Aaron Foyer

Director, Research

Are we on the verge of a turbine renaissance in North America?

Aaron Foyer

Director, Research

It’s a sign of extraordinary times when companies are looking to jet engines from old aircraft for new sources of power, but we are in extraordinary times.

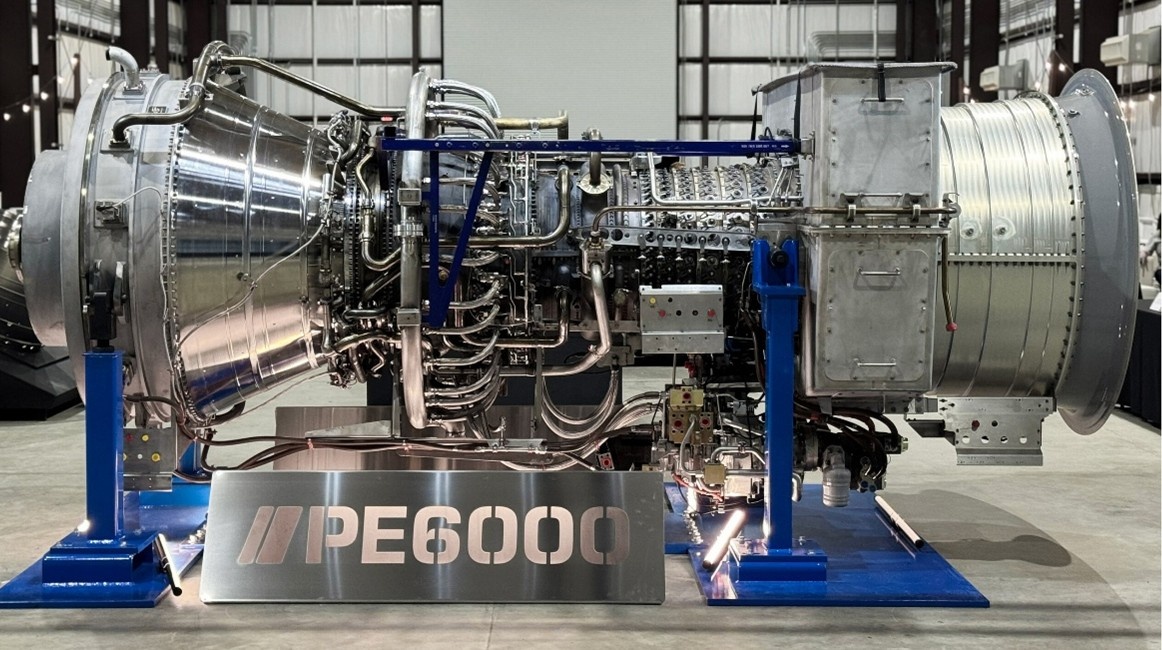

Last month, it was revealed that American energy solutions provider ProEnergy has been retrofitting and repurposing used jet engines from military and commercial planes — turning them into mini gas power plants for data centers. Each CF6-80C2 jet engine needs significant upgrades to make the jump — jets are designed for thrust, whereas gas turbines make shaft power. But engineers are clever, and the ones at ProEnergy can turn old thrusters into 48-megawatt power plants.

The company has reportedly sold 21 of these adapted turbines to two separate data center projects, amounting to over a gigawatt of new power generation. That’s equivalent to a large nuclear reactor, a bridge until more permanent supply becomes available.

ProEnergy’s retrofitted jet engine // ProEnergy

It's not just jet engines that are getting attention these days. Anything that can burn and turn to create electricity — coal, gas and nuclear — is being re-evaluated or reinvigorated to help meet the looming load growth for data centers.

So, are we on the verge of a turbine renaissance in North America? Let’s fire up and find out.

Tell us if you’ve heard this one before: data centers are driving rapid new load growth across North America.

To put some numbers behind that, we’ve seen 115 gigawatts of new data center projects announced in the US this year alone, three times the sum of all data centers currently operating in the country. And there’s more in the wings that have yet to be announced. The queue for large loads to connect to the Texas grid alone stands at 180 gigawatts.

NextEra chief executive John Ketchum put the rapid pace of new power demand, including trends like electrification and electric vehicles, in context on an earnings call earlier this year. “For perspective, we expect more than 450 gigawatts of cumulative demand for new generation between now and 2030 in the United States… Frankly, it's unlike anything we've ever seen since the end of World War II,” Ketchum said.

