Aaron Foyer

Director, Research

Can Mark Carney save Canada?

Aaron Foyer

Director, Research

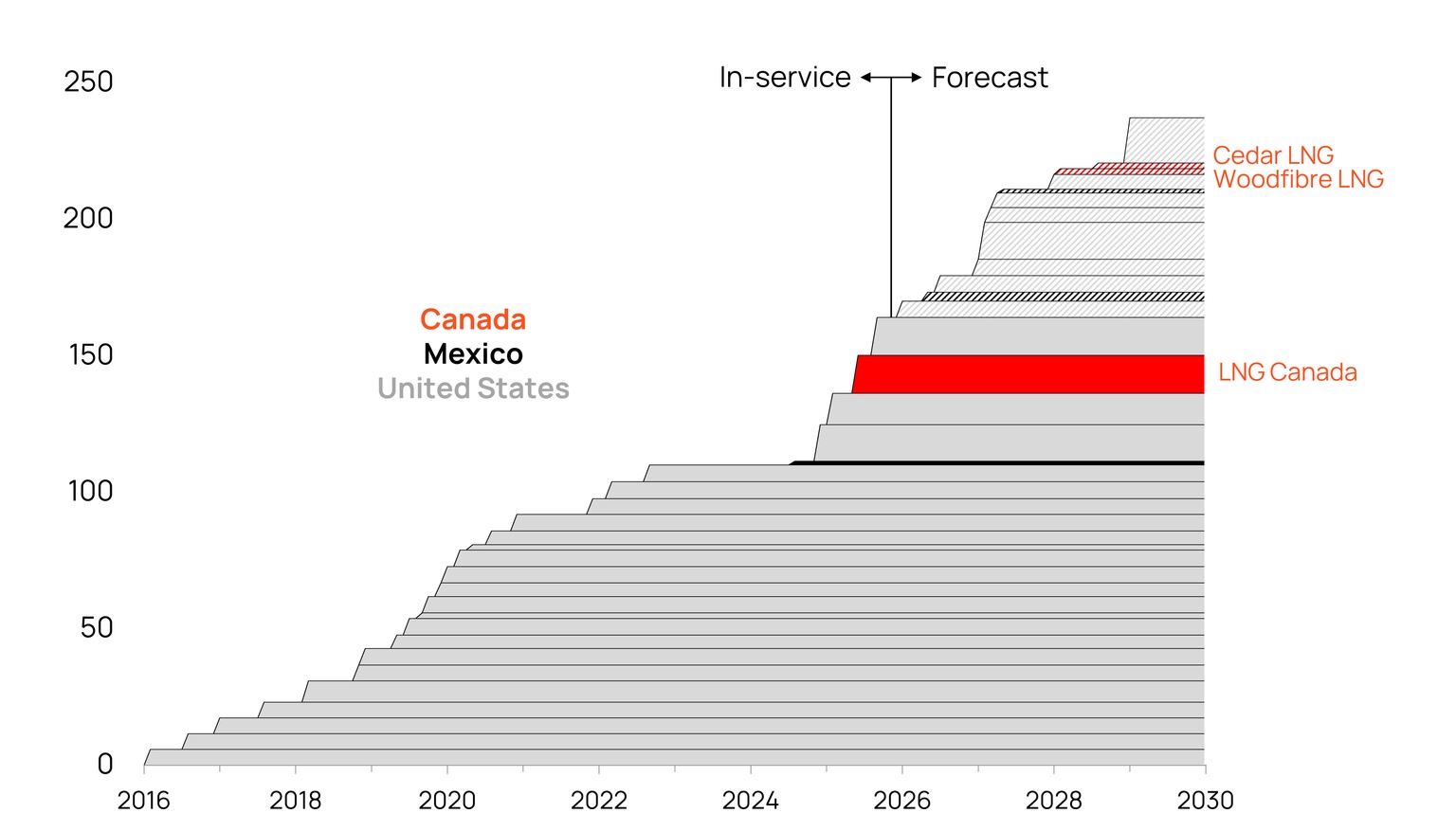

In June of this year, off British Columbia’s verdant and rugged West Coast, a ship containing liquefied natural gas set sail for international markets. Departing from LNG Canada, a joint venture between Shell, PETRONAS and three other Asian energy firms, the cargo represented the country’s very first export of the ultra-cold liquid fuel and a key milestone for the largest private sector investment in the country’s history.

