Aaron Foyer

Vice President, Research and Analytics

This might be the start of a new American nuclear era

Aaron Foyer

Vice President, Research and Analytics

The Westinghouse Electric Corporation is to the American power industry’s historical legacy and foundation what the Big Mac is to McDonald’s. Founded in 1886 in Pittsburgh by George Westinghouse, the company has been responsible for several key inventions and products for the power sector. Early highlights include patenting the first practical AC motor, building the world’s first industrial alternating current system – the Ames Hydroelectric Generating Plant in Colorado – and facing off against Thomas Edison in the so-called Current Wars.

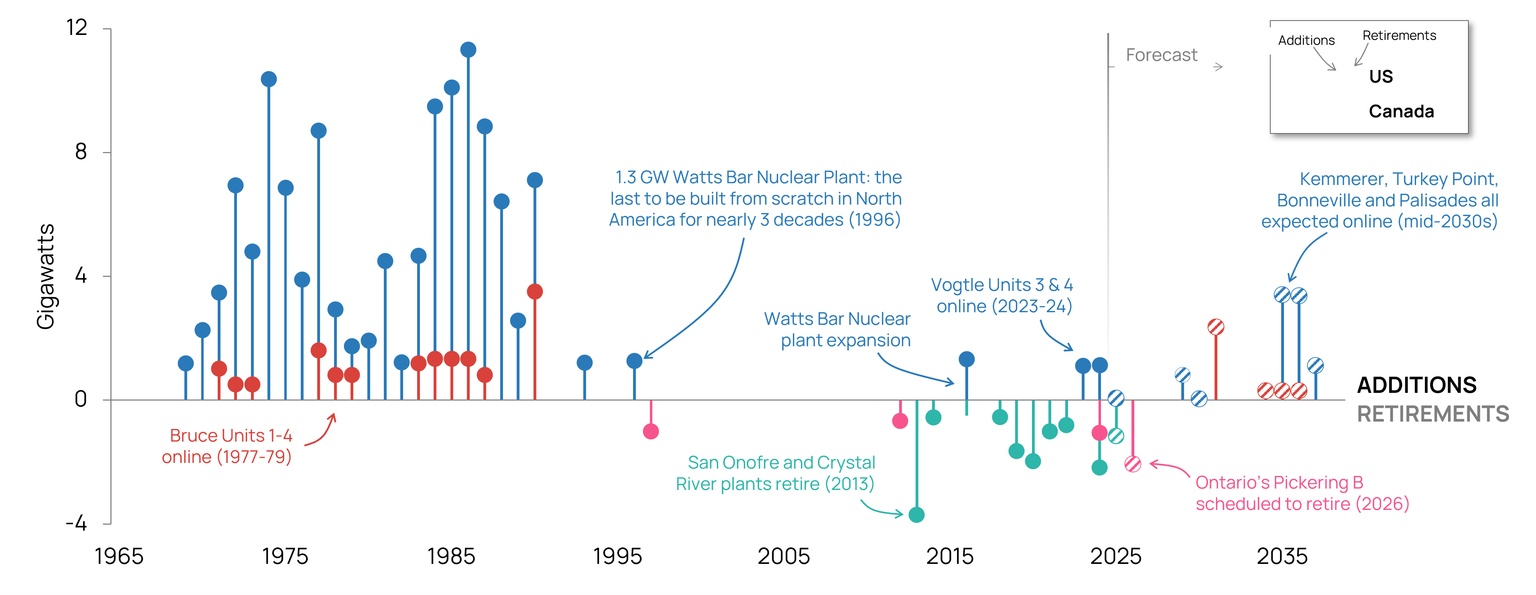

In March of last year, Westinghouse was part of American electric history, yet again, when its AP1000 pressurized water nuclear reactor at the Alvin W. Vogtle Electric Generating Plant in Waynesboro, Georgia, achieved first criticality. This meant the facility’s Unit 3 reactor was undergoing a self-sustaining nuclear reaction at the first reactor built from scratch in the US in three decades. A true milestone.