Our base forecast at Orennia sees more than 100 gigawatts of new data center capacity coming online by 2035. At that point, one out of every five electrons generated in America will be used to power a data center. Meeting that demand with sufficient supply is the challenge.

There are few multi-gigawatt power supply opportunities available across the technology stack over the next few years. But they do exist, and include delaying the retirement of coal plants, the large-scale deployment of renewables, building new natural gas power and nuclear.

Coal: It’s unlikely that a coal-fired power plant will ever be built in the US again, but that doesn’t mean existing ones can’t be put to good use. There are 49 gigawatts of operating coal plants set to retire between now and the end of 2028. With demand for electricity across the US growing at the fastest rate in 80 years, and especially with an administration that sees the race for artificial intelligence as existential (and renewables as an existential threat), there’s a strong appetite to keep these plants running for a few more years, though environmental groups aren’t thrilled.

On the more conventional approaches to doing so, the Department of Energy under Secretary Chris Wright announced $625 million of investment support to help revive the coal industry, more than half of that going toward recommissioning or retrofitting older power plants. That came paired with some laxer regulations from the US Environmental Protection Agency.

Source: Macrotrends

As for less conventional, more heavy-handed approaches, the DOE has taken its cue from the White House and invoked its own emergency powers under Section 202c of the Federal Power Act to force retiring coal plants to stay online. This was designed for responding to short-term crises, but the DOE under Wright has taken a different view of those powers and is using them to delay coal retirements.

Renewables: If a grand shortage of electrons on the horizon represents an existential threat to America’s technological dominance, the obvious sources to help fill the void would be the those that have contributed the majority of recent new additions to the grid.

Wind and solar, plus their great enabler, batteries, have accounted for 83% of new capacity that has come online in the US since the start of 2020. As an added benefit, states that have increased the share of wind and solar on their grids over the past decade have generally seen slower growth in electricity prices for their consumers.

But with the One Big Beautiful Bill Act accelerating the wind down of tax credits for wind and solar, there is an expected slowdown coming in their build-out. And since batteries have increasingly been making their returns on the daily price fluctuations driven by the volatility of renewables, the wind and solar slowdown will also impact storage. Overall, Orennia expects roughly 20% less wind, solar and battery storage to be built over the rest of the decade because of the bill.

And look, there are plenty of good arguments to be made that tax credits on wind and solar should be wound down. These are mature technologies whose prices have plateaued and arguably don’t need tax breaks to justify investment. Proponents have been championing for years that they’re the cheapest source of power available, so it’s hard to then turn around, stick your hat out and argue government subsidies are needed for the industry to survive. Subsidies have also warped power markets, seen most acutely by the emergence of negative bidding strategies by projects receiving tax credits. Removing them will lead to healthier overall market dynamics in the power space.

But the timing isn’t ideal. The US faces a shortage of electrons over the rest of the decade, so why hamper the sources that have delivered more than four-fifths of new capacity to the grid over the last five years? Consumers are also increasingly fraught with higher power bills, something that may have single-handedly returned Donald Trump back into the White House and something he explicitly promised to halve if he was brought back. Then why cut the subsidies that help lower prices? Overall, our latest power price forecasts now project much higher power costs across the US because of the OBBBA at the same time demand is exploding from data centers. In Texas, the North American leader for building out renewables and batteries, we see power prices being 40% higher over the coming 25 years than we did in the Inflation Reduction Act era. There is some irony that the IRA, an act which had almost nothing to do with inflation, will almost certainly cause it through its removal.

But while the OBBBA is not likely great for consumers or data centers, it’s created clear winners.

Natural gas: Higher electricity prices will be a boon for gas power developers.

