Aaron Foyer

Vice President, Research and Analytics

Why is there so much hype around this energy storage company?

Aaron Foyer

Vice President, Research and Analytics

Some of the most prominent American entrepreneurs of the early 20th century started their careers in Thomas Edison’s workshops, the Gilded Age’s version of the PayPal Mafia.

The Edison Mafia included the likes of Frank J. Sprague, who developed the commercial electric motor and the first successful electric streetcar system, and prominent utility magnate Samuel Insull, whose companies at one point served 4 million customers across 32 states. The most famous of his disciples was Nikola Tesla, who went on to have a rivalry in electric innovation with Edison, captured brilliantly in the Adam Cline book The Current War. But there were others.

It usually takes a true Edison nerd to know that Henry Ford started his illustrious career working at the Detroit Edison Illuminating Company. When the two eventually met, the young Ford showed Edison his designs for a gasoline-powered automobile, something Edison encouraged Ford to pursue. Ford went on to found the Ford Motor Company in 1903, pioneering automobile development, making cars affordable for middle-class Americans to own and popularizing the assembly line. He was even an early champion of the five-day workweek.

In early 1914, The Wall Street Journal began to report that Edison and Ford were working together on an electric vehicle. The car would be powered by a remarkable iron-nickel battery, something Edison had already used for his own prototype electric car, which traveled at twice the speed of gasoline-powered vehicles.

An early electric vehicle using Edison’s iron-nickel battery // picryl

Henry Ford hinted that chemistry was an all-important factor in battery performance.

“The problem so far has been to build a storage battery of light weight which would operate for long distances without recharging. Mr. Edison has been experimenting with such a battery for some time,” Ford said.

But as engineers began appreciating the energy density and mobility of gasoline for automobiles, especially with the prevalence of Standard Oil and the American petroleum industry, electric vehicles fell by the wayside. Iron-nickel batteries lost favor to lead-acid batteries. And the Edison-Ford EV never got off the ground.

