Aaron Foyer

Director, Research

A renewed drive to harness the Earth’s energy

Aaron Foyer

Director, Research

The Māori, the Indigenous Peoples of New Zealand, are probably best known in popular culture for the haka – the famous war dance embraced by the country’s national All Blacks rugby team, who perform it before each match. Beyond the haka, there are many other rich cultural traditions which are long-standing from the Māori. Among them is the impressive harnessing of local subsurface heat and water.

For centuries, local Māori have actively used the region’s geothermal energy, known colloquially as waiwhatu, which has been woven into the culture. Different types of hot springs in the region include geysering pools (puia), boiling pools (ngawha) and warm pools (waiariki). Each was used purposefully, including for bathing, healing, and cooking.

Māori preparing food in a hot pool in Whakarewarewa Forest Park, New Zealnd; photo courtesy of the New Zealand National Library

The Māori are not alone in trying to harness the Earth’s vast supply of geothermal energy. The renewable resource has long been a contender in the quest to decarbonize many energy systems, including heating, bathing and cooking, all mastered by the Māori.

Geothermal is a renewable source that is baseload rather than intermittent, which puts it nearly in a category of its own. Though, as a counterweight to its positives, the technology’s high costs and sparse geographic viability has limited its growth. Now, a new generation of technologies has emerged which could eventually meet the growing need for clean and firm power.

