Aaron Foyer

Director, Research

Are we witnessing the end of the petrodollar?

Aaron Foyer

Director, Research

Since the 1970s, the United States has benefitted mightily from oil being sold around the world in US dollars. This stems from the oil crises of the early 1970s, when petroleum flows to Western nations, particularly the US, Canada and Western Europe, were curtailed in response to their support for Israel in the Yom Kippur War. What followed was a quadrupling of oil prices, energy-driven inflation and a two-year recession in America.

To steady the ship, the US crafted a deal with Saudi Arabia by which oil sales in the kingdom would be priced, invoiced and paid for in USD. This led other Gulf states to follow suit, and soon the dollar became the de facto means of exchange for oil around the world. It would be hard to overstate the economic and political benefits this brought to America.

For one, just think of the demand it created for Benjamins. It meant that importers needed to acquire millions of dollars on the FX markets just to be able to buy oil, creating a steady baseline of demand for the US currency.

Henry Kissinger and King Faisal of Saudi Arabia // Wikipedia Commons

And since that required countries to hoard dollars in their central bank treasuries like Scrooge McDuck, that gave the US government geopolitical leverage through finance. In 1979, when the Iranian government took 52 Americans hostage, the US imposed financial sanctions, freezing Iran’s dollar reserves, which forced the Middle Eastern nation to the negotiating table and to eventually sign the Algiers Accord for the release of the hostages.

It gets better. When Middle Eastern oil exporters generated profits (which were enormous), they would often recycle those dollars by buying US Treasuries at such a scale it would give Washington cheap borrowing rates for decades and the ability to run a deficit without triggering a currency crisis.

All of this to say, the petrodollar helped transform the US dollar into the global reserve currency which comes with, in economic terms, exorbitant privilege.

A challenger rises: But as we know, the world is changing, both geopolitically and energetically. The petrodollar matters a lot less in a world where petroleum is less important. A rival superpower has seen the direction the world is heading, assessed its strengths, and is cobbling together a new-age petrodollar. With a push for clean energy, electrification and infrastructure, China has realized its great industrial base and new wealth has fostered the conditions for an electric alternative to the petrodollar: the electroyuan.

So, can China turn renewable energy into its own geopolitical hammer? Let’s plug in and find out.

