Aaron Foyer

Vice President, Research and Analytics

Expiring patents may pave the way for rapid innovation

Vice President, Research and Analytics

Thomas Edison is often miscredited as the inventor of the light bulb. For years prior to Edison’s work, scientists and engineers had been actively working on converting electricity into light. Many of the first light contrivances from early inventors failed due to being too expensive and suffering from burning out too quickly.

American inventor Thomas Alva Edison holding a light bulb in his laboratory. Menlo Park, 1910s (Photo by Mondadori via Getty Images)

In the 1870s, Edison and his team of researchers working at Menlo Park developed an alternative filament made of carbon, specifically cotton, that glowed from the heat created by electricity and could last for 14.5 hours. After further prototypes, the team switched the filament over to Japanese bamboo, allowing the light bulbs to operate for up to 1,200 hours.

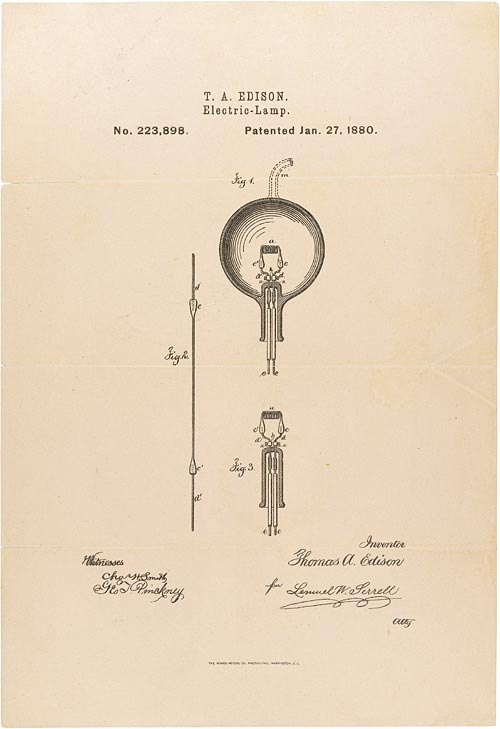

For these innovations, Edison was granted a series of patents. These included the famous Patent No. 223,898, which he received on Jan. 27, 1880, for the electric lamp, securing exclusive rights for nearly two decades to commercialize his technology.

Thomas Edison’s patent drawing and application for an improvement in electric lamps, patented Jan. 27, 1880; Records of the Patent and Trademark Office; Record Group 241; National Archives.

By 1897, Edison’s light bulb patents began to expire, allowing other companies to begin advancing the technology. Over the century that followed, light technology progressed at a remarkable rate. Key innovations included the introduction of the tungsten filament in the early 1900s, the invention of fluorescent lighting in the 1920s and the development of LEDs in the 1960s.

That century of innovation resulted in improved performance. Edison’s first light bulb had an electrical efficiency of just 1.4 lumens per watt (lpw). Modern high-efficiency LEDs now run at more than 100 lpw following the decades of ingenuity, gains of nearly two magnitudes.

Modern innovation: Today, it’s batteries that are seeing major advancements, with new chemistries and technologies being developed and optimized across the entire supply chain. The cathodes in lithium-ion batteries, in particular, are changing rapidly, with one looking ready to dominate future markets: lithium iron phosphate (LFP). Key patents for LFP batteries, already known for their technological and environmental benefits, are now expiring. And just like light bulbs in the late 1800s, that could turbocharge development and reshape several industries in the coming decades.

