Aaron Foyer

Director, Research

Amid a power market redesign

Aaron Foyer

Director, Research

If you make your way to the province of Alberta, you’re sure to see your fair share of cowboy boots, trucks with a lift kit and “I ♡ Canadian Oil & Gas” bumper stickers. Plus a few other stickers that might raise an eyebrow.

The Alberta Advantage: The prairie province punches above its weight for the Canadian economy. It boasts the highest GDP per capita in the country, exports $100 billion worth of oil and gas to the US annually and contributes an estimated $3 billion each year to the federal equalization program to help have-not provinces. That last bit helps sell a few more of those bumper stickers.

The province attributes much of its success to the so-called Alberta Advantage — a shape-shifting characteristic meant to embody its pro-business environment that attracts private capital.

Wind farms beside a pumpjack in Western Canada // iStock

In the 1990s, the Alberta Advantage meant fiscal conservatism, small government and balanced budgets (a real thing, once upon a time). By the 2000s, it was all about the oil sands and population growth. And after the oil price crash of 2014–15, the Alberta Advantage evolved into positioning the province as a low-cost, high-potential base for the future of energy — fossil and clean.

Attracting hyperscalers: When it comes to data centers, true to its brand, Alberta has many advantages. On top of its pro-business culture, the province’s land availability, cold weather and natural resources for clean power should check all the boxes for prospecting tech companies.

But the Alberta government has kicked off a highly controversial redesign of its power market, which has been met with heavy criticism from virtually every sector in the province. And its stance against renewables could throw cold water on data center developers who are notionally climate conscious.

So, can Alberta’s benefits outweigh recent actions from the provincial government to attract data centers? Let’s saddle up, ride this trail and see where it ends up.

If you’re a hyperscaler like Microsoft or Amazon looking to build large data centers and the power to support them, there’s a lot to love about the province.

Alberta is about the size of Ukraine but has only one-eighth the population, making land comparatively cheap. The weather is surely attractive for an industry that spends a fortune to cool servers. The province’s capital of Edmonton averages over 140 days per year with below-freezing temperatures and some towns are often colder than the surface of Mars.

