Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

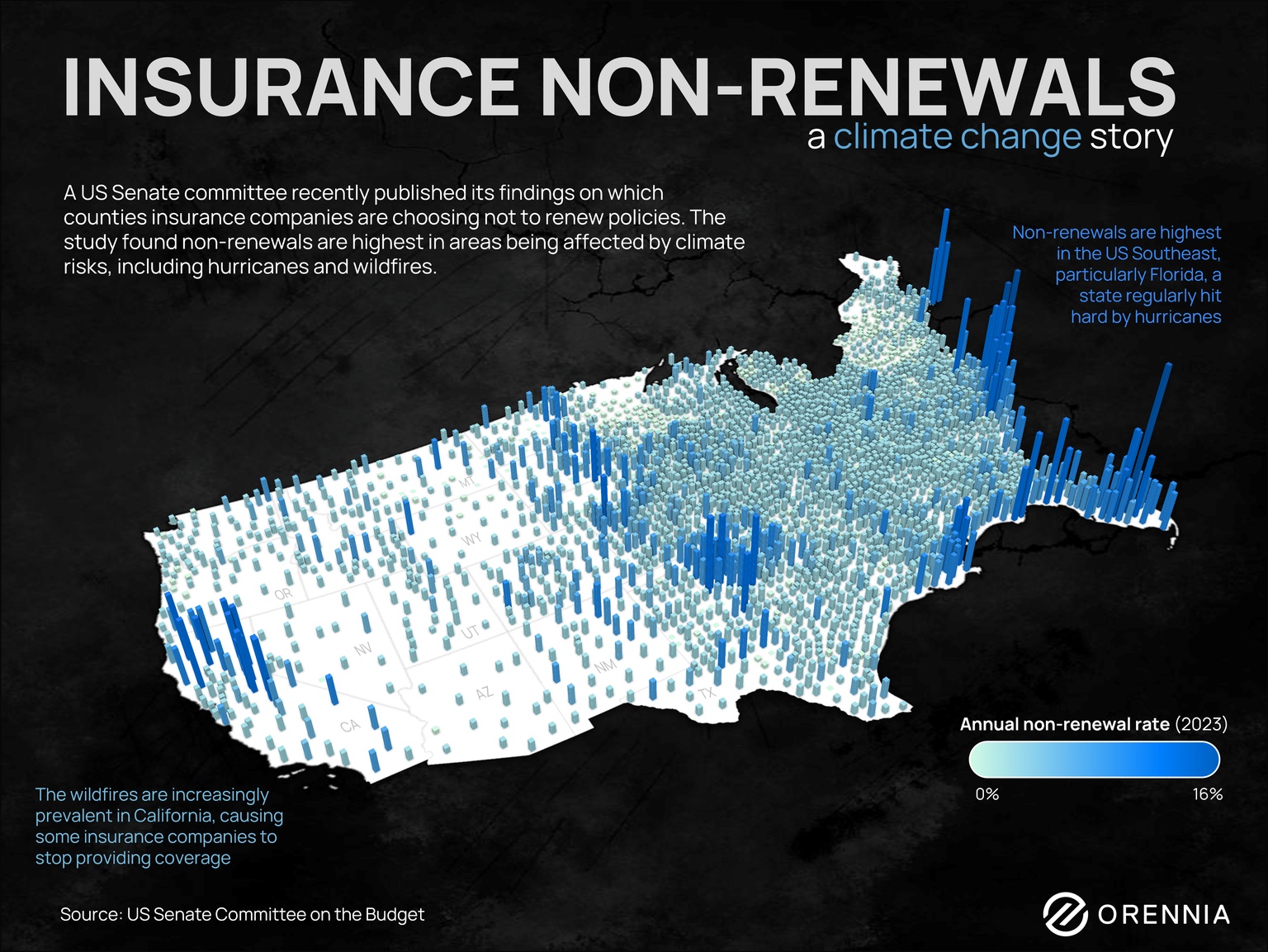

In December, the US Senate Committee on the Budget released its report on how climate change is affecting insurance by seeing which counties are seeing the highest rates of non-renewals.

Last summer, 1,600 insurance policies were dropped by State Farm in the wealthy Los Angeles neighborhood of Pacific Palisades, which was largely destroyed by one of the LA fires this month.

Background: Insurance non-renewals happen when an insurance company decides not to renew a policy at the end of its term. This is often the result of higher risk profiles, too many claims or changes in market conditions.

The committee found that climate change was a significant driver in insurance non-renewals. Areas that are more exposed to extreme weather events – Florida for hurricanes, Oklahoma for tornadoes and California for wildfires – have some of the highest non-renewal rates across the US.

Actuaries put together catastrophe (cat) models, which estimate the likelihood of a disaster.

The math: If a $1 million home is likely to get wiped out once every 100 years, insurance will cost roughly 1/100th of the home’s value every year, or $10,000 annually. Expensive, but manageable. As extreme weather events increase in frequency and intensity and the chance of destruction goes up, so do premiums. If the same home faces a catastrophe now every 20 years, insurance costs jump to $50,000 per year.

To protect consumers from price gouging, states often regulate how quickly insurers can increase the cost of insurance. But if insurance companies cannot raise prices enough to match the increased risks, they’ll often just cancel policies.

+Read the full report: Next to Fall: The Climate-driven Insurance Crisis is Here

Data-driven insights delivered to your inbox.