Vogtle Unit 3 processing tanks inside the reactor building courtesy of the US Nuclear Regulatory Commission, Georgia Power Company

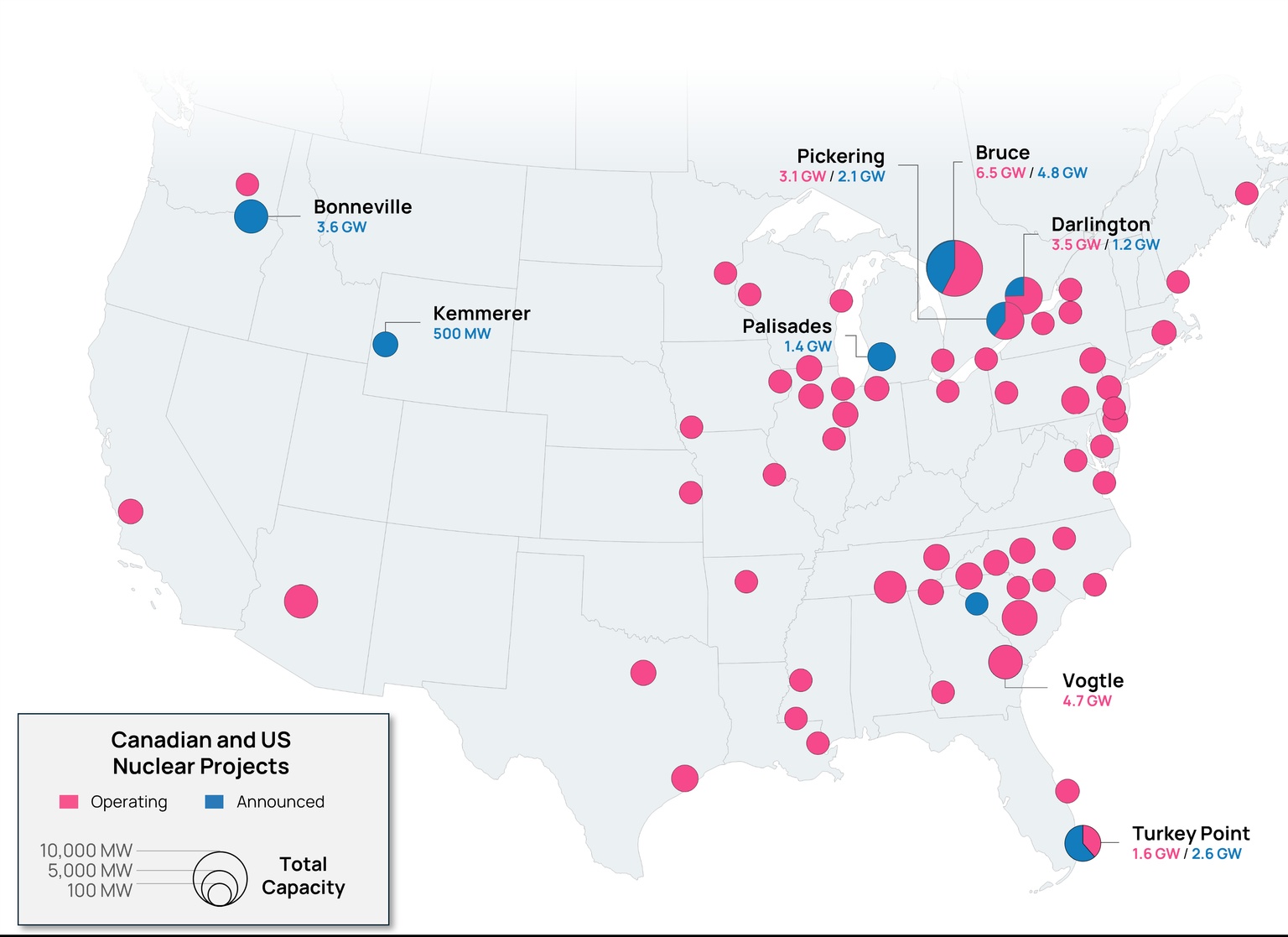

A year later, the Vogtle Unit 4 reactor also came online. The two together bring 2.2 GW of clean baseload power to the grid. Kids born in Burke County this year might grow old with these reactors, as they could operate for up to 80 years, the maximum operating life granted by the US Nuclear Regulatory Commission (NRC).