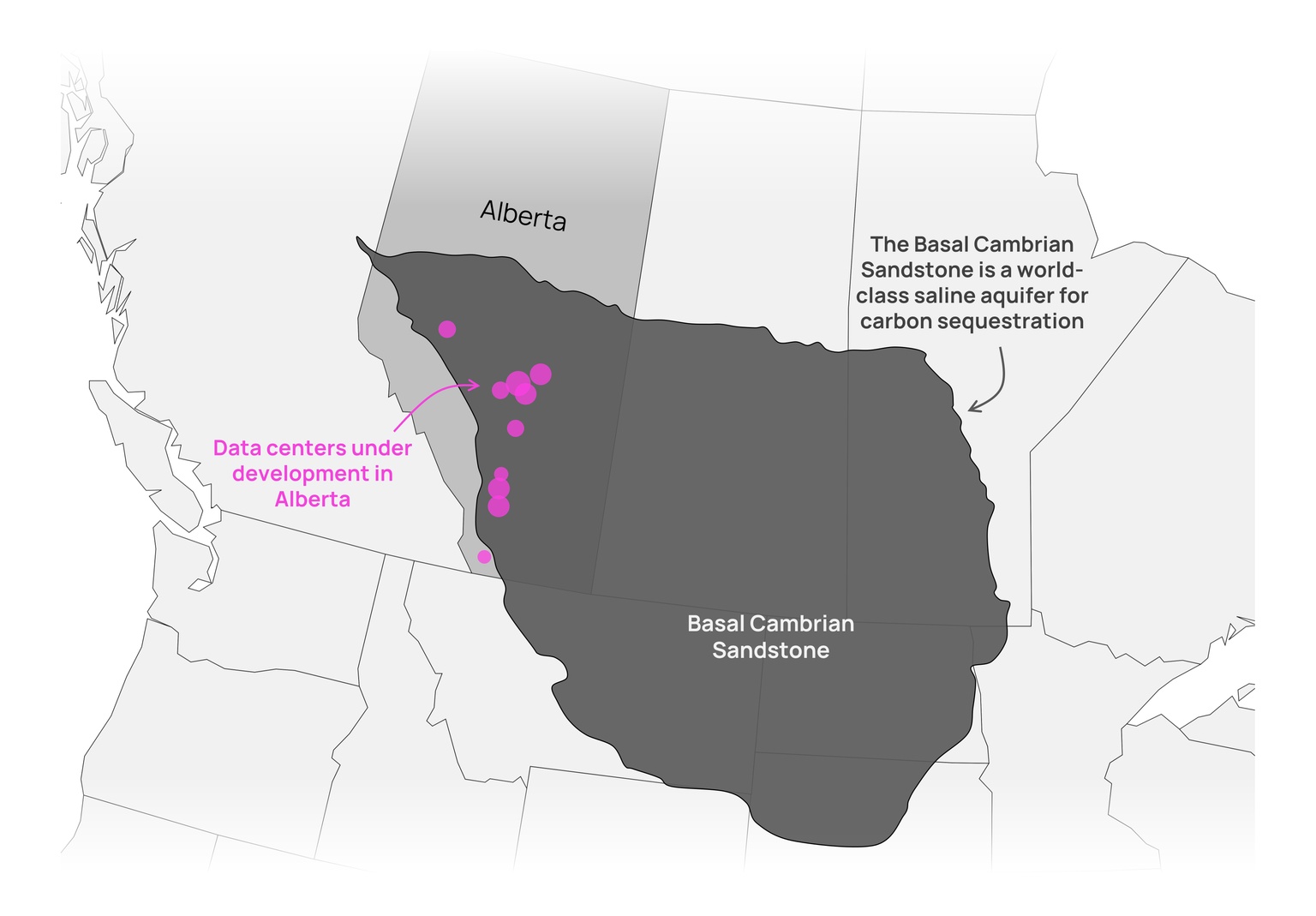

Energy aplenty: Access to power is a key bottleneck in building data centers. Here again, Alberta is blessed. With nearly 42 trillion cubic feet of natural gas reserves and an active oil and gas industry, gas plants can be built at the source of production. And what the Earth giveth, the Earth can taketh back: the large sedimentary basin that holds the gas reserves is also home to a world-class saline aquifer known as the Basal Cambrian Sandstone, which is ideal for carbon sequestration and storage.

