Aaron Foyer

Director, Research

What is the closest the US has come to electricity that is “too cheap to meter”?

Aaron Foyer

Director, Research

Speaking to an audience of science writers in 1954, Lewis Strauss, then chairman of the Atomic Energy Commission, was expounding on the great future of nuclear energy, including benefits to power. Strauss told the excited crowd, “It is not too much to expect that our children will enjoy in their homes electrical energy too cheap to meter.”

Seemed reasonable: It had been less than two decades since Lise Meitner and Otto Frisch published their famous paper in Nature with a theoretical explanation of nuclear fission and outlined the vast troves of energy that it would release. And to a group of science-inclined writers, whose memory banks included the knowledge that just 1 kilogram of uranium was needed to level the city of Hiroshima, the idea that harnessed nuclear energy from literally tons of the radioactive material could provide nearly unlimited cheap power didn’t seem far-fetched.

But as we know now, the promise of practically free nuclear power was never realized. And to the dismay of nuclear enthusiasts, the phrase “too cheap to meter” went on to haunt the industry and is regularly thrown in its face, even today.

Atomic power plant poster circa 1939

But there’s more to the “too cheap to meter” statement. Beyond being a four-word reminder of the unkept promise of nuclear technology, it’s a phrase that resonates because it plays on a fundamental want of every society: abundant cheap power.

Seventy years on and the promise of low-cost electricity is as potent a promise today as it was in 1954.

Power politics: Both candidates in last year’s presidential race ran vowing to lower energy bills for Americans. In August of last year, now President Donald Trump pledged, “Under my administration, we will be slashing energy and electricity prices by half within 12 months, at a maximum 18 months.” And Kamala Harris’ policy brief during her own candidacy emphasized, “Vice President Harris and Governor Walz will work to lower household energy costs and create millions of new jobs.”

Both candidates framed their solution to high electricity prices as their own party’s preferred energy sources. Shocker.

The big question: Taken together, it raises an interesting question: What is the closest the US has come to electricity that is “too cheap to meter”?

We’re lucky enough at Orennia to have collected thousands of announced power project price contracts, known as power purchase agreements (PPAs). The data also gives us insights into the types of projects that regularly sign low-cost power contracts.

So what is the lowest PPA in our platform?

Let’s start by acknowledging that not every generator signs a PPA.

Many generators, especially renewable ones, will sign a PPA to receive essentially bankable long-term revenues in exchange for sending power to an offtaker — think a solar project in Arizona inking a deal with Microsoft, looking for price certainty for clean data center power.

But just like Clippy, PPAs aren’t for everyone.