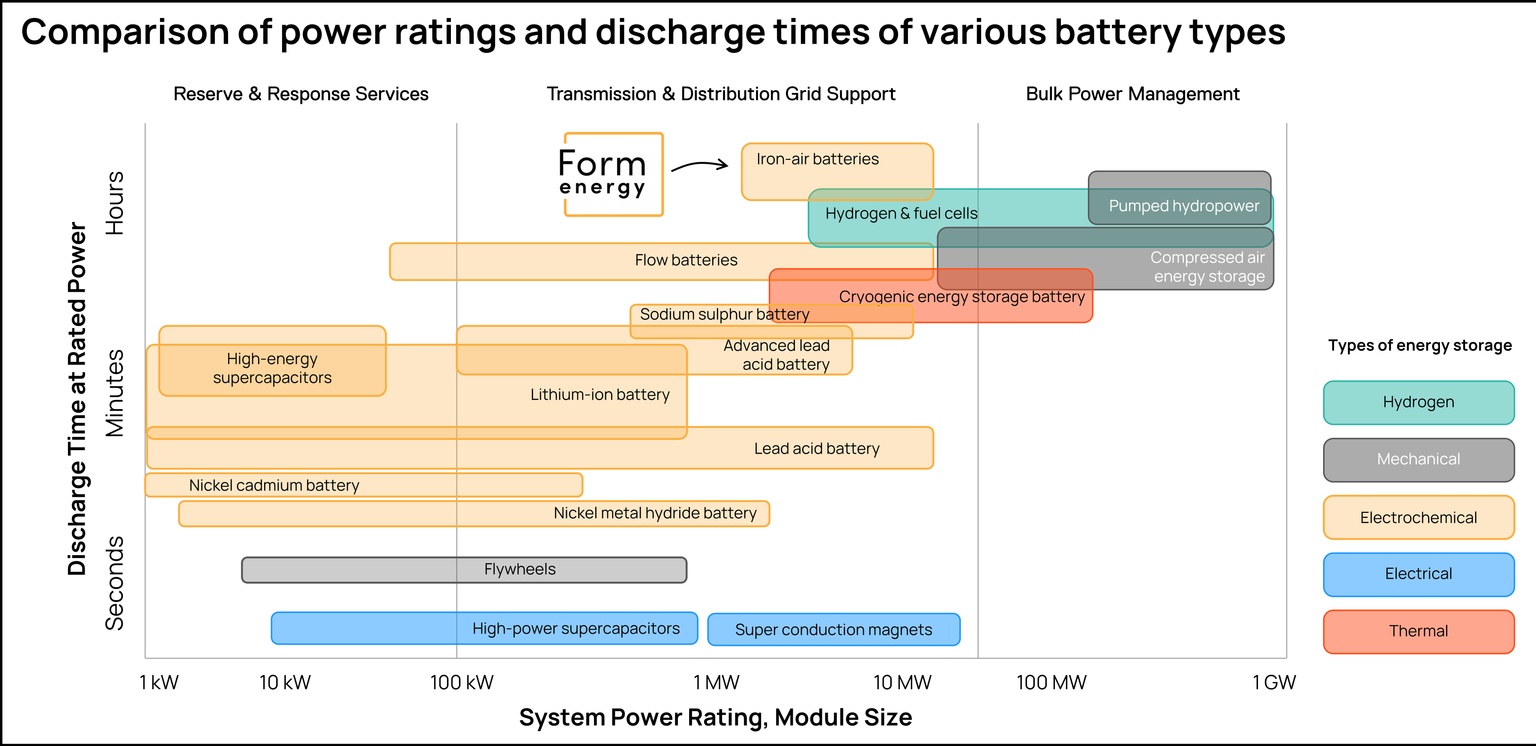

Fast forward: The battery of choice for modern electric vehicles addressed Ford’s concern. Lithium-ion batteries can now pack energy densely and somewhat affordably into electric vehicles: their costs have fallen by 99% while their energy density has increased by 5x over the past 30 years. But lithium batteries have their limits. While suitable for electric vehicles and short-term stationary storage, lithium isn’t the ideal metal for all types of batteries.

For long-duration energy storage (LDES) — holding onto energy for weeks or months at a time, then discharging continuously for days — lithium is too expensive to make economic sense. It’s a metal found in only a few places on Earth that’s difficult to mine and process, driving up its production cost.

This is leading venture capital and industrialists to look for alternatives, and there is no shortage of ideas to choose from.

One stands above the rest: Form Energy, a Massachusetts-based battery startup, has emerged as a funding and media darling. The company is cashing checks and turning necks like it’s Sabrina Carpenter, the reverse-rusting process of its iron-air battery seems like alchemy, and the company has been lining up some of the largest LDES projects across the US.

So, what about Form makes this Bill Gates-backed startup so compelling?

To start with, the company has an impressive founding team.

In 2017, Form was founded by several material science and engineering doctors, nuclear doctors and professors from MIT, alongside a former vice president of stationary energy storage at Tesla and the co-founder of the energy storage startup Aquion Energy. Together, they have more than 100 years of experience with batteries.

Early days: Developing batteries is both challenging and technical. One benefit of having a smart and technical founding team is being able to rule out ideas that are not likely to work, as Form CEO Mateo Jaramillo put it. “Because we’ve done the work looking at all the options in the electrochemical set, you can positively prove that almost all of them will not work,” Jaramillo said in an interview with GTM.

To build a battery that can affordably charge and discharge infrequently, the team recognized the need to use low-cost and abundant materials.

The team landed on developing an iron-air battery with a water-based electrolyte. It’s hard to think of cheaper materials than iron, air and water. Iron releases energy as it rusts, also known as an exothermic reaction. By harnessing this process, Form was able to create a battery.