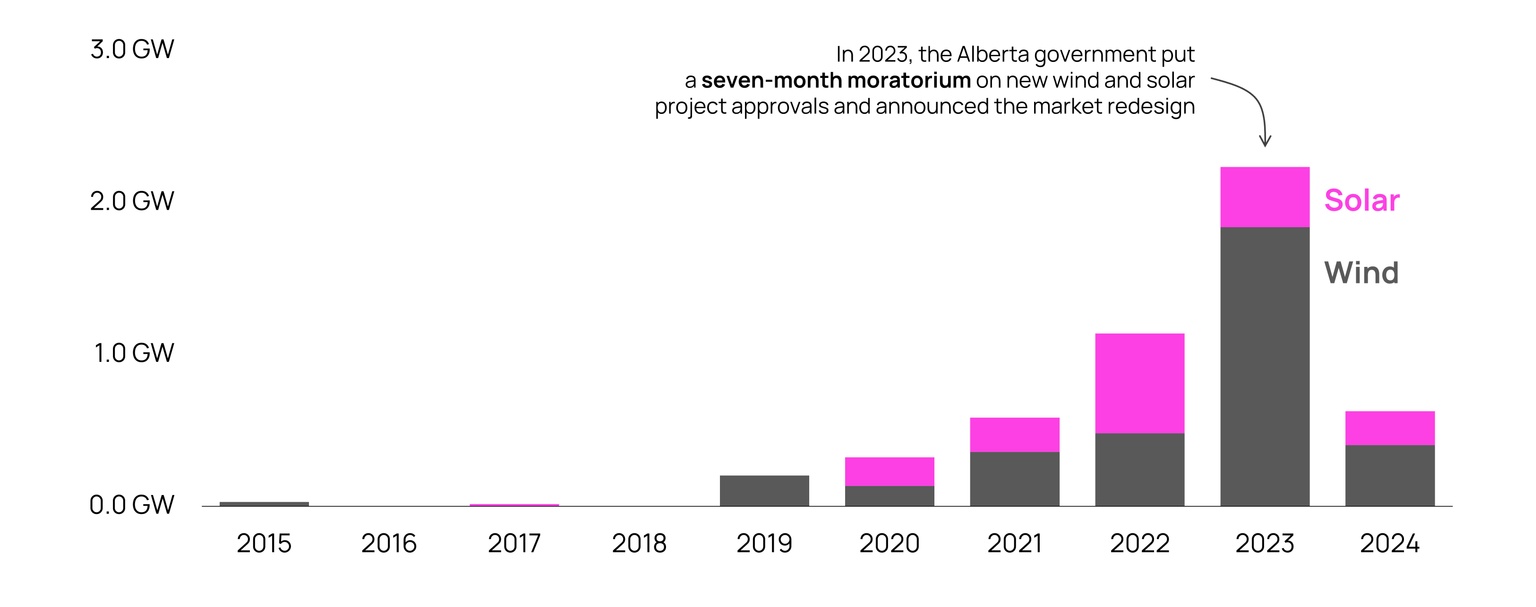

If renewable power is the goal, the province has also historically been the largest builder of wind and solar in Canada, including projects sponsored by Microsoft and Amazon. As recently as 2023, 2.2 gigawatts of renewable power projects were built in Alberta annually.

Source: Orennia, Research Gate

But there’s a fly in the ointment for the Alberta data center story: the province is redesigning its power market in the middle of the data center frenzy. With a controversial rollout and rules yet to be finalized, the province risks scaring much needed investment into the sector.

In late 2023, Alberta’s government launched a review to address reliability and affordability concerns over the province’s power system.

