Aaron Foyer

Director, Research

Aaron Foyer

Director, Research

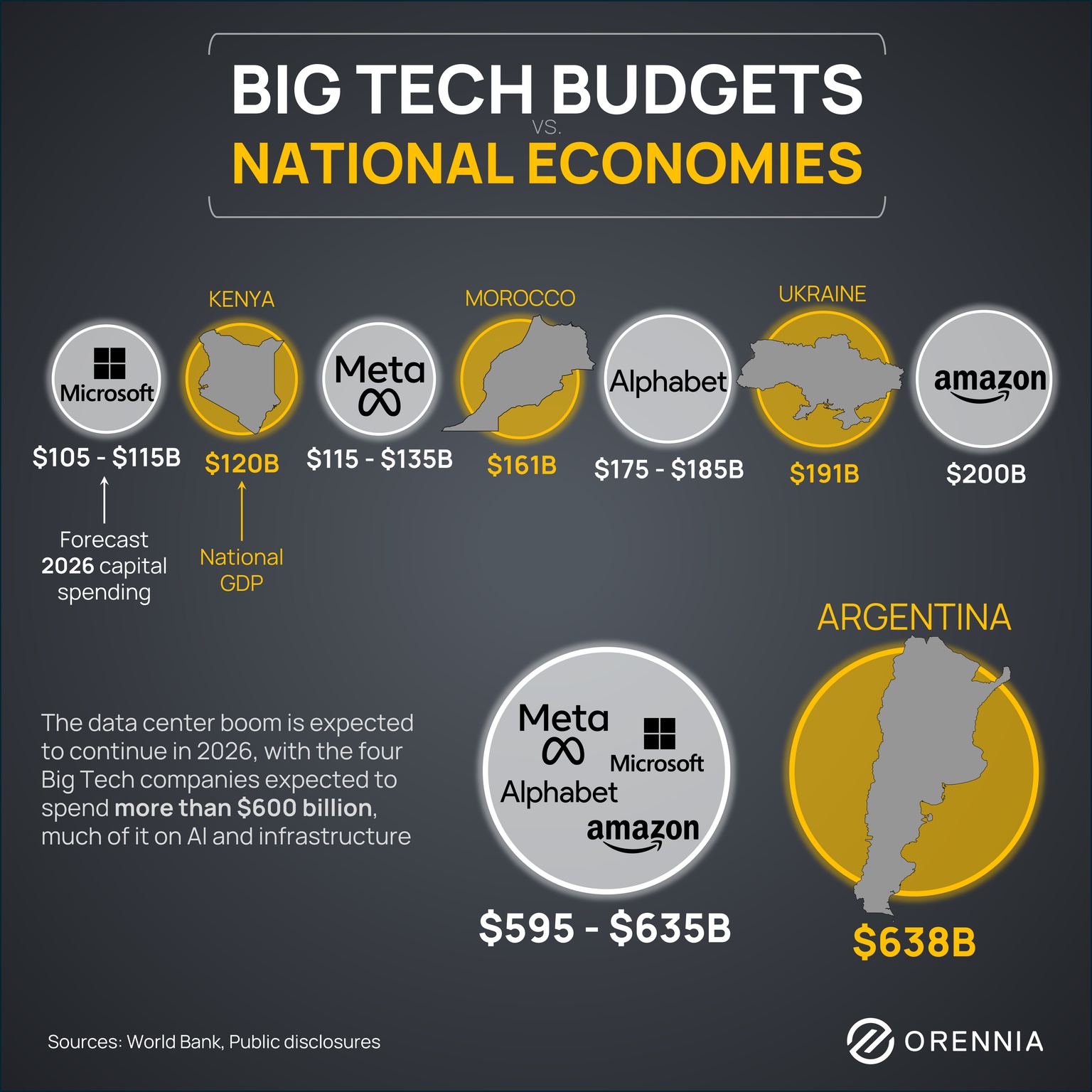

The four hyperscalers have just announced their spending plans for 2026, and they now rival the economies of mid-sized countries around the world.

Microsoft is preparing one of the largest capex budgets in its history, with analysts pegging its 2026 capital expenditures north of $105–$115 billion, driven largely by AI data center construction and cloud infrastructure. Despite strong cloud revenue, heavy spending has sparked investor scrutiny about cost versus near-term returns.

Meta is slated to sharply increase its infrastructure spending in 2026, with forecasts as high as $135 billion, focused on AI training clusters and expansive data center footprints. This ramp-up comes as investor debate whether AI investments will translate into profit expansion.

Alphabet is targeting up to $185 billion in capital expenditures in 2026, a near doubling from prior years, as it scales cloud services, AI models like Gemini and customized chip and data center capacity. Earlier this week, the company announced it was issuing 100-year bonds to help fund the buildout.

Amazon has announced a massive $200 billion capex plan for 2026, up sharply from 2025, earmarked for AWS data centers, AI and robotics capabilities as well as custom silicon and satellite connectivity. The company doesn’t break out its spending on AWS from its delivery and logistics business.

Should the four companies hit their spending targets, they could spend between $595 and $635 billion this year, largely on data centers. For context, that would approach entire output of Argentina’s economy.

Data-driven insights delivered to your inbox.