Aaron Foyer

Director, Research

To provide relief for being collateral damage, the White House is considering a bailout for soybean farmers

Aaron Foyer

Director, Research

Earlier this week, China released last month’s customs data and there was something missing: a complete lack of American soybeans, the first time in seven years that no golden beans were imported from US farms in September.

This has nothing to do with American farms as soybeans farmers have been absolutely knocking it out of the park. According to the US Department of Agriculture, the yield per acre of the current crop of soybeans in the US is the highest on record. Instead, China’s lack of imports has everything to do with the latest geopolitical bun fight between Beijing and Washington.

Trade war collateral: When the new administration took office and launched an aggressive barrage of tariffs, it strained an already fragile relationship with China. In the spring, as it became clear by the post-Liberation Day collapse of the stock market that tariffs were not a long-term solution, Washington and Beijing negotiated a trade truce.

Texas farmer planting soybean seeds // rawpixel

The cessation of hostilities was already on loose footing after China extended some anti-dumping duties to America and its allies in August and then froze access to Nvidia chips for Chinese companies. And at the same time, the US implemented its “Affiliates Rules,” extending Washington’s tech control to subsidiaries of Chinese companies.

But the dam broke earlier this month when Beijing ramped up its control over rare earth exports hitting the supply chains of key military technologies that rely on powerful rare-earth magnets made almost exclusively in China. Within hours, President Donald Trump threatened to both hit Chinese imports with an additional 100% tariff and to cancel a upcoming meeting with President Xi Jinping in Seoul.