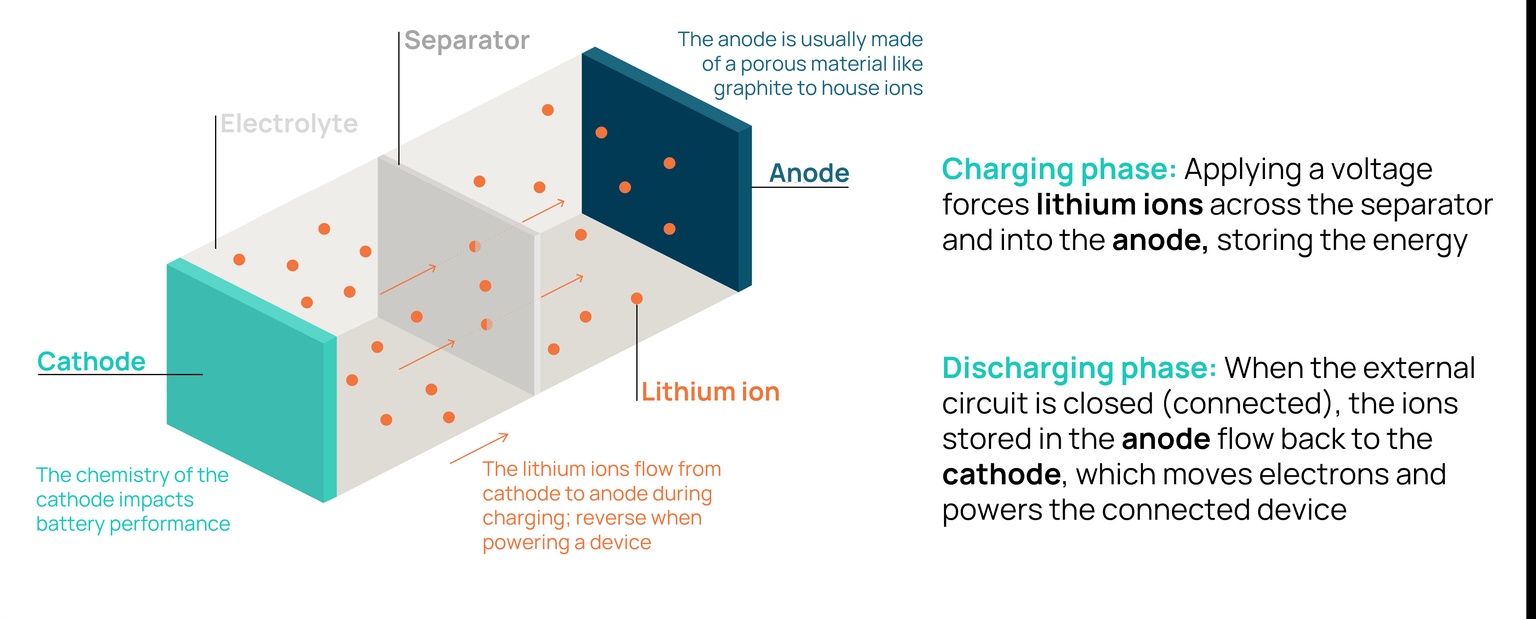

Despite being a 200-year-old technology, batteries are currently undergoing rapid evolution due to demand from several key decarbonization pathways that rely on energy storage. These include electric vehicles, grid-scale energy storage and industrial processes, each with its own unique storage requirements. For the multi-hour use, daily cycling needs of both grid-scale energy storage projects and electric vehicles, lithium-ion batteries are preferred.

