Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

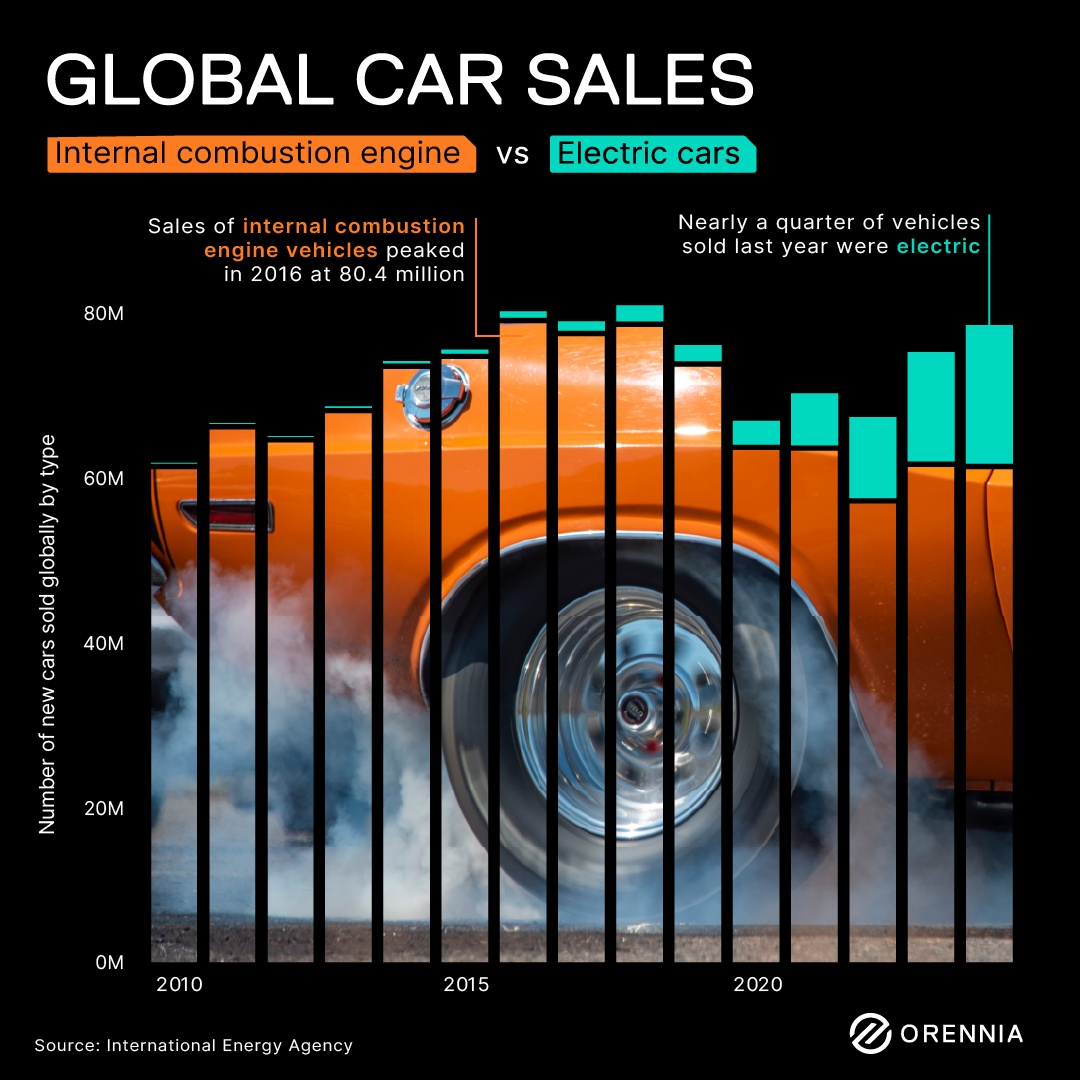

Global sales of internal combustion engine vehicles have been sliding for nearly a decade, and the skid marks aren’t stopping anytime soon.

Background: After peaking around 2016, ICE sales began a slow but steady decline, driven by the one-two punch of tighter emissions regulations and the electric vehicle boom.

Countries from Norway to China started laying out phase-out dates for new gas car sales. In China, ground zero for the EV surge, sales of ICE vehicles have fallen more than 40% since their zenith, driven by strong incentives.

The government’s share of spending on electric vehicles has dropped from 20% of global spending in 2017 down to just 6.8% today.

Automakers took the hint: General Motors, Volvo and others began shifting R&D dollars towards their electric platforms.

Between policy and innovation, EVs have gotten cheaper and faster, and not just in China. While North American electric vehicle batteries were 25% more expensive than Chinese-made ones in 2020, they were just 10% higher in 2023, according to the IEA.

The result: Even though global ICE vehicle sales are holding steady at 60 to 65 million per year, EVs are accounting for new growth.

+Full report: Global EV Outlook 2025

Data-driven insights delivered to your inbox.