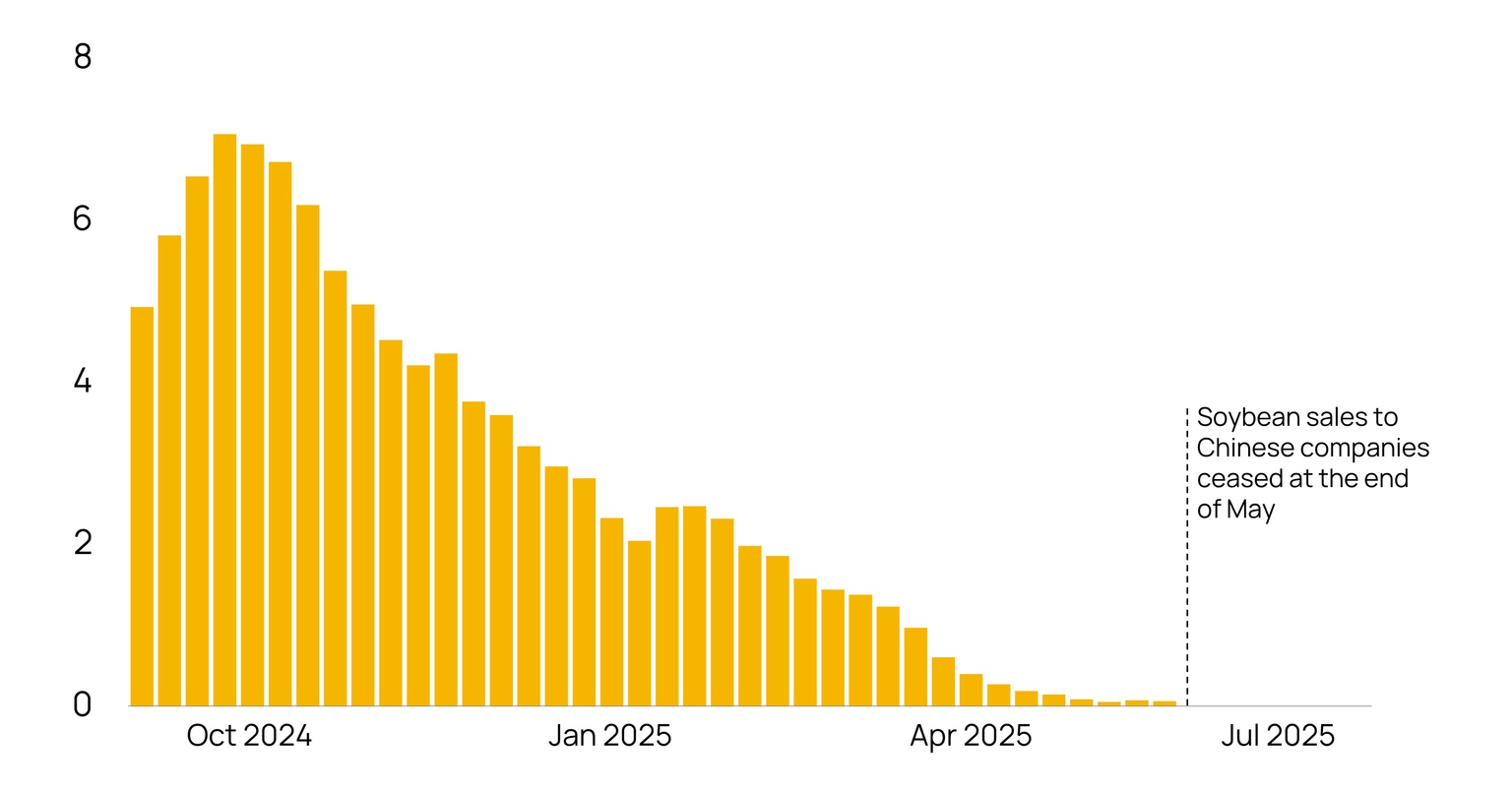

As a result of the rapid escalation from the White House, China stopped buying soybeans from the US, full stop, with importers placing their orders with South American producers instead.

Soybean relief fund: To provide relief for being collateral damage from the trade war, the White House is considering a $10 to $14 billion bailout for soybean farmers. This is a near perfect repeat of the first Trump administration, which had to send an economic rescue package to farms that were hit when it first imposed tariffs on China back in 2018.

Luckily, the pain is expected to be short lived, at least according to the president. “We’re going to take some of that tariff money that we made, we’re going to give it to our farmers who are, for a little while, going to be hurt until it kicks in, the tariffs kick in to their benefit,” Trump said in September.

So, is this just a bump on the White House’s golden paved road to American farming greatness, or are farmers facing a more existential threat here? Let’s roll up our sleeves and find out.

For city slickers, soybeans may not instantly register as being one of the most important crops in North America. But those beans offer far more than just another alt-milk for your Monday morning matcha latte.

On the energy front, soybeans play a critical role for biofuels and in the food supply. Most beans that stay in the US get turned into some sort of renewable fuel, mostly biodiesel, an alternative to diesel that reduces fuel emissions by 72%, and renewable diesel, a chemically identical low-carbon alternative to diesel. From there, soymeal, the residue left after oil is extracted from the bean, is used as a key source of energy and protein for livestock — fuel for heifers.

Between biofuels, animal feed and exports, soybeans are a top economic crop in the US.

