Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

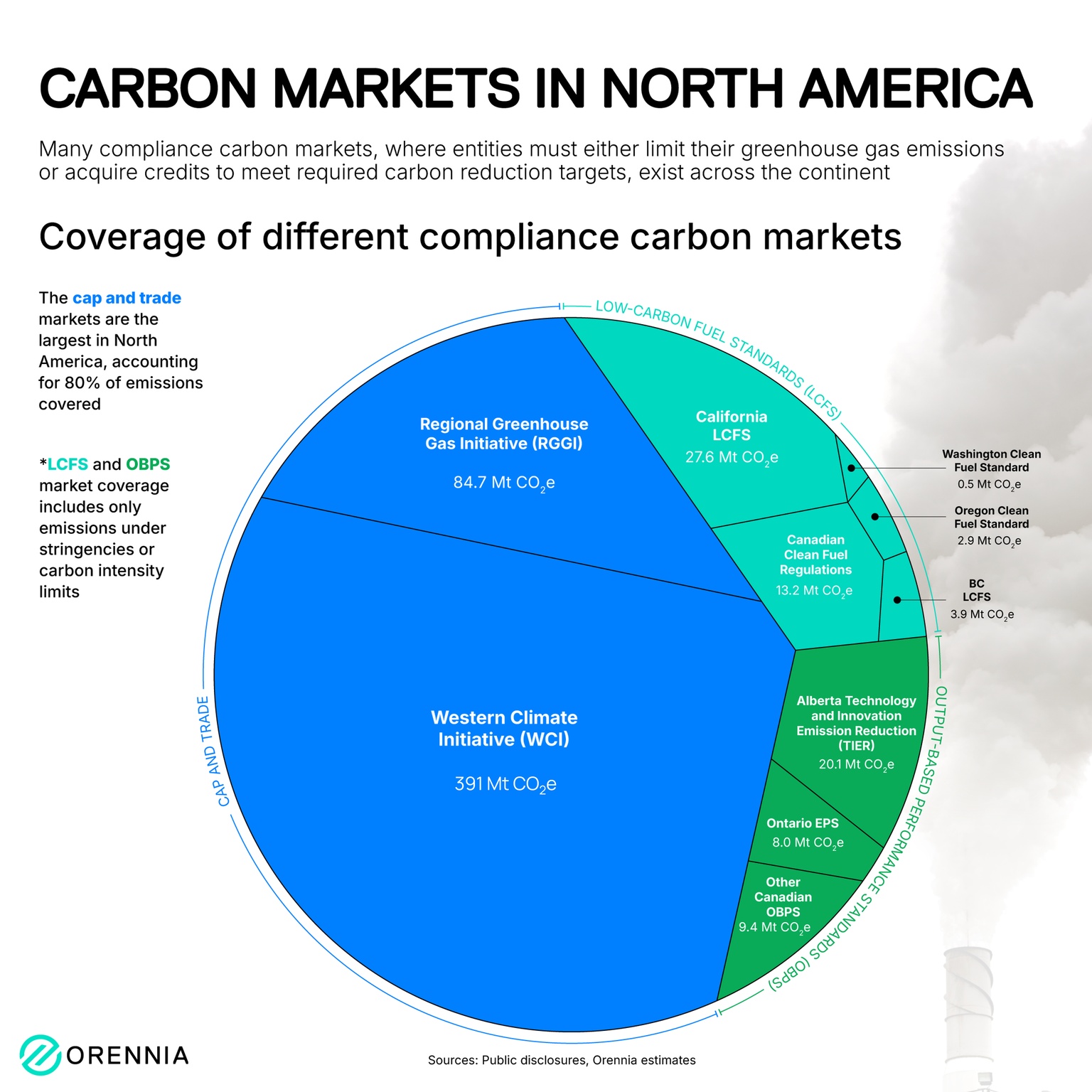

Carbon markets are increasingly popular as a market-based approach to reducing greenhouse gas emissions. They offer financial incentives to companies to decarbonize by placing a cost on carbon emissions while offering credits for overachieving reductions.

There are several carbon market types in action across North America. Some are broader markets, like regional cap-and-trade systems, which often cover a wide range of sectors and industries. While others are more focused on either industry or transportation.

Unlike cap-and-trade, where all emissions are covered right off the bat, both LCFS and OBPS type policies increase the share of emissions covered over time. This means the largest compliance markets in North America, almost by an order of magnitude, are cap-and-trade.

The design of cap-and-trade systems will naturally reduce emission coverage over time as the policy forces industry to decarbonize. By contrast, for both LCFS and OBPS, their designs are meant to ratchet up the pressure on industry by increasing the share of emissions covered. In Canada, the carbon tax price is also scheduled to increase, increasing the impact of higher coverage.

Data-driven insights delivered to your inbox.