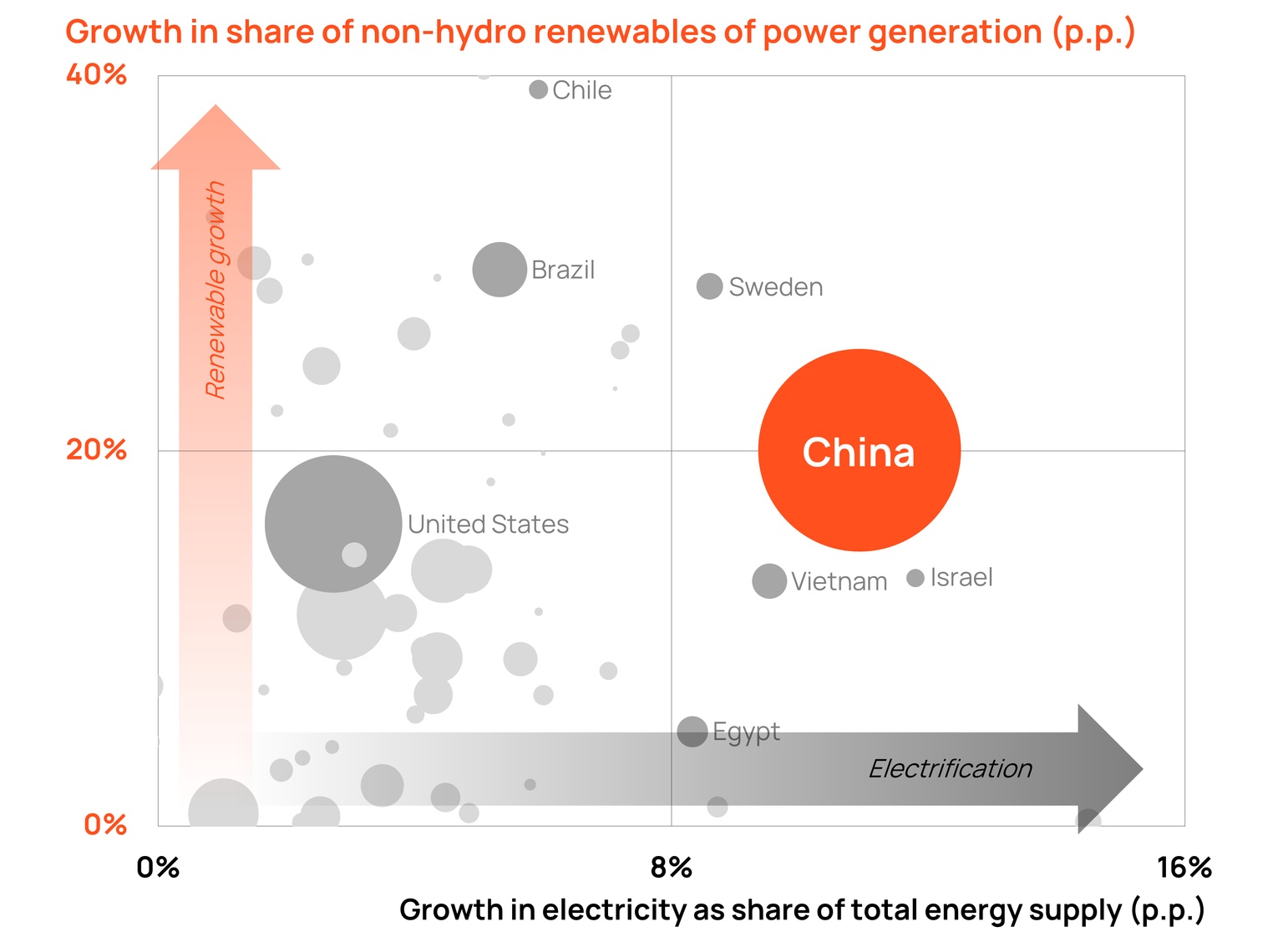

The growth of clean power in China, particularly with renewables, is well understood. No country has invested more or built faster in the space than the East Asian giant. China accounts for 40% of wind and solar installed globally since 2019, with Beijing clearly seeing the dual benefit of energy independence and manufacturing potential. This has led China to boost the share of its electricity coming from wind and solar by nearly 20% over the last decade.

Source: The Statistical Review of World Energy (Energy Institute)

That itself is impressive, considering China accounts for a third of all electricity generated on Earth. But what’s less appreciated is that Beijing is redesigning its entire economy to be increasingly electric. Over the past decade, the share of electricity making up its total energy consumption has increased by 10%, more than almost every other nation.