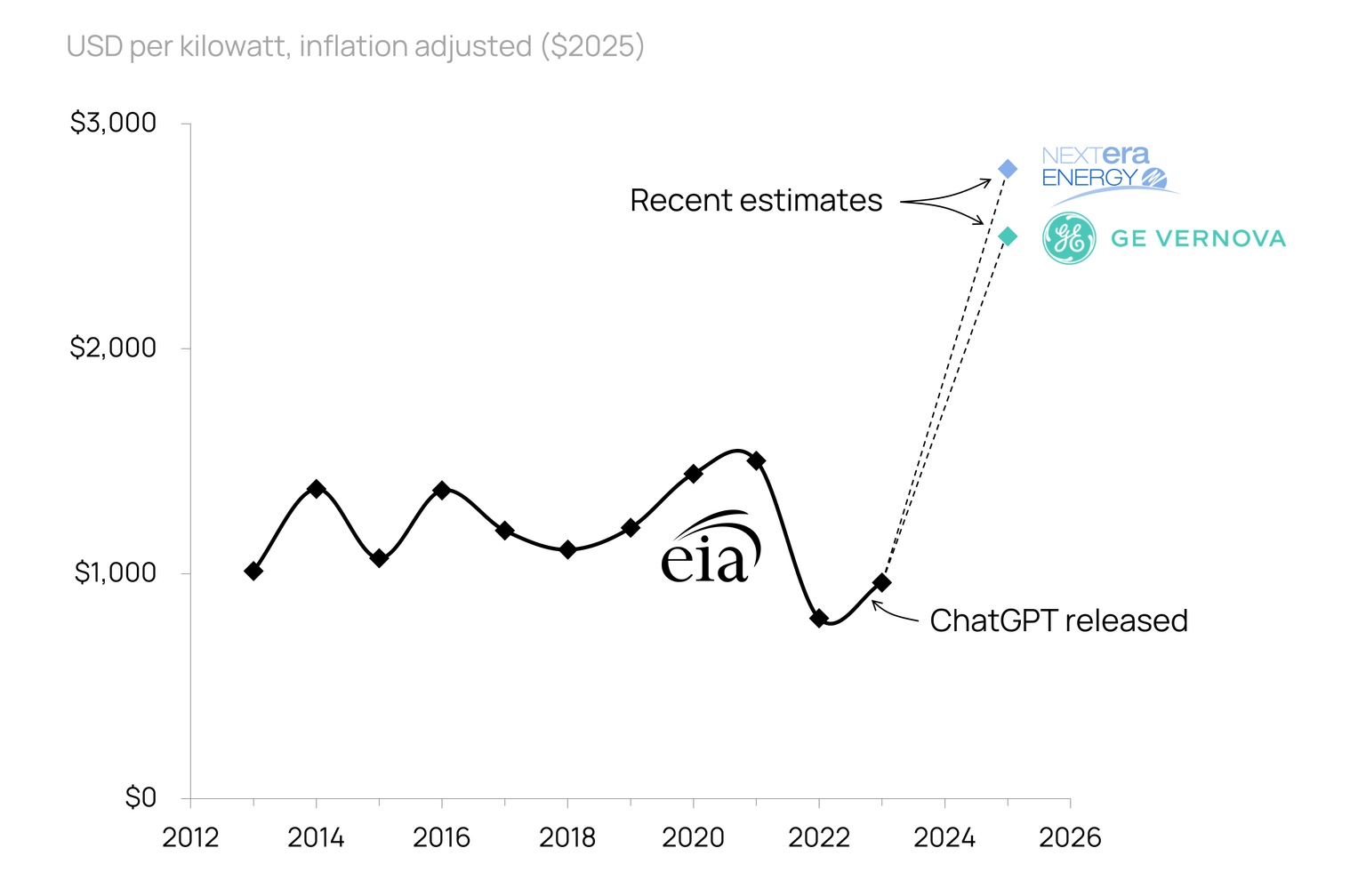

In its latest earnings call, power equipment maker GE Vernova highlighted that new gas turbines are now selling for $2,500 per kilowatt, three times their price just a couple of years ago. Paired with the lower electricity prices from the Inflation Reduction Act, this meant new gas projects would have struggled to pencil economically in markets like Texas, where power plants are rewarded only for the electricity they sell.

