Aaron Foyer

Vice President, Research and Analytics

There's a missing storage link lowering the ceiling for renewable penetration

Vice President, Research and Analytics

The word “typhoon” can be traced back to the 12th century where it’s thought to be derived from Chinese characters, which can be read as “wind which long last.” This is apropos, as these Pacific tropical storms are both powerful and tend to linger.

The famed Mongol leader Kublai Khan saw not one, but both of his 13th century naval invasions of Japan drowned by separate typhoons. The incredible timing of the storms led the pair of typhoons to be collectively referred to as the “divine winds,” or “kamikaze” in Japanese This is the first known use of the term.

The Mongol Invasion, by Tsomonbayar. Image courtesy of Deviant Art

Today, typhoons and other storms represent a new type of challenge, with weather often restricting wind and solar generation for days or even weeks at a time. Without solving how to store and distribute power over long periods, there is a natural ceiling for the growth of both wind and solar. While current lithium-based systems work well with daily storage cycling, they’re challenged when it comes to long-term duties.

So, what storage solutions could work when the next divine winds show up (or disappears)?

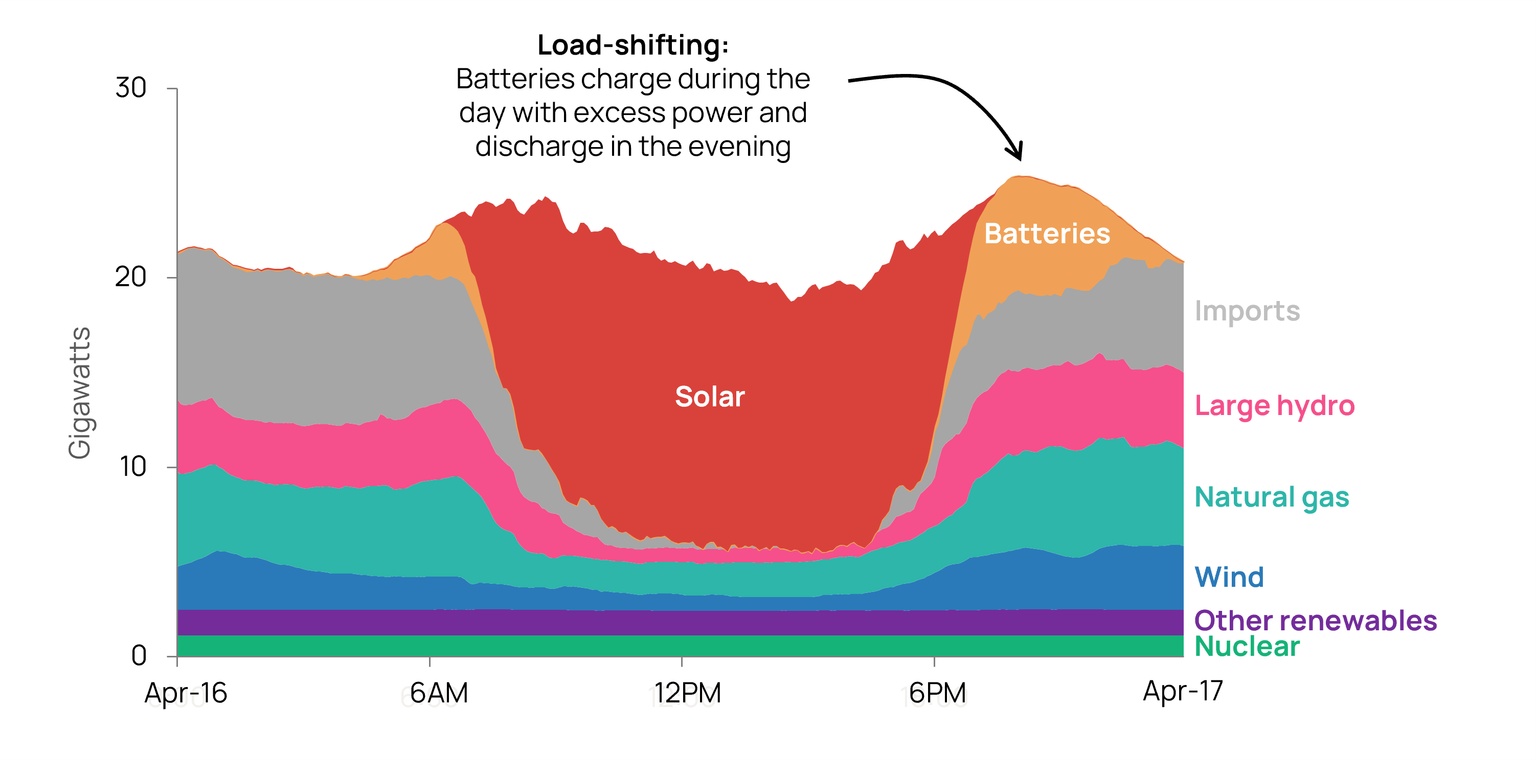

Our current suite of energy storage technologies runs the gamut from those that can discharge power in seconds to those that can discharge for months. Lithium-based batteries account for almost all storage projects currently being built across the US and Canada. These work best with multi-hour discharging, making them ideal for daily load shifting – capturing energy in the day and discharging at night.

California provides an excellent example of this. Batteries now routinely charge during the day by taking in excess solar, then discharge later in the evening.

Note: In the evening of April 16, 2024, batteries were briefly the top supplier of electricity in CAISO

Source: Orennia, CAISO

But these batteries require almost daily cycling to make the economics work. This means lithium-ion batteries are not the likely tech to hold electricity for occasional long periods of time. To bridge the gap between short-term batteries and long-term renewable ambitions, long-duration energy storage (LDES) is needed cheaply and at scale.

Depends on whom you ask. While it would come as no surprise an astronomer and Tommy Lee would disagree on what defines “long-term,” it’s more surprising no consensus exists in the energy world, either. CAISO defines LDES as a system that can deliver power for 8 hours or more, the US Department of Energy pegs it closer to 10+ hours, while the US Long Duration Storage Council has it at 24 hours or more.