But such milestones are increasingly rare in Canada. For a country blessed with natural resources, large projects seem strangely like a thing of the past. Dozens of infrastructure projects have been cancelled or delayed over the past decade, including the Energy East pipeline, the Goldboro LNG project in Quebec and the Kudz Ze Kayah critical mineral mine in the Yukon.

At the same time, the United States, the country’s historically reliable trade partner, has been anything but. Canada was already hit with one of the steepest US tariff rates at 35%, but that jumped another 10% last month after US President Donald Trump didn’t appreciate a World Series ad highlighting the downsides of tariffs. More than three-quarters of Canada’s exports last year went to the US, making it particularly vulnerable to American import levies.

LNG Canada

As Canada faced its worst international crisis in a generation, the Liberal Party ousted former prime minister Justin Trudeau and replaced him with international banker Mark Carney. Prime Minister Carney came out of the gate ditching unpopular policies like the consumer carbon tax and setting up a Major Project Office to fast-track so-called nation-building projects.

Since becoming the nation’s leader, his approval rating has only increased, something easier said than done these days (just ask Keir Starmer or Donald Trump).

But critics are worried that many of the moves in Carney’s opening salvo are just signaling change, with little transformative substance. Having spent a decade under Justin Trudeau, Canadians are well familiar with virtue signaling from the top.

So, can banker-turned-politician Mark Carney and his revitalized Liberal Party rise to this moment of shifting geopolitics and economic fraughtness to get Canada back on track? Let’s lace up the skates and find out.

By all accounts, Canada should be a global natural resource powerhouse.

The country has the third-largest crude oil reserves in the world, behind only Venezuela and Saudia Arabia, more than a billion tonnes of potash reserves, making it the top global producer of the fertilizer input, and 20% of the world’s surface freshwater. Not to mention an abundance of natural gas, timber, critical minerals, diamonds, uranium and viral lumberjacks.

A recent estimate put the value of the country’s natural resources at $1.7 trillion, so in the new age of critical mineral shortages, data center electricity needs and recurring European energy crises, Canada should be thriving. But it’s not.

