groups like the Leadership Counsel for Justice and Accountability criticize the subsidies given to RNG producers. If the new methane regulations on farms are approved, farm-based RNG would be much less valuable to produce.

Physical deliverability: CARB also outlined new rules earlier this year that limit where RNG can be sourced. While out-of-state producers can currently earn credits from California’s LCFS program, eventually producers will need to show their gas can be physically delivered to the state through pipeline flows. This will effectively limit RNG sourcing to farms in California’s neighboring states. Sorry Michigan.

Source: Orennia

Together, this means many RNG producers could be looking for a new home for their low-carbon gas in the coming years.

If only there was a set of buyers in the market today frantically looking for available energy, not sensitive to price but with vocal climate aspirations…

Diesel generators are currently the backup power source of choice for data centers, with ~20 gigawatts of data center backup capacity installed globally.

While outages are expensive, they’re infrequent. In the latest Uptime Intelligence report on annual outages, most data centers experienced an outage at least once in the past three years. Given how expensive downtime is to companies, backup systems are critical, but the technology options are limited by their infrequent use.

Batteries alone aren’t ideal: A 100-megawatt lithium-ion battery with 4 hours of storage costs ~$140 million to build today. The economics of high-cost batteries can pencil for projects that charge and discharge every day, as seen with utility grid projects, but not for the pull-chord-in-case-of-emergency use of data centers.

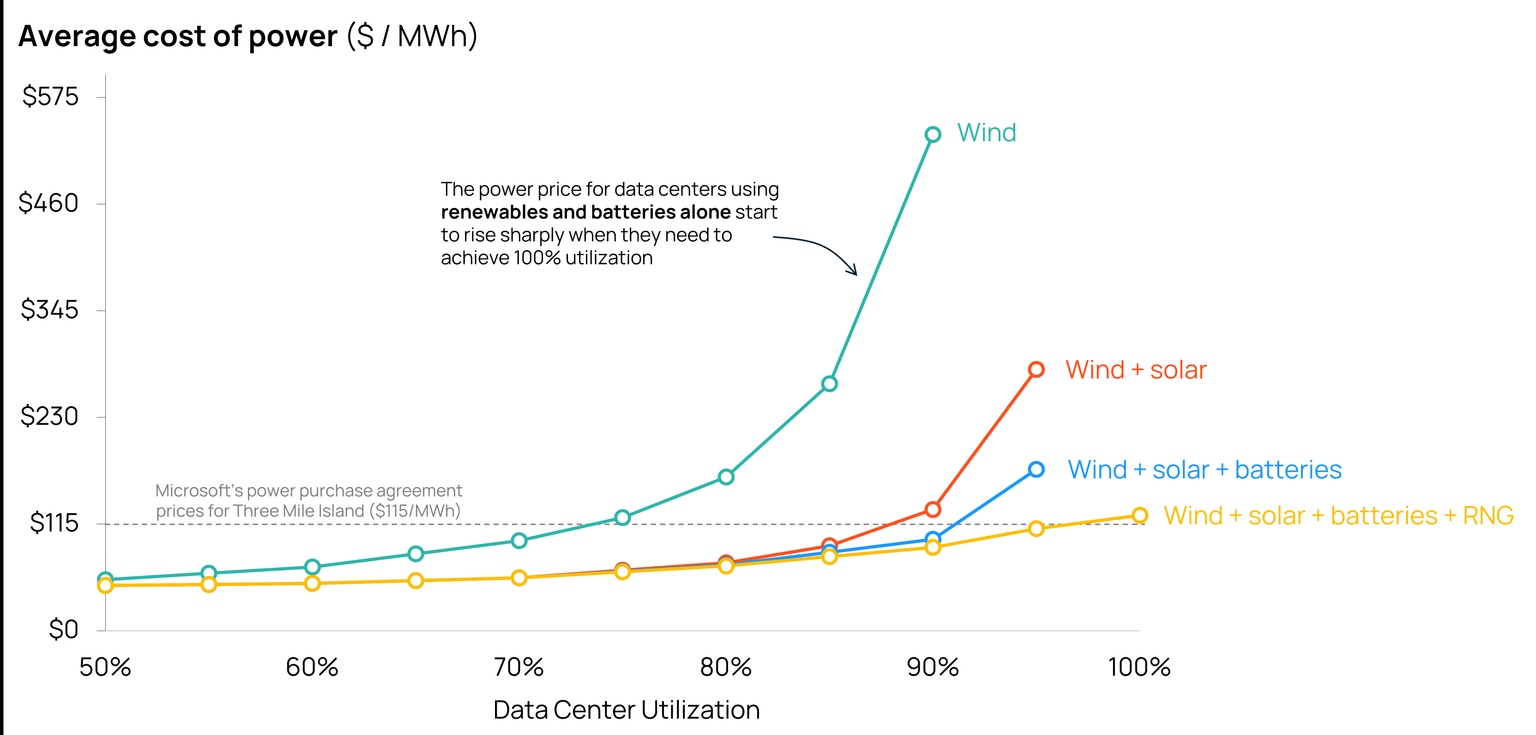

That’s not to say batteries shouldn’t be used at all. Our internal modeling at Orennia shows power prices for data centers can be kept low with a combination of wind, solar and batteries until near-perfect uptime is needed. Once a data center requires more than ~90% uptime, the overbuilding of renewables and batteries needed would send power prices up an asymptote. Even Google has its limits (a calculus joke.)

RNG’s role: Despite being an expensive form of gas to produce relative to conventional natural gas, it’s an inexpensive source of energy for the final 10% of power generation of a carbon-neutral data center.

Source: Orennia

RNG can also help gas-powered facilities achieve carbon neutrality. Many of the farm-based manure management projects are considered so carbon negative that blending just 15% RNG with conventional natural gas would result in carbon-neutral gas.

By avoiding methane, the highly potent greenhouse gas, RNG punches above its weight.

Being a low-carbon gas that both uses existing gas infrastructure and avoids methane emissions, groups like McKinsey have gone as far as calling RNG a “Swiss army knife for US decarbonization”. Unfortunately, it has its limits.

The largest farm-based project in the US, Colorado’s Platte River Biogas project, can produce methane at levels equivalent to about three dry gas wells from the Marcellus in Pennsylvania or 0.02% of total US gas demand. There’s only so much biogas that can be created from human-related activity in the US.

But while RNG is unlikely to replace all American natural gas use anytime soon, there are undoubtedly going to be buyers for the biofuel. It punches above its weight for emission reduction and there’s a large market of potential buyers. And data centers, who are less sensitive to prices, may ultimately be more suitable buyers for RNG than California’s residents who currently shoulder the costs of LCFS credits.

As a sign of what may come to pass, Microsoft announced a deal with the energy firm US Energy late last year to back up a key company data center in San Jose to maximize its uptime.

Bottom line: Mark Twain once said that history doesn’t repeat itself, but it often rhymes.

The Victorian-era biogas lamps which popped up around London eventually lost the competition for illumination to Joseph Swan’s lightbulb, powered by electricity.

Today, as companies look to backup electricity for large power-hungry facilities, it’s biogas that looks ready to take the job. To backup data centers and help minimize their emissions footprint, RNG may be the perfect Victorian innovation.

Data-driven insights delivered to your inbox.