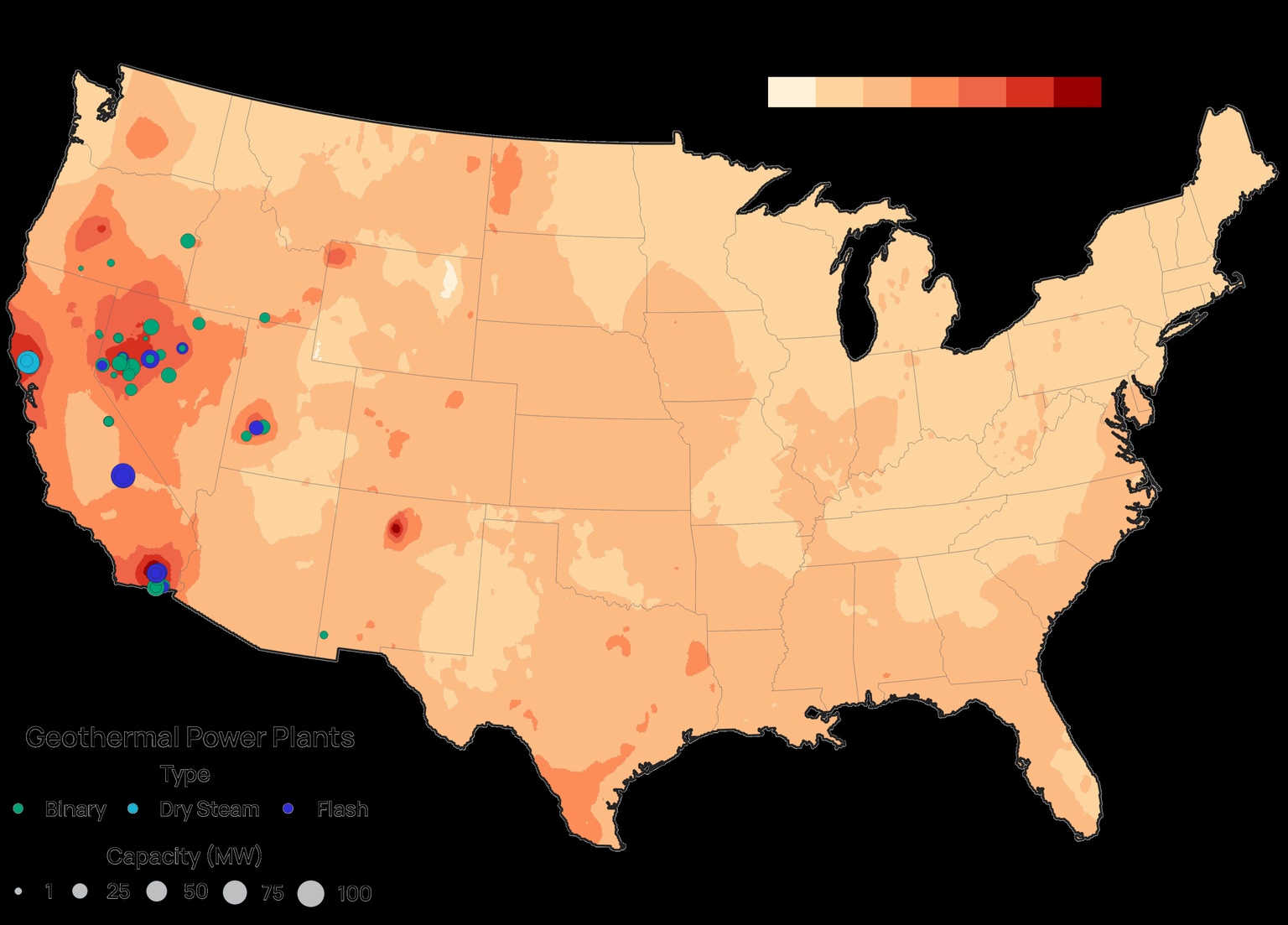

In terms of its contribution to overall power generation today, geothermal isn’t exactly Caitlin Clark carrying the Hawkeyes. In 2022, geothermal contributed just 0.3% of total electricity generated across the US and Canada. This is the result of low investment levels due to constraints in both technology and geology. Based on conventional technologies that require a subsurface hot and shallow enough to develop, only local regions of the western US are suitable for geothermal today.

Note: Binary, dry steam and flash are all facility designs which extract energy and depend mostly on the temperature of the geothermal fluid