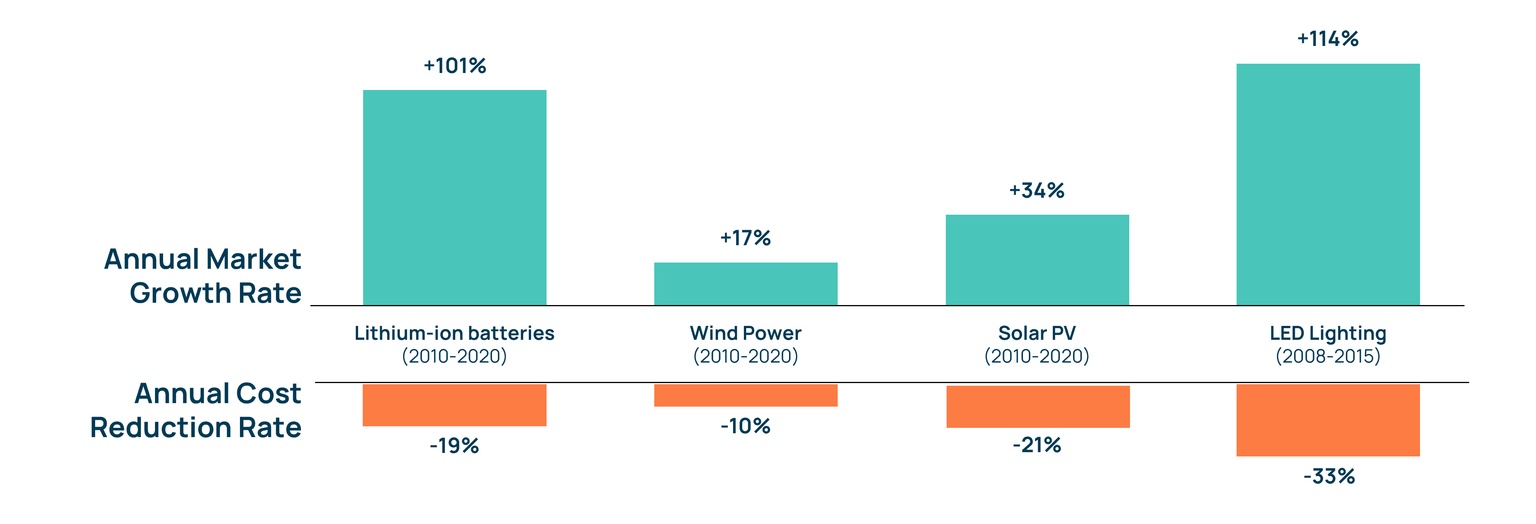

Already charged: Lithium-ion batteries have quietly been one of the most rapidly evolving technologies in the energy transition. From 2010 to 2020, globally deployed capacities have grown and reduced costs at a rate on par or faster than either wind or solar, both of which saw impressive improvements over the same period.

Markets: Lithium-ion batteries and wind power = GWh; solar power = GWac, LEDs = installations Costs: Lithium-ion batteries and wind power = USD/kWh; solar power = USD/Watt; LEDs = USD/kilolumen

Sources: IEA, BloombergNEF, IRENA, US Department of Energy

Li-ion batteries can be further segmented by the chemistry of their cathodes, key for a battery’s cost, safety and functionality. Apart from LFPs, other key types include cathodes that contain nickel and cobalt, with the two most common being nickel-manganese-cobalt (NMC) and nickel-cobalt-aluminum (NCA) batteries.

NMC and NCA have historically been preferred in EVs for their performance. Despite being more expensive, they have a higher energy density, higher power density and a proficiency to charge faster than LFPs. This made them the preferred choice by early EV automakers, including Tesla, which primarily used NCA battery cells in its early models. NMC and NCA are still preferred for high-end models, but LFP is increasingly the go-to choice for more affordable EV models.

Source: Orennia

Chinese dominance: Another factor limiting adoption of LFP batteries has been China’s historical monopoly on their development. Despite the key technological breakthroughs for LFPs occurring North America in the early 2000s, China has accounted for almost all global production due to patent agreements. Signed with the original patent owners, these agreements waived licensing fees for Chinese companies, making LFP expensive to manufacture outside of China, and forced manufacturers to focus on other chemistries, like NMC and NCA.

Context: While China is known for controlling much of the lithium-ion battery supply chain, its dominance over LFP batteries is on another level. The Fraunhofer Institute for Systems and Innovation Research estimates that China had more than 99% of all global LFP manufacturing capacity in 2022. That compares to the country’s 68% share of the global production capacity

for NMC.

In 2022, many of the key LFP patents and license agreements expired, opening the door for new innovation and international growth.