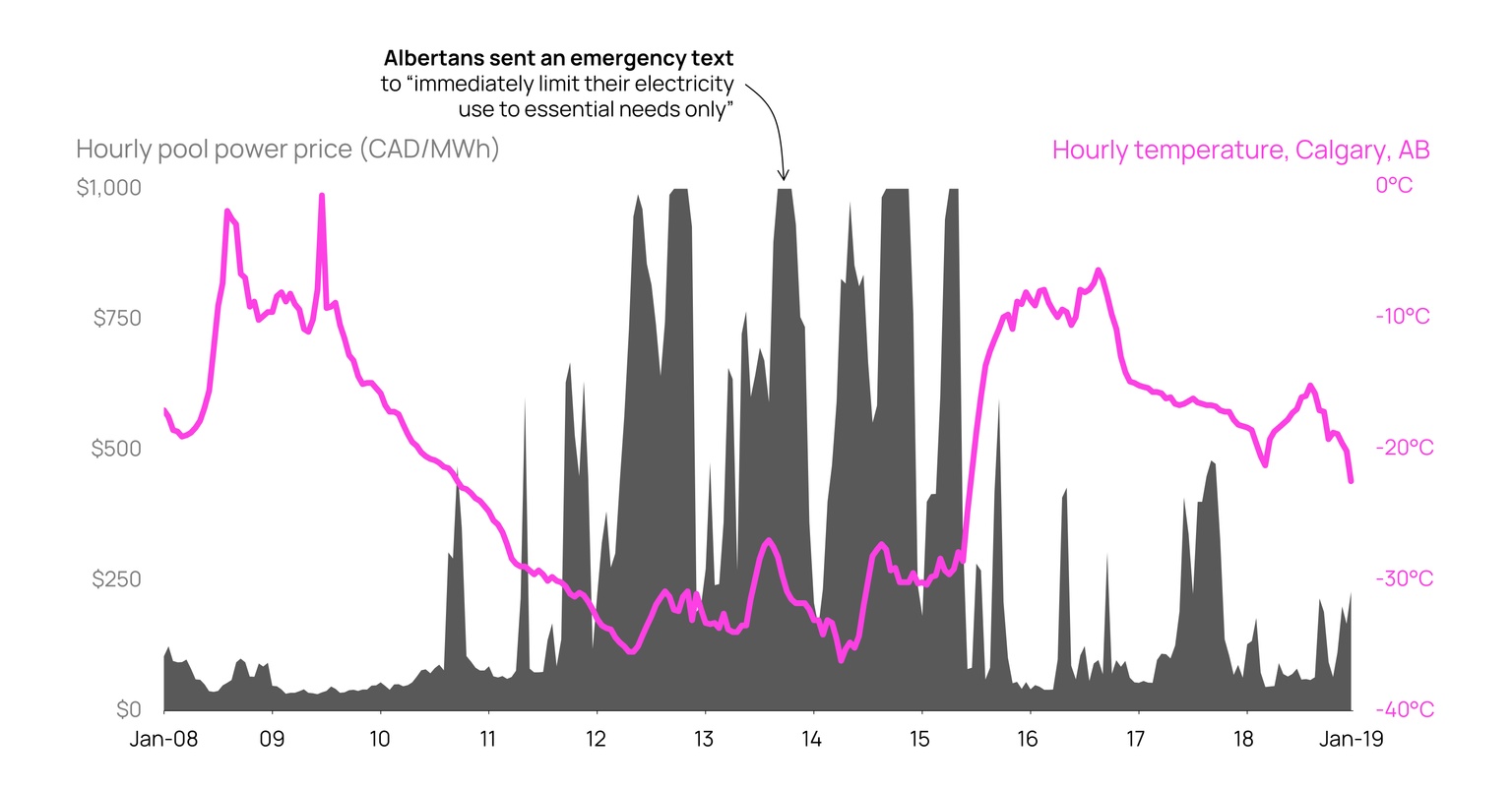

Last January, a province-wide cold snap hit, with temperatures in much of the province dipping below –40, where Celsius and Fahrenheit meet. With electrical heaters roaring, the grid was pushed to the brink and on Jan. 13, citizens were sent an emergency text to shut down all non-essential electrical uses. The grid survived but the incident fed concerns about grid reliability.

Later that month, the Alberta Electric System Operator delivered a recommendation for a market redesign — an ambitious overhaul that looks to preserve its free-market foundation while injecting new mechanisms for reliability and affordability. Or at least that’s the idea.

The changes: Alberta’s power market is unique, being the only deregulated electricity market in Canada, where private companies compete to generate and sell electricity. This contrasts with all other provinces, which have vertically integrated, government-owned utilities. It’s also an energy-only market, meaning generators are paid only for the electricity they produce and sell to the grid.

Source: Orennia, Environment and Climate Change Canada

Part of the redesign includes adding day-ahead pricing, which allows generators to secure power commitments a day in advance, ancillary services and reserves to better support renewables with fast-response power, and shorter settlement periods for more efficient supply-demand matching.

On the one hand, and to give credit to the provincial government, these are modernizations that most North American power markets have had for years, if not decades. (Welcome to the 2010s, Alberta. Don’t get too attached to any Kanye West songs.)

But on the other hand, the way the redesign is being handled and implemented could easily scare away the capital the province is hoping to attract.

The concerns: The Big Tech companies buying power for their data centers have ostensible climate targets and look for opportunities to support clean power development in regions where their data centers are being built. There’s over 16 gigawatts of data centers hoping to be built in the province.

In 2023, Premier Danielle Smith put a seven-month pause on approving wind and solar projects in the province. Following the moratorium, new permitting restrictions were added, including a 35-kilometer buffer around “pristine landscape”. This government intervention was a marked departure from the free-market, pro-business ethos that helped make Alberta into an energy superpower and the leading province for wind and solar installation.

It had an immediate chilling effect on investments in clean power projects and has not recovered.

Source: Orennia

Beyond adding a significant political risk premium to clean power projects, the entire approach to the redesign has raised concerns from local industries.

Fast, not careful: A power market is an ecosystem where hundreds of different players are constantly trading electricity to ensure the lights stay on for everyone affordably. Redesigning the rules, from how prices are set to who gets paid and when, leaves little room for error.

Despite the high stakes involved, Alberta is rushing through the process from start to finish in just three years. For context, Ontario is also redesigning its market and is expected to take nine years to make sure it’s built right.

To speed up the redesign, the province is sidestepping the regulator, the Alberta Utilities Commission, and approving the new market rules itself. Regulators would usually model a system with new rules to make sure electricity can deliver on reliability and affordability. But the province has decided to let the lawmakers try their hand at market design. What could go wrong?

Poorly received: The Alberta government sought feedback on the redesign from the key stakeholders in the province’s power industry. All 36 of the respondents, ranging from municipalities and industry associations to utilities and energy developers, gave tepid to scathing feedback. Bypassing the regulator was repeatedly a major concern.

Part of the rush for the redesign could be to tap into the incredible rush to develop data centers.

Amazon, Google, Microsoft and Meta are on track to spend $400 billion this year, mostly on AI-related infrastructure and the power to support them. These companies still maintain very aggressive clean energy goals, with most still looking to be carbon-free by 2030. This makes regions with existing abundant clean power and the ability to rapidly add more attractive. In this sense, Alberta lags.