Estimates: The US Energy Information Administration, NextEra, GE Vernova

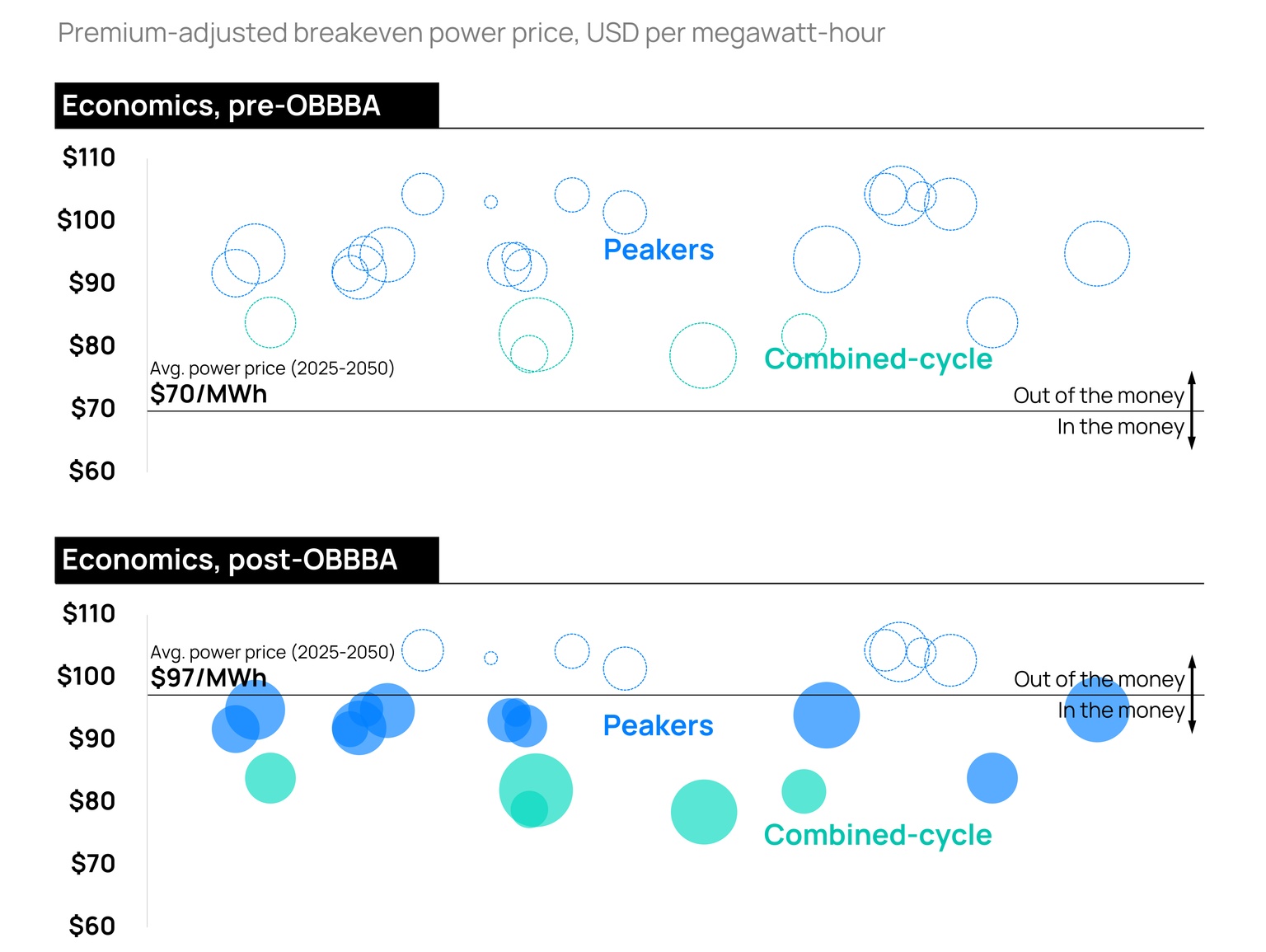

But in a Big Beautiful Bill world of higher power prices, gas projects that were previously out of the money are now in. Our forecasts had average power prices in Texas from now until 2050, averaging $70 per megawatt-hour, far lower than what would be needed to support a new gas plant. But following the OBBBA, we now expect them closer to $97, enough to justify many of the power plants.

But it’s tough to get your hands on a new gas turbine these days. GE Vernova CEO Scott Strazik reaffirmed the five-year delay for new turbine orders with no plans to expand the company’s manufacturing capacity. This has led developers to seek out novel (read: desperate) approaches to building gas power.

Source: Orennia analysis

Bloom Energy, a provider of solid oxide fuel cells that can turn gas into hydrogen and then electricity, has seen gigawatts’ worth of new orders over the past year, despite costing nearly double the already inflated per-kilowatt cost of modern turbines. There are also microturbines, like those made by Capstone Green Energy, which are being used. And of course, the repurposing of used jet engines.

And nuclear: The Big Tech companies still appear to be dedicated to using clean electricity to power their data centers. This endeavor was made more complicated last month after the GHG Protocol, which sets the carbon emissions accounting rules for the tech giants, released updated rules that require hourly matching. In other words, when Google or Amazon claim to use clean power for their data centers to lower their reported emissions, the electricity must be generated at the same time it’s used, something the previous rules were more flexible on.

Nuclear, a clean power source that operates around the clock, is a clear beneficiary of that rule.