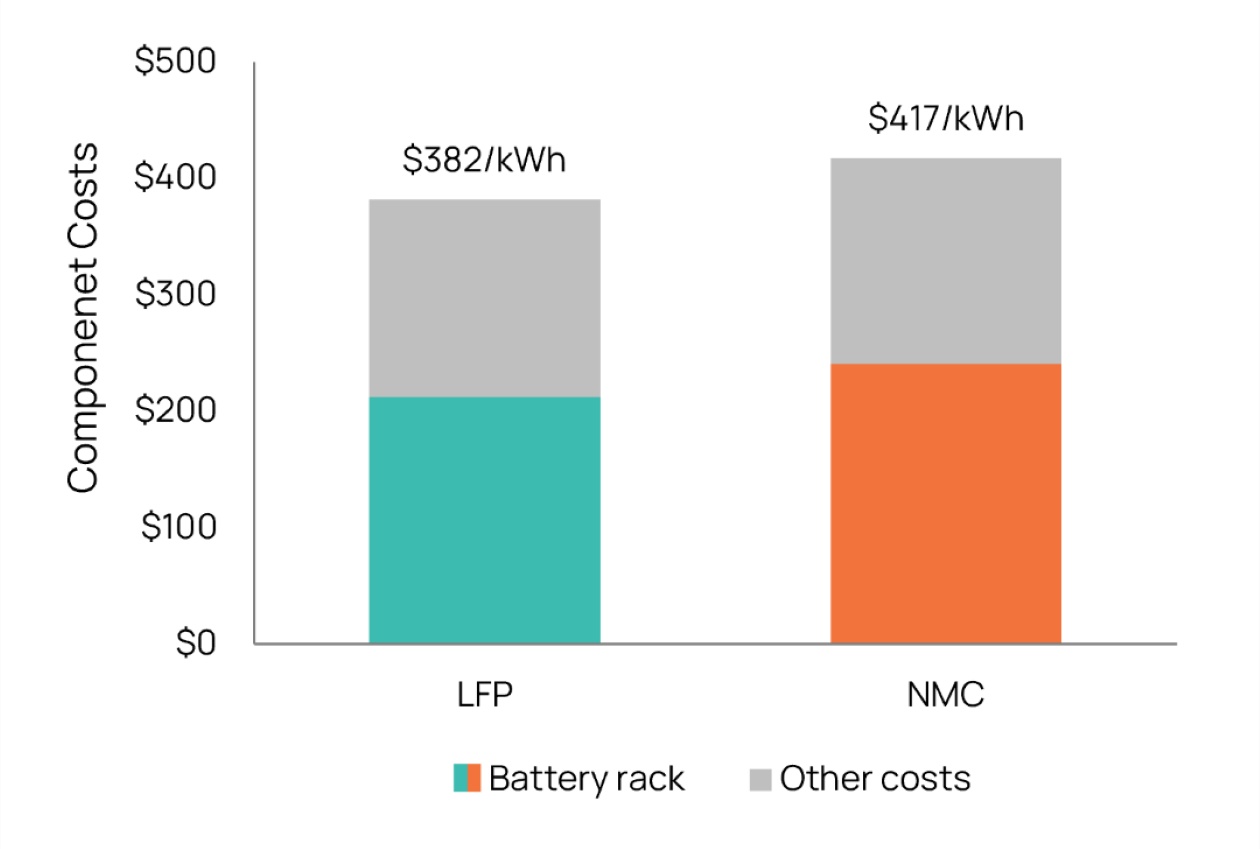

The first is overall cost. The battery alone for LFPs is roughly 20% cheaper than NMC systems on a kilowatt-hour basis. Compounding its capital benefit is the fact that LFPs typically degrade slower than competing chemistries.