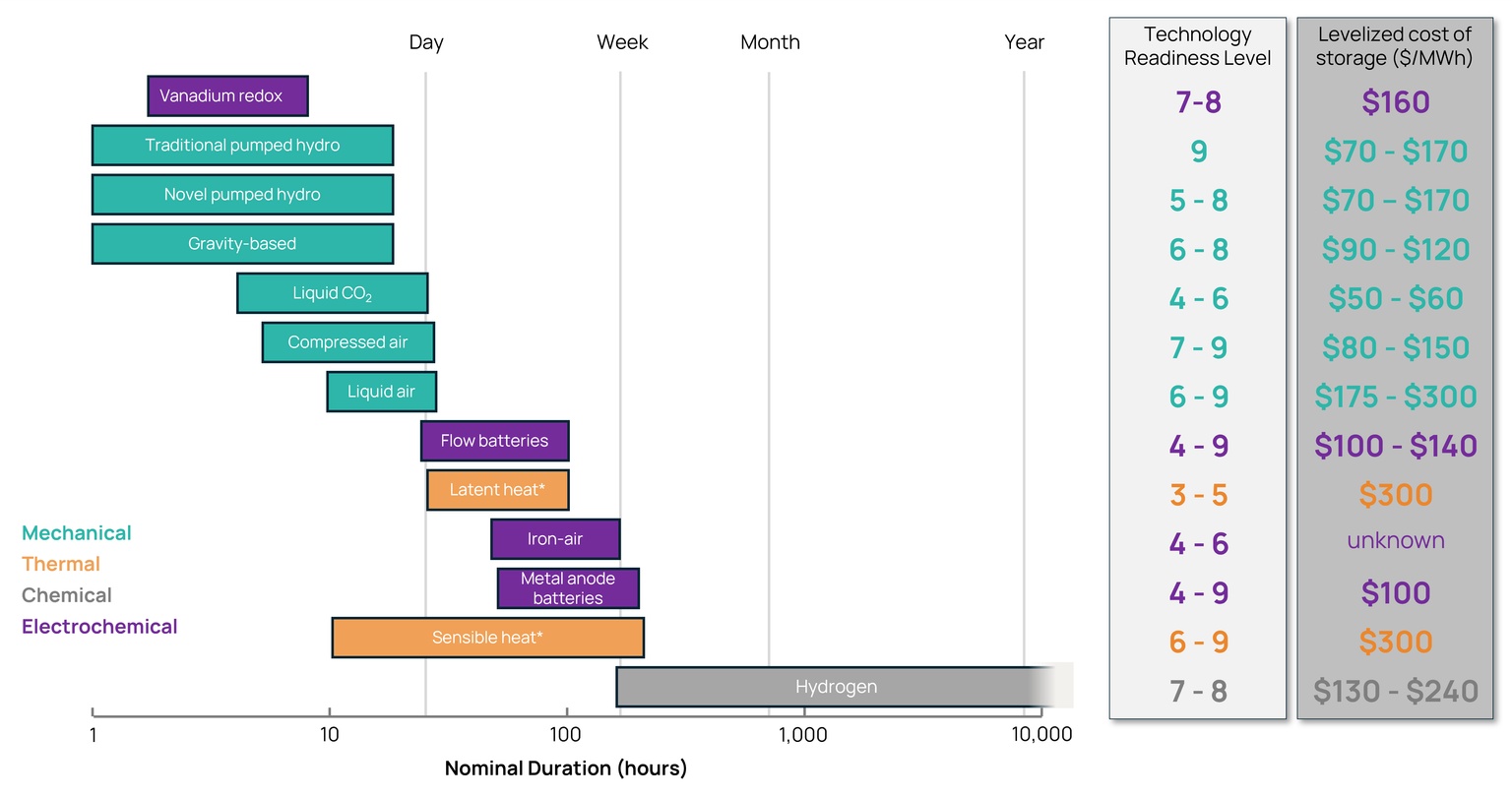

Regardless of the exact length, the key is technologies that can store and deliver energy economically for tens to hundreds of hours at a time.

Why it matters: We are unknowingly accustomed to cheap long-term energy storage: fossil fuels store energy magnificently. A mound of coal is pretty much the apex of cheap, efficient energy storage. But coal isn’t the future.

Note: Nominal duration is how long a battery can discharge at its maximum power rating *Sensible heat is energy stored in a material without a phase change (ex. concrete blocks), latent heat is energy stored with a phase change (ex. solid to liquid)

Sources: Orennia, US Department of Energy

Vying for the future instead is an array of emerging solutions meant to address long-duration storage needs. There’s a wide range of both duration and maturity among the various technologies.

Overview of key technologies:

Hydrogen, which stores energy chemically in a similar way to fossil fuels, can be stored multiple ways including in giant caves underground. Accessing this giant reservoir makes hydrogen one of the only mature technologies that can store energy over several months.