Source: US Department of Agriculture

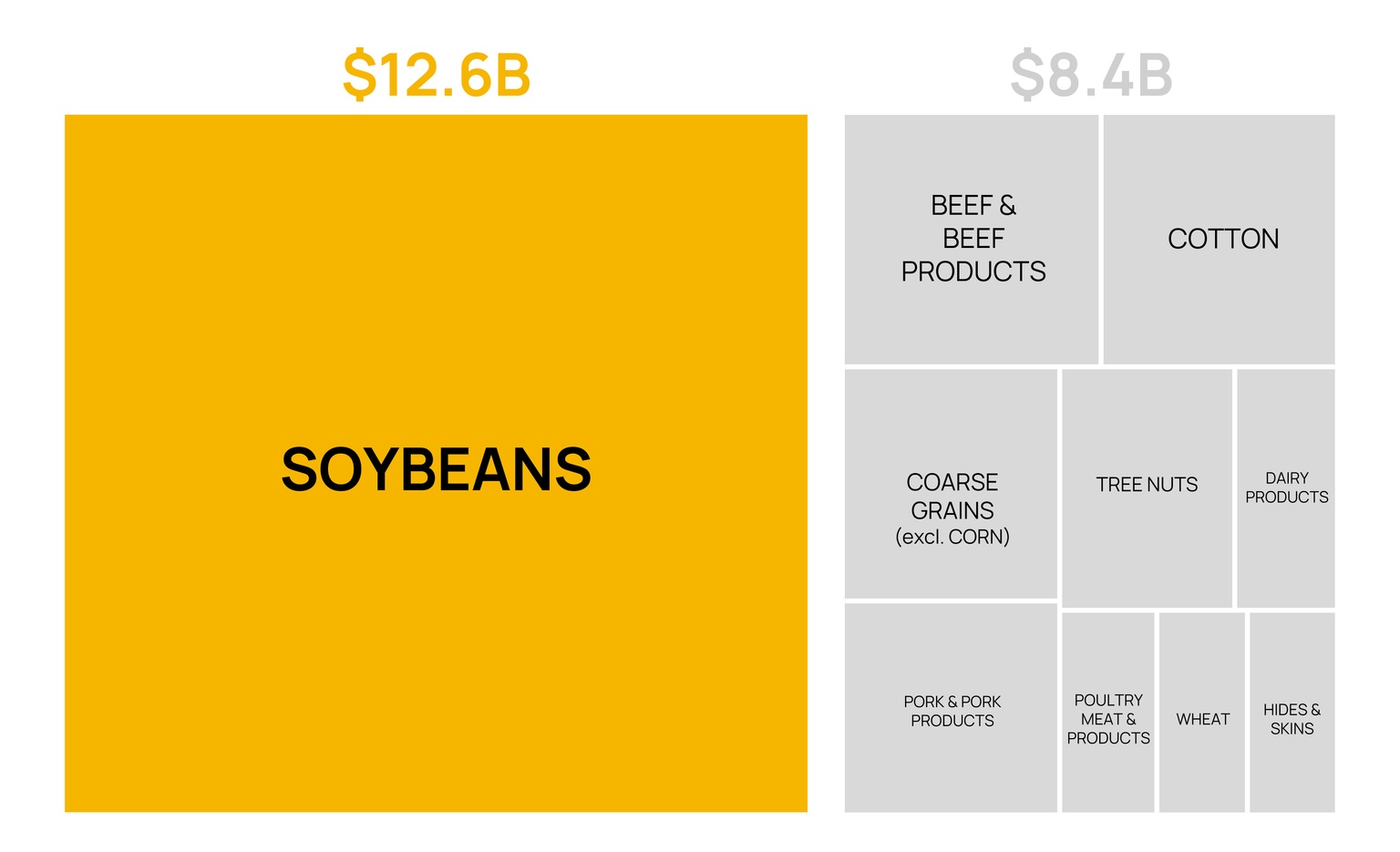

By acre, soybeans are the second-largest crop planted by American farmers, behind only corn. Last year, soybean farms across the US took in $47 billion, a quarter of all cash crop receipts in the country. And with most corn being used domestically, the golden bean routinely ranks as the No. 1 or No. 2 agricultural export from the US by value. The American economy sold 52 million tonnes of soybeans abroad last year, valued at $25 billion.