Source: Orennia, US Department of Energy

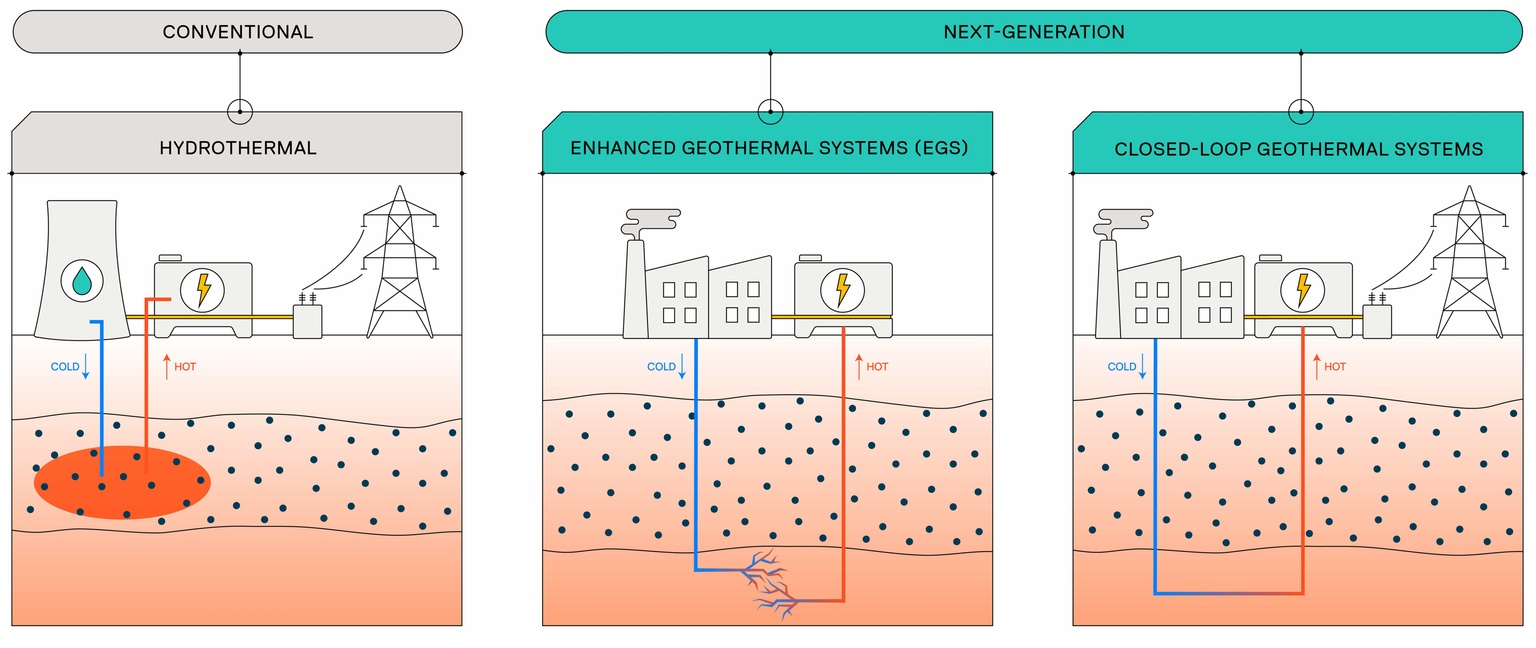

A primer: At the heart of all geothermal power projects is the ability to harness heat from the Earth to spin a turbine. Historically, this has been accomplished by accessing hot underground aquifers. These conventional hydrothermal projects require reservoirs that are hot enough to provide enough energy, permeable enough to supply sufficient waterflow and shallow enough to drill economically. In the center of this Venn diagram, where all three requirements are met, exist very few actual locations around the world for viable projects, especially near load centers.

To break the Venn, a new generation of companies are opening novel geothermal fairways by using advanced technologies.

By using techniques employed by the modern oil and gas industry, developers can engineer their own reservoirs, eliminating the need for aquifers altogether. Water can instead be injected from the surface, warmed up in artificial reservoirs underground, and brought back to the surface to extract the energy. With low enough costs, this would also allow geothermal to be deployed in previously unsuitable regions.

Source: Orennia

The tech: There are really two dominant designs of next-gen geothermal projects: enhanced geothermal systems (EGS) and closed-loop systems.

Both technologies are still in their early stages of commercialization, but the industry is showing signs of, dare we say, heating up.