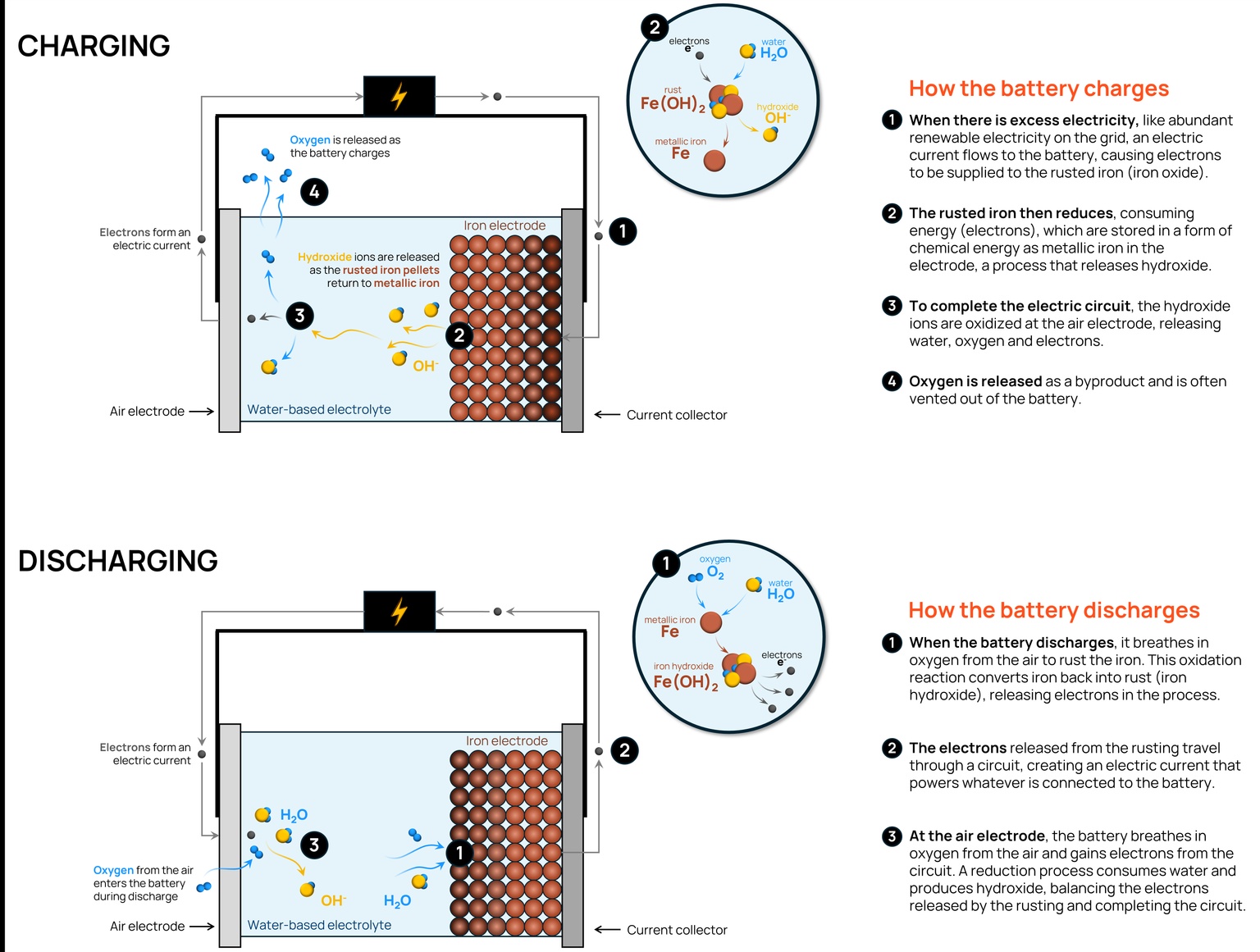

Reverse-rusting: The electrochemical battery is filled with thousands of tiny iron pellets. If the pellets are rusted, an electric current reverses the rusting and converts the electrons to chemical energy as iron metal. To produce electricity, the iron pellets are allowed to absorb oxygen, which rusts them and releases electrons, creating an electric current that can be harnessed.