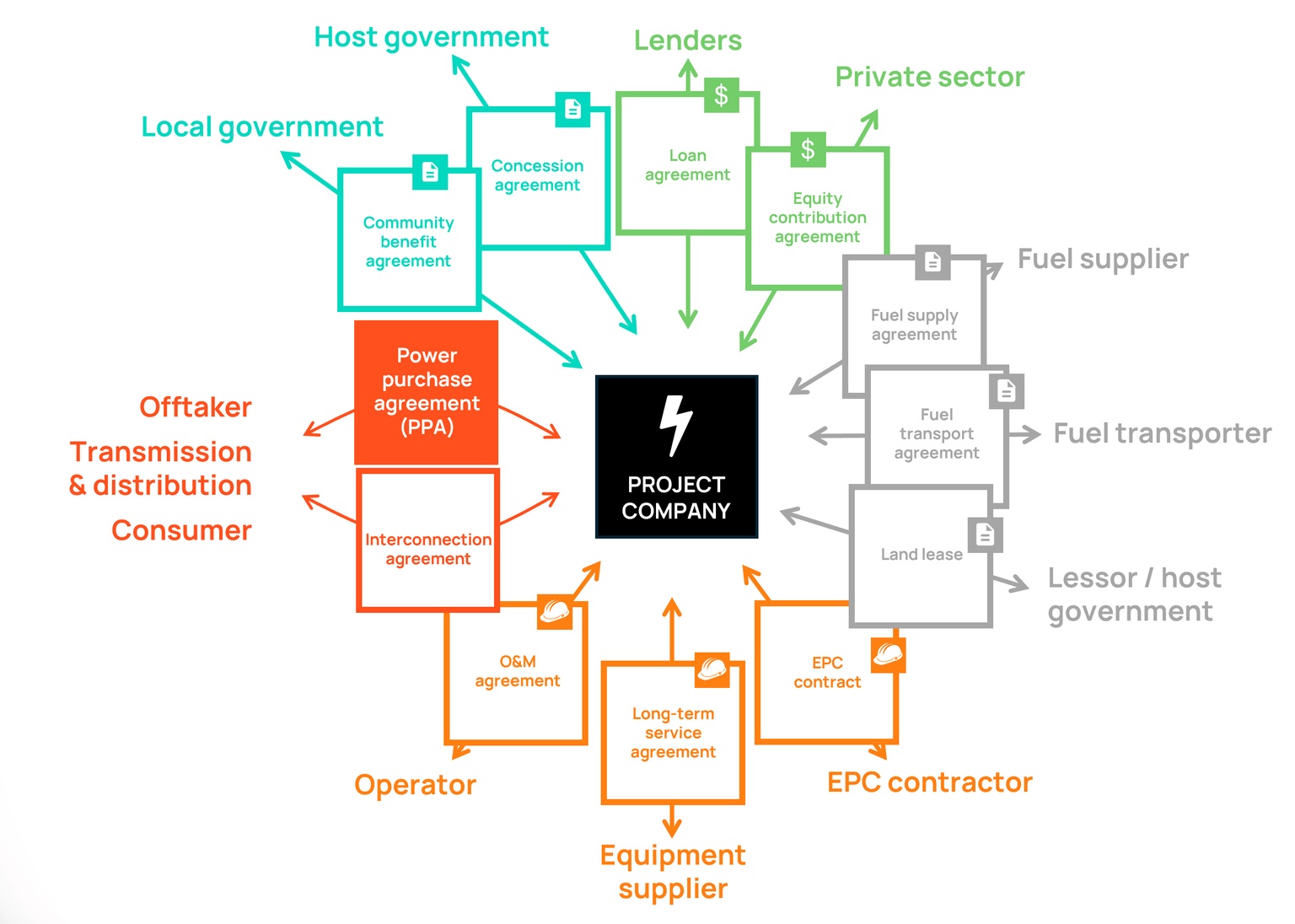

Source: Adapted from the US Department of Commerce

Projects such as batteries and natural gas peaker plants are often built explicitly to capture moments of elevated energy pricing, so they have no need for contracted energy prices. Neither do projects developed by offtakers themselves, like utilities or behind-the-meter setups.

Lastly, the details of many PPAs, particularly virtual PPAs, are not made public, so this is more of an instructional exercise than definitive answer. So, with that caveat in mind…

… is a 300-megawatt wind farm in Williams County, North Dakota, with a contract price of $10 per megawatt-hour. Wow.

Why that’s wild: We track thousands of PPAs across North America, and it’s exceedingly rare to see an agreement even signed for less than $20 per megawatt-hour, using any technology.

For context, according to the latest consumer price data from the EIA, the average cost of electricity to consumers was $132 per megawatt-hour. Now that includes transmission, distribution and other costs like administration, but even if just half of that price is energy costs, it’s still more than six times more expensive than power from this North Dakota wind farm.

So why so low?

