Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

The Big Beautiful Bill Act did not undercut support for batteries, as many had initially feared in the early drafts of the bill, but its provisions come with geopolitical strings attached.

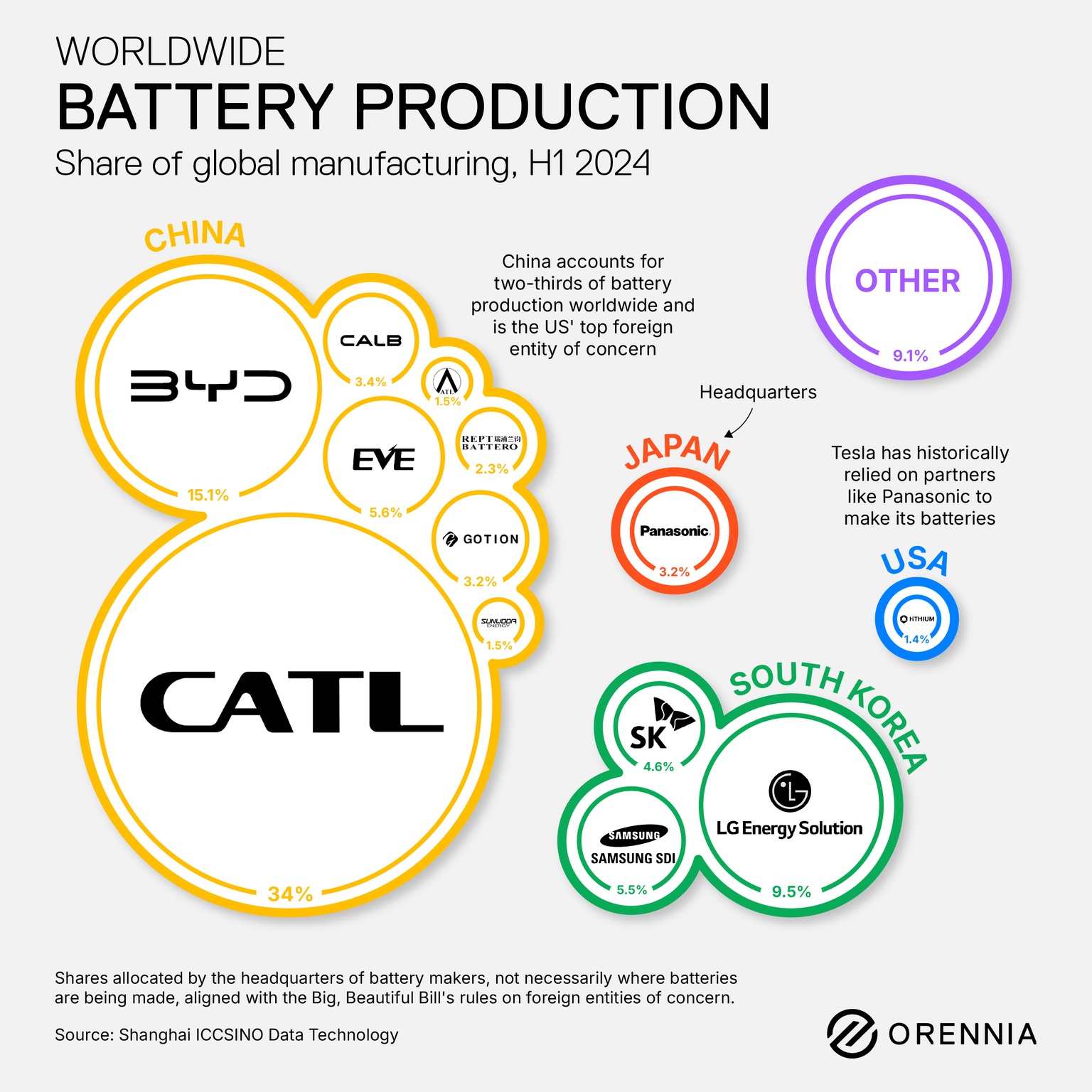

FEOC rules: At the heart of the bill is the drive to localize supply chains for EV and storage batteries, currently dominated by Asia.

To qualify for the tax credits, batteries must meet strict sourcing and financing rules. Projects are exempt from receiving the tax credits if either the taxpayer is either from a country listed as a foreign entity of concern (FEOC) or if the taxpayer is influenced by a FEOC.

In addition, projects are limited in the amount of equipment that can be used from FEOC nations, with the share dependent on when construction begins.

Bottom line: With China controlling two-thirds of global battery output, battery energy storage projects will need to adjust their supply chains to continue qualifying for tax credits in the US.

+FEOC rules explained: The “One Big Beautiful Bill” Act – Navigating the New Energy Landscape

Data-driven insights delivered to your inbox.