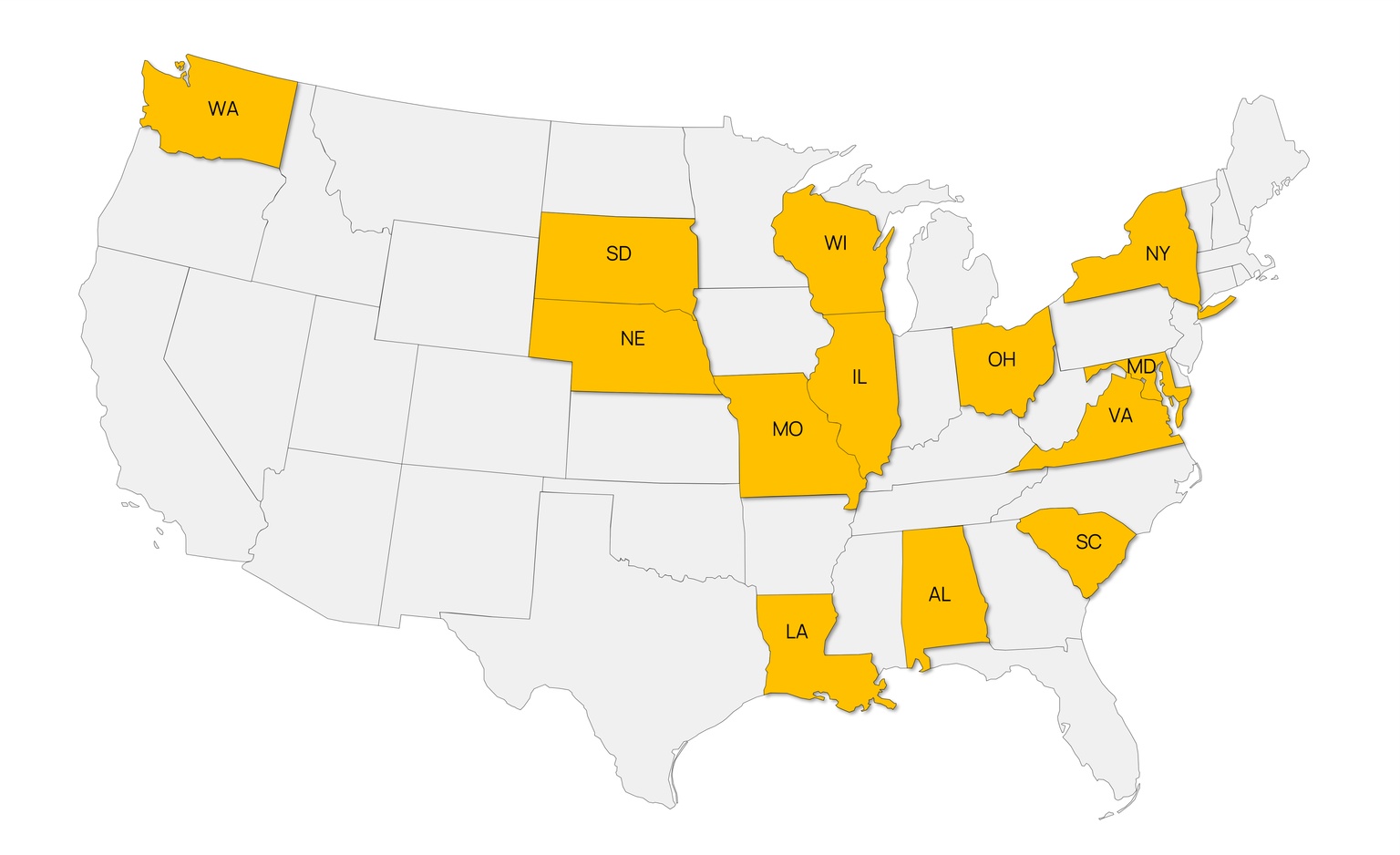

Since soybeans matter to farmers, and farmers matter to Republicans, soybeans matter to Republicans. Trump received 70% to 90% of the vote share in most farming-dependent counties in states like Nebraska, South Dakota, Missouri and Illinois, where soybeans were the top exported bulk commodity last year.

And of all the foreign buyers of American soybeans, the most important by far is…