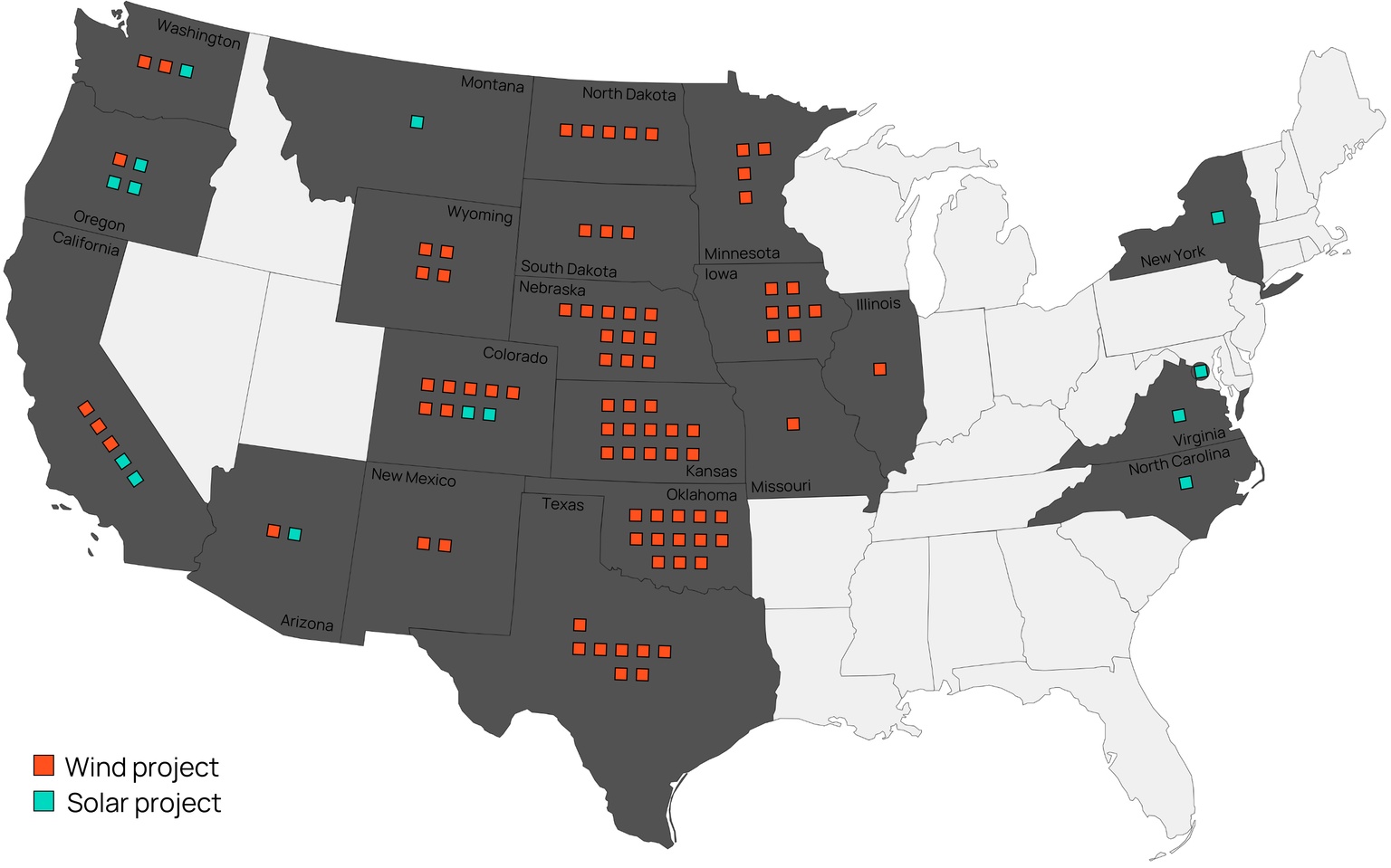

Source: Orennia, FERC

Let’s first take a second to understand PPAs. Before signing, a company will look at the cost to build and operate a project and the overall market conditions to come up with a price that meets some return threshold for its investors.

Market conditions and beyond, this project has plenty going for it.

Tailwinds: For starters, there are probably not too many toupées in Williams County. North Dakota is in the heart of the great North American Wind Belt that runs north-south, from the Canadian Prairies down to Central Texas. More wind means more generating hours to spread capital costs across, which translates to lower prices.

On top of that, the North Dakota project started construction in 2019, so it likely benefited from cheap debt. While not zero interest rate COVID-era levels, the project was still built in a rare time when both turbine technology costs and financing rates were low. And only half the power from this project was signed to this PPA, leaving the other half to sell to higher-paying offtakers or to the open market, which allowed for such a low price to be signed (probably to attract the cheap debt).

Lastly, the project took advantage of federal renewable production tax credits, worth around $25 per megawatt-hour for the first 10 years, further lowering the contracted PPA price needed to make a return.

In short, there were simply fewer costs to cover.

Beyond this lone project in North Dakota, there’s more to learn from PPAs.

Great winds: The Williams County project was far from the only wind generator with a low-cost contract in the Wind Belt. Of the cheapest 100 wind and solar PPAs across North America on our platform, roughly 80% are wind farms on the prairies. This has been helped in no small part because of larger onshore turbine designs, which have grown in size by nearly 400% since the turn of the century, helping drive down costs and increasing efficiency.

Solar has also benefited from better technology.

Shining bright: Photovoltaic projects have seen contract prices drop, falling with the cost of solar panels. Former founder of SunPower Richard Swanson described the learning curve the solar industry sees: every time the total volume of solar panels produced has doubled, prices drop 20%. This has been dubbed Swanson’s Law.