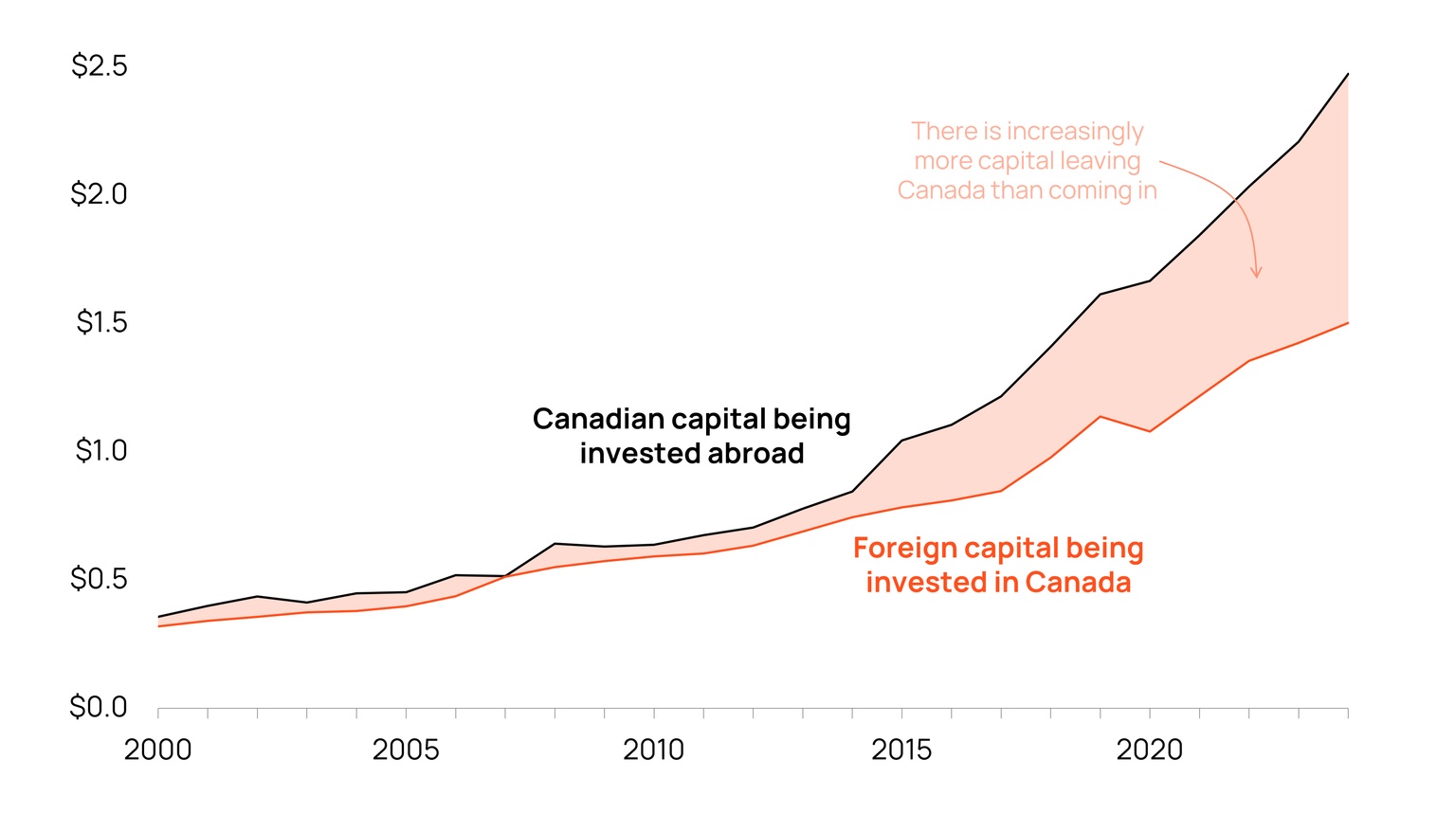

There is increasingly more investment leaving Canada than entering: it will only take a few years at the current pace before two dollars of Canadian capital leaves the country for every one dollar invested from abroad.

Source: Statistics Canada Table 36-10-0008-01

There is no single diagnosis for Canada’s problems, but a few notable events took place in the mid-2010s that have stung.

For one, when Justin Trudeau came into office, his newly-elected Liberal government overhauled regulations in such a way that chilled investors, particularly through a new environmental impact assessment that gave an unnerving amount of final decision power over major energy projects to the country’s environmental minister. But it can’t all be blamed on politics: the oil crash of 2014 plagued the energy industry for years, marking the end of major capital being put into the country’s oil sands deposits. And being a petrocurrency, the devaluation of the Canadian dollar that followed made investments into Canada less appetizing than a bowl of maple-baked beans.

Cold miss: Most emblematic of Canada’s decade of struggle was completely missing the North American LNG wave. When Trudeau first became prime minister, neither Canada nor the US had any LNG exports to speak of. By the time he left, the country’s southern neighbor had become the world’s largest LNG exporter while Canada had yet to turn on its first plant.

Source: US Energy Information Administration, public disclosures

Much to the dismay of investors and developers, Trudeau gave mixed messages about the government’s support for the industry. Sometimes he would boast about the LNG potential of Canada, then say there’s no business case for it in the middle of a European energy crisis. He articulated the role Canadian natural gas should play in helping reduce global emissions, then handed the keys to the all-powerful environmental minister role to former Greenpeace activist and environmental ideologue Steven Guilbeault.

Hot then cold, yes then no. He was truly destined to date Katy Perry.

