Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

Negative power pricing in the California Independent System Operator (CAISO) market occurs when the supply of electricity exceeds demand to such an extent that producers are essentially willing to pay consumers to take their electricity. This phenomenon can be attributed to several factors:

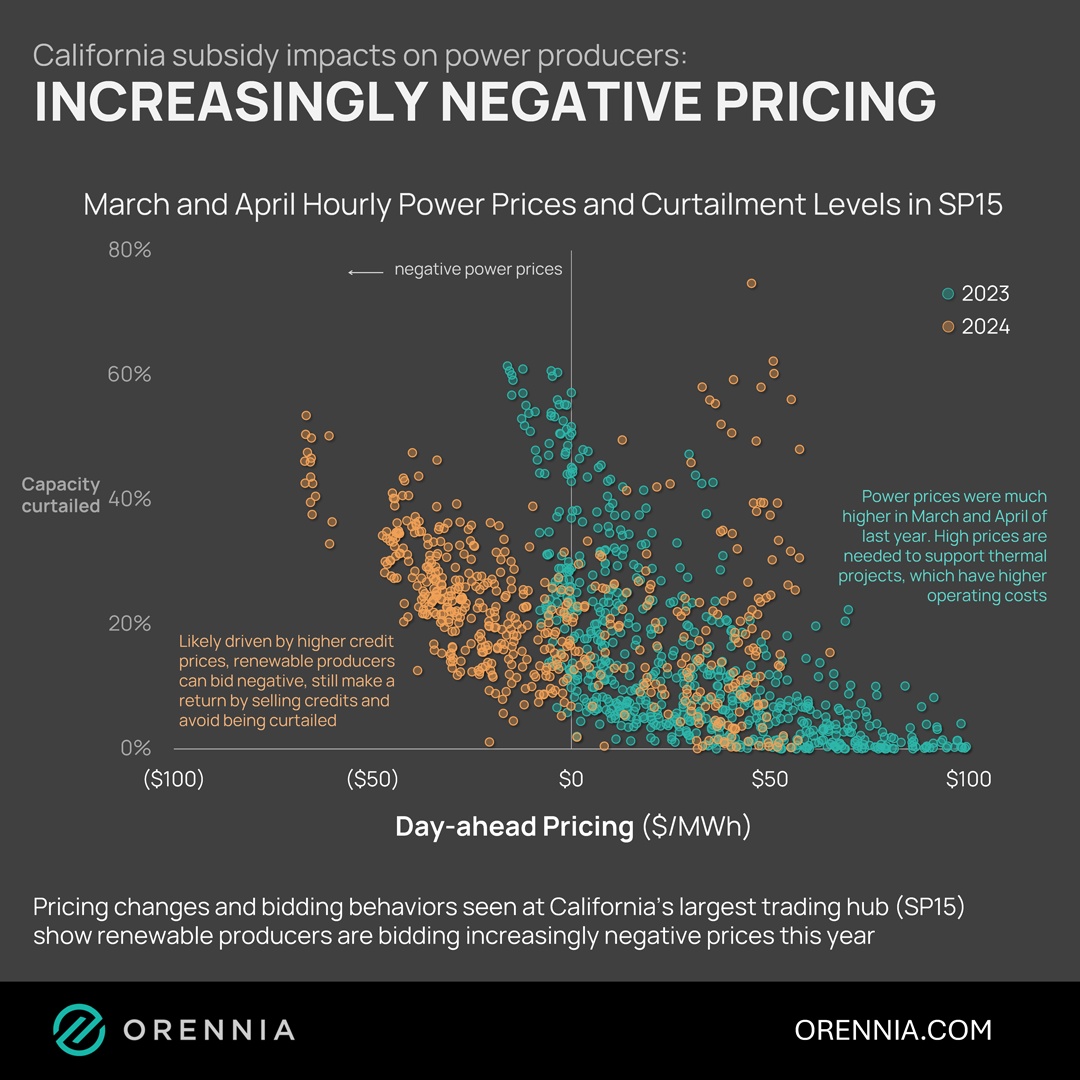

The growth of negative pricing between March and April of last year compared to this year is remarkable, and likely indicates elevated REC prices.

The impact: Producers that cannot easily reduce output but still have high operating costs (like thermal plants) are forced to accept periods of negative prices. As it relates to setting up a functioning power market for when incentives eventually roll off, persistent negative pricing may send the wrong signals to investors.

Despite the ramp up of cheap renewables and negative pricing events, California residential power prices have gone up much faster than the national average.

Data-driven insights delivered to your inbox.