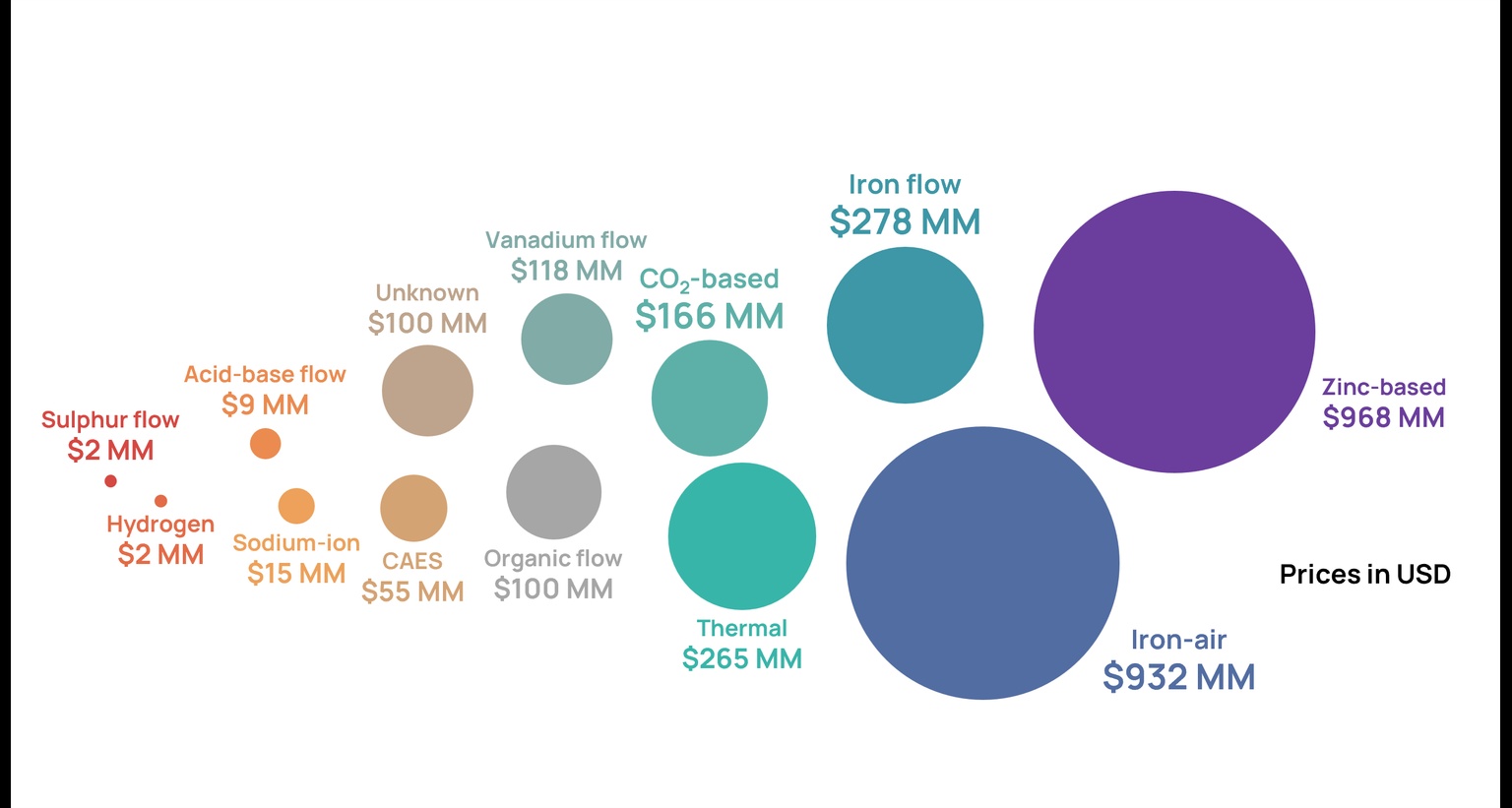

Companies included: Asylum, Antora, AquaBattery, CMBlu, Corre, Energy Dome, Eos, ESS, e-Zinc, Form, Fourth Power, H2GO Power, Hydrostor, Hyme, Invinity, LINA, Primus Power, RayGen, Sinergy, Storelectric and Vflow Funding includes everything from early-stage crowdfunding to post-IPO debt financing

Source: Orennia, Crunchbase

The catch: Despite the market need for LDES, lithium-based batteries accounted for 96% of all installed storage capacity between 2020 and 2023 in the US and Canada.

So, what’s holding back long-duration storage?

There are some markets where a small subset of technologies work with today’s prices. Orennia has run the economics of multiple technologies in various power markets across North America. In our analysis, compressed air systems already work in many parts of both CASIO and the Southwest Power Pool (Orennia report here), where geology allows. But for most technologies, a redesign of the market is needed to incentivize storage with durations beyond 24 to 48 hours.

While day-ahead pricing has been excellent at fostering daily cycling storage, more is needed for LDES where longer periods of low wind and sun are more difficult to forecast.

Note: Operating LDES projects include all storage projects with nominal durations longer than 12 hours

Source: Orennia

Some options: There are several different approaches market designers could take to attract LDES developers. The key is to design market mechanisms that explicitly value flexibility and reliability. For carrots, a market could use capacity payments to cover fixed and operating costs for storage projects that maintain a certain available capacity charged up. For extra incentive, projects may receive performance bonuses after supplying power when it’s needed most. On the flip side, projects not delivering when needed get hit with a penalty.

To be more prescriptive, charge-discharge price collars could be set: mandating LDES projects charge when power prices drop below a certain price and discharge when above another. Markets may also require utilities to include long-duration storage as part of their resource planning process.

And more data: Additional information can also help in derisking projects. Storage operators can be more accurate with their price predictions with better weather forecasting and 7-day expectations for both wind and solar production in a region.