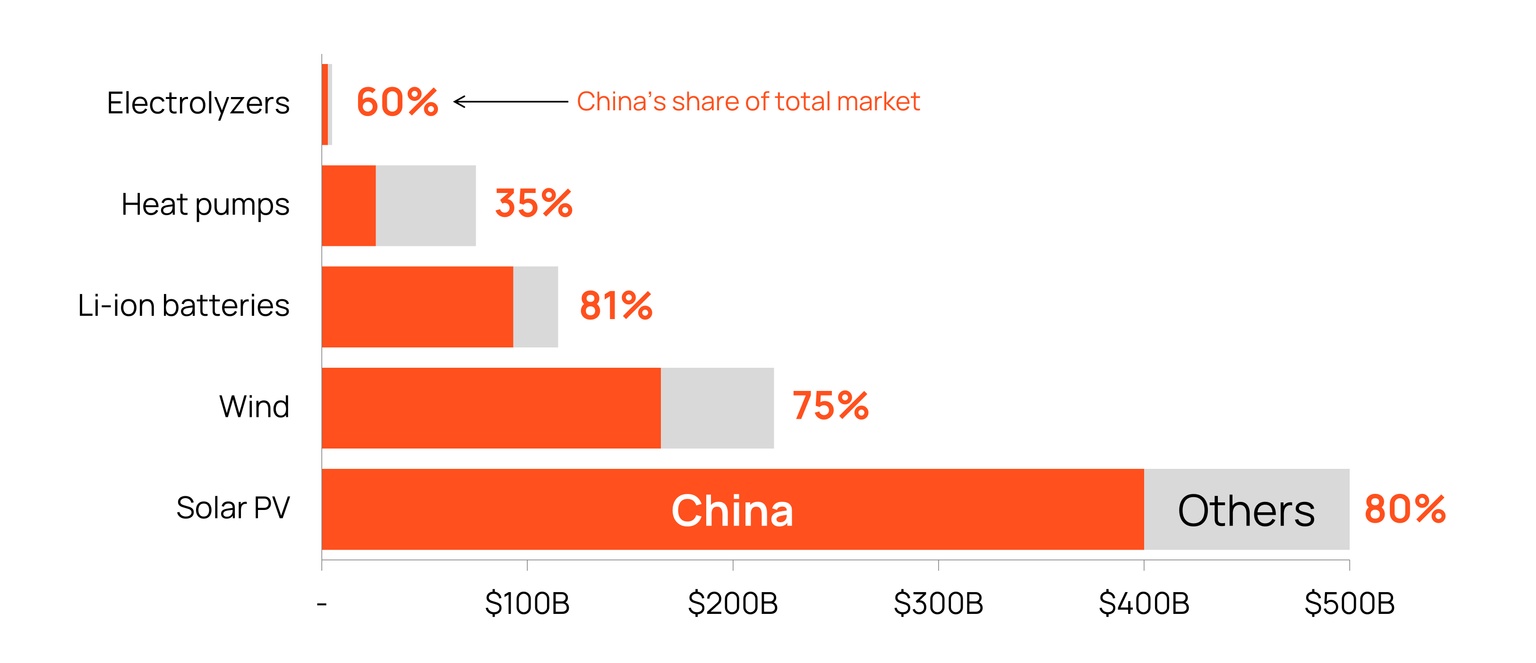

The people’s factory: Beyond generating clean power, China is the leading manufacturer of all things clean energy, producing a majority of the world’s solar panels, wind components, lithium-ion batteries, electrolyzers and electric vehicles sold last year, and is a significant producer of heat pumps. That shows no sign of slowing down, with three-quarters of cleantech factory investments last year happening in China.

The People’s Republic is well on its way to becoming the world’s first electrostate.

First off, it’s worth clarifying the difference between two Chinese currency terms: renminbi and yuan. The renminbi (RMB) is the currency name and the yuan is the unit, like how the UK’s currency is the Pound Sterling, but a jar of Marmite from Tesco costs three pounds.

OK. Being a technology supplier gives China enormous leverage, especially with countries that are developing and looking to energize on a budget. Projects that are financed by Chinese banks, built by Chinese companies or assembled using Chinese parts could receive favorable financial terms in exchange for using renminbi in the agreements.

A perfect example of this occurred in 2023, when a Chinese developer built a 500-megawatt solar farm in Uzbekistan and stipulated the power contracts be settled in yuan.

Source: International Energy Agency

Uzbekistan is just one of many countries striking these sorts of deals with Beijing.

ICBC Brazil signed a deal last year to import solar modules and inverters from Chinese manufacturer Longi Green Energy for a 165-megawatt solar farm in Brazil, with the trade deal being settled in yuan. Last month, a power producer in Argentina borrowed $50 million from the Industrial and Commercial Bank of China to help support developing its renewable energy projects. And over the summer, Australia’s Fortescue secured a 14.2-billion-yuan ($2-billion) loan for green hydrogen projects, the largest ever yuan-syndicated loan to a non-Chinese company.

A regular drumbeat of these sorts of deals are helping China make inroads in Africa, the Middle East and even Latin America, once enshrined as off-limits to non-American actors by the Monroe Doctrine.

No signs of slowing down: While Beijing has not formally declared an electroyuan standard, its actions have been clear.

In his keynote speech during the 2025 Shanghai Cooperation Organization (SCO) summit in September, President Xi Jinping laid out his vision for a multilateral economic order centered around China, Russia and four Central Asian states, and vowed to help these countries develop renewable energy. You can bet many of those Chinese-led projects will be yuan-based, all hinting at a future where Central Asian power projects, grids and trade could run on both Chinese technology and its currency, presenting a clear and direct challenge to the US and Western influence in Asia.

Source: FRED, Investopedia

Should this come to pass, it would be one of the most important geopolitical shifts in our lifetime.

The rise of an electroyuan would completely reshape global financial architecture and geopolitics.