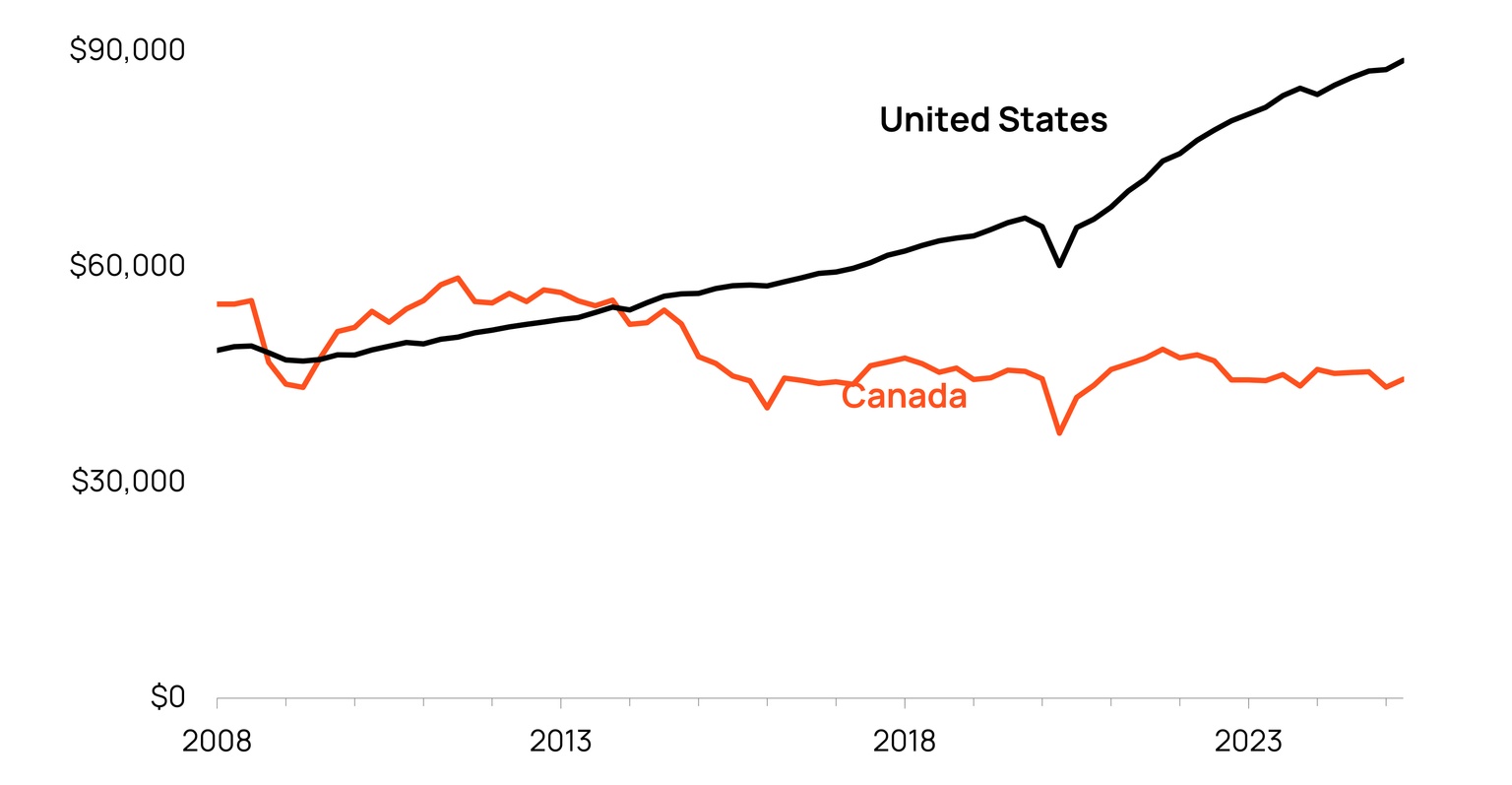

Divergence: The net result of it all is that Canada’s economy has slowed down. For the first 15 years of the century, the country’s GDP grew by 2.3% annually. However, that’s been hobbled over the last decade to just 1.6% per year. And when you adjust for population growth, GDP per capita has been shrinking — over a period when housing prices have nearly doubled across the country. A stark contrast to the US, where economic output per person has been rising steadily since the Financial Crisis and only seems to have gotten stronger from a multi-year global pandemic.