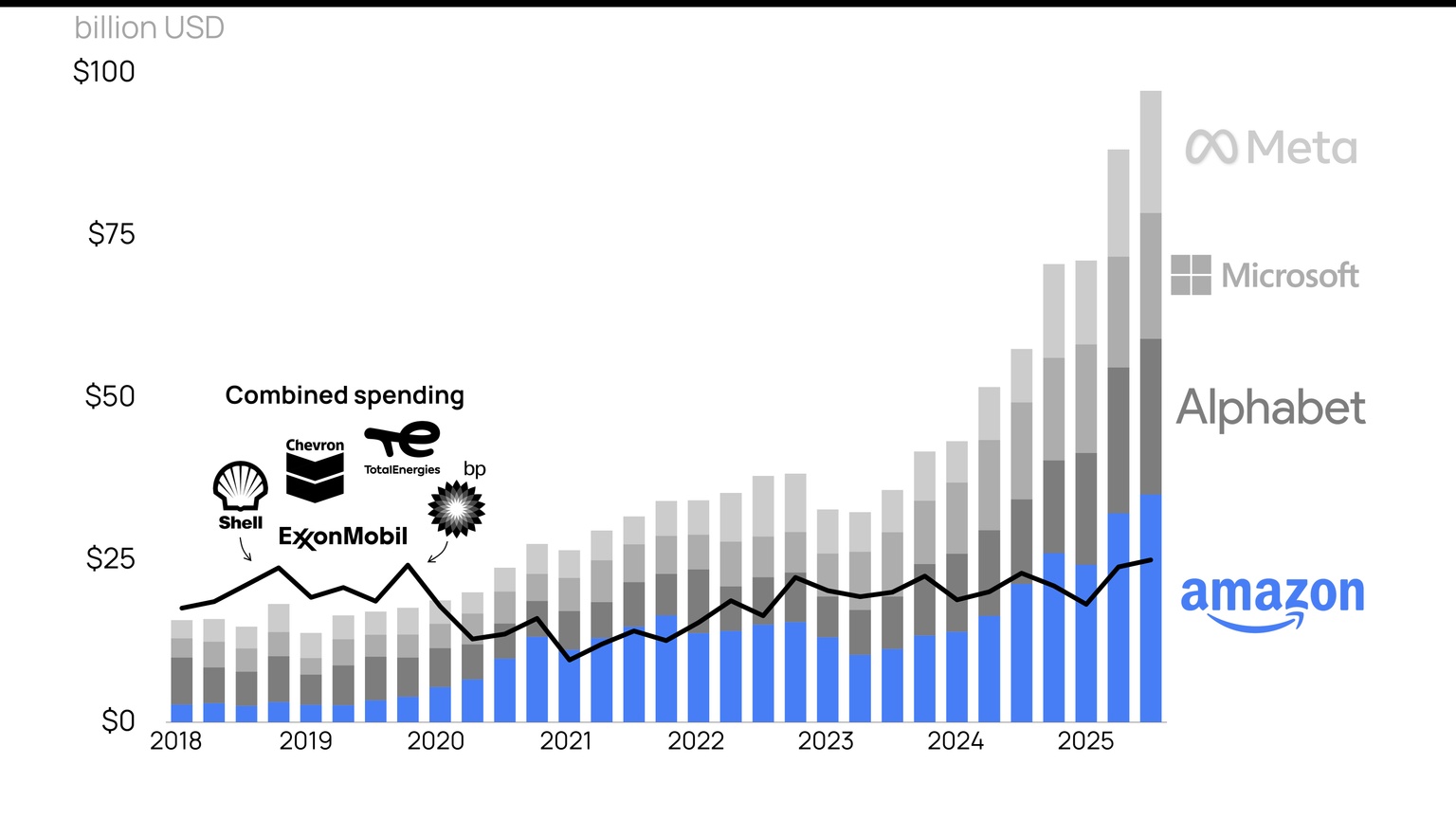

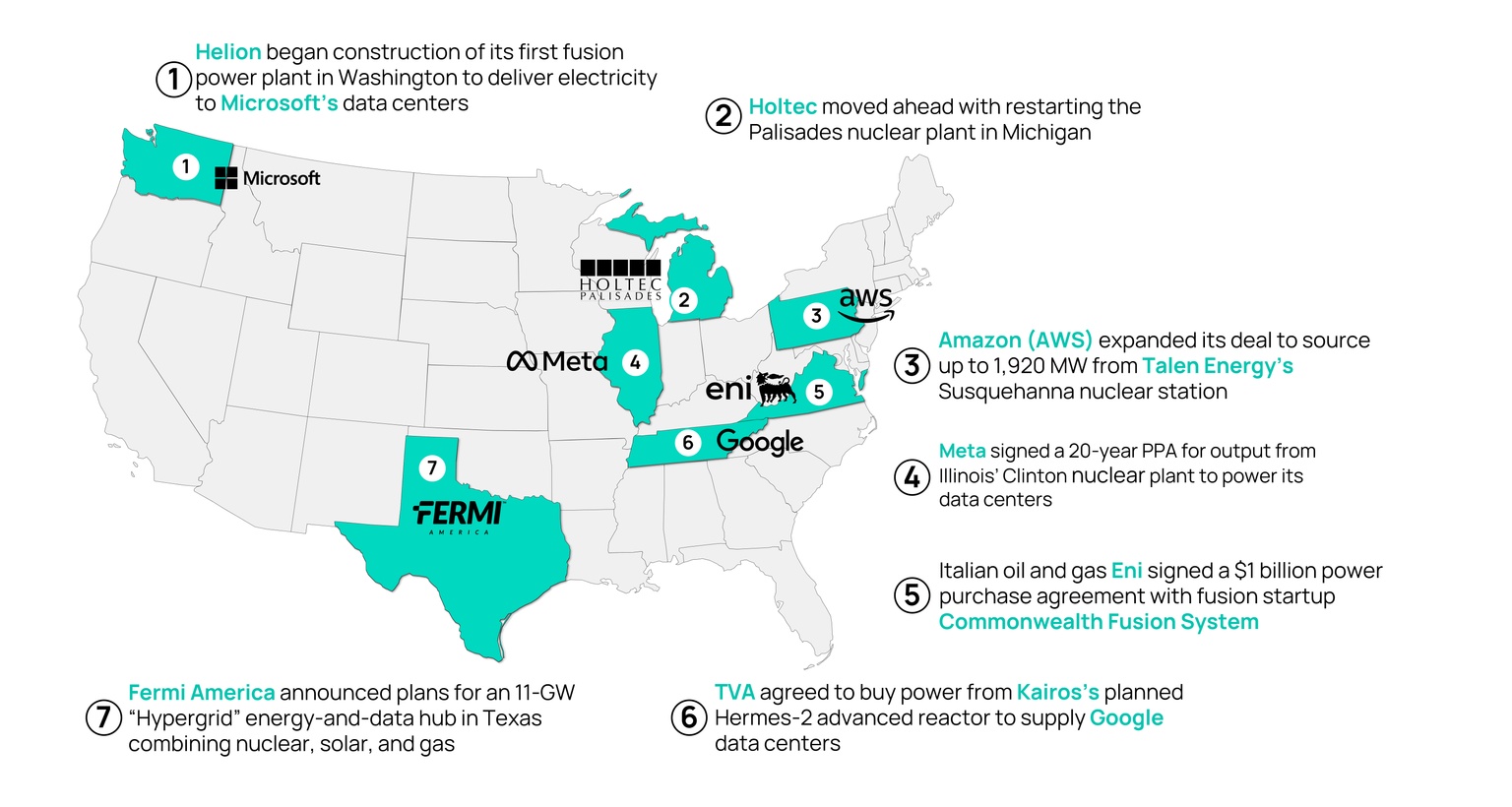

Source: Public disclosures

So far this year, we’ve seen everything from refurbishing old nuclear facilities to breaking ground on the first commercial fusion plant. The list of announcements is long, but all you need to know is that the average stock price of nine nuclear-focused stocks we follow has risen by an average of 156% this year while the S&P 500 has gained just 15%.

Nuclear is the hot flavor of 2025.

The Trump administration got elected on a promise to halve energy prices for consumers, but the Big Beautiful Bill is likely to do the exact opposite. Luckily for owners and developers of thermal power plants, higher prices are good for business.

For years, the broader energy narrative has been that gas plants will act as a bridge to renewables, but these days it seems more like renewables are bridging for gas. Some of the largest acquisitions of the past year have been companies buying up thermal power, including the giant $26-billion deal for Constellation to acquire Calpine.

Bottom line: AI and data centers continue to be the main economic driver in North America, and behind every AI breakthrough is a jet engine in disguise.

Data-driven insights delivered to your inbox.