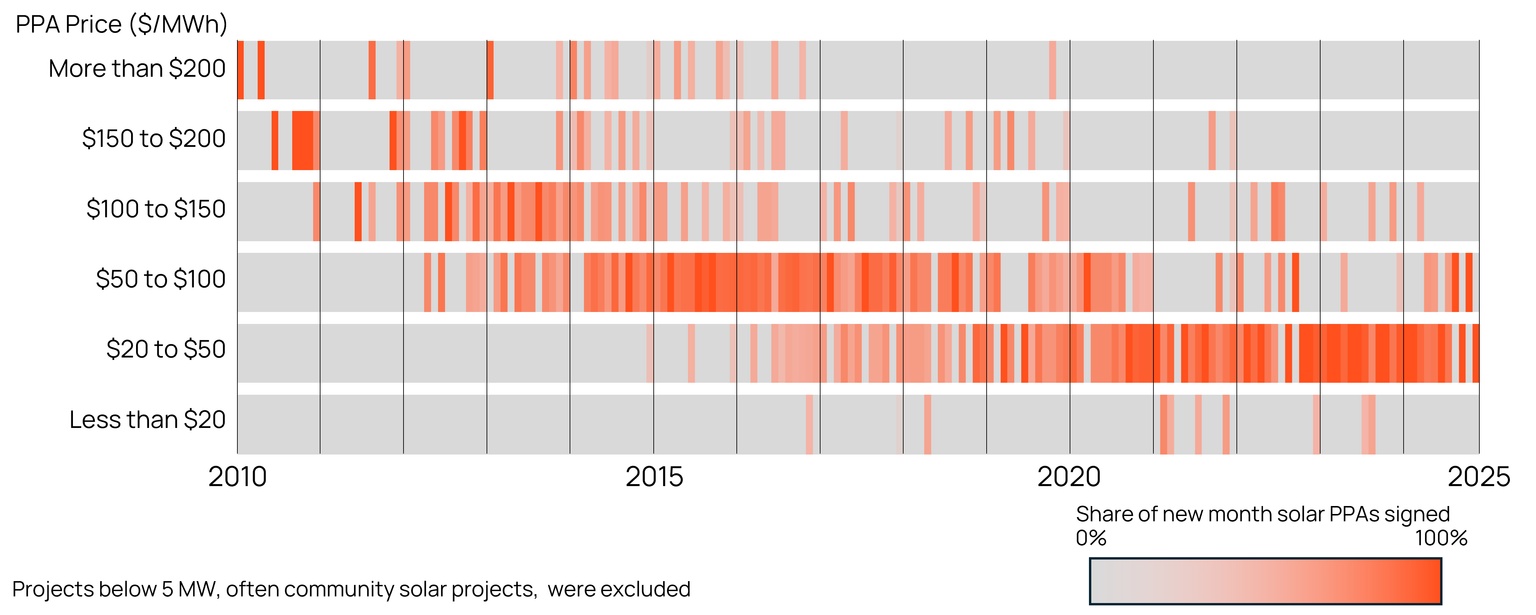

Source: Orennia, FERC

Over just the last decade, panel prices have fallen 90% while their efficiency in turning sunlight to electricity has jumped.

But while both wind and solar projects have benefited recently from cheap technology costs and better performance, there is reason to believe costs could start climbing.

For one, there are changes expected in the mass industrial solar panel factory that is China. The government has instituted a production limit on the country’s output of solar modules, which will likely wipe out many of the manufacturers that make low-reliability Tier 2 and Tier 3 panels. That is expected to boost prices to where Chinese firms are no longer losing money.

For cells that do survive the production limits and make it out of China, the US still has a 50% tariff in place on solar cells from the Asian superpower, and steep tariffs on solar products from other southeast Asian producers.