About this time last year, Canadians had finally had enough. Trudeau’s approval rating fell to an all-time low of just 22% and it was all but assured that the country would vote in a Conservative government in the forthcoming election.

But after a forced resignation from Trudeau, the surprise launch of a trade war from the White House and some morally questionable political maneuvers by the Liberal Party, by hook or by crook, Mark Carney became the new Prime Minister of Canada.

Source: Stats Canada, FRED

It was clear from the start that Carney needed to distance himself from the Liberal Party of the past decade.

The Trudeau government had hung its hat on a national carbon tax being the heart of its environmental strategy. But it had become so unpopular, the Conservatives tried to brand the former governor of both the Bank of Canada and Bank of England as “Carbon Tax Carney,” a move that backfired spectacularly when the new prime minister repealed the consumer carbon tax as his first move in office.

And he’s kept busy in the eight months since.

In June, the government passed Bill C-5, also known as the One Canadian Economy Act, aimed at reducing trade barriers between the provinces and expediting so-called nation-building projects.

Self-tariffs: Canada’s patchwork of provincial rules and regulations for things like permitting, licensing, standards and procurement make it harder, costlier and slower for goods, services, labor and energy to move freely across the country. While Canadians are all up in a fuss about the new White House tariffs on Canadian goods sold to America, the Public Policy Forum estimates the interprovincial trade barriers add the equivalent of a 7.8% to 14.8% tariff on Canadian goods sold between provinces.

Estimates show getting rid of the internal barriers could single-handedly boost Canadian economic productivity by nearly 4%.

Nation-building projects: To really get the country back on track, Canada needs to return to its roots in building large energy and infrastructure projects, and there are hopes Bill C-5 can help.

One of the key targets of the Bill is to reduce approval times from five years down to two. A Major Project Office was set up in Calgary, the heart of Canada’s energy industry, to help expedite the process, and named Dawn L. Farrell, former CEO of both TransAlta and Trans Mountain, to lead the initiative.