Source: Orennia

The benefit of using a slower reaction process like reverse-rusting is that the discharge period lasts days. Form claims its battery can discharge for 100 hours — more than an order of magnitude longer than the traditional 4-hour lithium-based batteries.

A notable drawback of iron-air batteries is their lower efficiency compared to lithium-ion batteries. If you put 100 electrons into Form’s battery during charging, only 50 to 70 electrons come back when the battery is discharged. For a modern lithium-ion battery, it’s closer to 90.

By using cheaper materials, Form believes iron-air batteries can be produced at one-tenth the cost, more than offsetting their lower efficiency.

The company’s track record of raising money and building its large-scale production factory suggests investors are confident that the technology is sound. However, how LDES projects get paid is anything but.

It’s lithium’s world: The various strategies and incentives for energy storage projects in the US have been designed with lithium-based batteries in mind. While there are different revenue streams that batteries can earn, like regulating the frequency of the grid, many battery projects make their returns with energy arbitrage — buying electricity when it’s plentiful and cheap, then selling it back when it’s not, something that more efficient batteries like lithium-ion are much better at.

Source: Orennia, adapted from Rae, C., et al. to include iron-air batteries

For context, over the past three years in CAISO, California’s power market, batteries made nearly half their monthly revenues from buy-low/sell-high energy arbitrage. For LDES projects to be fully charged for when they’re needed most, they’ll need to be incentivized to hold their charge and wait.

Rust gathers where there’s no movement: Most power markets don’t have mechanisms designed to reward technologies for multi-day reliability backup from batteries like Form’s. In the recent State of Play from the Clean Energy States Alliance, the industry group highlighted there is little consensus on how LDES projects in the US should be compensated, used, or even defined. California is the only state to even have an LDES policy in place.

Outside of the US, some jurisdictions are developing mechanisms specifically for LDES. Just last month, the UK announced it was developing a cap-and-floor scheme designed to spur investment in LDES. The model would provide a base revenue for projects (the floor) while limiting their upside to reduce costs passed on to consumers (the cap).

Nonetheless, even without well-developed supportive policies in the US (California notwithstanding), Form Energy is finding success.