They might be.

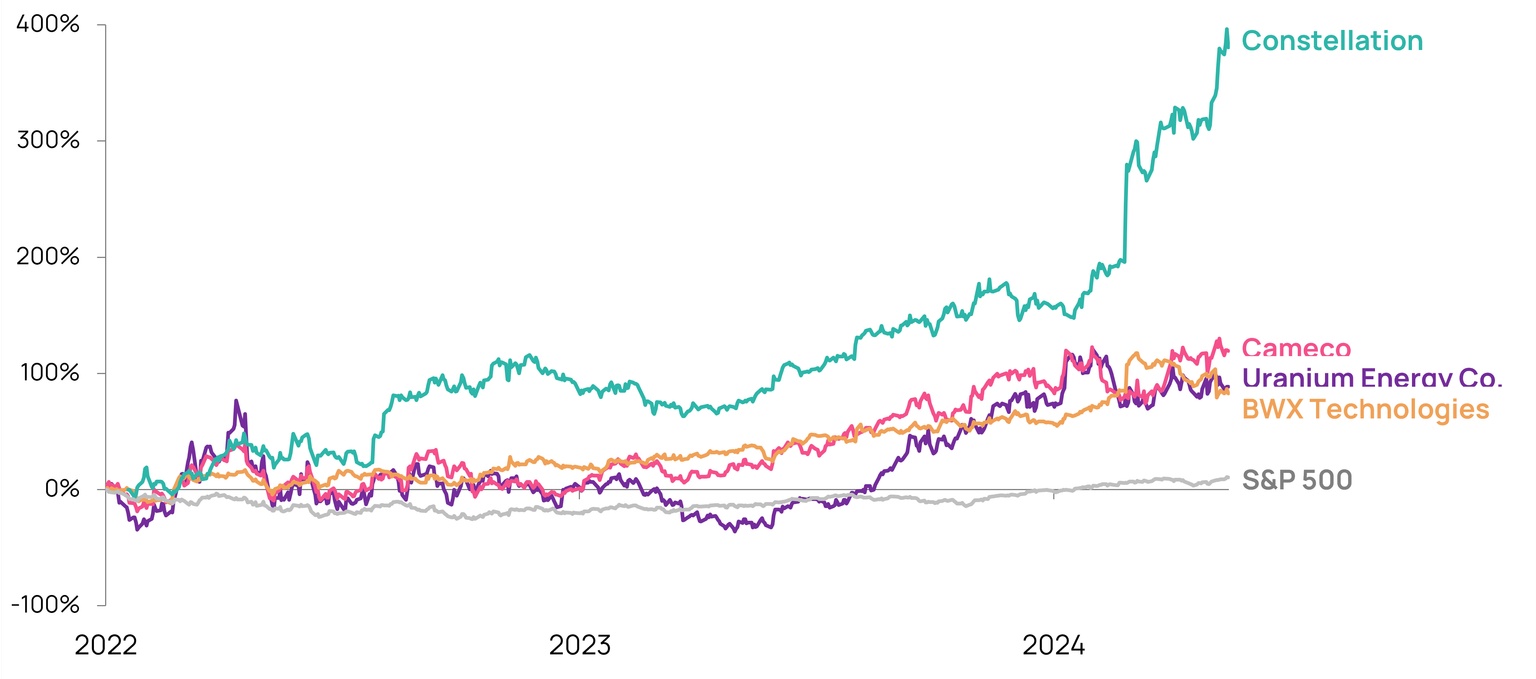

To start, it’s not just the people of Georgia who are rediscovering nuclear reactors like they’re low-rise jeans. Public equities with a nuclear focus have significantly outperformed the market in recent years.

In detail: Baltimore-based Constellation Energy, the largest operator of nuclear energy in the US, is one of the top performing stocks in the S&P 500 this year. It sits behind just two computer chip companies and Vistra – another energy firm – for YTD returns. Meanwhile, shares in uranium mining companies Cameco and Uranium Energy alongside nuclear tech company BWX Technologies have seen their shares all nearly double since the start of 2022.