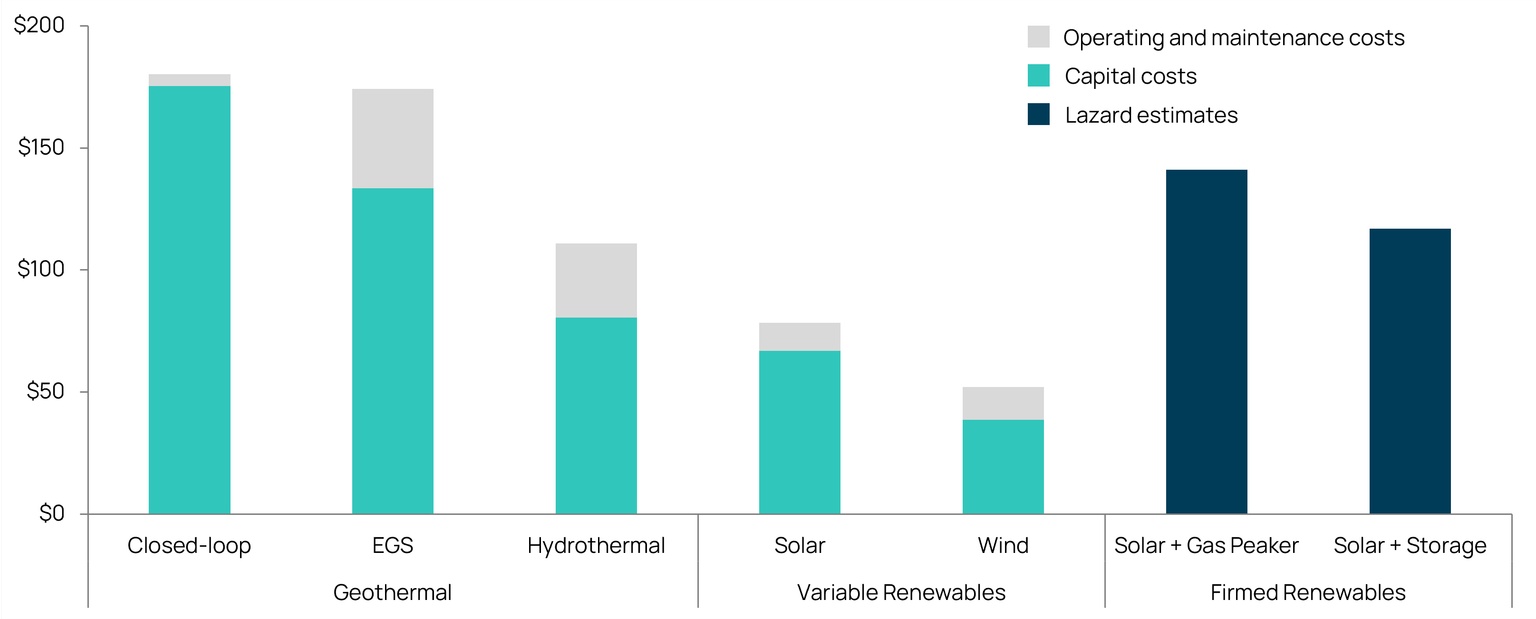

The costs: While it’s hard to compete with wind and solar today in price, there are reasons to believe these next-gen technology costs are coming down. On top of that, an emerging class of customers seeking reliable firm power, including data centers, could pay a premium if it’s clean and available asap.

Amongst geothermal technologies, traditional hydrothermal is still the lowest cost, benefiting from decades of development and drilling into geologic sweet spots. Both EGS and closed-loop systems, which are aiming to be deployable nearly everywhere, are just entering commercialization so expect prices to come down further.

Note: Levelized costs are unsubsidized and unlevered; costs are discounted at a 10% discount rate

Source: Orennia

The key to bringing down costs for both EGS and closed-loop systems is to reduce capital expenses. Especially for close-loop, which uses a clever system known as a thermosiphon to effectively eliminate pumping, almost all lifetime project costs are upfront. And there are signs these are coming down.

The US Department of Energy (DOE) estimates that EGS overnight capital costs came down 47% between 2021 and 2023 alone. This was due to improvements in drilling, well stimulations and reduced exploration costs. The US’ energy executive department is targeting a further ~65% reduction in cost over the coming years.

The emerging power needs of data centers may have opened a window of opportunity. Their demand for around-the-clock power paired with climate commitments from many of the large tech companies sets some difficult guardrails on the long-term power supply sources. With the US Bureau of Land Management recently expediting the permitting process for geothermal projects, next-gen companies could be the beneficiaries of a green firm premium to supply data center power.