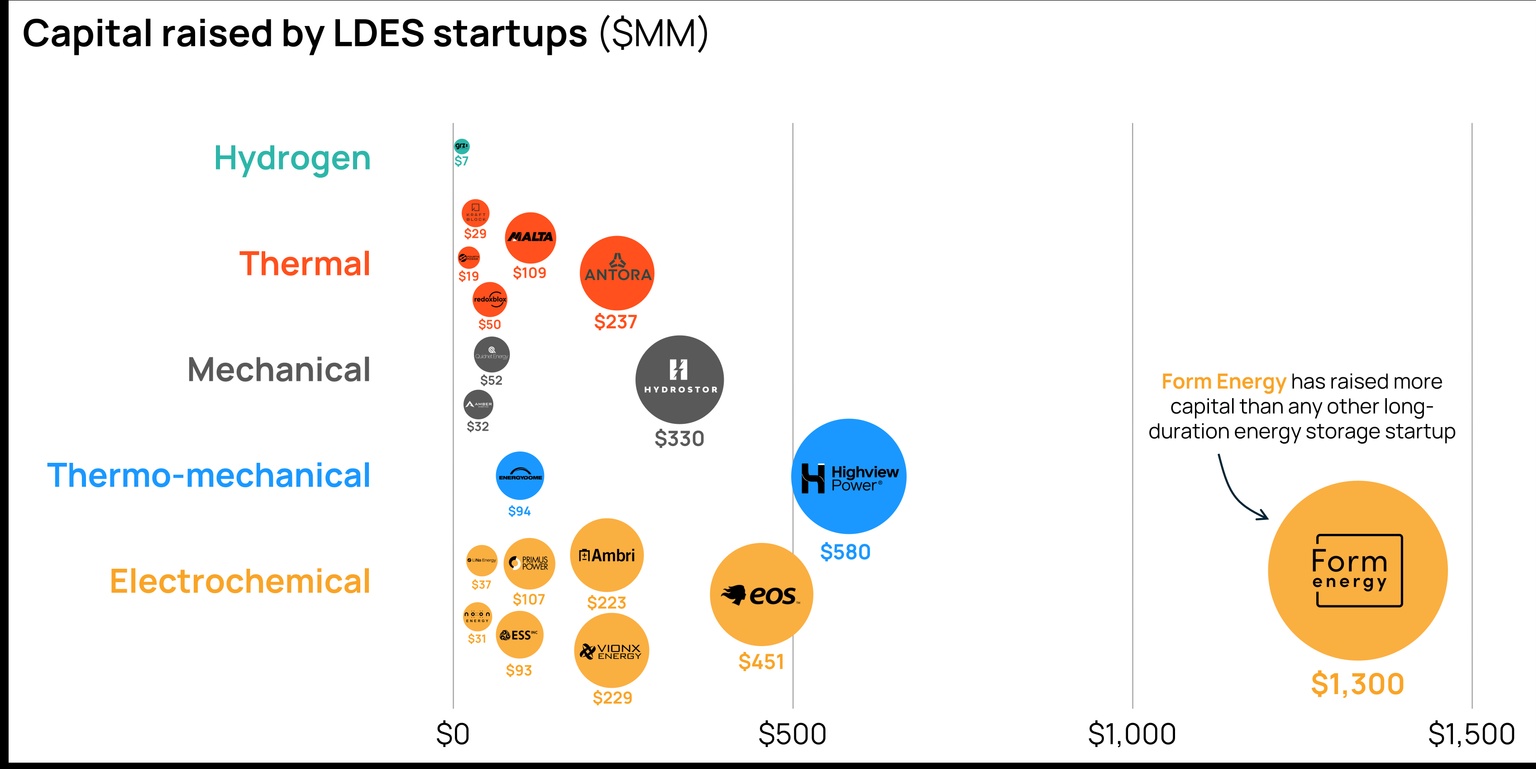

To date, Form has far outraised any other LDES startup. Part of that speaks to the maturity of the business.

In September, the company celebrated the start of battery production at its first high-volume manufacturing plant located in Weirton, West Virginia. Just a few weeks later, it secured another $405 million in funding to further expand the factory to an annual capacity of at least 500 megawatts and 50,000 megawatt-hours.

Data source: PitchBook Data, Inc.

The expansion comes as no surprise, as some of the largest LDES projects announced in the US will be built using Form’s batteries.

Striking while the iron is hot: Form will develop and build New York’s first multi-day storage project in the state, a 10-megawatt / 1,000-megawatt-hour facility. Georgia Power also plans to install a 15-megawatt / 1,500-megawatt-hour iron-air battery onto the Georgia grid and test the company’s operations modeling software for power grids, known as Formware. And in Maine, the biggest of all, Form is developing the world’s largest battery energy storage system, which will hold 8.5 gigawatt-hours’ worth of energy.

And on top of all its accomplishments in the battery space, Form may have inadvertently helped solve one of the world’s hardest-to-abate industries: steelmaking.

Iron-air green steel: One of the most energy- and emission-intensive processes in steelmaking is the reduction of iron — removing oxygen from iron ore to produce solid iron. This is usually done using massive, hundred-million-dollar blast furnaces. Form’s batteries do this in their charging phase.