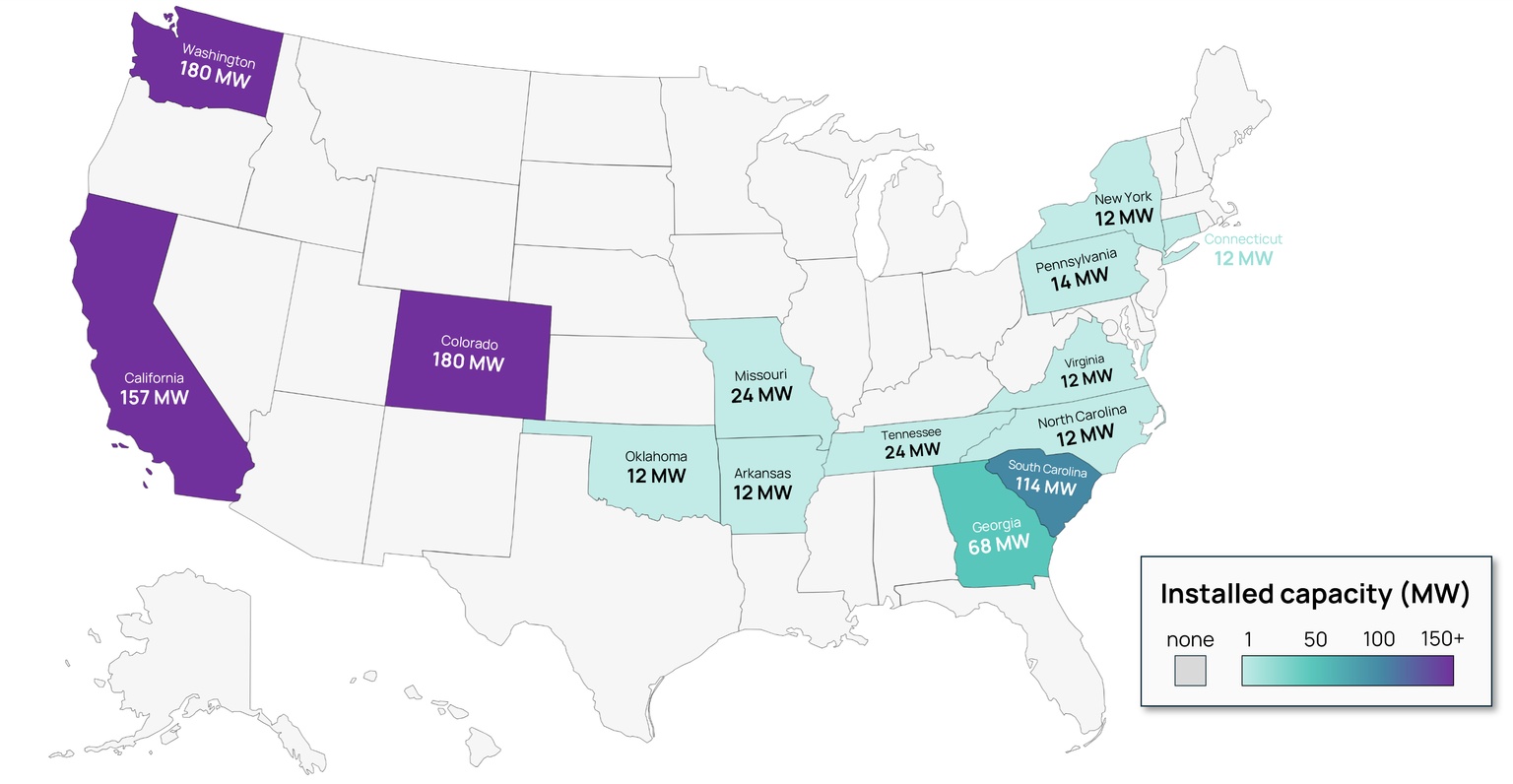

There are some encouraging signs for long-duration storage, including pilot and demonstration projects across the US.

And pumped hydro isn’t giving up its crown anytime soon, showing signs of growth. The storage technology’s capacity has been roughly flat since the 1990s, hovering around 20 gigawatts installed. But the US now has 12 gigawatts of new pumped hydro projects in the interconnection queue and a total development pipeline of nearly 50 gigawatts.

Bottom line: Without long-duration energy storage, there is a ceiling to wind and solar penetration. Luckily, as the market share of wind and solar grows, so does the value of LDES. The US Department of Energy estimates the price arbitrage for LDES will be twice that of lithium-ion batteries by 2050.

Data-driven insights delivered to your inbox.