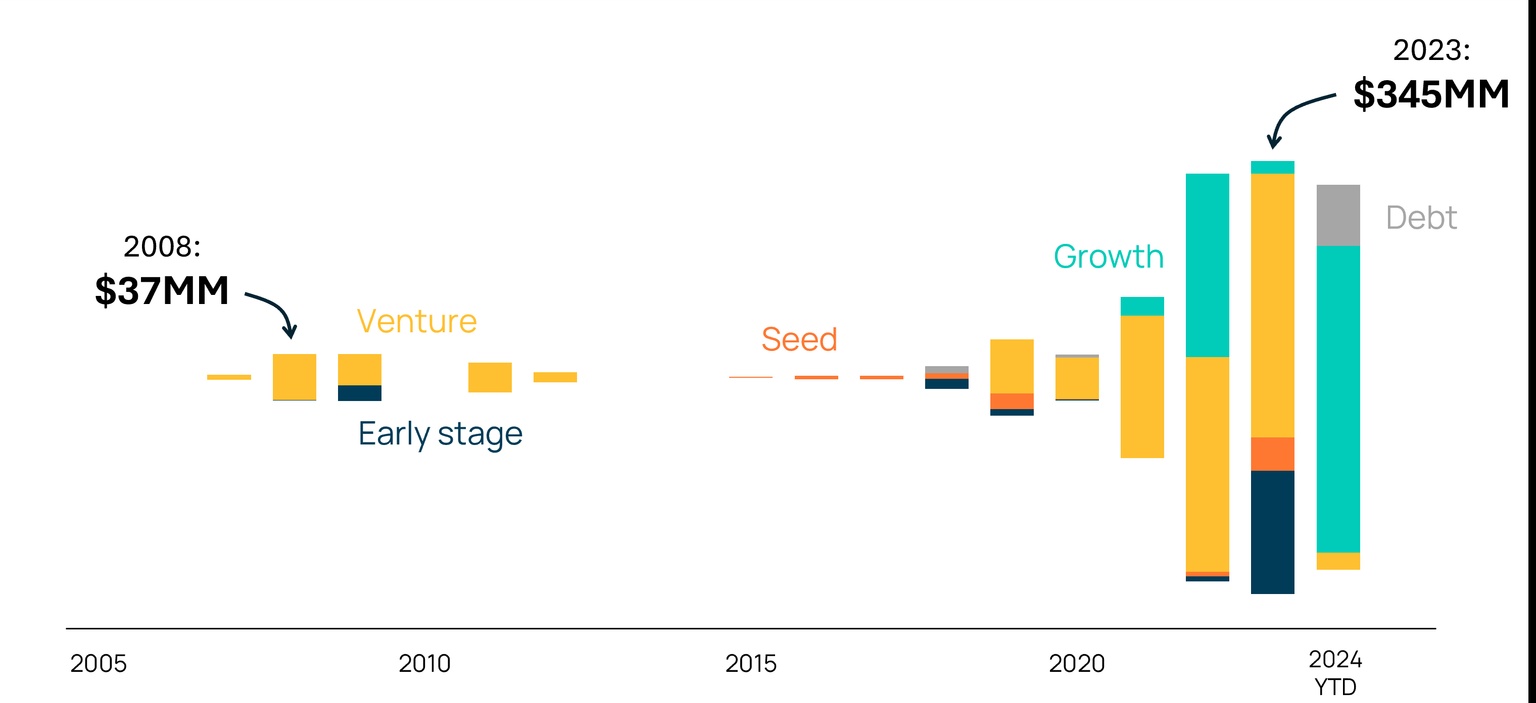

Note: Early stage = crowdfunding, grants, and pre-seed; venture = venture capital, Series A and Series B; growth = Series C, Series D and corporate

Source: Orennia, Crunchbase, PR Newswire, Dealroom, Business Wire

An encouraging sign for their future is the investments flowing into next-gen companies. Not only have total dollars increased markedly over the past few years, but so has the maturity of the financing. The increase in growth funding – private equity and corporate – highlights how the risks of the technologies have come down while the opportunities to scale have gone up.

Looking ahead: Geothermal is still not yet ready for primetime. It remains a novel and expensive technology, but one where the necessary cost reductions are attainable.

Like storage benefiting from years of R&D spent on electric vehicles, geothermal has also benefitted from advancements in another sector. On a recent C.O.B. Tuesday podcast, guest Jigar Shah of the DOE pointed out that geothermal has a clear advantage: the years of technological innovation, capital and human resources developed by the oil and gas industry means next-gen geothermal has a much smaller investment hurdle to overcome relative to other technologies to be competitive. If so, the recent increase in new private investment and a spike in demand for clean and firm power may be just the catalysts the industry needs to achieve a true geotherm-assianceTM.

Data-driven insights delivered to your inbox.