Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

Just like the phrases “talk to the hand” and “that’s hot”, Americans are using coal a lot less than they were in the early 2000s.

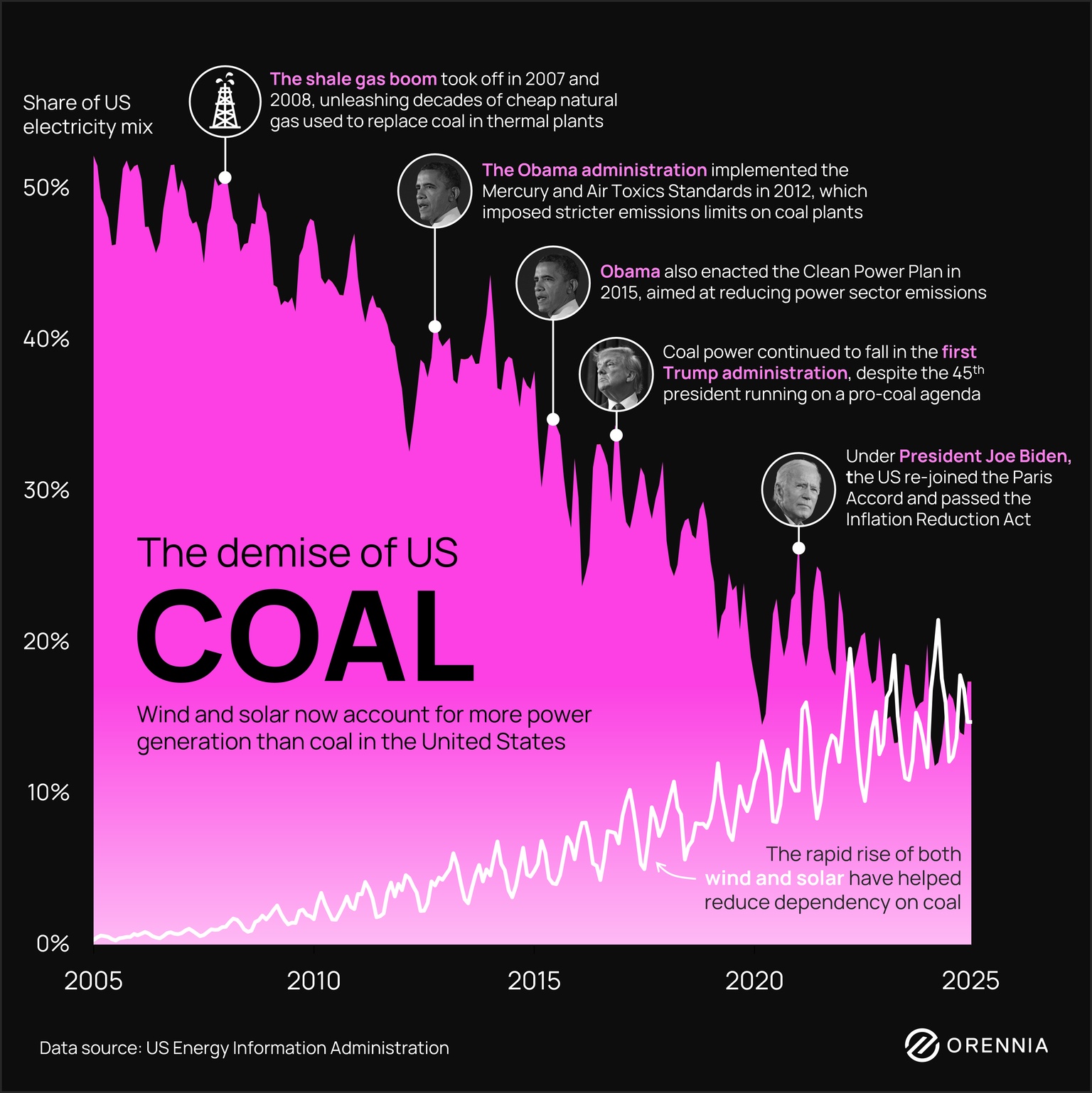

What happened: Wind and solar combined now generate more power in the US than coal, a significant change in just two decades. The share of coal power in the US electricity mix has been dropping since 2005, falling from a share of ~50% of power generation down to ~15% last year.

There has been some growth in electricity use, so absolute coal use for electricity is down by 40% over that time.

What led to the drop?

Together, along with public and investor pressure, regulations and new power sources have significantly replaced coal in the US electricity mix.

Looking ahead: The United States is shifting from a period of low power demand growth to one of considerable growth. While this is unlikely to drive new coal power plants coming online, it could delay retirements or even revive recently shuttered plants.

Data-driven insights delivered to your inbox.