Source: Orennia, Yahoo Finance

No doubt nuclear is benefiting from the AI-data center boom. As a provider of low-carbon, baseload power, atomic energy is speculated to be a winner out of the growing need for 24/7/365 clean power. It’s clear that these huge new load centers are interested. On an earnings call with investors last month, Constellation chief Joseph Dominguez said the level of interest from data centers is “nothing like we’ve seen in 20 years.”

Big Tech investors: Amazon also made headlines earlier this year when it bought a 960-MW data center powered by the adjacent Susquehanna nuclear power station to help power its Amazon Web Services.

On the new plant front, Microsoft’s Bill Gates and his nuclear company, TerraPower, look set to begin construction on a next-generation nuclear power plant in Kemmerer, Wyoming, this month. The facility will use the company’s branded Natrium reactor, one of the many small modular reactors (SMR) looking to be deployed on the market.

SMRs are part of an emerging set of technologies that could help reinvigorate the industry.

While all operating nuclear plants in the US and Canada are so-called large reactors, a new suite of reactors, including SMRs, is being developed to tackle the technology’s shortcomings.

Source: Orennia

Digging in: In the case of SMRs, “small” refers to their capacity. Unlike most existing nuclear reactors, often at the gigawatt scale, these are typically 300 MW or less. TerraPower’s Kemmerer plant will be just above, at 345 MW.

Companies usually look for economies of scale to help bring down costs. By going down in size, SMRs are effectively going back up the cost curve. To counteract this effect, TerraPower and others are looking to modularize these reactors so they can be mass produced. Paraphrasing Nikita Khrushchev, they hope to turn out reactors like sausages.

Their smaller size makes SMRs ideal for distributed energy and mini-grids, which are likely to become more valuable as grid volatility continues to increase.

The benefits: SMRs and other advanced reactors have benefited from decades of additional research, design and technology advancement, with the newest reactors being much safer than their predecessors. Aside from operating at lower, safer pressures, new designs also include passive safety measures. This means natural forces like gravity and pressure accomplish safety functions rather than relying on active intervention from a computer or a person, which can fail from human or electrical error.

Advanced nuclear reactors also typically use fuels that produce less nuclear waste. Most existing reactors use an enriched uranium fuel made up of 3% to 5% uranium-235, the isotope that produces energy in a nuclear reaction. By contrast, advanced reactors use what the industry calls high-assay low-enriched uranium (HALEU), which is enriched to between 5% and 20%. The higher enrichment levels allow for smaller core designs, longer operating lives and better fuel use – this last point is what reduces nuclear waste.