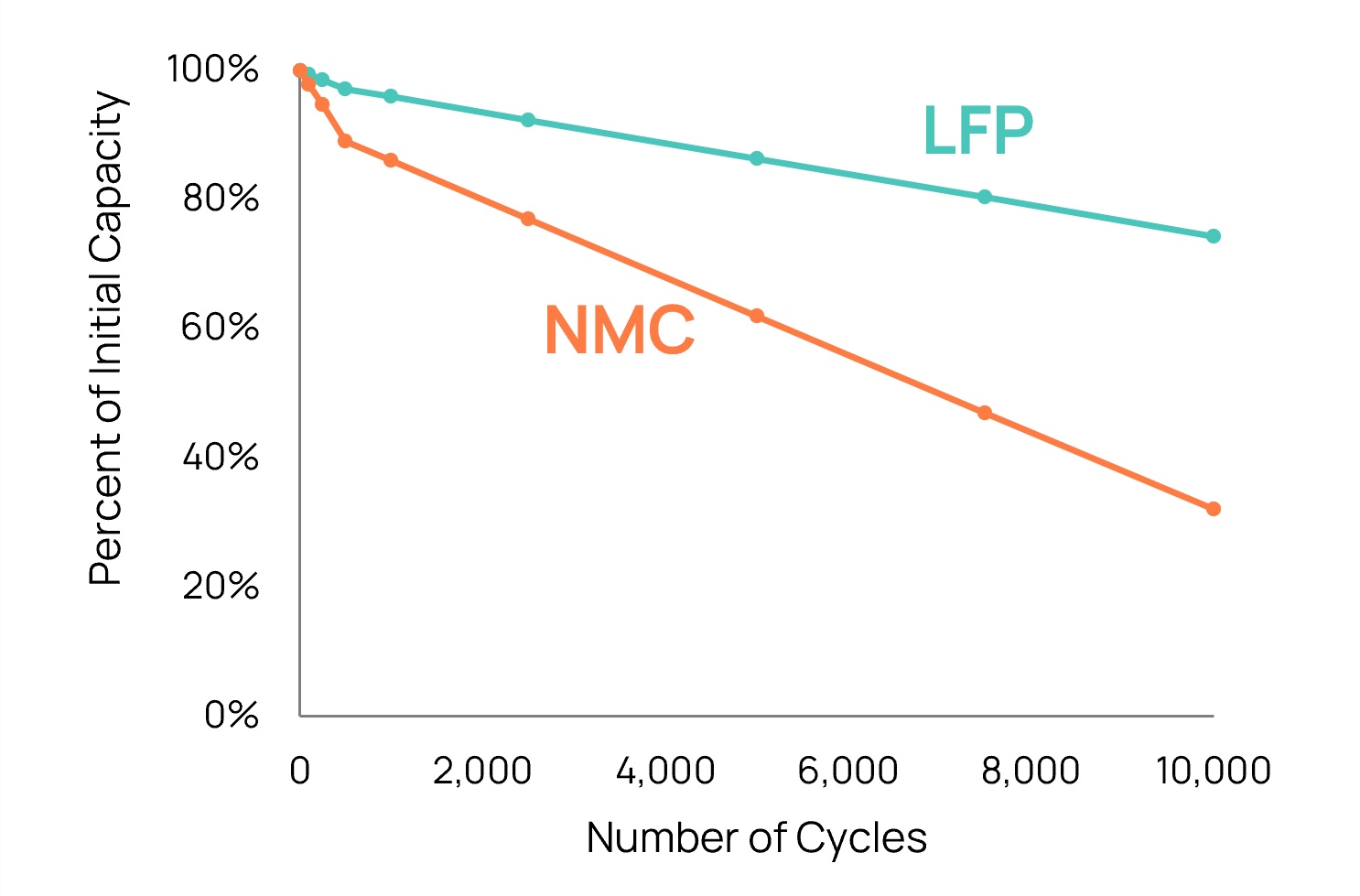

A key concern for batteries is how their performance is affected by regular charge and discharge cycles. After seven years of daily use (roughly 2,500 cycles), our models show an NMC battery loses about 23% of its initial capacity whereas LFP loses just 8%. Said another way, LFPs have a cycle life 2 to 4 times longer than NMCs. For energy storage projects, that either limits revenues over time or requires additional spending to maintain energy capabilities. This may explain why most battery energy storage systems (BESS) that use lithium-ion now elect for LFP cathodes. For EVs, the faster degradation eventually reduces the vehicle’s range on a single charge and could depreciate the value of vehicles faster.

Note: Capital costs are based on a 400 MW BESS with a 4-hour duration

Source: Orennia

Source: Orennia

Improved fire safety: Given the public scrutiny that faces any major new technology, even a limited number of safety incidents can create hostility and NIMBYism. For Li-ion batteries, concerns revolve around battery fires. One key advantage LFP cathodes have over nickel-based ones is they’re viewed as being safer and less likely to experience thermal runaway – the chemical process that leads to fires. Whether the public can be convinced that a novel lithium-ion chemistry is safer than others is a whole other matter.