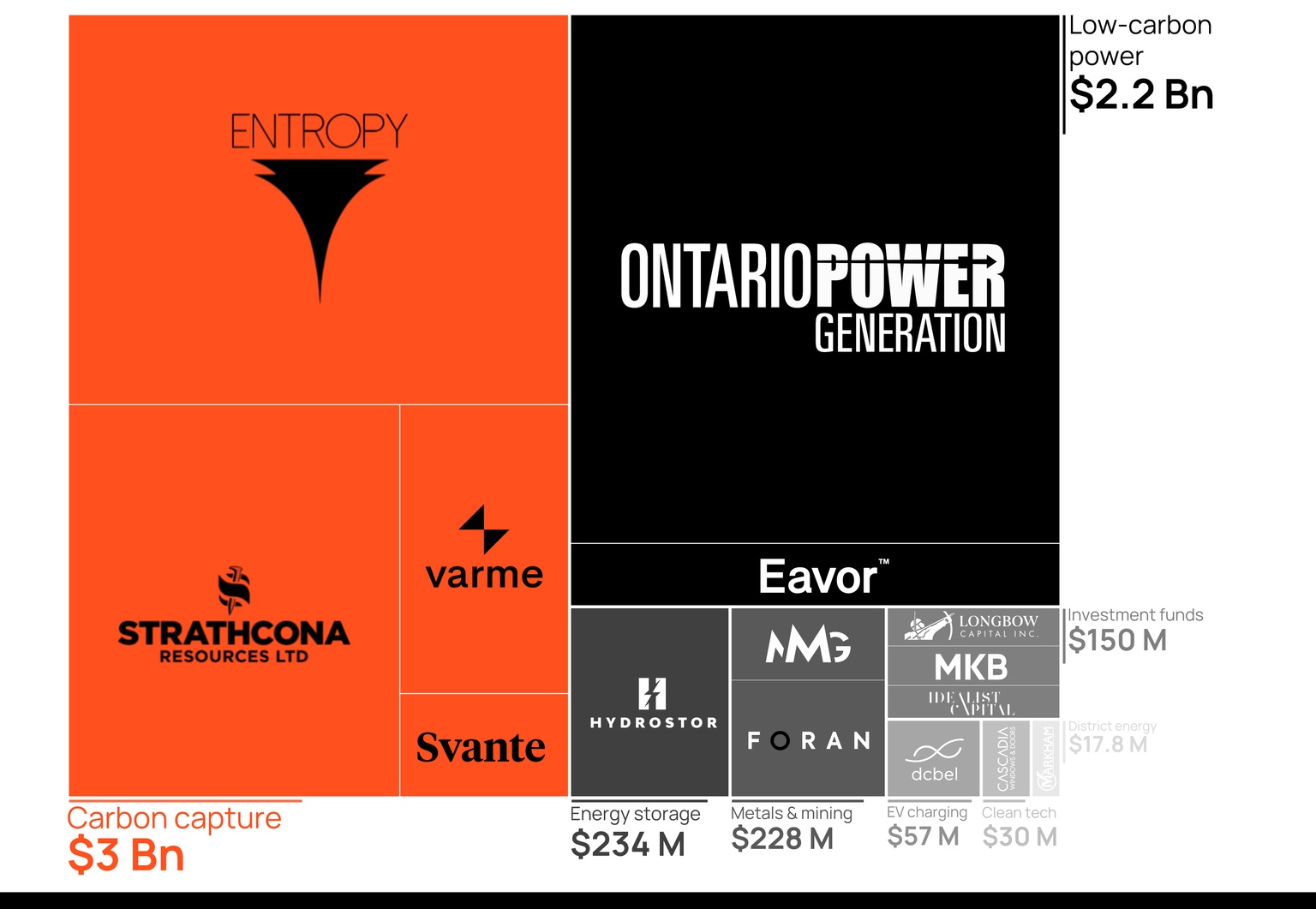

Source: Canada Growth Fund

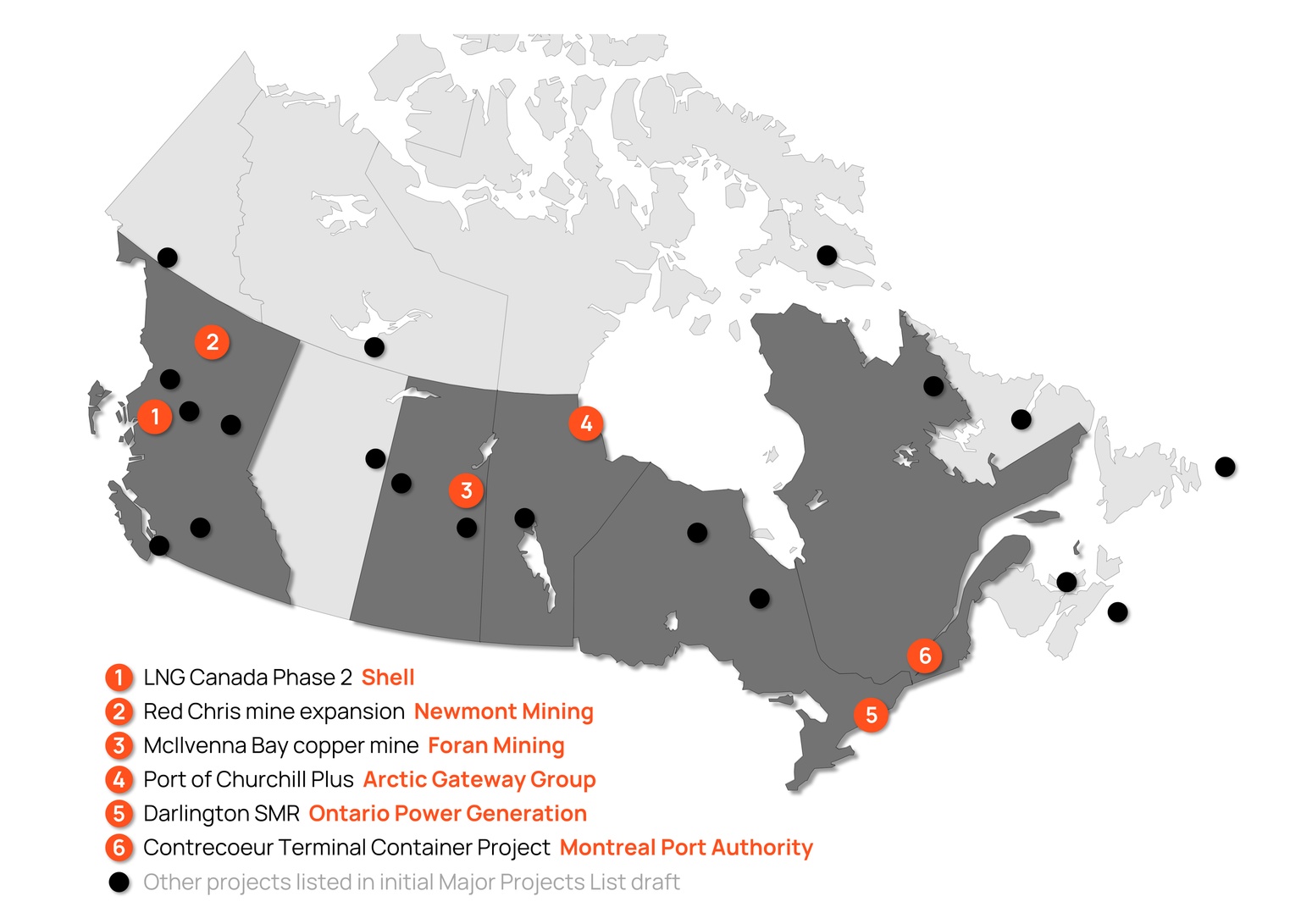

In September, the government announced the first round of nation-building projects, six developments across five provinces, bequeathing them each with the turbocharged approval process from Bill C-5.

While most of the projects announced in the first round were safe choices, already in advanced stages of development, more are expected, and the hopes are these will be bolder.

Beyond faster approvals, the Canada Growth Fund, a $15 billion federal arm’s length investment vehicle, has been active in providing capital for clean-growth technologies and infrastructure. Last month, the CGF pledged $2 billion to help fund four small modular nuclear reactors at the existing Darlington nuclear power station in Ontario, itself one of the announced nation-building projects.

But it's not all rosy

While many are hopeful Carney will breathe new life into the Canadian economy through deregulation and a can-do banker attitude, many are still concerned.

The Fraser Institute, a prominent conservative think tank, has highlighted that Bill C-5 doesn’t do away with the challenging regulations that have made investing in Canada near impossible. Instead, it just gives cabinet the right to choose when it needs to abide by the rules and when it doesn’t. If there’s anything investors love, it’s uncertainty about whether projects will arbitrarily get special regulatory treatment or not. (Read: sarcasm. Investors do not like this.)

Source: Government of Canada, The Globe and Mail

Canada is also in the midst of reconciling a challenging past between the government and its Indigenous population. One area where the past Trudeau government can rightfully feel proud of is the steps it took to embrace the principles of the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP), including free, prior and informed consent.

But First Nations leaders see Bill C-5, which allows government to bypass regulations when deemed necessary, as a threat to their constitutional rights that they have fought for more than a century to secure.

The quagmire of Canadian resource and infrastructure development.

Whether it’s the energy transition, electrification or the data center boom, there are plenty of tailwinds supporting the need for energy and natural resources right now, and Canada’s got loads of both.

At a time when the US and China have both charted bold and aggressive visions of the future, Canada looks lost. What’s truly missing for the country is a cohesive and enduring national industrial strategy: a north star with adjoining policies that investors can feel confident survives changes in government and that plays to the strengths of every region in the great country.

Hopefully, with decades of experience seeing countless strategic investment decks roll across his desk, Carney can deliver one himself.

Canada missed out on the last boom; it can’t afford to miss out on the next.

+Bonus Infographic: Canada Growth Fund: Continued Investment in Canada's Low-Carbon Future

Data-driven insights delivered to your inbox.