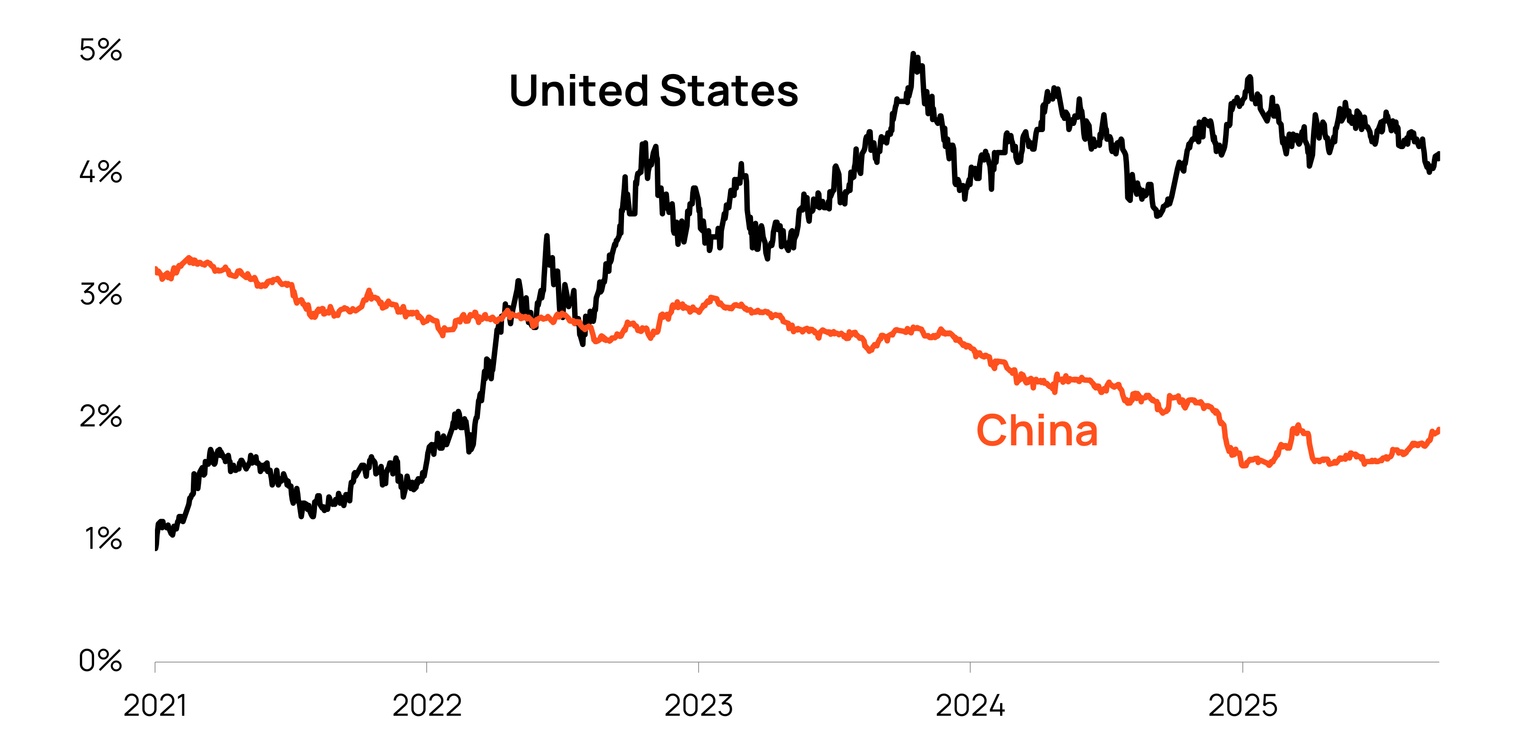

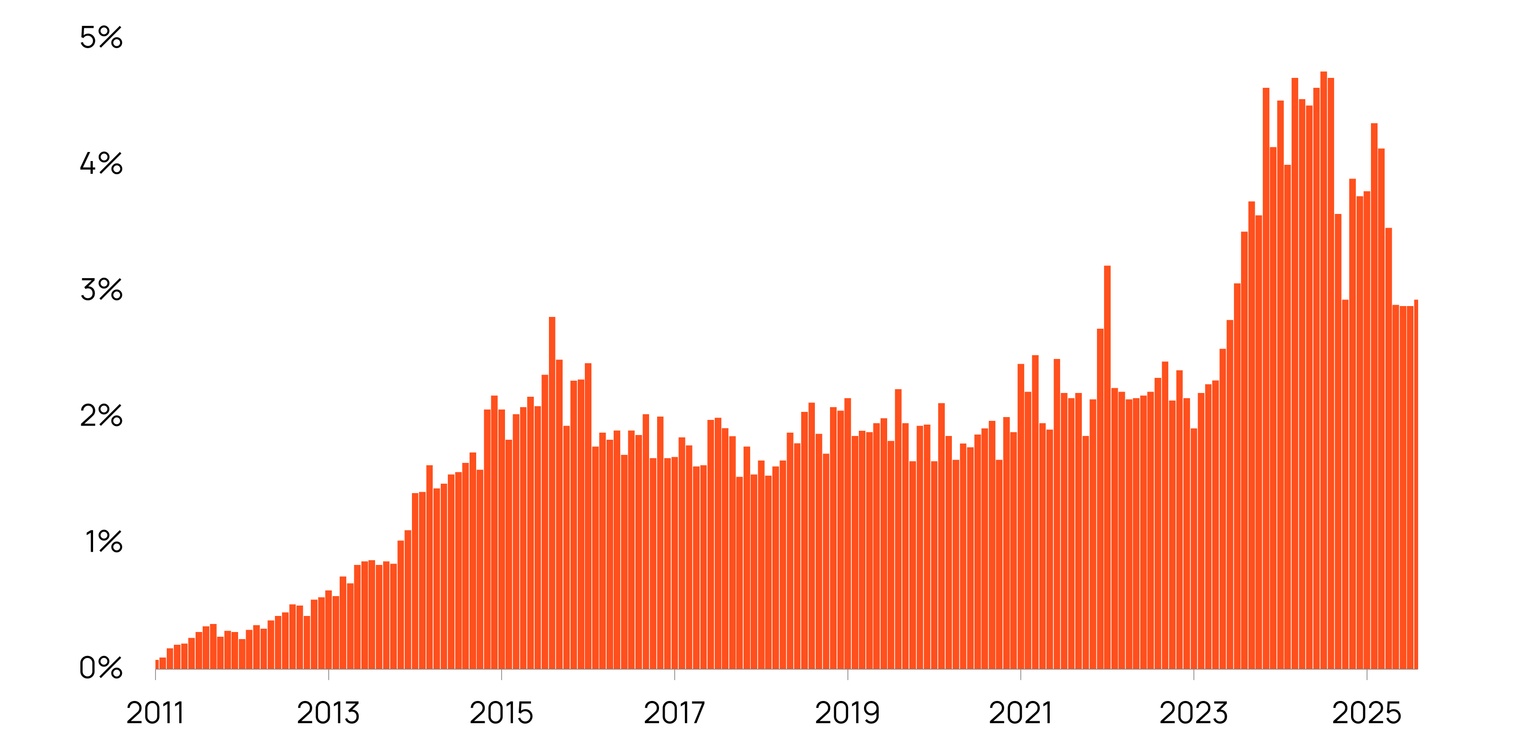

For one, it would increase the yuan’s share in international payments, something that’s already been growing for over a decade and brings a certain inertia with it. Countries that become economically tethered to Chinese power projects might start invoicing in yuan by default. Over time, swaths of Asia, the Middle East and Africa could start conducting their commerce and trade in yuan, further eroding the trade dominance the dollar has enjoyed for decades.

An international yuan trading world would also hand Beijing incredible geopolitical leverage and weaken US influence. Just as the widespread use of the dollar gave America the ability to hit bad-boy nations with financial sanctions to compel their governments into taking specific actions, China could pull the same Don Corleone moves.

Source: SWIFT

Xi wouldn’t even need to go full gangster to get compliance. In international arenas like the United Nations, a country that was indebted to China or that depended on Chinese-built grids would be compelled to align with Beijing’s diplomatic positions. We’ve seen for years how American allies stand behind Washington because their state’s fortunes are linked to US policy.

The replacement of the petrodollar with the electroyuan and the American dollar with the Chinese renminbi is far from certain. The US dollar currently accounts for about half of global payment values while the renminbi is still less than 5%.

But there is no one better at playing the long game than China.

Trust in the American dollar, which was built over decades through the strength of US financial markets and institutions, is starting to erode, especially as the White House tries to weaken the independence of the Federal Reserve. Central Banks around the world hit an important milestone last month, holding more gold than US Treasuries for the first time in three decades.

And for China, the clean energy horse seems like a good one to hook your wagon to: spending on clean energy and electrification hit $2 trillion last year, double that of fossil fuels, and the gap continues to widen. All of this made easier by the aggressive and isolationist trade stance of the White House, which has long-time allies looking to reduce their exposure to the US.

Bottom line: If the energy economy of the last century was built on Middle Eastern oil fields and American dollars, our current one looks poised to be built on Chinese solar factories and the renminbi.

Data-driven insights delivered to your inbox.