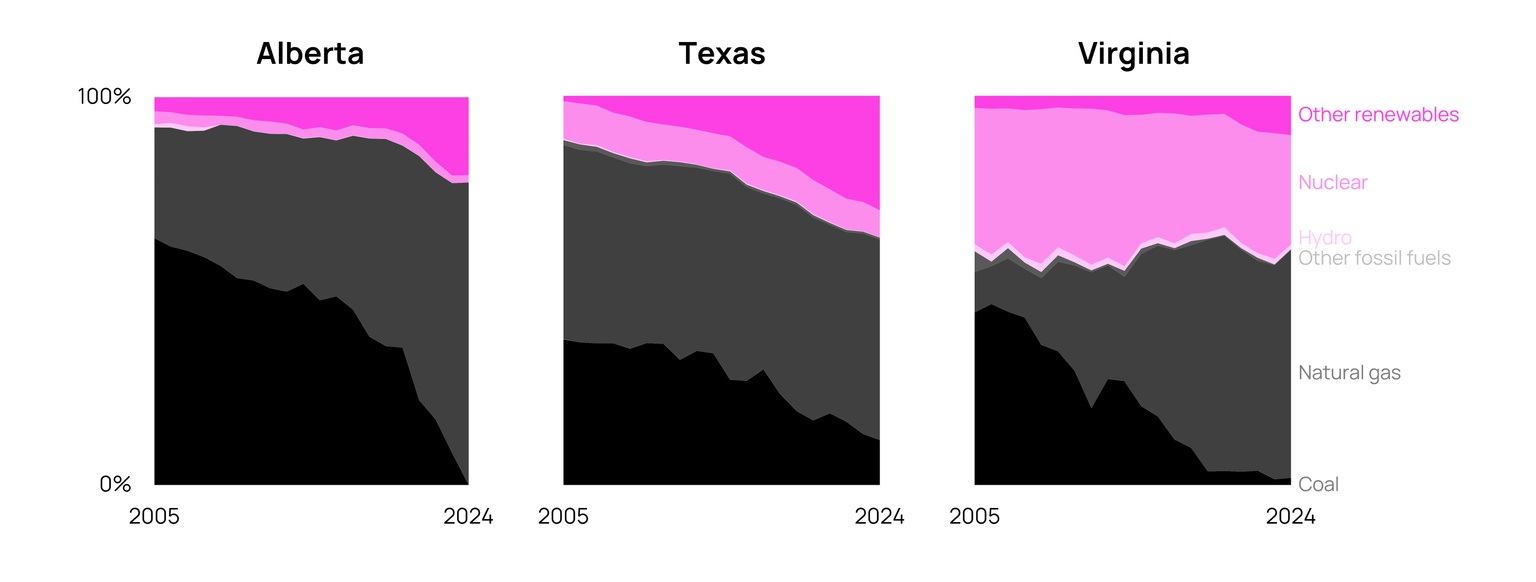

Courting clean: The two jurisdictions in North America where the most data centers are being developed are Virginia and Texas.

Virginia, home to Data Center Alley and the hub for 70% of the world’s internet traffic, has relied heavily on nuclear power for decades. Microsoft, Google and Amazon have all signed significant nuclear power deals in Virginia over the past couple of years.

Source: Government of Canada: Canada Energy Futures, US Energy Information Administration

Texas, probably the closest proxy to Alberta in terms of how its power market works, has been a key hub of renewable energy growth. The competitive, deregulated market of ERCOT has allowed wind and solar power to flourish in the state, attracting with it the hyperscalers.

But renewable growth in Alberta has all but evaporated. The business-friendly place for clean power developers is no more. The brief moratorium on wind and solar approvals and new permitting restrictions didn’t help and now a complete power market redesign is forcing companies to take a wait-and-see approach during one of the greatest power sector investment booms in history.

The Alberta government probably gets too much flack for being anti-renewable.

Sure, it’s moratorium torpedoed wind and solar investment in the province, and Premier Smith has been a vocal opponent of the country’s clean electricity regulations to make the grid clean by 2035. But it’s also been supportive of the country’s overall aspirations of achieving net-zero carbon emissions nationwide by 2050. And many of the rules the province is trying to implement are clearly designed to support a grid with more renewables and batteries, like negative power pricing, ancillary services and shorter dispatch intervals.

Bottom line: The province has thrived for decades by pragmatically rising to meet the challenges of the day. In the late 1990s, with much of its coal fleet set to retire, Alberta diverged from other Canadian provinces and deregulated its power market to attract private investment. It worked.

But the approach the government has taken to support gas power and forsake renewables recently has backfired. The uncertainty created from the redesign and shutting the regulator out is keeping data center developers away which, ironically, would have materialized as a huge boon for gas (and renewables).

Data-driven insights delivered to your inbox.