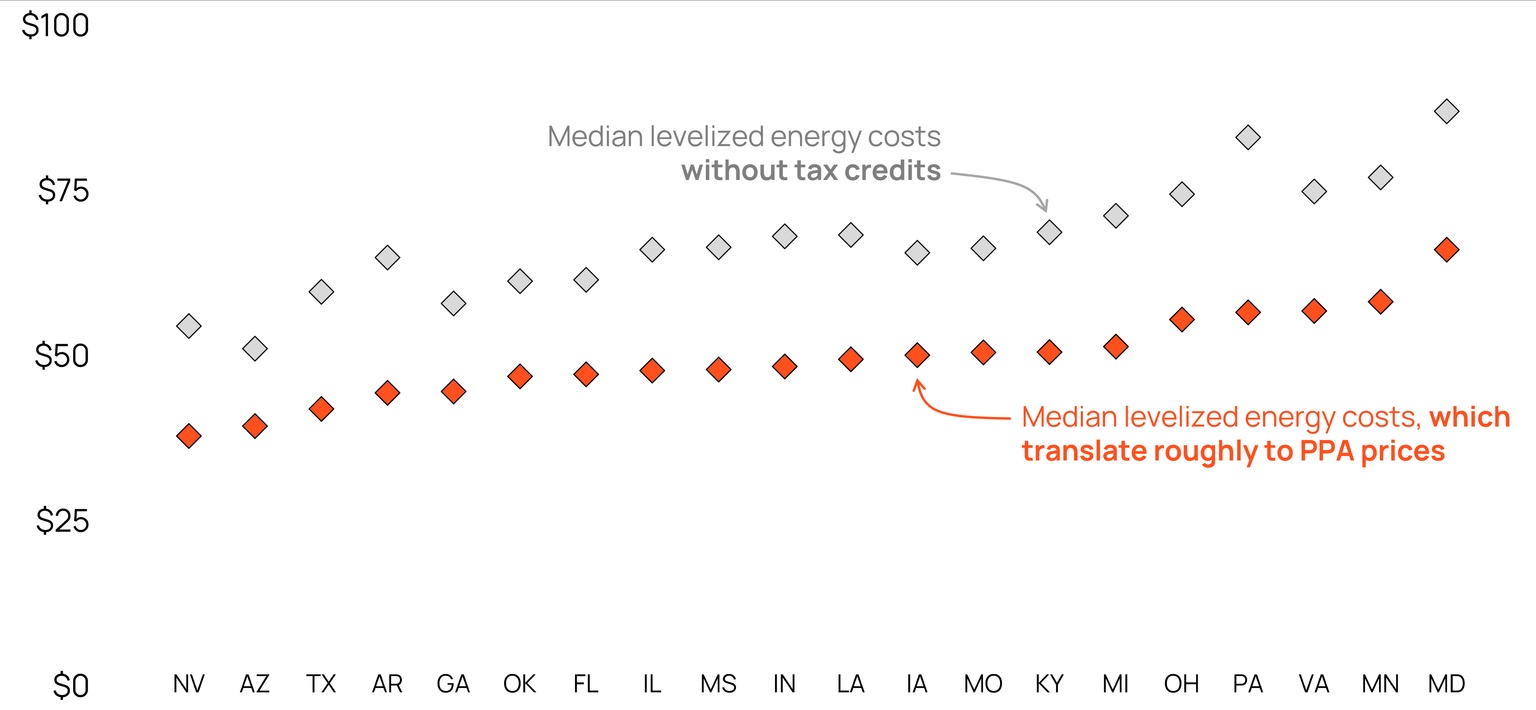

Regardless of where the panels are from, contract prices could jump if tax credits are eliminated by Republicans in the upcoming budget reconciliation process. If credits go away, we see PPAs going up by ~$15 per megawatt-hour, depending on the technology and project.

Source: Orennia

And the growth of renewables has coincided with the growth of congestion on the grid. Projects are likely giving themselves a bit more economic shoulder padding to withstand higher-than-expected periods where projects are curtailed.

To Lewis Strauss’ defense, it’s believed his comment referred not to power generated from nuclear fission but to fusion, a secret program he was working on at the time of his speech. Nevertheless, fission or fusion, power that’s too cheap to meter has not come to pass.

What has though, has been a wave of other low-cost power technologies, including wind and solar, that have resulted in some of the lowest power purchase contracts signed in the US, helping decarbonize the grid.

Sabrina Andrei, sustainability analyst at JLL, explained the tie between PPAs and sustainability: “The global urgency for meaningful climate action is driving an uptick in [corporate] PPAs. More companies now have clean energy goals, which are increasingly under scrutiny, while legislation is also becoming more stringent. In particular for large companies with purchasing power, [corporate] PPAs can be an attractive route,” Andrei said.

Bottom line: While too-cheap-to-meter power is still just a fantasy that future generations might someday enjoy, there is nonetheless an abundance of extraordinarily cheap electricity being produced today. You might just have to hold on to your toupée to get it.

Data-driven insights delivered to your inbox.