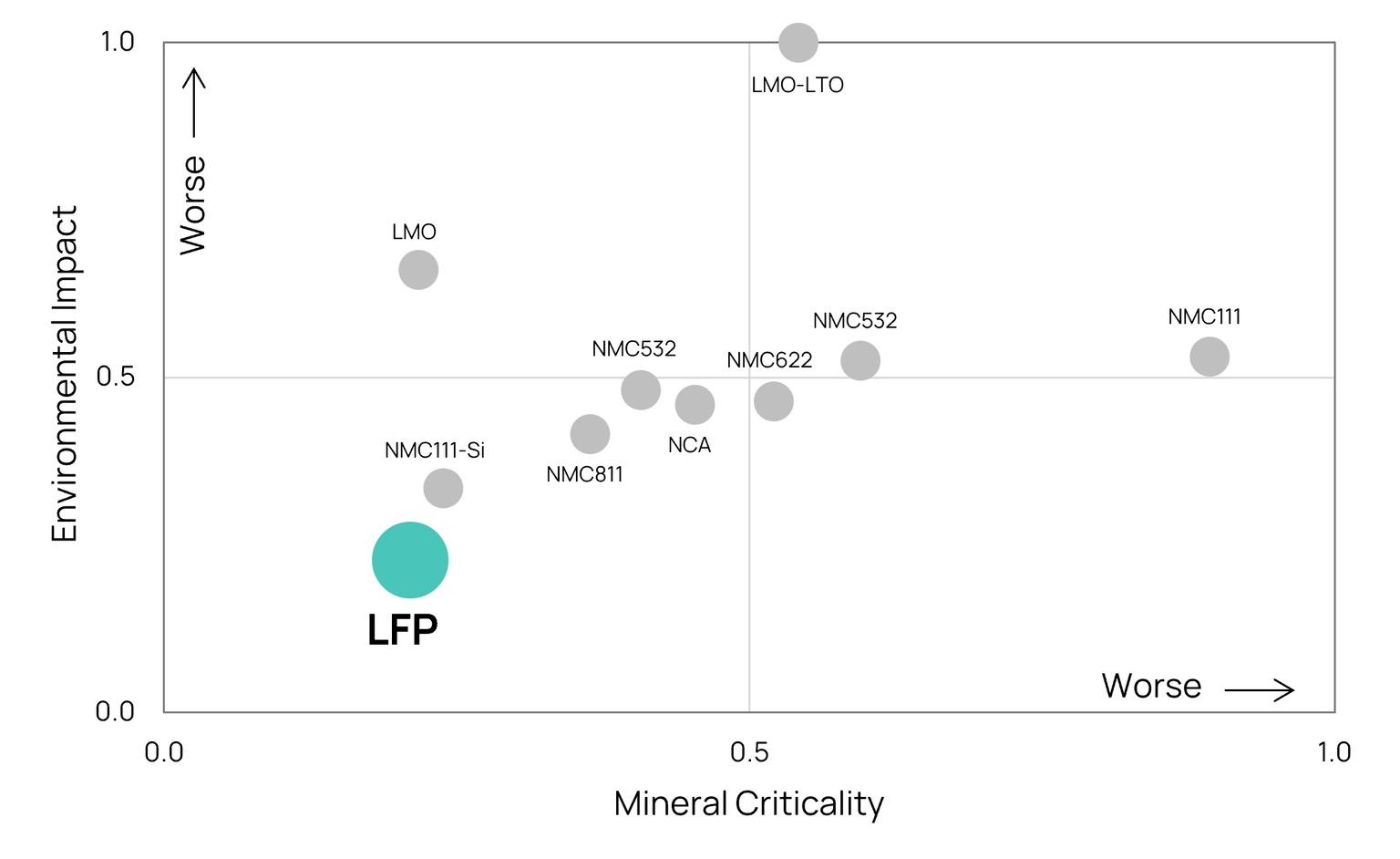

By swapping out nickel and cobalt with iron and phosphorus, which are more abundant on Earth, companies can alleviate some of the anxieties around critical minerals and battery supply chains. This includes the ethical sourcing of cobalt. LFPs score well against other chemistries in this regard.

In a study published in Sustainable Materials and Technologies in June of last year, researchers from Norway and Germany assessed the value chains of several leading Li-ion cathodes. The team found LFP scored favorably from both an environmental and mineral criticality standpoint.

From a technological level comparison, LFP has the best overall performance on the criticality and embodied environmental impact categories, which increases its potential as the chemistry to dominate the future market.– Manjong, N. et al

Overall, there are many reasons that help explain why LFP batteries are increasingly popular.

Source: Manjong, N. et al

On the rise: In 2022, according to the International Energy Agency (IEA), more than 90% of the Li-ion EV market was for light-duty vehicles. Between 2019 and 2022, LFPs increased their market share of global LDV battery capacity from just 3% to 27%. Much of that growth was just China.

With the renewed ability to produce LFP domestically following the expiry of the patents and Chinese licensing agreements, American and European automakers are increasingly turning to the iron-based cathode for their base-level models. Last year, Tesla, Ford, General Motors and Rivian all announced plans to shift some or all of their EV models to LFP cathodes.

