Brook Papau

Chief Executive Officer

Letter from the CEO

Brook Papau

Chief Executive Officer

The power and renewables sector faces unprecedented uncertainty. After years of steady growth, Washington’s policy volatility – swinging tariffs, IRA revisions, and canceled DOE LPO loans – threatens to unravel hard-won gains and erode investor confidence.

At the same time, the rise of AI is transforming energy into a matter of national security. AI's massive and growing appetite for power means energy policy now directly affects America's technological edge. China is aggressively investing in both sectors, while the U.S. risks losing its leadership by destabilizing the very foundation of its clean energy future. If we fall behind in energy, we will fall behind in AI – and with it, global competitiveness.

The stakes have never been higher.

Our clients are facing unprecedented challenges. The landscape for power and renewables is shifting more rapidly than ever before, and I know these changes are top of mind for all of us.

At Orennia, we recognize that our success is deeply tied to your ability to navigate uncertainty and pursue new opportunities. That’s why I want to personally share my outlook and how we are doubling down on our commitment to you and your business. We are here to help you navigate this shifting terrain, providing insights and collaboration needed to stay ahead.

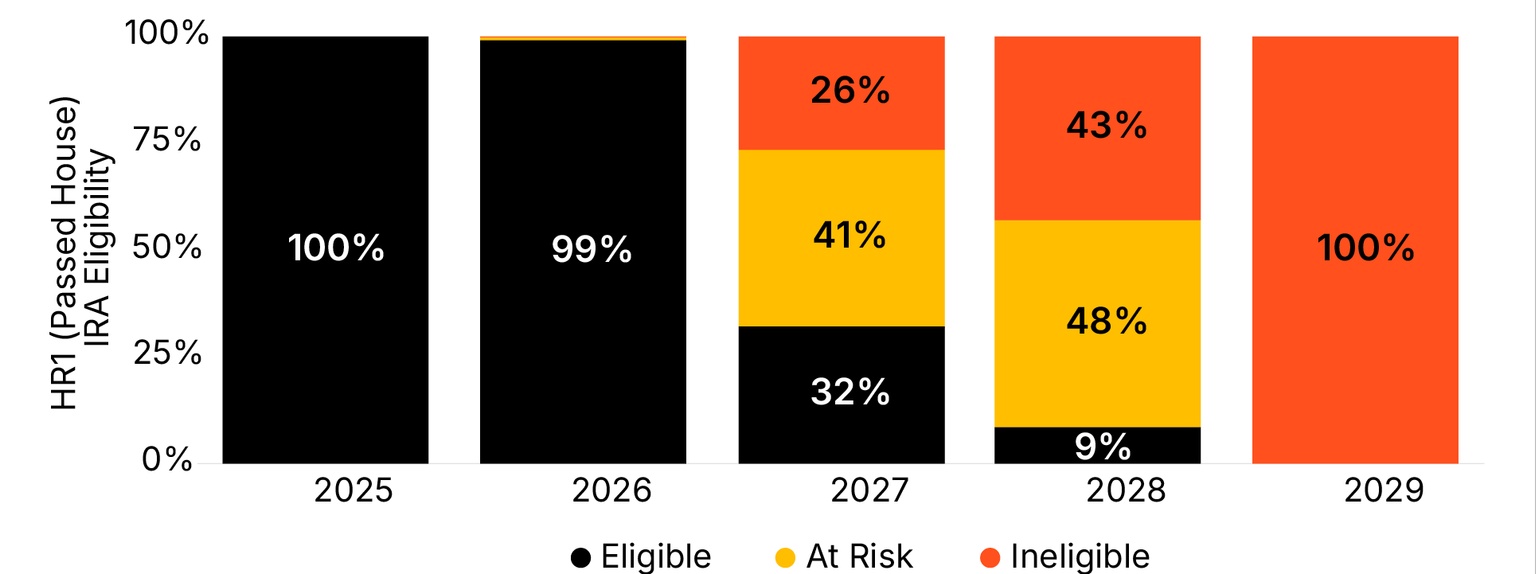

Under the “One Big Beautiful Bill,” which has passed the House and is now under Senate debate, renewable energy and battery storage projects must begin construction by the end of September and be operational before 2029 to qualify for tax credit incentives.

These proposed changes cast serious doubt over projects slated for 2027 and 2028, precisely when energy demand from new AI data centers is expected to surge.