Source: Orennia

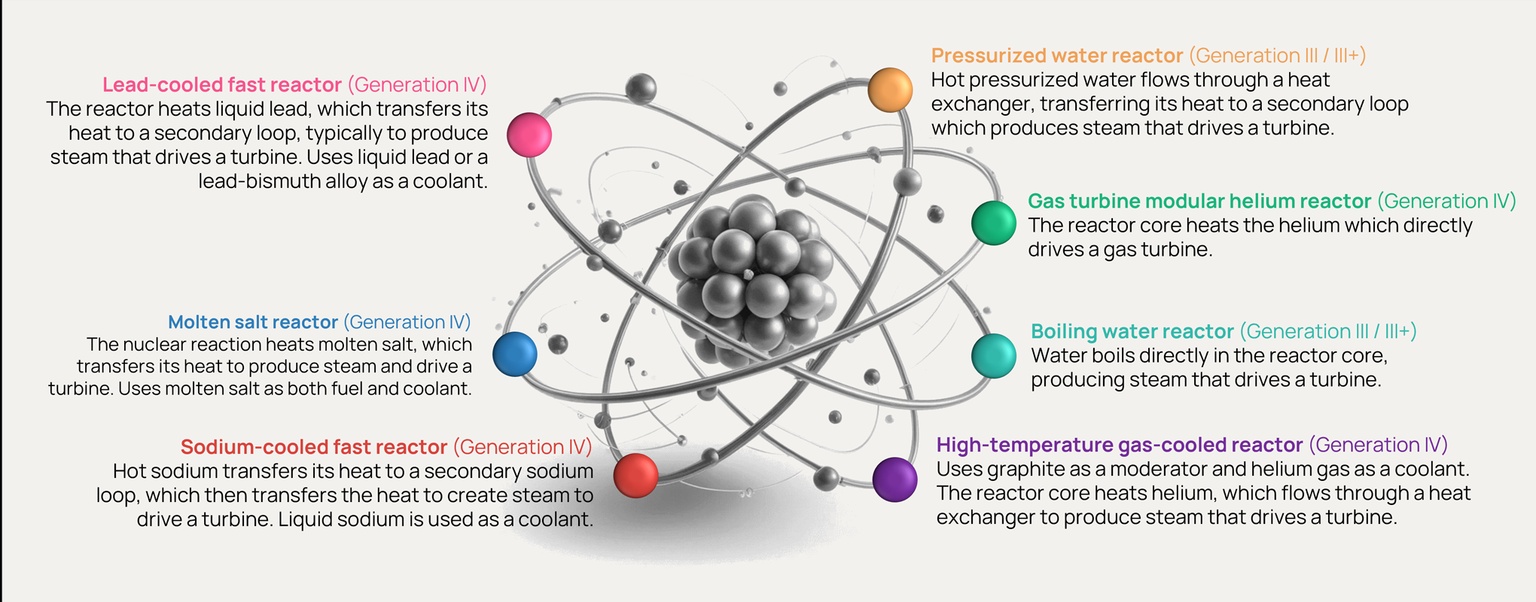

If you thought nuclear physics was hard, it takes a PhD just to understand the different types and classifications of reactor designs. For starters, each is assigned to a reactor generation:

Within each generation exists a range of designs. There are several different fuels that can undergo continuous nuclear reactions, including uranium, plutonium and thorium. Coolant systems, reaction moderators and safety features are also varied.

Follow the money: For SMR designs, there are just a couple that look to be going ahead in American projects today.

Source: Orennia

TerraPower will be building its own Natrium sodium-cooled fast reactor when it kicks off construction for its Kemmerer plant this year. The Darlington Nuclear Generation Station started earth works for its first SMR back in 2022, with plans to install an advanced boiling water reactor by GE Hitachi. Darlington has already announced plans to build three more using the same BWRX-300 design, which is also popular in many European projects and is planned for a proposed project in Estevan, Saskatchewan. Globally, it’s Chinese and Russian small reactor designs that are the most advanced in their development.

While following the money helps highlight which technologies are currently getting built, it also unearths the principal challenge facing new nuclear: cost.

Cost comparisons: In Lazard’s Levelized Cost of Energy+ report, the nuclear price is estimated to be between $160 and $180/MWh based on the recent Vogtle reactors. This makes it one of the most expensive forms of electricity covered by Lazard. But unlike most power technologies, which have come down in price over time, nuclear prices have been increasing over the decades.

According to research estimating the lifetime levelized cost of electricity of all nuclear reactors in the US fleet, the country’s median reactor has a levelized cost of $88/MWh in today’s dollars. Some of the cheapest, including the Turkey Point 3 and 4 reactors in Florida, go as low as $54/MWh. These are in line with or lower than what Lazard estimates for the firming prices of wind and solar, making it a viable option for data centers and other users with firm load.

Cost overruns have also plagued the industry. NuScale nixed its Carbon Free Power Project in Idaho last year after the planned $3.6-billion, 720 MW project budget ballooned to $9.3 billion for a smaller 462 MW plant.

Source: Orennia, World Nuclear Association

While the two Vogtle reactors are now operating, the expansion project came in seven years late and $17 billion over budget. That, according to Power Magazine, makes it the most expensive power plant on Earth. An honor only Mr. Burns would be proud of.

To mitigate some financial risk, some nuclear projects are getting clever with financing. In 2021, Bruce Power in Ontario issued the world’s first nuclear green bond, successfully raising C$600 million. Following two subsequent green bond rounds, the company raised a total of C$1.7 billion. Earlier this year, Constellation issued the first American nuclear green bond.

And decaying skillsets: The West has spent decades forgetting the key skills required to build nuclear plants. So much so, the Financial Times recently highlighted the huge skills gap that’s being filled by luring thousands of retired engineers and older professionals back to the workforce. The FT euphemistically referred to the former retiree workforce needed for the wave of new projects as the “silver tsunami.”