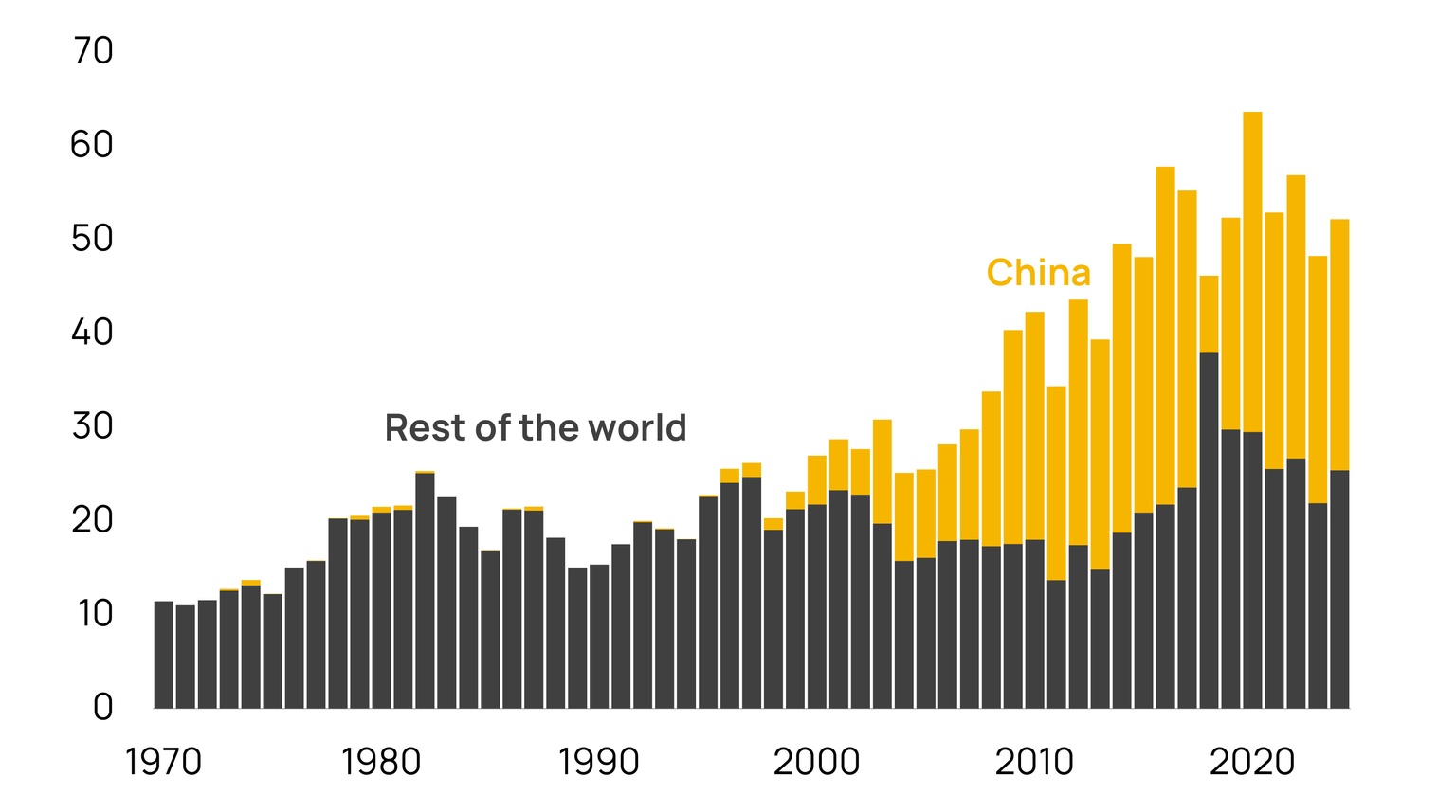

China: In the early 2000s, as China’s industrialization started to take hold, the country began importing an ever-growing volume of soybeans from the US, mostly to support its vast pork and poultry industries. Last year, the US exported nearly 27 million tonnes of soybeans to China, selling for $12.6 billion.

Source: US Department of Agriculture

But the US isn’t China’s only supplier. More than 70% of the country’s imported soybeans come from Brazil, 21% from the US and the rest from a handful of other nations. And unfortunately for the current administration in Washington, Beijing has figured out that it can find other sellers, but the US struggles to find other buyers.

In 2018, Trump announced several rounds of tariffs against China over what he saw as unfair trade practices. China hit back with retaliatory tariffs on almost every American agricultural export, leading to half of all US ag exports to be dropped and $27.2 billion of lost income for farmers, far outweighing the $15 billion in tariff revenue collected. Soybeans, corn and wheat were the hardest hit, with exports falling 77%, 61% and 88% respectively through 2018 and 2019.

In response, like the bailout being considered by the Trump administration today, the US government provided farmers with funding support, sending $28 billion in direct payments to farms affected. The farmers lived to harvest another day and there were several important lessons learned on the strengths and vulnerabilities of American farms.

Source: US Department of Agriculture

In its favor, the US fundamentally has excellent soil quality, high crop yields and a culture of innovation that will benefit the sector over the long term.