As shown in Figure 1, our analysis estimates that 68% of 2027 projects and 91% of 2028 projects are at risk under the new rules. In total, that puts 164 GW of planned capacity, representing $250 – $300 billion in capital investment, in jeopardy of cancellation.

Source: Orennia

Renewables and storage aren't an alternative anymore; they’re the backbone of the future grid. Opponents of renewable energy must now face two unambiguous facts:

Renewables and storage are the only technologies ready to scale in the next five years.

Their costs are competitive with, or better than, legacy generation.

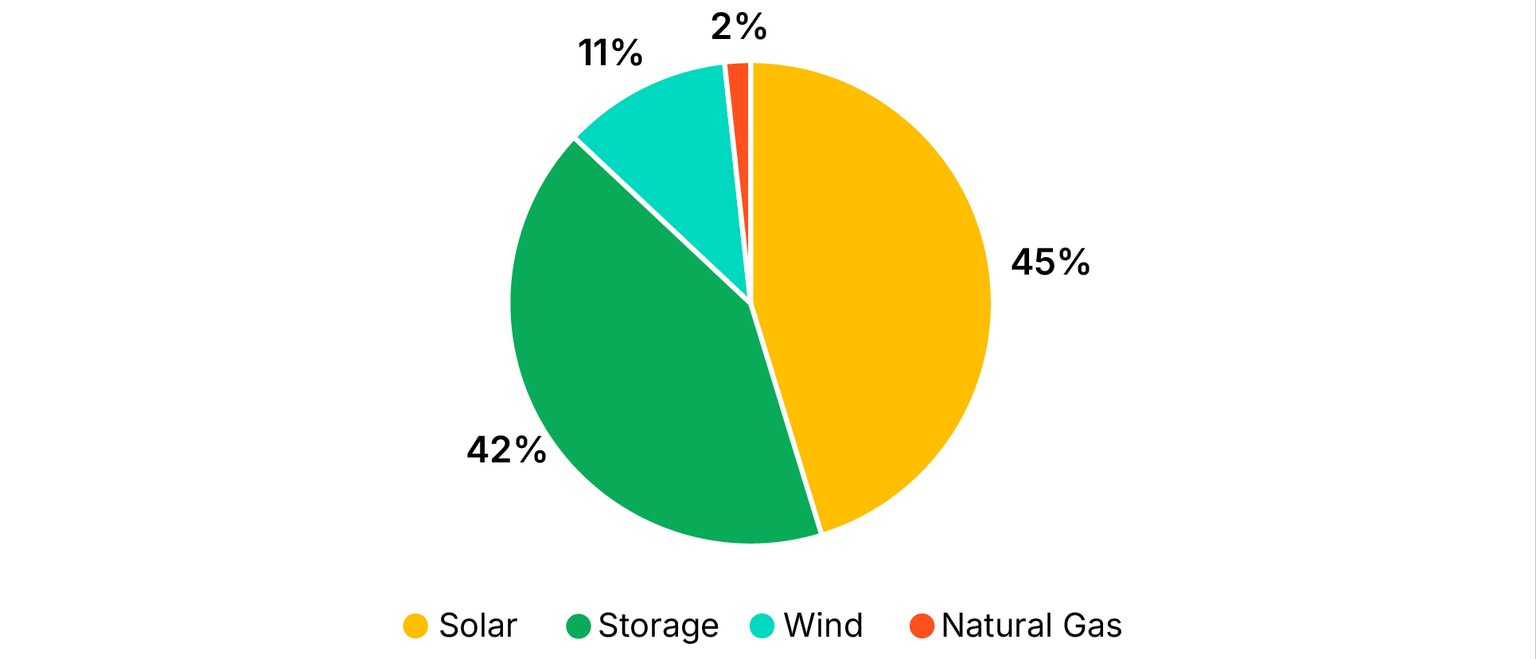

For the years from 2027 to 2028, 98% of new capacity is expected to come from solar, wind, or storage, as shown in Figure 2. These projects have been in development for years and are critical to meeting near-term demand, most strategically, power for data centers. Without them, the supply gap will widen dramatically, driving up prices.

Even if dozens of natural gas plants could be permitted overnight, it wouldn’t help as the turbines simply aren’t available. The bottlenecks are real, and the clock is ticking.