Bottom line: Nuclear is a promising and proven technology. The popular Lazard Levelized Cost of Energy+ report does nuclear a disservice by attributing it an operating life of just 40 years. Many plants (even older ones) look capable of operating for 80 years, which would bring down its estimated levelized cost considerably. However, that may be counterbalanced by projects coming in late and over budget. Until timelines become more reliable, investors will be wary of the industry.

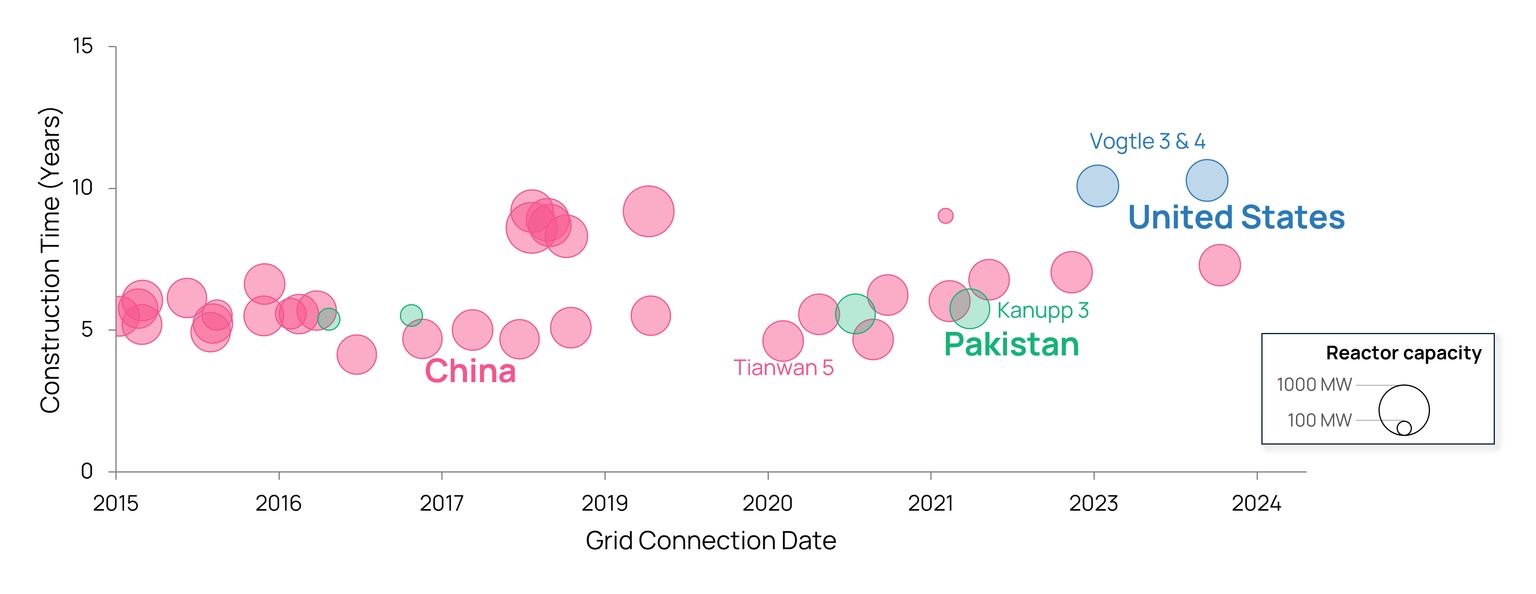

That said, timeline delays are not a nuclear problem, they’re a Western problem. While the new American Vogtle reactors each took more than 10 years from start of construction to first grid connection, other countries regularly do much faster. China took 4.6 years to grid connect its recent 1.1-GW Tianwan 5 reactor while Pakistan took less than six years for its 1-GW Kannup 3 reactor. Like Brock Purdy and the 49ers intricately rehearsing each play and its exquisite timing, building nuclear plants requires a similar sort of muscle memory to be successful. That can only be acquired by building.

Data-driven insights delivered to your inbox.