But the actions from China also tipped the hand of the administration, highlighting a few key crops that are economically and politically vulnerable. The soybean industry, in particular, was found to be a sensitive spot.

The second act of the US–China trade conflict began with familiar choreography: tariff volleys, tit-for-tat restrictions, and one very immediate casualty, soybeans.

After the Liberation Day tariff package imposed sweeping new duties on Chinese imports, Beijing responded by freezing agricultural purchases, effectively slamming the door on the most important foreign buyer of American soy. For the first time in years, American soybean exporters were shut out of the Chinese market entirely.

This has been one of the most poorly managed trade wars in recent memory and Midwestern soybean farmers have many reasons to be frustrated.

Vanished market: Exports to China accounted for a quarter of all soybean production in the US prior to the trade war. That demand is gone and is likely never coming back.

The American Farm Bureau Federation, representing two million farms across the country, asked the US government for policies that support its farmers’ exports and to avoid tariffs that hurt agricultural competitiveness in global markets. Instead, tariffs were applied that drove the largest buyer of soybeans away to seek more reliable trade partners, with crushers turning to Brazil and Argentina to fill the gap.

Source: US Department of Agriculture

With a stable supply secured, it’s unlikely China returns at any scale to American markets looking for soybeans.

Speaking of bailouts and Argentina: Farms in the South American nation have been some of the largest beneficiaries of the trade war. Just as China weaned off US soybeans, the government in Buenos Aires under Javier Milei announced it was scrapping its grain export tax in an effort to attract Chinese traders to buy Argentine soybeans, filling the American gap.

A few weeks later, despite that economic alley-oop from the White House, the Trump administration announced it was using $20 billion of taxpayer dollars to further bail out the Argentine economy. For those keeping track, that’s roughly double what’s being considering for American farmers. And now there’s talks of doubling the bailout for Argentina to $40 billion. (But only if the right party wins the next election. Apparently, the Argentine people are only worthwhile if their leadership is.)

The irony of the bailout was highlighted by an apparent text message sent by US Agriculture Secretary Brooke Rollins to Treasury Secretary Scott Bessent saying, “We bailed out Argentina yesterday (Bessent) and in return, the Argentine’s removed their export tariffs on grains, reducing their price, and sold a bunch of soybeans to China, at a time when we would normally be selling to China. Soy prices dropping further because of it. This gives China more leverage on us.”

Well put, Secretary.