Tesla CEO Elon Musk made his preference for LFPs known, posting on X (formerly Twitter) in 2021:

“Nickel is our biggest concern for scaling lithium-ion cell production. That’s why we are shifting standard range cars to an iron cathode. Plenty of iron (and lithium)!”– Tesla CEO Elon Musk

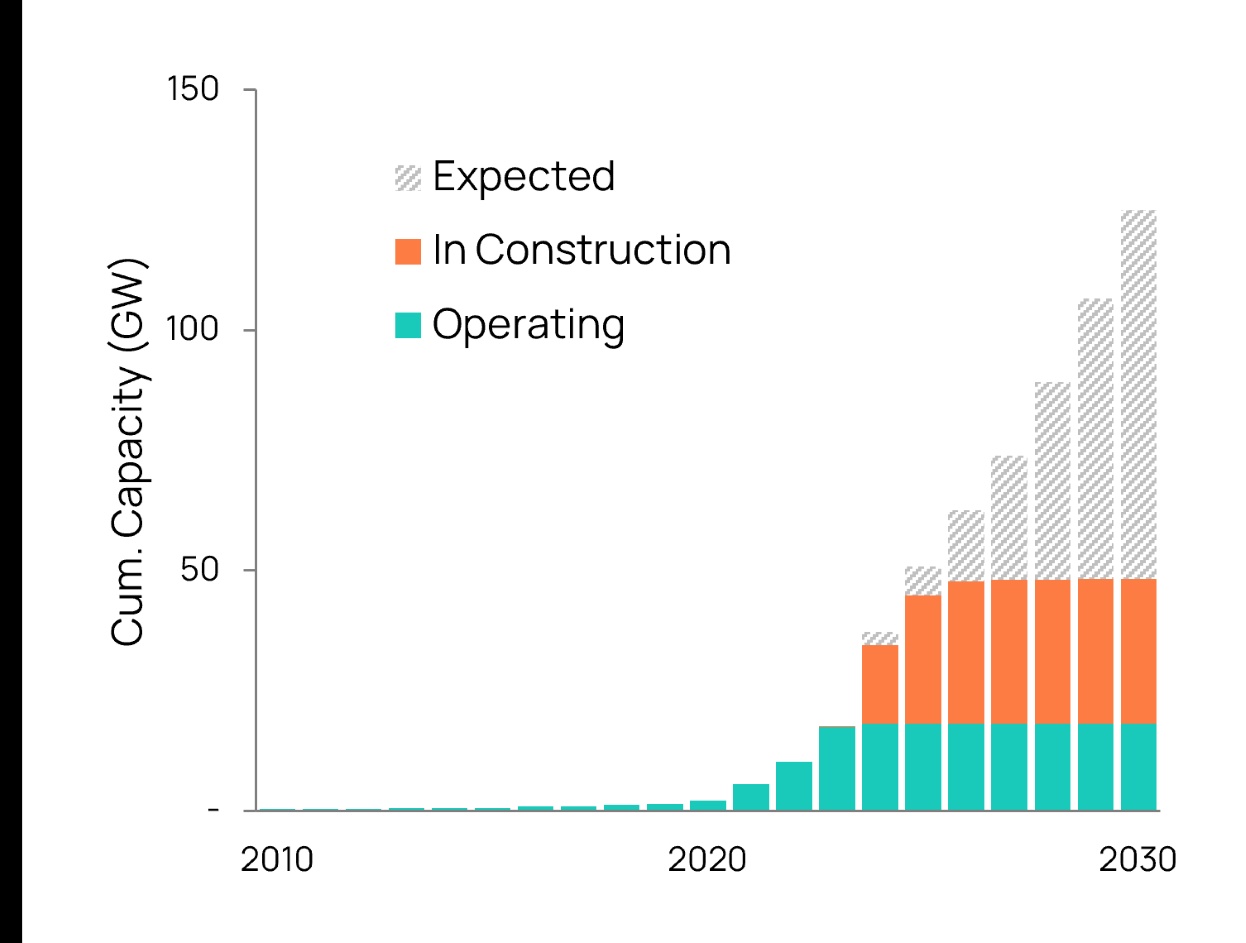

LFP demand is also growing from the energy storage sector. As the build-out of intermittent power sources continues, the demand for BESS has suddenly picked up. There are more than 17 gigawatts (GW) of energy storage projects in construction across North America scheduled to connect to the grid this year. Storage projects using lithium-ion batteries have overwhelmingly preferred LFP over other chemistries.