Source: Orennia

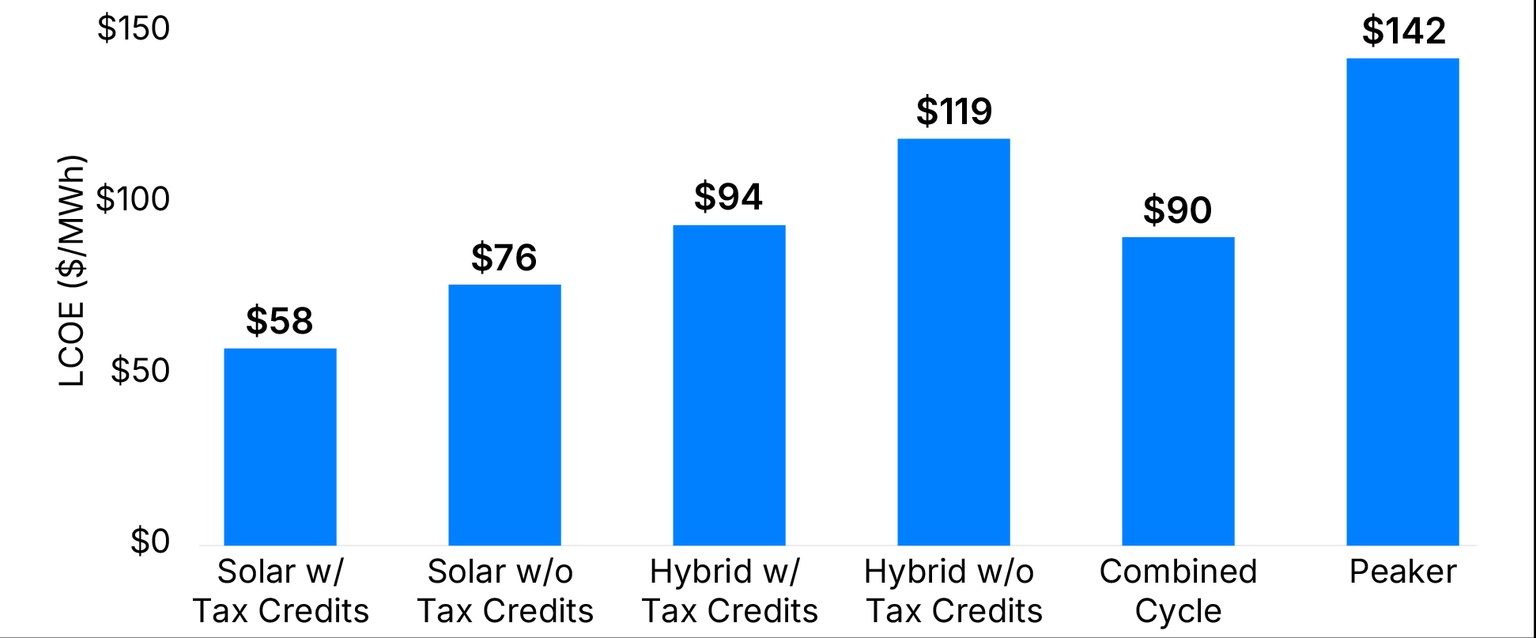

At the same time, renewable energy and battery technologies have seen dramatic cost declines over the past decade, while the cost of new-build natural gas has steadily increased. As a result, solar paired with storage is now approaching cost parity with combined-cycle natural gas on a levelized cost of energy (LCOE) basis, as shown in Figure 3. And unlike combined-cycle gas plants, incremental solar and storage can be brought online before 2030.

Source: Orennia

Put simply, if the current version of H.R.1 passes, and given the lack of viable near-term alternatives combined with price-insensitive AI demand, we expect contracted and wholesale + REC prices will need to increase by approximately 30% to compensate for the resulting supply shortfall.

At Orennia, we recognize the significance of this moment, and we’re rising to meet it. Our clients depend on us for actionable insights, especially as the implications of the OBBB take shape. That’s why we’ve been on the road, hosting roundtables, sharing analysis, and engaging directly with industry leaders.

From New York to Houston, Austin to Denver, and San Francisco to Chicago, Orennia is connecting with stakeholders across the country to help navigate what’s next for the energy transition (Figure 4).

Source: Orennia

We don’t yet know the final shape H.R. 1 will take. While we’re hopeful key provisions will be revised in the Senate, we’re prepared for any outcome. What is clear, though, is that in times of volatility, having a thoughtful partner and world-class data can bring clarity amid the storm. I’m incredibly proud of the work Orennia has done to support our clients through uncertainty.

Data-driven insights delivered to your inbox.