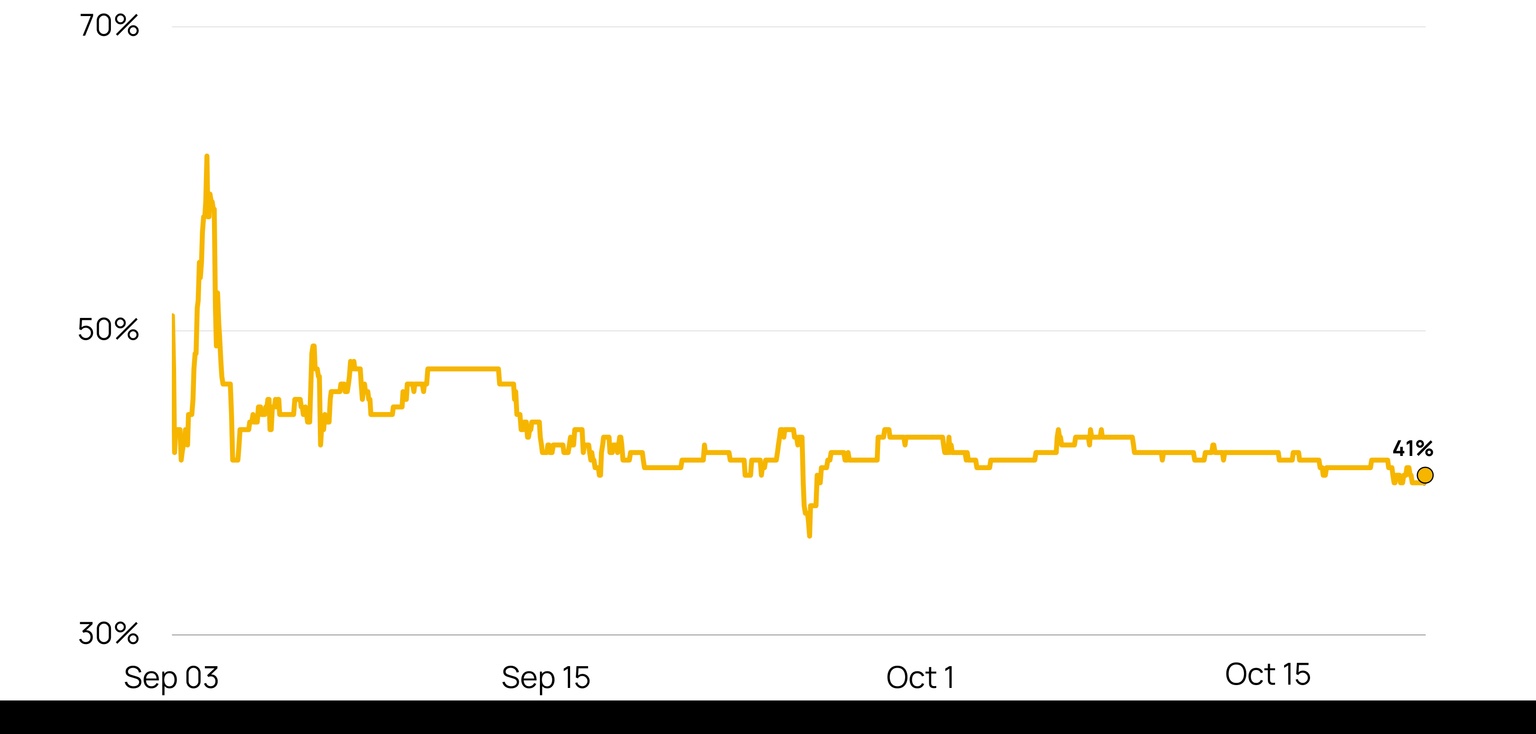

Source: Polymarket

There is, though, one small group likely benefitting handsomely from the trade war.

Insider grift: If soybean farmers are a little upset over losing a quarter of their market over a trade dispute, and many of them are, then no one talk about the insiders getting wealthy off American tariff threats.

Earlier this month, a crypto wallet under the name of Hyperliquid appeared, then placed several short-position bets against the value of Bitcoin and Ethereum moments before Trump announced new tariffs targeting China. The last short trade by the crypto whale was placed literally seconds before the new levies were unveiled and ultimately netted the anonymous trader(s) $150 million in profit. What incredible luck.

The famed crypto investigator Coffeezilla found US presidential aides Zach Whitkoff and Chase Guerro along with Eric Trump were all likely involved.

The US took in an estimated $31 billion of tariff income in September alone. There’s a pretty good argument to be made that the best use of tariff income is exactly to support the industries that are being hurt by trade policies as a new economic system sets in.

Stephen Miran, who now serves as the chair of the White House’s Council of Economic Advisors, released an influential paper last year articulating how the US government could use tariffs to improve the competitiveness of American products by devaluing the dollar, which is happening. Helping to bridge industries during a painful transition might be exactly what’s needed to get there.

But this is not that. The tariffs are paid by American importers and increasingly being passed along to consumers via higher prices. The aggressive trade policies are turning a key foreign buyer off one of the country’s most important and valuable crops forever and then using taxpayer money for bailouts.

And just as the Chinese demand for American soybeans was going away, the International Maritime Organization was on the verge of swooping in to provide a large new source of demand for farmers to sell into with its Net Zero Framework. But the White House orchestrated the end to that last week, too.

Scott Gallaway from The Prog G Pod put it best:

“This is a case study on why tariffs don’t work. They raise prices for consumers, they prop up industries that are not competitive, they increase taxes and increase debt, and lead to a reduction in prosperity for Americans. This is socialism, meets oligarchy, meets poor economic policy. The government set the house on fire and now want they want to charge the taxpayers to put out the fire.”

Data-driven insights delivered to your inbox.