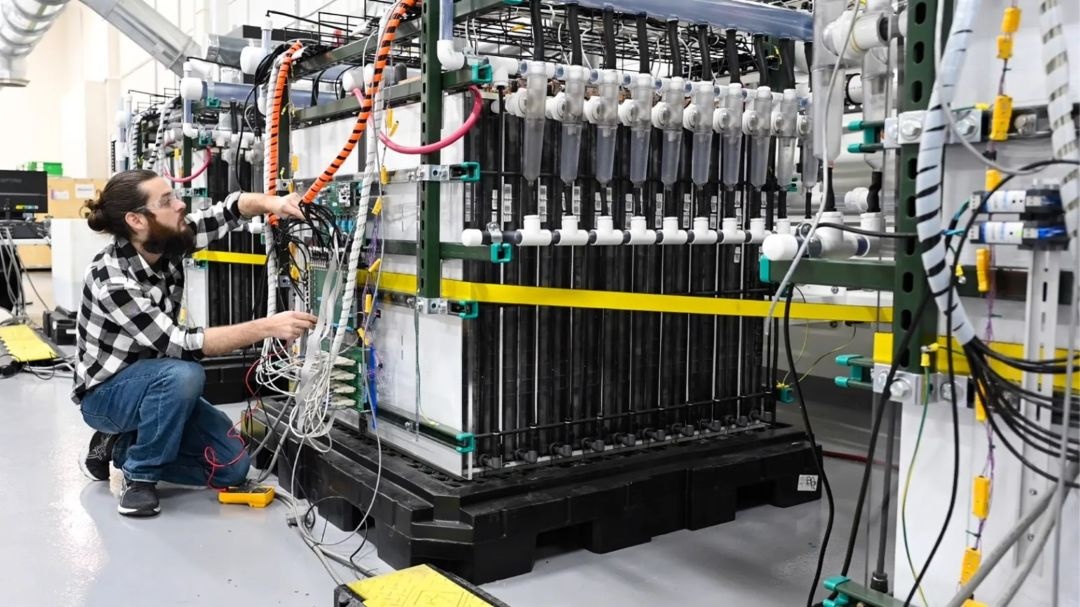

Form Energy’s battery module in the company’s Berkeley lab // Form Energy

Earlier this year, the US Department of Energy awarded Form, along with 12 other winning projects, funding to advance zero-process-emission ironmaking. An interview with Jaramillo conducted by Canary Media highlighted the company’s discovery. “We found a cheaper, more scalable, more efficient process for producing green iron. We know that it has a chance to create a ton of value, so we’re going to pursue it,” Jaramillo said.

Form’s factory that just began production in Weirton is a golden thread that nicely weaves the company’s story together.

Located in West Virginia, Weirton got its first iron furnace back in 1790 and went on to host one of the country’s largest steel mills. The mill employed more than 10,000 workers at its peak, helping Weirton become a major American steel production town. But after changing hands several times, ArcelorMittal eventually demolished the mill in 2019.

Poetically, Form’s battery factory is being built on the site of the former steel plant, creating new iron-working jobs for former steelworkers. As Form’s co-founder and Chief Scientist Yet-Ming Chiang put it, “this will create real manufacturing jobs in parts of the country that have seen a great loss of jobs from traditional industries and may not have seen themselves as part of this green revolution.”

Weirton is an embodiment of the change happening to industries across America in the energy transition.

Bottom line: Did the gasoline-versus-battery debate divide Henry Ford and Thomas Edison? No. While Ford never ended up manufacturing Edison’s iron-battery-powered electric vehicle, the two nonetheless remained lifelong friends, even owning neighboring vacation homes in Fort Myers, Florida.

One of Edison’s early employees, Nikola Tesla, is the namesake for today’s leading American electric vehicle maker, Tesla. There is some historical justice in the fact that iron-based batteries could play a meaningful role on the future electric grid that Edison helped build because of Form Energy, whose CEO descends directly from Tesla.

Thomas Edison, left, and Henry Ford // Flikr

Data-driven insights delivered to your inbox.