Across North America

Source: Orennia

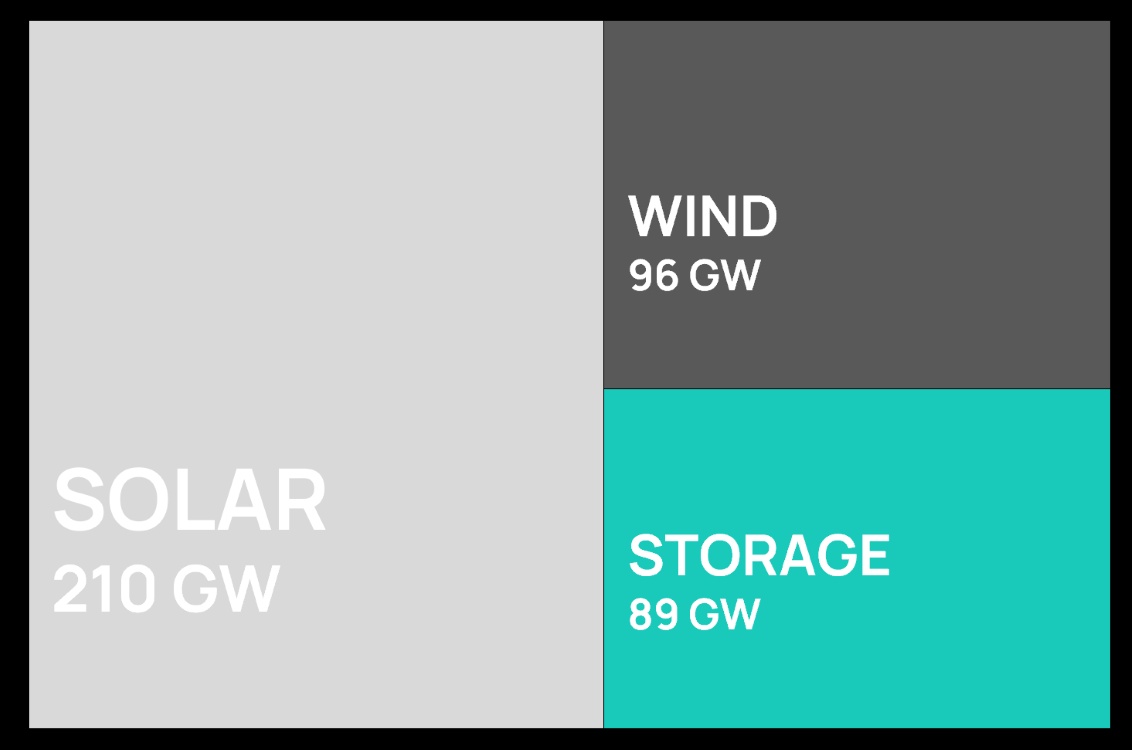

Across North America Orennia’s forecasted capacity supply: net new capacity change between 2024 and 2030; all other generation types are flat or declining over this time period

Source: Orennia

Due to its cost and performance benefits, we anticipate the majority of future North American lithium-based storage projects will continue to elect for LFP cathodes.

Factory boom: All the excitement around LFP batteries paired with an almost complete monopoly of Chinese manufacturing has led to a surge in gigafactory announcements across the US. Key LFP projects include Tesla’s battery cell factory using CATL machines in Nevada, Ford’s LFP-focused plant in Michigan and American Battery Factory’s 2-million-square-foot gigafactory near the Tuscon International Airport in Arizona. Incentives from the Inflation Reduction Act have catalyzed the investments, with the goal of domesticating battery manufacturing in the US.

Stepping back a bit, this raises bigger questions about the role patents will play in decarbonization. Patents are a necessary part of the innovation process and can act as a catalyst for technology, incentivizing companies by allowing a period of exclusivity to monetize research investments. But they also create a period without competition, something that would limit cost reductions and adoption of technology.

Bigger picture: The dynamic between patents and competition is key as we look ahead at the volume of technologies needing innovation to achieve decarbonization goals.

In 2020, the IEA assessed the difference between existing public policies and the significant emissions reduction outlined in its Sustainable Development Scenario. It found just 25% of the future emission reductions stemmed from mature technologies. The rest came from solutions that would likely involve significant patenting, including technologies that were in the early stages of adoption (41%), in demonstration phase (17%) or still prototypes (17%).

For Thomas Edison and the eventual General Electric, patents provided nearly two decades of dominance in the light bulb market without significant competition. But patents can also represent a barrier for adoption, as was the case for companies outside of China looking to produce LFP cathodes.

Data-driven insights delivered to your inbox.